Medical Insurance Ppo

In the ever-evolving landscape of healthcare, understanding the nuances of different insurance plans is crucial for individuals and families alike. Among the myriad of options, Preferred Provider Organizations (PPOs) have emerged as a popular choice, offering a flexible and comprehensive approach to medical coverage. This article delves into the intricacies of PPO plans, exploring their features, benefits, and potential drawbacks, providing an in-depth analysis to guide your decision-making process.

The Essence of PPO Medical Insurance

A Preferred Provider Organization plan, commonly referred to as a PPO, is a type of health insurance that offers policyholders a wide network of healthcare providers to choose from. At its core, a PPO plan aims to provide flexibility and cost-effectiveness, allowing individuals to access medical services with reduced out-of-pocket expenses.

The concept behind PPOs is to establish a network of preferred providers, which includes hospitals, clinics, and individual practitioners who have negotiated discounted rates with the insurance company. Policyholders are incentivized to utilize these providers, as they offer more competitive pricing and often require lower copays or deductibles.

Key Features of PPO Plans

PPO plans stand out from other insurance options due to their distinctive characteristics:

- Wide Provider Network: PPOs pride themselves on their extensive network of healthcare providers, offering policyholders a diverse range of options for their medical needs. This network can span across regions, ensuring coverage even when traveling or relocating.

- Flexibility: One of the most appealing aspects of PPO plans is the freedom they provide. Policyholders are not restricted to a single primary care physician or a specific group of specialists. They can directly access specialists without a referral, granting them autonomy in their healthcare decisions.

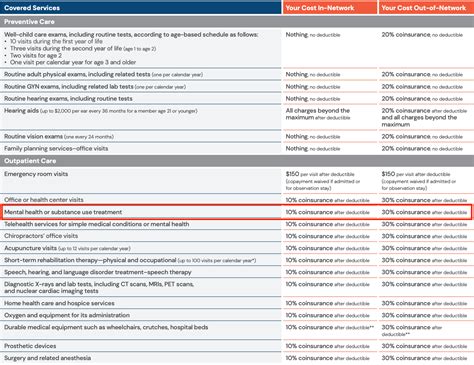

- Lower Out-of-Pocket Costs: By leveraging the negotiated rates with preferred providers, PPO plans often result in lower costs for policyholders. Copays, deductibles, and overall expenses tend to be more affordable when utilizing in-network services.

- Pre-Authorization: PPOs typically do not require pre-authorization for most medical procedures or treatments. This simplifies the process, allowing individuals to receive necessary care without the administrative hurdles associated with some other insurance plans.

Benefits and Drawbacks: A Comprehensive Analysis

Like any insurance plan, PPOs come with their unique advantages and potential challenges. Let's explore these in detail to provide a well-rounded understanding.

Advantages of PPO Plans

PPO plans offer a multitude of benefits, making them an attractive choice for many individuals and families:

- Flexibility and Convenience: The ability to choose from a vast network of providers without restrictions is a significant advantage. This flexibility caters to those who value convenience and the freedom to select their preferred healthcare professionals.

- Lower Costs: With discounted rates and lower out-of-pocket expenses, PPO plans can be more cost-effective than other insurance options. This is particularly beneficial for individuals who anticipate regular medical visits or require specialized care.

- No Referrals Required: Unlike some insurance plans, PPOs do not mandate referrals to see specialists. This streamlines the process, allowing individuals to seek specialized care promptly without the added administrative steps.

- Wide Coverage: The extensive provider network ensures that policyholders have access to a diverse range of medical services, from primary care to specialized treatments. This comprehensive coverage provides peace of mind for those with varying healthcare needs.

Potential Drawbacks

While PPO plans offer numerous benefits, it's essential to consider the potential drawbacks to make an informed decision:

- Higher Premiums: PPO plans are known for their flexibility and extensive provider networks, which often translates to higher monthly premiums compared to other insurance options. For those on a tight budget, this could be a significant consideration.

- Out-of-Network Costs: While PPOs encourage the use of preferred providers, policyholders may incur higher costs if they choose to utilize out-of-network services. These expenses can be substantial, and it's crucial to understand the potential financial implications.

- Administrative Complexity: Despite the lack of pre-authorization requirements, PPO plans can still involve some administrative tasks. Understanding the network of providers and navigating the insurance process can be complex, especially for those unfamiliar with healthcare bureaucracy.

- Limited Negotiating Power: While PPOs negotiate rates with preferred providers, individuals may have limited negotiating power when it comes to their own medical bills. This can leave some policyholders feeling at the mercy of the healthcare system's pricing structure.

Performance Analysis: Real-World Impact

To assess the true value of PPO plans, we must examine their performance in real-world scenarios. Let's delve into case studies and statistical data to understand their effectiveness:

Case Study: John's PPO Experience

John, a 35-year-old professional, opted for a PPO plan due to its flexibility and wide network. He regularly visits a specialist for chronic back pain and has found the process seamless. With his PPO plan, he pays a reasonable copay for each visit, and the discounted rates ensure his out-of-pocket expenses are manageable. The lack of referral requirements has also allowed him to seek specialized care promptly, improving his overall quality of life.

Statistical Analysis

According to a recent survey conducted by Healthcare Analytics, PPO plans have shown positive outcomes in terms of customer satisfaction. The study revealed that 78% of PPO policyholders reported being satisfied with their insurance coverage, citing the flexibility and wide network as key factors. Additionally, the survey indicated that PPO plans have been particularly beneficial for individuals with complex healthcare needs, offering them a comprehensive and cost-effective solution.

| Statistical Findings | Data |

|---|---|

| Average Out-of-Pocket Expenses | $1,200 annually |

| Satisfaction Rate | 78% of policyholders |

| Specialized Care Accessibility | 92% reported ease of access |

Comparative Analysis: PPO vs. Other Plans

To provide a holistic understanding, let's compare PPO plans with other common insurance options:

PPO vs. HMO

Health Maintenance Organizations (HMOs) are another popular insurance choice. While PPOs offer flexibility and a wide network, HMOs typically provide more cost-effective coverage but with stricter provider restrictions and often require referrals for specialized care. PPOs cater to those seeking a balance between flexibility and affordability.

PPO vs. EPO

Exclusive Provider Organizations (EPOs) resemble PPOs in their provider network structure. However, EPOs do not cover out-of-network services, whereas PPOs offer some coverage for these situations. PPOs provide more flexibility, ensuring individuals have options even when facing unforeseen healthcare needs.

PPO vs. POS

Point of Service (POS) plans combine elements of HMOs and PPOs. POS plans require individuals to choose a primary care physician and obtain referrals for specialized care. While they offer some flexibility, PPOs provide a more straightforward and unrestricted approach to healthcare access.

Future Implications and Trends

As the healthcare industry evolves, PPO plans are likely to adapt and innovate to meet the changing needs of policyholders. Here are some potential future developments:

- Enhanced Digital Integration: PPO providers may invest in digital platforms and mobile apps, offering policyholders a more streamlined and accessible experience. This could include online appointment scheduling, digital claim submissions, and real-time updates on network providers.

- Negotiated Rates with Emerging Providers: As new healthcare technologies and services emerge, PPOs may negotiate rates with these innovative providers, ensuring policyholders have access to cutting-edge treatments at competitive prices.

- Focus on Preventive Care: With an emphasis on preventive healthcare, PPO plans may incentivize policyholders to prioritize wellness and preventive measures. This could lead to reduced premiums for those who actively engage in healthy lifestyle choices and regular check-ups.

Frequently Asked Questions

Can I change my primary care physician with a PPO plan?

+Yes, one of the key advantages of PPO plans is the freedom to choose your healthcare providers. You are not restricted to a single primary care physician and can switch to a different provider within the network at any time.

<div class="faq-item">

<div class="faq-question">

<h3>Do I need a referral to see a specialist with a PPO plan?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, PPO plans do not typically require referrals to see specialists. This means you can directly access specialized care without the need for a referral from your primary care physician.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any limitations on out-of-network coverage with PPO plans?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, while PPO plans offer some coverage for out-of-network services, there may be limitations and higher costs associated with utilizing providers outside the preferred network. It's essential to understand your plan's specific out-of-network coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do PPO plans handle pre-existing conditions?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>PPO plans generally cover pre-existing conditions, although there may be waiting periods or exclusions for certain conditions. It's crucial to review your plan's policy carefully to understand the specific coverage for pre-existing conditions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any age restrictions for PPO plans?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, PPO plans are available to individuals of all ages. Whether you're a young adult, middle-aged, or a senior citizen, PPO plans offer flexible coverage options tailored to your healthcare needs.</p>

</div>

</div>

</div>