How Does Business Insurance Work

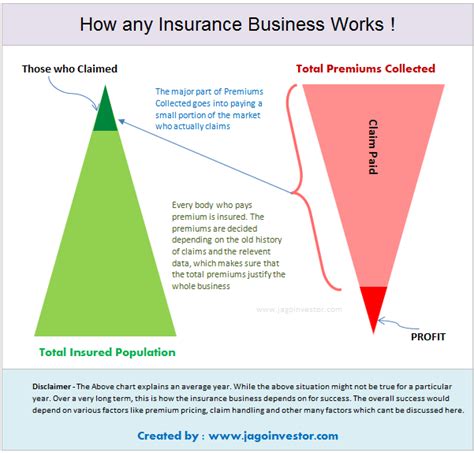

Business insurance is a vital component of any successful enterprise, providing a safety net and financial protection against a wide range of risks and unforeseen events. In an unpredictable business landscape, where challenges can arise from every angle, having the right insurance coverage is essential to mitigate potential losses and ensure the long-term viability of your company. This comprehensive guide will delve into the intricate world of business insurance, exploring its mechanics, benefits, and key considerations to help you make informed decisions for your organization's protection.

Understanding the Basics of Business Insurance

Business insurance, also known as commercial insurance, is a specialized form of coverage designed to safeguard businesses against various liabilities and perils. It offers a comprehensive approach to risk management, providing financial support and legal protection in the event of accidents, injuries, property damage, or other covered incidents. The primary objective is to minimize the financial impact of such events, ensuring that businesses can continue operations and maintain their reputation and stability.

The need for business insurance arises from the inherent risks associated with running a company. From natural disasters and cyberattacks to employee injuries and customer lawsuits, the potential threats are diverse and can have severe consequences. By investing in the right insurance policies, businesses can transfer these risks to insurance providers, gaining peace of mind and the ability to focus on core operations.

Key Components of Business Insurance Policies

Business insurance policies are tailored to meet the unique needs of each organization. They typically encompass a range of coverages, each addressing specific risks. Here are some fundamental components commonly found in business insurance packages:

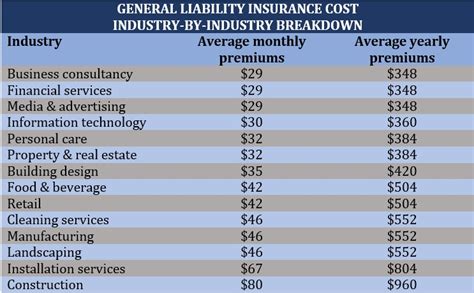

- General Liability Insurance: This coverage protects businesses from third-party claims arising from bodily injury, property damage, or personal and advertising injury. It covers legal costs, settlements, and judgments in such cases.

- Property Insurance: Property insurance safeguards the business's physical assets, including buildings, inventory, and equipment, against damage or loss due to covered perils like fire, theft, or natural disasters.

- Business Interruption Insurance: This policy provides financial support to businesses during periods when operations are interrupted due to covered events, such as a fire or severe weather. It helps cover ongoing expenses and lost income.

- Professional Liability Insurance (Errors and Omissions): Essential for professionals like consultants, accountants, and lawyers, this coverage protects against claims of negligence, errors, or omissions in the provision of professional services.

- Workers' Compensation Insurance: Mandated by most states, workers' comp insurance provides benefits to employees who suffer work-related injuries or illnesses, covering medical expenses and a portion of lost wages.

- Commercial Auto Insurance: If your business owns or leases vehicles, this insurance covers damages and injuries caused by those vehicles in accidents.

- Product Liability Insurance: Particularly relevant for manufacturers and retailers, this coverage protects against claims arising from defective products that cause harm to consumers.

- Cyber Liability Insurance: In an era of increasing cyber threats, this policy covers the costs associated with data breaches, cyberattacks, and other online risks.

How Business Insurance Works: A Step-by-Step Guide

Understanding the process of acquiring and utilizing business insurance is crucial for effective risk management. Here’s a detailed breakdown of how business insurance works, from assessment to claims management:

Assessing Your Business Risks

The first step in obtaining effective business insurance is conducting a thorough risk assessment. This involves identifying potential hazards and vulnerabilities specific to your industry, location, and business operations. Consider factors such as:

- Nature of your business and its unique risks (e.g., manufacturing, retail, service industry)

- Location and its associated risks (e.g., flood zones, high crime areas)

- Number of employees and their roles

- Use of vehicles and potential exposure to accidents

- Handling of sensitive data and potential cyber threats

- Manufacturing or selling of products and associated product liability risks

By understanding these risks, you can tailor your insurance coverage to address your specific needs.

Selecting the Right Insurance Provider and Policies

With a clear understanding of your business’s risks, the next step is to choose an insurance provider and select the appropriate policies. Consider the following factors when making this decision:

- Reputation and Financial Stability: Opt for insurance companies with a solid reputation and strong financial ratings to ensure they will be able to pay out claims in the event of a loss.

- Customizable Policies: Look for providers who offer customizable policies that can be tailored to your business's unique needs. This ensures you're not paying for coverage you don't require.

- Claims Handling Process: Inquire about the insurer's claims process, including response times, procedures, and customer satisfaction. Efficient and fair claims handling is crucial in times of need.

- Additional Services and Support : Some insurers offer risk management tools, loss prevention resources, and other value-added services that can enhance your overall risk management strategy.

It's beneficial to consult with insurance brokers or agents who can provide expert advice and guide you through the process of selecting the right coverage.

Obtaining Quotes and Finalizing Coverage

Once you’ve identified potential insurance providers and policies, request quotes. These quotes will detail the coverage, premiums, deductibles, and any additional terms and conditions. Compare quotes from multiple providers to ensure you’re getting the best value for your business’s needs.

When reviewing quotes, consider not only the cost but also the coverage limits, exclusions, and any endorsements or riders that may be necessary to enhance the policy's protections. Ensure that you understand the fine print and that the policy aligns with your risk assessment.

Understanding Policy Terms and Conditions

Before finalizing your insurance coverage, carefully review the policy documents. Pay close attention to the following key aspects:

- Coverage Limits: Ensure that the policy provides adequate coverage limits for your business's needs. Higher limits may cost more, but they provide greater protection in the event of a major loss.

- Deductibles: Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Consider your financial capacity to meet these deductibles in the event of a claim.

- Exclusions: Review the policy's exclusions carefully. These are specific situations or perils that are not covered by the policy. Understand what is not covered to avoid surprises later.

- Endorsements and Riders: These are additions or amendments to the policy that can broaden coverage. If your business has unique needs, discuss with your insurer the possibility of adding endorsements to enhance your protection.

Policy Renewal and Ongoing Risk Management

Business insurance policies typically have a set term, often one year. As your business evolves, your risks may change, so it’s crucial to review and renew your policies annually. Here’s what you should consider during the renewal process:

- Evaluate whether your current coverage still aligns with your business's needs. Has your business grown, expanded its operations, or introduced new products or services that may require additional coverage?

- Review your policy's coverage limits and deductibles. Consider whether they need to be adjusted based on your business's financial health and risk exposure.

- Stay updated on changes in your industry or location that may impact your risks. For example, new regulations or technological advancements could introduce new liabilities.

- Regularly assess your risk management strategies and loss prevention measures. Implement improvements where necessary to reduce the likelihood and impact of potential losses.

The Claims Process: Navigating Business Insurance Claims

When a covered incident occurs, the claims process is where the value of your business insurance truly comes to light. Understanding how to navigate this process is crucial to ensure a smooth and timely resolution.

Reporting a Claim

The first step in the claims process is to report the incident to your insurance provider. This should be done as soon as possible after the event to ensure timely processing. Here’s what you need to do:

- Contact your insurance agent or the insurer's claims department. Provide them with all relevant details about the incident, including the date, time, location, and any injuries or damages involved.

- Gather and maintain all documentation related to the claim. This may include police reports, photographs of damages, medical records (if applicable), and any other evidence that supports your claim.

- Cooperate fully with the insurer's investigation. Provide any additional information or documentation they request to facilitate the claims process.

Claims Investigation and Adjustment

Once you’ve reported a claim, the insurer will initiate an investigation to assess the validity and extent of the loss. Here’s what typically happens during this phase:

- Initial Assessment: The insurer's claims adjuster will review the documentation you've provided and may request additional information to better understand the circumstances of the incident.

- Site Visit: In some cases, the adjuster may visit the site of the incident to inspect the damages and gather further evidence. This is particularly common for larger or more complex claims.

- Evaluation of Coverage: The adjuster will carefully review your policy to determine whether the incident is covered. They will also assess the applicable coverage limits and deductibles.

- Determination of Liability: If the claim involves a third party, the adjuster will investigate to determine liability. This may involve reviewing police reports, witness statements, and other relevant documentation.

Settlement and Payment

Once the investigation is complete and the adjuster has determined the validity and value of your claim, they will offer a settlement. Here’s what you can expect during this stage:

- Settlement Offer: The insurer will present a settlement amount, which should be based on the policy's coverage limits and the assessed value of the loss. It's important to review this offer carefully and consider whether it adequately covers your damages.

- Negotiation: If you believe the settlement offer is insufficient, you can negotiate with the insurer. Provide additional evidence or arguments to support your claim for a higher settlement. However, be mindful of your policy's coverage limits and deductibles.

- Payment Process: Once a settlement is agreed upon, the insurer will initiate the payment process. This may involve issuing a check or transferring funds to your business's designated account. Ensure that you have the necessary information and documentation ready to facilitate a smooth payment process.

Maximizing Your Business Insurance Coverage

Business insurance is a powerful tool for risk management, but it’s important to ensure you’re getting the most out of your coverage. Here are some strategies to maximize the benefits of your business insurance:

Review and Update Your Coverage Regularly

Business landscapes are dynamic, and your insurance coverage should evolve with your business. Regularly review your policies to ensure they remain aligned with your changing needs. Consider the following:

- Has your business expanded or added new products or services? You may need to adjust your coverage to accommodate these changes.

- Have you invested in new equipment or technologies? Ensure they're adequately covered by your property insurance.

- Have your sales or revenue increased significantly? Consider increasing your coverage limits to protect your business's growing assets.

Implement Loss Prevention Measures

While business insurance provides financial protection, it’s always better to prevent losses in the first place. Implement proactive loss prevention strategies to minimize the likelihood and impact of potential incidents. Some effective measures include:

- Regular maintenance and inspections of your business premises and equipment to identify and address potential hazards.

- Training your employees on safety protocols and best practices to reduce the risk of accidents and injuries.

- Implementing cybersecurity measures to protect your business from cyber threats and data breaches.

- Developing a comprehensive disaster recovery plan to minimize business interruption in the event of a disaster.

Utilize Risk Management Tools and Resources

Many insurance providers offer risk management tools and resources to help businesses better understand and manage their risks. Take advantage of these resources to enhance your risk management strategies. Some common offerings include:

- Risk assessment tools to help identify potential hazards and vulnerabilities.

- Loss control resources and guides to implement effective loss prevention measures.

- Online portals or apps for easier policy management, claims reporting, and tracking.

- Educational materials and webinars to stay updated on industry trends and best practices.

Common Misconceptions and Pitfalls to Avoid

While business insurance is a valuable tool, there are several misconceptions and pitfalls that businesses should be aware of. Understanding these can help you make more informed decisions and avoid potential pitfalls.

Misconception: “My Business Is Too Small for Insurance”

One common misconception is that small businesses don’t need insurance. However, regardless of size, every business faces risks. Even a small business can experience property damage, employee injuries, or legal liabilities that can be financially devastating. Business insurance provides a safety net to protect your business’s financial stability and reputation.

Pitfall: Underinsured or Overinsured

Finding the right balance of insurance coverage is crucial. Being underinsured can leave your business vulnerable to significant financial losses in the event of a claim. On the other hand, being overinsured can result in unnecessary expenses for premiums that provide little additional protection. Work closely with your insurance agent or broker to find the right coverage limits that align with your business’s unique needs.

Misconception: “Insurance is Too Expensive”

While insurance premiums can be a significant expense, they should be viewed as an investment in your business’s future. The financial protection provided by insurance can be invaluable in the event of a covered loss. Additionally, many insurers offer risk management resources and loss control measures that can help reduce the frequency and severity of claims, potentially leading to lower premiums over time.

Future of Business Insurance: Trends and Innovations

The world of business insurance is constantly evolving, driven by advancements in technology, changing business landscapes, and evolving risks. Here are some key trends and innovations shaping the future of business insurance:

Digitalization and Insurtech

The rise of digital technologies and insurtech is revolutionizing the insurance industry. Insurers are leveraging technology to enhance the customer experience, streamline processes, and improve risk assessment. Some key developments include:

- Online policy management and claims reporting platforms for easier access and faster processing.

- Use of predictive analytics and artificial intelligence to more accurately assess risks and personalize coverage.

- Integration of IoT (Internet of Things) devices and sensors for real-time risk monitoring and loss prevention.

Enhanced Cyber Risk Coverage

With the increasing prevalence of cyber threats, cyber liability insurance is becoming an essential component of business insurance packages. Insurers are developing more comprehensive coverage options to address a wider range of cyber risks, including data breaches, ransomware attacks, and social engineering schemes.

Focus on Sustainability and Environmental Risks

As businesses become more conscious of their environmental impact, insurers are developing coverage options that address sustainability and environmental risks. This includes policies that cover liability for environmental damage, as well as incentives for businesses to adopt more sustainable practices.

Telematics and Usage-Based Insurance

In the realm of commercial auto insurance, telematics technology is being used to monitor driving behavior and assess risk. Usage-based insurance policies offer customized premiums based on real-time data, providing incentives for safe driving and reducing claims costs.

Conclusion: Empowering Your Business with Effective Insurance

Business insurance is a powerful tool that empowers businesses to navigate an unpredictable world with confidence. By understanding the mechanics of business insurance, conducting thorough risk assessments, and selecting the right coverage, businesses can mitigate potential losses and focus on growth and success. Remember, effective risk management is not a one-time event but an ongoing process that requires regular review and adaptation.

As you embark on your journey to safeguard your business, keep in mind that insurance is just one component of a comprehensive risk management strategy. By combining insurance coverage with proactive loss prevention measures and staying abreast of industry trends, you can ensure your business remains resilient and protected against the unforeseen challenges that lie ahead.

What is the difference between general liability insurance and professional liability insurance (E&O)?

+General liability insurance covers a wide range of third-party claims, including bodily injury, property damage, and personal and advertising injury