Get Auto Insurance Online Now

In today's fast-paced world, convenience and efficiency are key factors when it comes to managing our daily lives. This extends to one of the most important aspects of our financial and personal well-being: auto insurance. Gone are the days of tedious paper forms and endless phone calls to insurance brokers. The digital age has brought about a revolution in how we can obtain auto insurance, offering a seamless and convenient online experience. This article delves into the world of online auto insurance, exploring the benefits, the process, and the key considerations to help you navigate this digital landscape with ease.

The Benefits of Getting Auto Insurance Online

Opting for online auto insurance comes with a myriad of advantages that make it an attractive choice for modern consumers. First and foremost, it offers unparalleled convenience. With just a few clicks, you can compare policies, customize your coverage, and secure your insurance, all from the comfort of your home or on the go with your mobile device. This level of accessibility is a game-changer, especially for those with busy schedules or limited mobility.

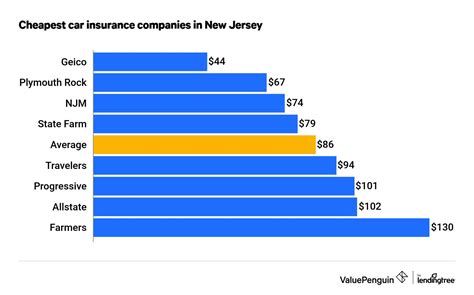

Another significant benefit is cost-effectiveness. Online insurance providers often have lower overhead costs, which can translate to more competitive premiums. Additionally, the ability to easily compare multiple quotes online empowers you to find the best deal that suits your needs and budget. Many online platforms also offer discounts for various factors such as safe driving records, vehicle safety features, and even loyalty rewards, further reducing your insurance costs.

Furthermore, online auto insurance platforms provide an efficient and streamlined experience. The digital nature of the process means less paperwork and quicker processing times. You can often receive your policy documents almost instantly after purchase, and managing your policy online makes it easy to make changes, add endorsements, or renew your coverage.

The transparency of online insurance is another notable advantage. With comprehensive online resources, you can easily understand the different coverage options, policy terms, and exclusions. This ensures that you make informed decisions and select a policy that provides the right protection for your vehicle and driving needs.

Understanding the Online Auto Insurance Process

The process of obtaining auto insurance online is straightforward and user-friendly. Here’s a step-by-step breakdown:

Step 1: Research and Compare Providers

Start by researching reputable online insurance providers. Look for companies with a solid reputation, good customer reviews, and a comprehensive range of coverage options. Compare their policies, premiums, and any additional benefits or discounts they offer. Many websites provide tools to help you easily compare quotes from multiple providers, making this step efficient and informative.

Step 2: Get Quotes and Customize Your Policy

Once you’ve selected a few providers, it’s time to get quotes. Most insurance websites offer online quote tools where you can input your personal and vehicle details to receive an instant quote. This quote will be based on factors such as your age, driving record, vehicle make and model, and the level of coverage you require. You can then customize your policy by adding or removing coverages, adjusting deductibles, and exploring optional add-ons to create a plan that suits your needs and budget.

Step 3: Purchase Your Policy

When you’ve found the right policy, you can proceed to purchase it online. This typically involves filling out some additional forms, providing payment details, and accepting the terms and conditions of the policy. You’ll often receive an email confirmation and a digital copy of your policy documents shortly after the purchase.

Step 4: Manage Your Policy Online

One of the great advantages of online auto insurance is the ability to manage your policy digitally. You can often log into your account on the provider’s website or app to make changes to your coverage, update your personal or vehicle information, and pay premiums. This convenience ensures that you can easily keep your policy up-to-date and tailored to your changing needs.

Key Considerations for Online Auto Insurance

While the online process offers numerous benefits, there are a few key considerations to keep in mind when obtaining auto insurance online:

Research and Reputation

It’s essential to research the reputation and financial stability of the insurance provider you choose. Look for companies with a strong track record of paying claims promptly and fairly. Check customer reviews and ratings to get an idea of their service quality and responsiveness.

Coverage and Policy Terms

Ensure that you thoroughly understand the coverage and policy terms. Read through the fine print to be aware of any exclusions, limitations, or conditions that could impact your coverage. Make sure the policy provides adequate protection for your vehicle and driving needs.

Customer Service and Claims Process

Consider the quality of customer service and the ease of the claims process. Look for providers with a dedicated customer support team and a user-friendly online claims reporting system. Understanding how the claims process works and the steps involved can help you make an informed decision.

Renewal and Ongoing Management

Online insurance providers often offer convenient renewal options and ongoing policy management tools. Consider how easy it is to renew your policy and make changes to your coverage over time. Look for providers that offer flexible renewal terms and the ability to easily adjust your coverage as your needs evolve.

Future of Online Auto Insurance

The landscape of online auto insurance is continually evolving, driven by advancements in technology and changing consumer expectations. We can expect to see even more personalized and data-driven insurance offerings in the future. This could include dynamic pricing models that adjust premiums based on real-time driving data, as well as more tailored coverage options to meet the diverse needs of modern drivers.

Furthermore, the integration of telematics and connected car technologies is set to play a significant role in the future of online auto insurance. These technologies can provide insurers with valuable data on driving behavior, allowing for more accurate risk assessment and potentially leading to further cost savings for policyholders.

As we move towards a more digital and connected world, the convenience and efficiency of online auto insurance will only become more appealing. With ongoing innovations in the industry, the process of obtaining and managing auto insurance is likely to become even more streamlined and customer-centric.

Conclusion

Obtaining auto insurance online offers a modern, efficient, and cost-effective approach to securing the protection you need for your vehicle. With the convenience of digital platforms, you can easily compare policies, customize your coverage, and manage your insurance from anywhere at any time. By understanding the benefits, process, and key considerations, you can navigate the world of online auto insurance with confidence, ensuring you find the right policy that meets your needs and budget.

Can I still get auto insurance through a broker if I prefer personal assistance?

+Absolutely! While online auto insurance offers convenience and efficiency, many insurance brokers still provide personalized assistance and can help you navigate the world of insurance. They can offer expert advice, answer your questions, and guide you through the process of selecting the right policy for your needs.

What factors impact the cost of my auto insurance policy?

+Several factors influence the cost of your auto insurance policy, including your age, driving record, the make and model of your vehicle, the level of coverage you choose, and your location. Insurance providers use these factors to assess your risk level and determine your premium.

Are there any discounts available for online auto insurance policies?

+Yes, many online insurance providers offer a range of discounts. These can include discounts for safe driving records, vehicle safety features, multi-policy bundles (e.g., bundling your auto insurance with home or life insurance), and loyalty rewards for long-term customers.

How do I know if an online insurance provider is reputable and trustworthy?

+Researching an insurance provider’s reputation is crucial. Look for companies with a strong financial rating from reputable agencies like AM Best or Standard & Poor’s. Check customer reviews and ratings on independent review websites. Additionally, ensure the provider is licensed and regulated in your state or country.