Best Insurance Near Me

Navigating the world of insurance can be a daunting task, especially when you're searching for the best options near your location. With numerous providers and policies available, it's crucial to make an informed decision that aligns with your specific needs and circumstances. This comprehensive guide will delve into the factors to consider when choosing insurance, the key players in the industry, and how to find the best coverage tailored to your situation.

Understanding Your Insurance Needs

The first step in finding the best insurance near you is to understand your unique requirements. Insurance policies come in various forms, each designed to cover specific risks and provide financial protection. From health insurance to auto insurance, homeowners’ insurance, and life insurance, the options are vast. Consider the following aspects to determine your insurance needs:

- Risk Assessment: Evaluate the potential risks you face in your daily life. Are you concerned about medical emergencies, car accidents, natural disasters, or unexpected deaths? Assessing these risks will help you prioritize the types of insurance you need.

- Financial Stability: Consider your current financial situation and how insurance can provide a safety net. Think about the costs you can afford in the event of an accident or loss, and how insurance can help bridge the gap.

- Legal Requirements: Some types of insurance are mandatory by law, such as auto insurance in most states. Ensure you meet the legal requirements to avoid penalties and maintain peace of mind.

- Personal Preferences: Your individual preferences play a role in insurance choices. For instance, you might prefer a higher deductible to save on premiums, or you might prioritize coverage for specific assets or medical conditions.

Key Insurance Providers and Their Offerings

Once you’ve identified your insurance needs, it’s time to explore the market and understand the offerings of various providers. Here’s an overview of some of the top insurance companies and their specialties:

- State Farm: With a strong focus on auto and home insurance, State Farm offers personalized coverage options and a network of local agents for personalized service.

- Allstate: Allstate provides a wide range of insurance products, including auto, home, life, and business insurance. They are known for their innovative features like Drivewise, which rewards safe driving with discounts.

- Progressive: Progressive Insurance offers competitive rates and a user-friendly digital experience. They specialize in auto insurance but also provide coverage for homes, businesses, and recreational vehicles.

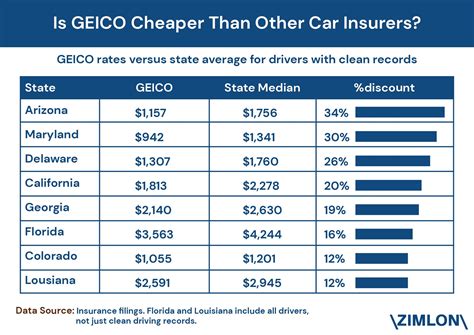

- Geico: Geico is renowned for its affordability and extensive auto insurance coverage. They also offer policies for homeowners, renters, and life insurance, catering to a diverse range of customers.

- Liberty Mutual: Liberty Mutual provides comprehensive insurance solutions for individuals and businesses. Their products include auto, home, renters, and business insurance, along with specialized coverage for unique needs.

Finding the Best Insurance Near You

Now that you have a grasp of your insurance needs and the top providers in the market, it’s time to delve into the process of finding the best insurance near your location. Here are some steps to guide you:

- Define Your Budget: Determine how much you can afford to spend on insurance premiums. This will help narrow down your options and ensure you find coverage that fits within your financial means.

- Research Local Providers: Explore insurance companies operating in your area. Local providers may offer unique benefits, such as a deeper understanding of local risks and tailored coverage options.

- Compare Policies and Quotes: Request quotes from multiple providers to compare coverage and prices. Pay attention to the specific terms and conditions of each policy to ensure you’re getting the right coverage for your needs.

- Consider Online Insurers: Don’t limit your search to local providers. Online insurers often offer competitive rates and convenient digital experiences. Compare their offerings to traditional providers to find the best fit.

- Read Reviews and Ratings: Check online reviews and ratings to assess the reputation and customer satisfaction of insurance companies. This can provide valuable insights into the quality of service and claims handling.

- Seek Professional Advice: Consult with an independent insurance agent or broker who can provide impartial advice. They can help you navigate the complex world of insurance and find the best coverage at the right price.

Factors to Consider for Tailored Coverage

When searching for the best insurance near you, it’s crucial to consider factors that can impact your coverage and premiums. Here are some key aspects to keep in mind:

- Deductibles: Higher deductibles can lower your premiums, but they also mean you’ll pay more out of pocket when filing a claim. Assess your financial situation and choose a deductible that aligns with your ability to cover costs.

- Coverage Limits: Ensure that your policy provides adequate coverage limits to protect your assets and meet your needs. Higher limits may cost more, but they provide greater financial protection in the event of a significant loss.

- Discounts and Bundles: Many insurance companies offer discounts for bundling multiple policies or for certain qualifications like safe driving or home security systems. Take advantage of these discounts to save on your premiums.

- Customer Service and Claims Handling: The quality of customer service and claims handling can significantly impact your experience. Choose an insurer with a reputation for prompt and efficient service to ensure smooth handling of any claims you may need to make.

The Future of Insurance: Technological Innovations

The insurance industry is evolving rapidly, driven by technological advancements. Here’s a glimpse into some of the innovative trends shaping the future of insurance:

- Telematics and Usage-Based Insurance: Telematics technology allows insurers to monitor driving behavior in real-time. Usage-based insurance policies reward safe drivers with lower premiums, encouraging safer driving habits and providing personalized coverage.

- Artificial Intelligence and Machine Learning: AI and machine learning are transforming insurance underwriting and claims processing. These technologies enable insurers to analyze vast amounts of data quickly, improving accuracy and efficiency.

- Digital Platforms and Self-Service Options: Insurers are investing in digital platforms and mobile apps to enhance the customer experience. These tools allow policyholders to manage their policies, file claims, and access support services conveniently and efficiently.

- Blockchain Technology: Blockchain is revolutionizing insurance by providing secure, transparent, and tamper-proof record-keeping. This technology can streamline claims processing, reduce fraud, and enhance data sharing between insurers and customers.

Conclusion: Empowering Your Insurance Journey

Finding the best insurance near you requires a comprehensive understanding of your needs, a thorough exploration of the market, and a keen eye for the latest innovations. By following the steps outlined in this guide, you can navigate the insurance landscape with confidence and make informed decisions. Remember, insurance is a vital tool for protecting your finances and ensuring peace of mind. Stay informed, compare options, and choose coverage that provides the right balance of protection and affordability for your unique circumstances.

What is the average cost of insurance premiums near me?

+The average cost of insurance premiums can vary greatly depending on your location, the type of insurance, and your individual circumstances. Factors such as your age, gender, driving record, and the value of your assets all influence the cost of your premiums. It’s best to obtain quotes from multiple providers to get an accurate estimate for your specific situation.

How can I save money on insurance premiums?

+There are several strategies to save on insurance premiums. Consider increasing your deductible, which can lower your premiums but requires you to pay more out of pocket when filing a claim. Additionally, look for discounts offered by insurers, such as safe driver discounts, loyalty discounts, or bundle discounts when you purchase multiple policies from the same provider. Regularly reviewing and comparing policies can also help you find the most cost-effective coverage.

What should I do if I’m not satisfied with my current insurance provider?

+If you’re dissatisfied with your current insurance provider, it’s important to take action. Start by carefully reviewing your policy and identifying the specific areas of dissatisfaction. Then, research alternative providers and compare their offerings. Consider factors such as coverage, premiums, customer service, and claims handling. Once you’ve found a suitable alternative, you can switch providers by canceling your existing policy and purchasing a new one.