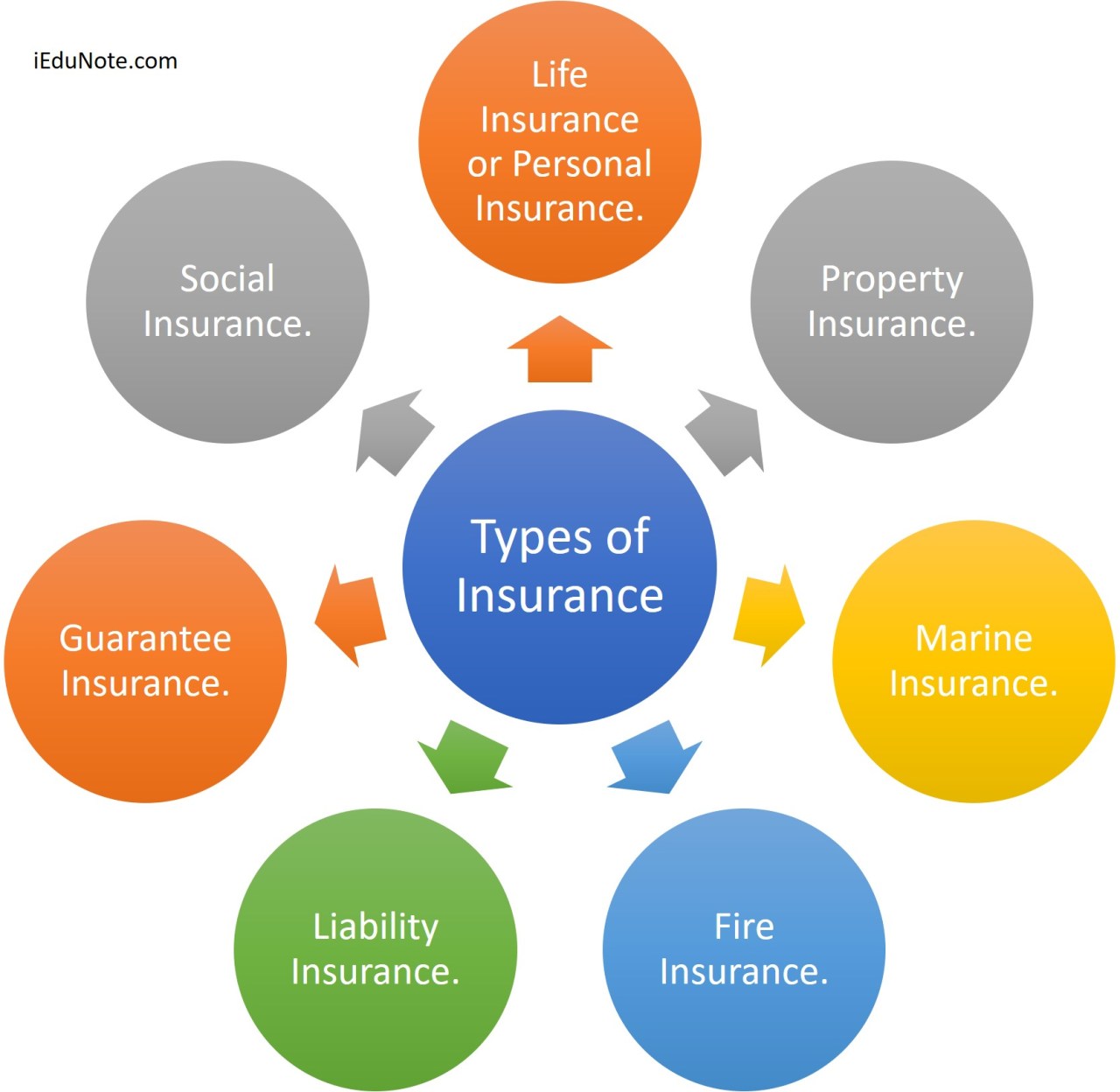

Types Of Of Insurance

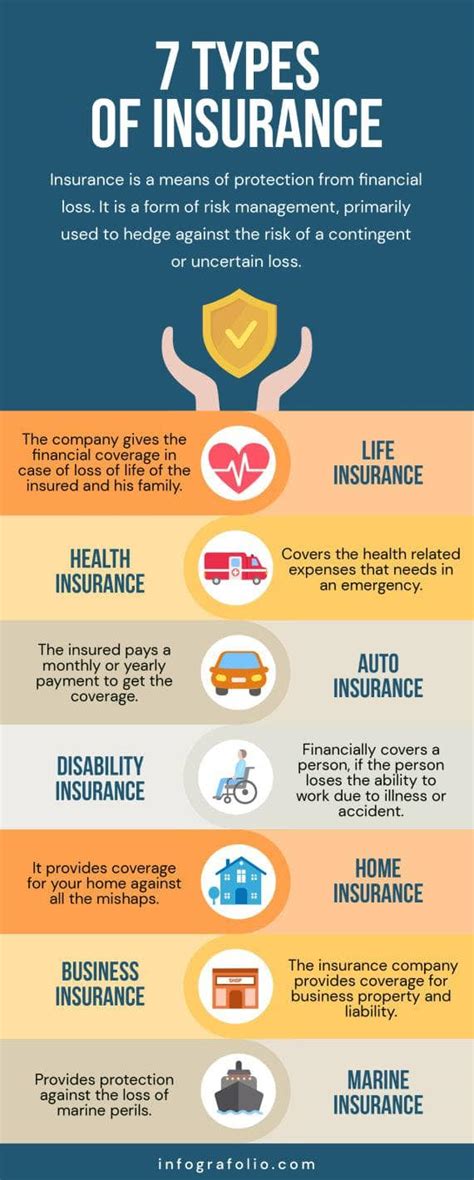

Insurance is an integral part of modern life, offering financial protection and peace of mind across a wide range of potential risks and uncertainties. From safeguarding our health and property to managing business operations, insurance plays a pivotal role in mitigating losses and ensuring continuity. This article delves into the diverse landscape of insurance types, shedding light on their unique features, benefits, and relevance in various contexts.

Health Insurance

Health insurance stands as a cornerstone in the insurance realm, focusing on the coverage of medical expenses and associated healthcare costs. With rising healthcare costs worldwide, this type of insurance has become increasingly vital. It provides individuals and families with access to necessary medical treatments, hospitalization, and prescription medications, alleviating the financial burden of unexpected illnesses or accidents.

Key Features of Health Insurance

- Coverage Types: Health insurance plans vary widely, offering coverage for specific illnesses, hospitalization, outpatient care, prescription drugs, and even preventive care. Some plans provide comprehensive coverage, while others focus on particular aspects of healthcare.

- Premiums and Deductibles: Policyholders pay regular premiums to maintain their coverage. Deductibles, which are the out-of-pocket expenses paid before insurance coverage kicks in, can vary depending on the plan. Higher deductibles often result in lower premiums.

- Network Providers: Many health insurance plans have a network of preferred healthcare providers, offering discounted rates. Out-of-network care may incur higher costs.

- Pre-existing Conditions: Some health insurance plans cover pre-existing conditions, ensuring individuals with existing health issues have access to necessary treatments.

| Coverage Aspect | Health Insurance |

|---|---|

| Hospitalization | Covers expenses for inpatient care, surgeries, and related treatments. |

| Outpatient Care | Includes doctor visits, diagnostic tests, and follow-up care. |

| Prescription Drugs | Provides coverage for essential medications, often with preferred pharmacy networks. |

| Preventive Care | Offers coverage for routine check-ups, screenings, and vaccinations. |

Life Insurance

Life insurance is a financial safeguard for individuals and their loved ones, providing a lump-sum payment upon the policyholder’s death. This type of insurance serves as a safety net, ensuring financial stability and security for beneficiaries during emotionally challenging times.

Types of Life Insurance

- Term Life Insurance: This type offers coverage for a specified term, typically ranging from 10 to 30 years. It provides a death benefit to beneficiaries if the insured passes away during the term. Term life insurance is often more affordable compared to permanent life insurance.

- Whole Life Insurance (Permanent Life Insurance): This policy provides coverage for the insured’s entire life. It includes a cash value component that grows over time, offering a savings element alongside the death benefit. Whole life insurance is typically more expensive but provides lifelong coverage.

- Universal Life Insurance: A flexible permanent life insurance option, allowing policyholders to adjust coverage and premiums over time. It offers a cash value component and provides a death benefit to beneficiaries.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Affordable, fixed-term coverage with a death benefit. |

| Whole Life Insurance | Lifetime coverage with a cash value component. |

| Universal Life Insurance | Flexible permanent insurance with adjustable coverage and premiums. |

Property Insurance

Property insurance, encompassing homeowners’ insurance and renters’ insurance, provides coverage for homes, personal belongings, and liability protection. This type of insurance safeguards individuals from financial losses resulting from damage to their property due to events like fires, storms, theft, or vandalism.

Key Aspects of Property Insurance

- Dwelling Coverage: This component covers the physical structure of the home, including walls, roofs, and permanent fixtures.

- Personal Property Coverage: It provides protection for personal belongings like furniture, electronics, and clothing.

- Liability Coverage: Property insurance often includes liability protection, covering legal costs and damages if someone is injured on the insured property.

- Additional Living Expenses: In case of a covered loss that makes the home uninhabitable, this coverage helps with temporary living expenses.

| Property Insurance Type | Coverage Highlights |

|---|---|

| Homeowners' Insurance | Protects the home and its contents, offering coverage for structural damage, personal belongings, and liability. |

| Renters' Insurance | Covers personal belongings and liability for renters, providing financial protection against losses due to theft, fire, or accidents. |

Auto Insurance

Auto insurance is a legal requirement in most countries, providing financial protection in the event of car accidents or other vehicle-related incidents. It covers a range of potential risks, including liability for bodily injury or property damage caused by the insured driver, as well as damage to the insured vehicle itself.

Components of Auto Insurance

- Liability Coverage: This is the most basic form of auto insurance, covering bodily injury and property damage caused by the insured driver. It’s a legal requirement in most places.

- Collision Coverage: This optional coverage pays for repairs or replacement of the insured vehicle after an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects against non-collision incidents like theft, vandalism, natural disasters, or damage caused by animals.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if the at-fault driver in an accident has no insurance or insufficient insurance to cover the damages.

| Auto Insurance Component | Coverage Details |

|---|---|

| Liability Coverage | Covers bodily injury and property damage caused by the insured driver. |

| Collision Coverage | Pays for repairs or replacement of the insured vehicle after an accident. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, and natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides coverage if the at-fault driver in an accident lacks sufficient insurance. |

Business Insurance

Business insurance is a broad term encompassing various types of coverage designed to protect businesses from a wide range of potential risks. These risks can include property damage, liability claims, business interruption, and other financial losses that could potentially derail a business’s operations.

Common Types of Business Insurance

- General Liability Insurance: This policy covers bodily injury, property damage, and personal and advertising injury claims. It’s a crucial protection for businesses that interact with the public.

- Professional Liability Insurance (Errors & Omissions Insurance): This coverage is designed for professionals like consultants, accountants, and lawyers, providing protection against negligence claims and errors in their professional services.

- Business Owner’s Policy (BOP): A BOP is a bundled insurance package that typically includes property insurance, business interruption insurance, and general liability insurance. It’s a cost-effective option for small to medium-sized businesses.

- Workers’ Compensation Insurance: This insurance is mandated by law in most states, providing coverage for medical bills and lost wages for employees injured on the job.

| Business Insurance Type | Coverage Overview |

|---|---|

| General Liability Insurance | Protects businesses from bodily injury, property damage, and personal injury claims. |

| Professional Liability Insurance | Covers professionals against negligence claims and errors in their services. |

| Business Owner's Policy (BOP) | A cost-effective bundle of property, business interruption, and general liability insurance. |

| Workers' Compensation Insurance | Provides coverage for medical expenses and lost wages for injured employees. |

Travel Insurance

Travel insurance is a temporary insurance plan that covers the policyholder’s trip, typically including medical expenses, trip cancellation, lost luggage, and other travel-related emergencies. It provides peace of mind and financial protection for travelers, ensuring they can enjoy their trips without the worry of unexpected costs or disruptions.

Key Features of Travel Insurance

- Medical Coverage: This is a crucial component, providing coverage for emergency medical treatment during the trip. It covers expenses like doctor visits, hospital stays, and prescription medications.

- Trip Cancellation/Interruption: This coverage reimburses travelers for non-refundable trip costs if they need to cancel or interrupt their trip due to covered reasons, such as illness, injury, or natural disasters.

- Lost Luggage and Personal Effects: Travel insurance often includes coverage for lost, stolen, or damaged luggage and personal items.

- Emergency Evacuation: In cases of severe illness or injury, this coverage provides for emergency medical evacuation to a more suitable facility.

| Travel Insurance Component | Coverage Details |

|---|---|

| Medical Coverage | Covers emergency medical treatment, including doctor visits and hospital stays. |

| Trip Cancellation/Interruption | Reimburses non-refundable trip costs if the trip is canceled or interrupted due to covered reasons. |

| Lost Luggage and Personal Effects | Provides coverage for lost, stolen, or damaged luggage and personal items. |

| Emergency Evacuation | Covers the cost of emergency medical evacuation to a more suitable facility. |

Conclusion

The world of insurance is vast and diverse, offering tailored protection for individuals, families, and businesses across a wide range of potential risks. From safeguarding our health and property to protecting our financial interests, insurance plays a vital role in modern life. Understanding the various types of insurance and their specific coverage is crucial for making informed decisions and ensuring comprehensive protection.

As we navigate an increasingly complex and uncertain world, insurance remains a vital tool for managing risk and ensuring peace of mind. Whether it's protecting our health, securing our property, or safeguarding our businesses, insurance provides the financial stability and security needed to weather life's unexpected storms.

FAQ

What is the primary purpose of health insurance?

+

Health insurance primarily aims to cover medical expenses and healthcare costs, ensuring individuals have access to necessary treatments and medications without the financial burden of unexpected illnesses or accidents.

How does life insurance benefit beneficiaries?

+

Life insurance provides a lump-sum payment upon the policyholder’s death, ensuring financial stability and security for beneficiaries during emotionally challenging times. It can cover funeral expenses, outstanding debts, and provide ongoing financial support.

What is the difference between term and whole life insurance?

+

Term life insurance offers coverage for a specified term, typically 10-30 years, and is more affordable. Whole life insurance provides lifetime coverage with a cash value component, offering savings alongside the death benefit, but it is more expensive.