Supplemental Health Care Insurance For Medicare

In the realm of healthcare, understanding your coverage options is crucial, especially when it comes to Medicare, the federal health insurance program for individuals aged 65 and older, as well as those with certain disabilities or conditions. While Medicare offers a comprehensive range of benefits, there are situations where additional coverage might be beneficial. This is where Supplemental Health Care Insurance steps in, providing an extra layer of protection and peace of mind.

Understanding Medicare’s Gaps

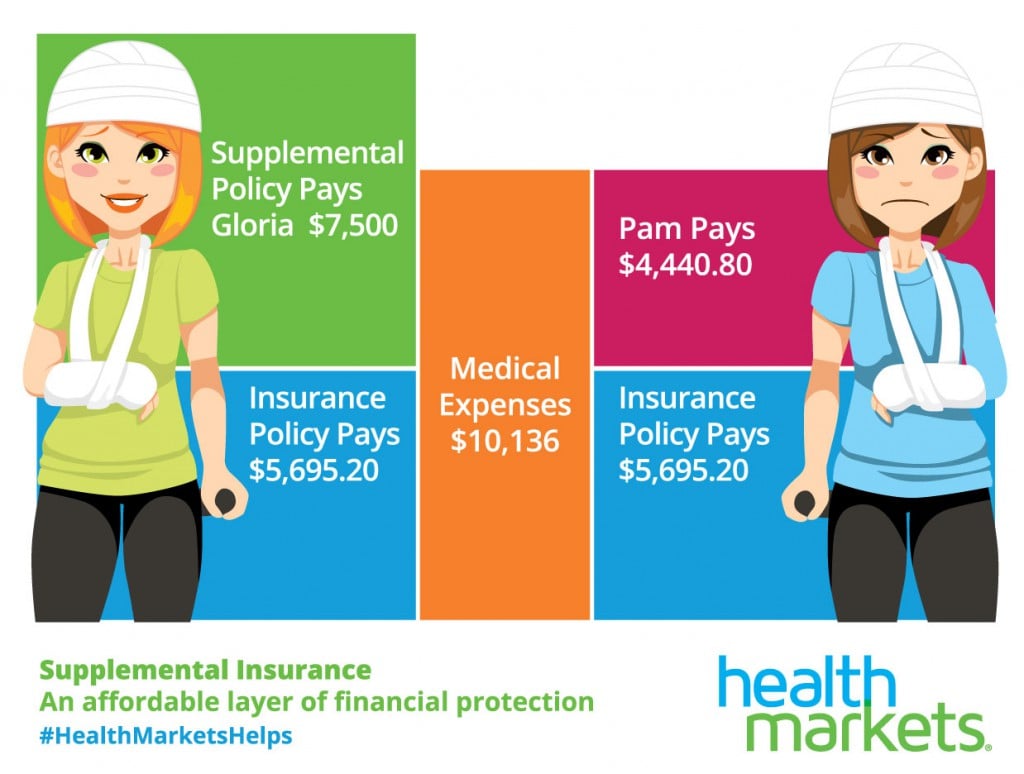

Despite the extensive coverage provided by Medicare, there are potential gaps that individuals may encounter. These gaps can include high out-of-pocket costs, limited coverage for certain services, or even the lack of coverage for specific medical conditions. Supplemental Health Care Insurance, often referred to as Medigap policies, is designed to fill these gaps and ensure that individuals have the financial support they need during their healthcare journey.

The Importance of Supplemental Coverage

As individuals navigate the complex world of healthcare, the importance of supplemental insurance becomes increasingly evident. Here’s a closer look at why Supplemental Health Care Insurance is a valuable addition to any Medicare plan:

1. Coverage for Out-of-Pocket Costs

One of the primary benefits of Supplemental Health Care Insurance is its ability to cover out-of-pocket expenses that Medicare may not fully address. This includes deductibles, co-payments, and co-insurance, which can quickly add up, especially for individuals with chronic conditions or those requiring frequent medical attention.

For instance, Medicare Part B, which covers outpatient services, has a deductible that must be met before coverage kicks in. With a Medigap policy, this deductible is often covered, ensuring that individuals aren't burdened with unexpected costs.

| Out-of-Pocket Expense | Medicare Coverage | Supplemental Insurance Coverage |

|---|---|---|

| Deductible | Partial | Full Coverage |

| Co-Payments | Varies | Reduced or Eliminated |

| Co-Insurance | Varies | Full Coverage |

2. Broader Coverage Options

While Medicare provides a solid foundation of coverage, it may not include certain services or treatments. Supplemental Health Care Insurance can bridge this gap by offering a wider range of benefits. For example, some Medigap policies cover services like prescription drugs, dental care, and vision care, which are not typically covered by Medicare.

Additionally, Medicare often has limitations on the number of visits or days covered for certain services. Supplemental insurance can remove these restrictions, ensuring that individuals have access to the care they need without worrying about exceeding coverage limits.

3. Peace of Mind and Financial Security

Healthcare expenses can be unpredictable and often come at the most inconvenient times. Supplemental Health Care Insurance provides a sense of security, knowing that unexpected medical bills won’t lead to financial strain. This peace of mind is invaluable, allowing individuals to focus on their health and well-being without the added stress of financial worries.

Moreover, Supplemental Insurance can be particularly beneficial for those with pre-existing conditions or chronic illnesses. By having comprehensive coverage, individuals can ensure they receive the necessary treatments and medications without facing financial barriers.

Types of Supplemental Health Care Insurance

There are various types of Supplemental Health Care Insurance plans available, each designed to cater to different needs and preferences. Understanding these options is crucial when deciding on the best supplemental coverage for your specific situation.

1. Medigap Policies

Medigap policies, as mentioned earlier, are the most common form of Supplemental Health Care Insurance for Medicare beneficiaries. These policies are standardized by the government, ensuring that regardless of the provider, the benefits remain consistent. Medigap policies are identified by letters A through N, with each offering a different combination of benefits.

| Medigap Plan | Benefits Covered |

|---|---|

| Plan A | Basic coverage, including deductibles, co-insurance, and co-payments |

| Plan F | Comprehensive coverage, including all Part A and Part B deductibles and co-insurance |

| Plan G | Similar to Plan F, but with a Part B deductible |

| Plan N | Covers most Part A and Part B co-insurance, but with a smaller benefit limit |

2. Medicare Advantage Plans

Medicare Advantage plans, also known as Part C, are another form of Supplemental Health Care Insurance. These plans are offered by private insurance companies and provide an alternative to original Medicare. They often include additional benefits, such as prescription drug coverage and vision care, all within a single plan.

One advantage of Medicare Advantage plans is their flexibility. They can be tailored to meet the specific needs of individuals, offering a customized approach to healthcare coverage.

3. Prescription Drug Plans (PDPs)

Prescription drug coverage is a critical aspect of healthcare, especially for individuals with chronic conditions. Medicare Part D offers prescription drug coverage, but it can be enhanced through Supplemental Health Care Insurance known as PDPs (Prescription Drug Plans). These plans provide additional coverage for medications, ensuring that individuals have access to the drugs they need without excessive out-of-pocket expenses.

Choosing the Right Supplemental Plan

Selecting the appropriate Supplemental Health Care Insurance plan involves careful consideration of your unique healthcare needs and financial situation. Here are some key factors to keep in mind when making your decision:

1. Evaluate Your Healthcare Needs

Assess your current and potential future healthcare requirements. Consider any pre-existing conditions, chronic illnesses, or regular medical procedures you may need. This evaluation will help you identify the specific gaps in your Medicare coverage that need to be addressed.

2. Compare Plans and Benefits

Research and compare the various Supplemental Health Care Insurance options available. Look into the benefits offered by each plan, including coverage for deductibles, co-payments, and co-insurance. Consider whether the plan covers services that are important to you, such as dental or vision care.

3. Assess Your Budget

While comprehensive coverage is essential, it’s also important to choose a plan that aligns with your financial capabilities. Supplemental insurance plans come with monthly premiums, and some may have additional costs associated with specific benefits. Ensure that the plan you select is affordable and fits within your budget.

4. Seek Professional Guidance

Navigating the world of Medicare and supplemental insurance can be complex. Consider consulting with a licensed insurance agent or a Medicare specialist who can provide personalized advice based on your circumstances. They can help you understand the intricacies of different plans and guide you toward the most suitable option.

The Future of Supplemental Health Care Insurance

As healthcare continues to evolve, so too will the landscape of Supplemental Health Care Insurance. The industry is constantly adapting to meet the changing needs of individuals, and we can expect to see further innovations in the coming years. Here are some potential future developments:

1. Improved Digital Integration

With the increasing digital transformation of healthcare, we can anticipate that Supplemental Health Care Insurance providers will integrate more seamlessly with electronic health records and online platforms. This will enhance the efficiency of claims processing and provide individuals with better access to their policy information.

2. Focus on Preventive Care

There is a growing emphasis on preventive care in the healthcare industry, and this trend is likely to influence Supplemental Health Care Insurance plans. We may see an increase in coverage for preventive services, such as wellness visits, screenings, and immunizations, further encouraging individuals to take a proactive approach to their health.

3. Customized Plans

The future of Supplemental Health Care Insurance may involve even more personalized plans. With advancements in data analytics and artificial intelligence, insurance providers could develop customized policies based on an individual’s unique health profile, medical history, and lifestyle choices. This level of customization could optimize coverage and ensure individuals receive the benefits they truly need.

Can I have both a Medigap policy and a Medicare Advantage plan simultaneously?

+No, you cannot have both a Medigap policy and a Medicare Advantage plan at the same time. These plans are designed to work as alternatives to original Medicare, so choosing one or the other is necessary. However, you can switch between these options during specific enrollment periods if your needs change.

Are there any age restrictions for enrolling in Supplemental Health Care Insurance?

+Age restrictions vary depending on the type of Supplemental Health Care Insurance you’re considering. Medigap policies, for instance, have no age restrictions, but Medicare Advantage plans may have specific enrollment periods and age criteria. It’s best to consult with an insurance provider or Medicare specialist for detailed information.

What happens if I change my mind about my Supplemental Health Care Insurance plan after enrollment?

+The ability to change or cancel your Supplemental Health Care Insurance plan depends on the type of plan and the timing of your request. Medigap policies often have a trial period during which you can cancel without penalty. Medicare Advantage plans also have specific enrollment periods where you can make changes. It’s important to review the terms and conditions of your plan to understand your options.