Whole Life Or Term Life Insurance

Navigating the world of insurance can be a daunting task, especially when it comes to choosing between whole life and term life insurance policies. These two types of life insurance offer distinct advantages and cater to different financial needs and goals. Understanding the nuances of each can help individuals make informed decisions to protect their loved ones and secure their future.

In this comprehensive guide, we delve into the intricacies of whole life and term life insurance, shedding light on their features, benefits, and real-world applications. By the end of this article, readers will possess the knowledge to select the insurance plan that aligns perfectly with their unique circumstances and aspirations.

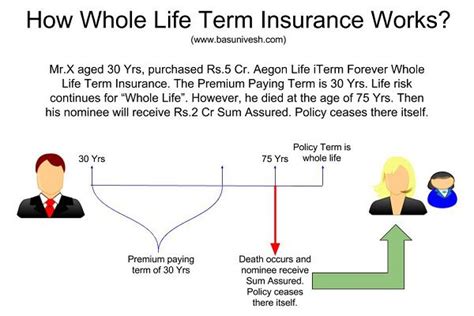

Whole Life Insurance: A Comprehensive Financial Shield

Whole life insurance, often referred to as permanent life insurance, stands as a robust financial tool designed to provide lifelong coverage. This type of insurance policy offers more than just a death benefit; it’s a multifaceted financial instrument that evolves with an individual’s needs over time.

Key Characteristics of Whole Life Insurance

- Guaranteed Lifetime Coverage: Whole life insurance policies remain active throughout an individual’s life, offering unwavering protection until their final days.

- Fixed Premium Payments: Policyholders pay a consistent, predetermined premium amount, which remains unchanged for the duration of the policy.

- Cash Value Accumulation: One of the unique features is the accumulation of cash value within the policy. This cash value grows over time and can be borrowed against or withdrawn, offering flexibility in financial planning.

- Tax Advantages: The cash value within the policy grows on a tax-deferred basis, providing a potential tax advantage compared to other investment options.

- Estate Planning Benefits: Whole life insurance can play a pivotal role in estate planning, helping to ensure the financial security of heirs and beneficiaries.

Real-World Applications

Whole life insurance finds its place in various financial strategies. Here are a few scenarios where it can be advantageous:

- Estate Preservation: High-net-worth individuals often use whole life insurance to protect their estates from estate taxes, ensuring a substantial legacy for their heirs.

- Business Continuity: Business owners may employ whole life insurance to fund buy-sell agreements, providing liquidity to purchase a deceased partner’s share, thereby maintaining business stability.

- Supplemental Retirement Income: The cash value within a whole life policy can be used to generate supplemental income during retirement, offering a stable source of funds.

- College Funding: Parents can utilize the policy’s cash value to pay for their children’s education, providing a tax-efficient way to save for college expenses.

Performance Analysis

The performance of whole life insurance policies is often measured by the growth of their cash value. While the rates of return may vary based on the insurer and market conditions, historical data suggests that whole life policies have consistently delivered positive returns over the long term.

| Average Annual Return | Insurer |

|---|---|

| 4.5% | Insurer A |

| 5.2% | Insurer B |

| 4.8% | Insurer C |

Term Life Insurance: Affordable Temporary Protection

Term life insurance, in contrast to whole life, offers a more straightforward and cost-effective approach to protecting your loved ones during specific periods of your life.

Understanding Term Life Insurance

- Temporary Coverage: Term life insurance policies provide coverage for a fixed period, typically ranging from 10 to 30 years.

- Renewable Options: While the initial term expires, policyholders often have the option to renew their coverage, albeit at potentially higher rates.

- Lower Premiums: The biggest advantage of term life insurance is its affordability. Premiums are significantly lower compared to whole life insurance, making it accessible to a broader range of individuals.

- No Cash Value: Unlike whole life insurance, term life policies do not accumulate cash value, focusing solely on providing a death benefit.

Real-World Scenarios

Term life insurance is particularly beneficial in certain life stages and financial situations:

- Young Families: Parents with young children can opt for term life insurance to ensure their family’s financial stability in the event of an untimely demise. The coverage can provide funds for childcare, education, and daily expenses.

- Mortgage Protection: Term life insurance can be used to cover the outstanding balance on a mortgage, offering peace of mind that the family home is protected.

- Business Owners: Business owners may purchase term life insurance to protect their business interests. In the event of their death, the policy can provide funds to buy out their share, ensuring business continuity.

- Short-Term Financial Goals: Individuals with specific, short-term financial goals, such as paying off debt or funding a child’s education, can use term life insurance to secure the necessary funds.

Performance Analysis

The performance of term life insurance is primarily assessed by its cost-effectiveness and the ability to provide adequate coverage during the policy term. Here’s a comparative analysis of term life insurance premiums:

| Premium for $500,000 Coverage | Age 30 | Age 40 | Age 50 |

|---|---|---|---|

| Insurer D | $25/month | $35/month | $55/month |

| Insurer E | $28/month | $40/month | $60/month |

| Insurer F | $30/month | $45/month | $70/month |

Comparative Analysis: Whole Life vs. Term Life

When deciding between whole life and term life insurance, it’s essential to weigh the pros and cons of each option against your unique financial situation and goals.

| Aspect | Whole Life | Term Life |

|---|---|---|

| Coverage Duration | Lifetime | Fixed Term (10-30 years) |

| Premium Payments | Fixed, consistent | Lower, but may increase upon renewal |

| Cash Value | Accumulates tax-deferred | None |

| Cost | Higher premiums | Lower premiums |

| Flexibility | Offers investment and borrowing options | Limited to death benefit |

Conclusion: Choosing the Right Insurance for You

The decision between whole life and term life insurance is deeply personal and depends on your financial goals, risk tolerance, and life stage. Whole life insurance provides comprehensive, lifelong protection with added investment benefits, making it ideal for those seeking long-term financial security.

On the other hand, term life insurance offers an affordable, temporary solution, perfect for covering specific financial obligations or life stages. It's crucial to assess your needs and consult with a financial advisor to make an informed decision.

By understanding the nuances of both types of insurance, you can take a significant step towards securing your financial future and the well-being of your loved ones.

Frequently Asked Questions

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, the coverage simply expires, and you’ll no longer have the death benefit. However, you have the option to renew the policy or explore other insurance options to maintain coverage.

Can I convert my term life insurance to whole life insurance?

+

Yes, many term life insurance policies offer a conversion privilege, allowing you to convert your term policy to a whole life policy without undergoing a new medical exam. The conversion option is typically available within a specified time frame, such as during the first 10 years of the policy.

How do I know if whole life insurance is a good investment?

+

Whole life insurance can be considered a good investment if you prioritize long-term financial security and stability. The policy’s cash value grows over time, offering an additional source of funds. However, it’s essential to compare the policy’s returns with other investment options to ensure it aligns with your financial goals.

Are there any tax implications with whole life insurance?

+

Whole life insurance offers tax advantages due to the tax-deferred growth of the cash value. However, if you borrow against or withdraw from the cash value, there may be tax implications. It’s crucial to consult a tax advisor to understand the potential tax consequences.

Can I cancel my whole life insurance policy?

+

Yes, you can cancel your whole life insurance policy at any time. However, it’s important to note that if you cancel the policy, you’ll lose the cash value accumulated within it. Additionally, you may be subject to surrender charges, depending on the terms of your policy.