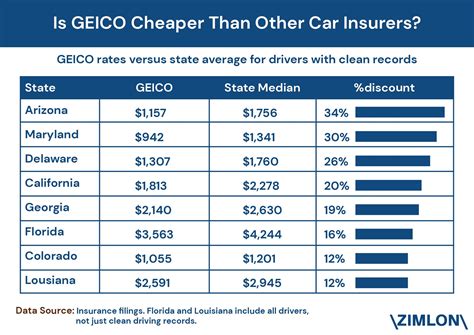

Geico Car Insurance Prices

Geico, short for Government Employees Insurance Company, is a well-known insurance provider in the United States. With a focus on offering competitive rates and a user-friendly experience, Geico has become a popular choice for many car owners. In this comprehensive guide, we will delve into the world of Geico car insurance prices, exploring the factors that influence rates, the coverage options available, and the steps you can take to find the best deal.

Understanding Geico Car Insurance Prices

Geico offers a range of car insurance policies tailored to meet the diverse needs of its customers. The cost of your car insurance policy with Geico will depend on several key factors, including your personal circumstances, the type of coverage you choose, and the state in which you reside. Let’s break down these factors to gain a clearer understanding of Geico’s pricing structure.

Personal Factors

Geico takes into account various personal factors when determining your insurance rates. These factors can significantly impact the cost of your policy. Here are some of the key personal factors considered by Geico:

- Age and Gender: Younger drivers, especially males, tend to be associated with higher risk and, consequently, higher insurance premiums. As you get older, your driving experience increases, leading to potentially lower rates.

- Driving History: Your driving record plays a crucial role. A clean driving history with no accidents or violations can result in more affordable rates. Conversely, multiple accidents or traffic violations may lead to higher premiums.

- Credit Score: Believe it or not, your credit score can influence your insurance rates. Geico, like many other insurers, uses credit-based insurance scores to assess risk. A higher credit score may lead to lower premiums, as it indicates financial responsibility.

- Marital Status: Married individuals are often considered lower-risk drivers and may benefit from slightly reduced insurance rates.

- Education Level: In some cases, having a college degree or higher education can result in slightly lower insurance rates, as it is associated with higher levels of responsibility.

It's important to note that personal factors are just one piece of the puzzle. Geico also considers the type of coverage you choose and the specific features of your vehicle.

Coverage Options and Their Impact on Prices

Geico offers a comprehensive range of coverage options to meet different needs and budgets. The type of coverage you select will directly impact the cost of your insurance policy. Here’s a breakdown of the coverage options and their potential effects on your premiums:

- Liability Coverage: This is the most basic form of car insurance and is mandatory in many states. It covers damages you cause to others’ property or injuries you cause to others in an accident. Liability coverage typically has lower premiums compared to more comprehensive plans.

- Collision Coverage: This coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. It is an optional coverage, but it can provide significant peace of mind. Collision coverage usually increases your premiums.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against non-accident-related incidents, such as theft, vandalism, fire, or natural disasters. It is also an optional coverage but can be beneficial for older vehicles. Adding comprehensive coverage may further increase your premiums.

- Medical Payments Coverage: Also known as MedPay, this coverage pays for medical expenses for you and your passengers after an accident, regardless of fault. It can be a valuable addition to your policy, especially if you don’t have health insurance. Medical payments coverage may add a modest increase to your premiums.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you’re involved in an accident with a driver who has no insurance or insufficient insurance. It’s an important coverage to have, especially in areas with a high rate of uninsured drivers. Uninsured/underinsured motorist coverage may add a small premium increase.

- Rental Car Reimbursement: This optional coverage provides reimbursement for rental car expenses if your vehicle is in the shop for repairs covered by your policy. It can be a convenient addition, but it may slightly increase your premiums.

By understanding the coverage options and their potential impacts on your premiums, you can make informed decisions about the level of protection you need and how it affects your budget.

Vehicle-Specific Factors

In addition to personal factors and coverage choices, Geico also considers the specific characteristics of your vehicle when determining your insurance rates. Here are some vehicle-related factors that can influence your premiums:

- Vehicle Make and Model: Different vehicles have different insurance costs. Sports cars and luxury vehicles often come with higher premiums due to their higher repair costs and greater risk of theft. On the other hand, safer and more economical vehicles may result in lower rates.

- Vehicle Age and Condition: Older vehicles generally have lower insurance costs, as they are typically less valuable and may have fewer advanced safety features. However, if your older vehicle is in excellent condition or has valuable modifications, it could impact your premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, air bags, and collision avoidance systems, may qualify for lower insurance rates. These features reduce the risk of accidents and potential damage, making them attractive to insurers.

- Usage and Mileage: Geico may take into account how you use your vehicle and the average number of miles you drive annually. If you primarily use your car for commuting or occasional trips, your rates may be lower compared to someone who drives frequently for work or leisure.

Finding the Best Geico Car Insurance Prices

Now that we’ve explored the various factors that influence Geico car insurance prices, let’s discuss some strategies to help you find the best deals and save money on your policy.

Shop Around and Compare

While Geico is a reputable insurer with competitive rates, it’s always a good idea to compare quotes from multiple providers. Different insurance companies have unique pricing structures and policies, so shopping around can help you identify the most affordable option for your specific needs. Use online quote comparison tools or contact multiple insurers directly to gather quotes.

Utilize Geico’s Discounts

Geico offers a wide range of discounts to its customers. By taking advantage of these discounts, you can potentially reduce your insurance premiums significantly. Here are some of the discounts you may qualify for:

- Multi-Policy Discount: If you bundle your car insurance with other types of insurance, such as homeowners or renters insurance, you may be eligible for a multi-policy discount. This can lead to substantial savings.

- Good Driver Discount: Maintaining a clean driving record is rewarded by Geico. If you haven’t had any accidents or violations for a certain period, you may qualify for a good driver discount, reducing your premiums.

- Military Discount: Geico has a long-standing relationship with the military community. Active-duty military personnel, veterans, and their families may be eligible for a military discount, making Geico an attractive option for service members.

- Student Discount: If you’re a student or have a young driver in your household, Geico offers discounts for good grades and driver’s education courses. Encouraging academic excellence can result in lower insurance rates.

- Safe Driver Discount: By enrolling in Geico’s Safe Driver Program, you can receive discounts for safe driving habits. This program uses data from your vehicle’s onboard diagnostics to monitor your driving behavior and provide feedback, helping you become a safer driver and potentially lowering your premiums.

Customize Your Coverage

When choosing your coverage options, consider your specific needs and budget. Opting for higher deductibles can lower your premiums, but it’s essential to ensure you can afford the out-of-pocket expenses in the event of a claim. Additionally, carefully evaluate the coverage limits and consider whether you need additional coverage, such as rental car reimbursement or roadside assistance.

Bundle Your Policies

If you have multiple insurance needs, such as homeowners, renters, or life insurance, consider bundling your policies with Geico. Bundling can lead to significant savings, as insurers often offer discounts for customers who choose multiple policies.

Maintain a Good Credit Score

As mentioned earlier, your credit score can impact your insurance rates. Maintaining a good credit score is not only beneficial for financial reasons but can also result in lower insurance premiums. Work on improving your credit score by paying bills on time, reducing debt, and monitoring your credit report regularly.

Consider Geico’s Payment Options

Geico offers flexible payment options to suit different financial situations. You can choose to pay your premium annually, semi-annually, quarterly, or monthly. While paying annually may result in some savings, it’s important to consider your financial stability and choose a payment plan that works best for you.

Conclusion

Geico car insurance prices are influenced by a combination of personal factors, coverage choices, and vehicle-specific characteristics. By understanding these factors and taking advantage of Geico’s discounts and customization options, you can find the best car insurance rates that suit your needs and budget. Remember to shop around, compare quotes, and make informed decisions to ensure you’re getting the most value for your insurance dollar.

Can I get a quote for Geico car insurance online?

+Yes, Geico offers an easy and convenient online quoting process. You can visit their website, provide your personal and vehicle information, and receive a personalized quote in just a few minutes. Online quotes are a great way to quickly compare rates and get an initial estimate.

What is the average cost of Geico car insurance?

+The average cost of Geico car insurance can vary widely depending on individual factors. On average, Geico’s premiums range from 100 to 300 per month. However, your specific rate will depend on factors like your age, driving record, credit score, and the coverage options you choose.

Does Geico offer any discounts for safe driving?

+Absolutely! Geico recognizes and rewards safe driving habits. They offer a Good Driver Discount for customers with a clean driving record. Additionally, their Safe Driver Program uses telematics to monitor driving behavior and provide feedback, potentially leading to further discounts.

Can I customize my Geico car insurance policy?

+Yes, Geico allows you to customize your car insurance policy to fit your specific needs and budget. You can choose the coverage types and limits that suit you best, and adjust your deductibles to find the right balance between coverage and cost.