Cheapest Insurance Rates

In the vast landscape of insurance, finding the cheapest rates is a quest that many embark on, driven by the desire to secure essential coverage without breaking the bank. This article aims to guide you through the intricacies of insurance costs, offering a comprehensive understanding of how to navigate the market and secure the most affordable policies for your needs.

Unraveling the Factors that Impact Insurance Costs

Understanding the cheapest insurance rates necessitates an exploration of the various factors that influence the cost of insurance policies. These factors are as diverse as the individuals and businesses seeking coverage, and they can significantly impact the final price tag.

Demographic and Personal Factors

Insurance providers consider a range of demographic and personal factors when calculating insurance rates. Age is a primary consideration; generally, younger individuals, especially those under 25, often face higher premiums due to their relative inexperience and perceived higher risk. Gender can also play a role, with some insurance companies applying different rates based on statistical data related to gender-specific risk profiles.

Furthermore, marital status can influence insurance costs. Some providers offer discounted rates for married couples, believing that they tend to exhibit more responsible behavior and have a lower risk profile. Geographic location is another crucial factor; the cost of living, crime rates, and even weather patterns in a particular area can all impact insurance premiums.

For instance, in regions prone to natural disasters like hurricanes or earthquakes, insurance rates are typically higher to account for the increased risk of claims. Similarly, urban areas with higher crime rates may see elevated insurance costs, especially for auto insurance, as the risk of theft or vandalism is perceived to be greater.

Policy Type and Coverage Limits

The type of insurance policy and the coverage limits chosen significantly affect the cost. Different types of insurance, such as auto, home, health, or life insurance, carry varying levels of risk and, consequently, different premium costs.

Within each policy type, the level of coverage selected also influences the price. For example, in auto insurance, opting for comprehensive coverage that includes collision, liability, and uninsured motorist protection will typically be more expensive than a basic liability-only policy. Similarly, in home insurance, choosing higher coverage limits to protect against potential losses will result in higher premiums.

| Policy Type | Average Annual Premium |

|---|---|

| Auto Insurance | $1,500 - $2,000 |

| Home Insurance | $1,200 - $2,500 |

| Health Insurance | $6,000 - $12,000 |

| Life Insurance | $500 - $2,000 |

The table above provides a general overview of average annual premiums for various policy types. However, it's essential to note that these figures can vary significantly based on individual circumstances and the specific coverage chosen.

Risk Assessment and Credit History

Insurance companies conduct thorough risk assessments to determine the likelihood of a policyholder making a claim. This assessment considers factors such as driving records for auto insurance, claim history for home insurance, and health conditions for life and health insurance.

A clean driving record, for example, can lead to lower auto insurance premiums, as it indicates a lower risk of accidents. Conversely, a history of multiple claims or serious traffic violations may result in higher rates, as the insurer perceives a greater likelihood of future claims.

Additionally, many insurance providers now consider credit history when calculating rates. Individuals with higher credit scores are often viewed as more financially responsible and, therefore, less likely to default on their insurance payments or file frequent claims. As a result, they may be offered lower premiums.

Strategies to Secure the Cheapest Insurance Rates

While insurance rates can be influenced by various factors that are beyond an individual’s control, there are still several strategies that can be employed to secure the cheapest insurance rates available.

Comparing Quotes from Multiple Providers

One of the most effective ways to find the cheapest insurance rates is to compare quotes from multiple providers. Insurance companies use different formulas to calculate premiums, and the rates they offer for the same level of coverage can vary significantly.

By obtaining quotes from a range of insurers, you can identify the company that offers the best combination of coverage and price for your specific needs. This process can be done manually by contacting each insurer individually or by using online comparison tools that provide quotes from multiple providers in one place.

When comparing quotes, ensure that you're comparing apples to apples. This means that the policies you're considering should have similar coverage limits, deductibles, and other key features. This allows for a more accurate comparison of the true cost of the insurance.

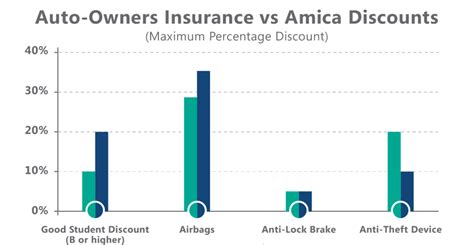

Understanding Discounts and Bundling Options

Many insurance providers offer a variety of discounts that can significantly reduce the cost of your insurance premiums. These discounts can be based on factors such as safe driving records, good student status, multiple policies with the same insurer (known as bundling), or even certain professional affiliations.

For example, some insurers offer discounts to policyholders who have taken defensive driving courses or who install safety features in their vehicles. Others may provide reduced rates for homeowners who have certain security systems or who live in neighborhoods with lower crime rates.

Bundling multiple insurance policies, such as auto and home insurance, with the same provider is another effective way to save money. Many insurers offer multi-policy discounts, which can result in significant savings. By bundling, you may also simplify your insurance management, as you'll have a single point of contact for all your insurance needs.

Reviewing and Adjusting Coverage Regularly

Insurance needs can change over time, and it’s essential to review your coverage regularly to ensure that it remains adequate and cost-effective. As your circumstances change, such as buying a new car or moving to a different home, your insurance requirements may also change.

Regularly reviewing your coverage allows you to make necessary adjustments and ensure that you're not overpaying for coverage you no longer need. It also gives you the opportunity to explore new discounts or promotions that your insurer may be offering.

For instance, if you've recently installed a home security system or made significant upgrades to your home's plumbing or electrical systems, you may be eligible for discounts on your home insurance. By notifying your insurer of these changes, you can potentially reduce your premiums.

The Impact of Technological Advancements on Insurance Rates

The insurance industry is undergoing a significant transformation driven by technological advancements. These innovations are not only changing the way insurance is sold and managed but are also influencing the cost of insurance premiums.

Telematics and Usage-Based Insurance

Telematics is a technology that allows insurance companies to track and analyze a vehicle’s usage and driving behavior. This data is then used to calculate insurance premiums based on an individual’s actual driving habits rather than on generalized risk profiles.

Usage-based insurance (UBI) programs, which utilize telematics, offer policyholders the opportunity to significantly reduce their insurance costs. By agreeing to have their driving behavior monitored, drivers can potentially lower their premiums if they exhibit safe driving habits.

For example, a driver who rarely exceeds the speed limit, always drives during daylight hours, and maintains a consistent, defensive driving style may be rewarded with lower insurance rates through a UBI program. Conversely, those who frequently engage in risky behaviors like speeding or driving late at night may see their premiums increase.

Digital Tools for Efficient Claims Processing

The digital transformation of the insurance industry has also led to the development of efficient claims processing tools. These tools streamline the process of filing and managing claims, reducing administrative costs for insurers and, in turn, potentially lowering insurance premiums for policyholders.

For instance, many insurers now offer mobile apps that allow policyholders to file claims, upload supporting documentation, and track the progress of their claims in real-time. This level of efficiency not only benefits the policyholder but also reduces the overhead costs for the insurer, which can be reflected in the premium rates.

Data Analytics for Risk Assessment

Advanced data analytics and machine learning technologies are being utilized by insurance companies to enhance their risk assessment processes. By analyzing vast amounts of data, insurers can identify patterns and trends that were previously difficult to discern, leading to more accurate risk assessments and potentially lower insurance rates for policyholders.

For example, data analytics can be used to identify geographical areas with a lower risk of natural disasters or to pinpoint specific driver behaviors that lead to a higher risk of accidents. By understanding these risks more precisely, insurers can offer more tailored insurance products and potentially reduce premiums for lower-risk policyholders.

The Future of Insurance: Emerging Trends and Their Impact on Rates

The insurance landscape is continually evolving, driven by technological advancements, changing consumer preferences, and shifting regulatory environments. Understanding these emerging trends is crucial for policyholders seeking the cheapest insurance rates, as these trends can significantly influence the cost and availability of insurance coverage.

The Rise of Insurtech

Insurtech, a term used to describe the fusion of insurance and technology, is transforming the traditional insurance industry. Insurtech startups and established insurers are leveraging technology to create innovative insurance products and services that are more efficient, personalized, and cost-effective.

For instance, some Insurtech companies are developing insurance products that are tailored to the specific needs of gig economy workers, such as ride-sharing drivers or freelance professionals. These products often offer more flexible coverage options and competitive rates, appealing to a segment of the population that has traditionally struggled to find adequate insurance coverage.

The Shift Towards Personalized Insurance

The insurance industry is moving away from one-size-fits-all insurance products towards more personalized coverage options. This shift is being driven by advances in data analytics and a deeper understanding of individual risk profiles.

Personalized insurance products take into account an individual's unique circumstances, behaviors, and preferences to offer tailored coverage. For example, a health insurance policy could be designed to provide additional coverage for individuals with specific health conditions or lifestyle choices, such as offering discounted gym memberships or providing access to personalized wellness programs.

The Role of Regulatory Changes

Regulatory changes can significantly impact the insurance industry and, by extension, insurance rates. These changes can affect the types of insurance products that are available, the level of coverage required by law, and the overall cost of insurance.

For example, recent regulatory changes in the health insurance industry, such as the Affordable Care Act (ACA) in the United States, have mandated that certain health insurance benefits be included in all plans. While these changes have expanded coverage and protected consumers, they have also increased the cost of health insurance premiums.

Similarly, changes in auto insurance regulations, such as the introduction of mandatory coverage requirements or the elimination of certain discounts, can impact the cost of auto insurance policies. Policyholders need to stay informed about these regulatory changes to understand how they might affect their insurance rates and coverage options.

How do I find the cheapest insurance rates for my specific needs?

+To find the cheapest insurance rates, it’s essential to shop around and compare quotes from multiple providers. Consider your specific needs and circumstances, and tailor your coverage accordingly. Don’t forget to explore potential discounts and bundling options, which can significantly reduce your premiums. Regularly reviewing and adjusting your coverage can also help ensure you’re not overpaying.

What is the impact of my credit score on insurance rates?

+Many insurance providers now consider credit history when calculating rates. A higher credit score can lead to lower premiums, as it’s seen as an indicator of financial responsibility and a lower risk of defaulting on insurance payments or filing frequent claims. Maintaining a good credit score can therefore be beneficial for securing more favorable insurance rates.

How can I save money on my insurance premiums without compromising coverage?

+To save money on insurance premiums while maintaining adequate coverage, consider increasing your deductible. A higher deductible can lead to lower premiums, but it’s important to ensure that the increased deductible amount is manageable in the event of a claim. Additionally, explore discount opportunities and consider bundling multiple policies with the same insurer.