State Farm Insurance Com

Welcome to a comprehensive exploration of State Farm Insurance Company, a prominent player in the insurance industry. With a rich history spanning over a century, State Farm has established itself as a trusted provider of various insurance services across the United States. This article aims to delve into the depths of this company's offerings, reputation, and impact on the industry, providing an in-depth analysis for those seeking to understand its role and significance.

A Legacy of Trust: State Farm’s Historical Perspective

State Farm Insurance Company was founded in 1922 by George J. Mecherle, a former farmer and insurance salesman. Recognizing the challenges faced by farmers and motorists in obtaining affordable insurance, Mecherle envisioned a company that would offer quality coverage at reasonable rates. The company’s initial focus was on automobile insurance, a decision that proved to be astute as the number of vehicles on American roads surged in the following decades.

State Farm's early success can be attributed to its innovative business model. Unlike many of its contemporaries, State Farm opted for a direct-to-consumer approach, cutting out the middleman and allowing for more competitive pricing. This strategy, combined with a commitment to exceptional customer service, quickly gained the company a loyal customer base.

Diverse Portfolio: State Farm’s Offering

While State Farm began its journey with a focus on automobile insurance, it has since expanded its portfolio to become a comprehensive insurance provider. Here’s a breakdown of its key offerings:

Automobile Insurance

Automobile insurance remains the cornerstone of State Farm’s business. The company offers a wide range of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) insurance. State Farm’s auto insurance policies are known for their flexibility, allowing customers to customize their plans to fit their specific needs and budgets.

State Farm also provides various discounts to its auto insurance customers. These include discounts for safe driving, multiple vehicles, and advanced safety features in vehicles. Additionally, the company offers a usage-based insurance program, allowing policyholders to potentially save money by demonstrating safe driving habits.

Homeowners Insurance

State Farm’s homeowners insurance policies provide protection for one of the most significant investments many people make—their homes. The company offers coverage for a wide range of residential properties, including single-family homes, condominiums, and rental properties. State Farm’s homeowners insurance policies typically include protection against damage caused by fire, wind, hail, and other perils.

State Farm also offers additional coverage options for homeowners, such as personal liability coverage, which can protect policyholders in the event of lawsuits related to accidents on their property. The company's policies often include coverage for personal belongings and additional living expenses in case of a covered loss.

Renters Insurance

Recognizing that not everyone owns a home, State Farm also provides renters insurance. This type of insurance protects policyholders’ personal belongings and provides liability coverage in case of accidents or injuries that occur on the insured premises. Renters insurance is an affordable way for tenants to safeguard their possessions and peace of mind.

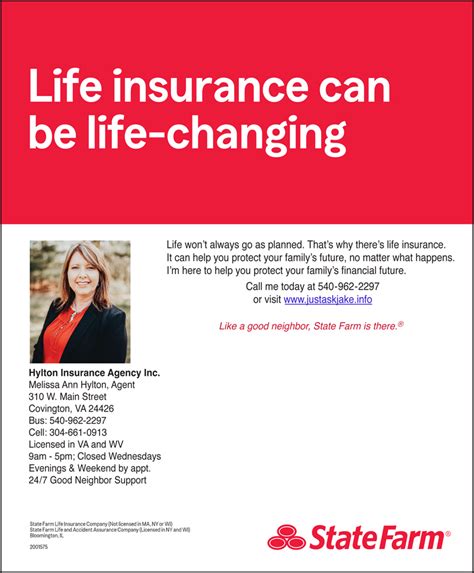

Life Insurance

State Farm offers a range of life insurance products to help individuals and families protect their financial future. The company’s life insurance policies can provide a death benefit to help cover expenses such as funeral costs, outstanding debts, and ongoing living expenses for surviving family members. State Farm offers both term life and permanent life insurance policies, allowing customers to choose the option that best fits their needs and budget.

Health Insurance

State Farm also offers health insurance plans, providing coverage for medical expenses. The company’s health insurance policies can include benefits such as coverage for doctor visits, hospital stays, prescription drugs, and preventive care. State Farm’s health insurance plans are designed to offer comprehensive protection at competitive rates.

Business Insurance

For business owners, State Farm provides a range of commercial insurance products. These policies can protect businesses against various risks, including property damage, liability claims, and business interruption. State Farm’s business insurance policies are tailored to meet the unique needs of different industries and business sizes.

Exceptional Customer Service: The State Farm Difference

One of the key factors that have contributed to State Farm’s success is its commitment to exceptional customer service. The company has built a reputation for being responsive, empathetic, and dedicated to meeting its customers’ needs. State Farm’s customer service representatives are known for their knowledge, professionalism, and willingness to go the extra mile to ensure customer satisfaction.

State Farm offers a range of convenient service options, including online account management, mobile apps, and a network of local agents. Policyholders can easily manage their policies, make payments, and file claims through these digital channels. Additionally, State Farm's network of local agents provides personalized service and expert advice to help customers choose the right insurance coverage for their needs.

Financial Strength and Stability

State Farm’s financial strength and stability are key factors in its ability to provide reliable insurance coverage. The company has consistently maintained a strong financial position, with high ratings from independent agencies such as AM Best and Standard & Poor’s. These ratings reflect State Farm’s ability to meet its financial obligations to policyholders and its resilience in the face of economic challenges.

| Rating Agency | Financial Strength Rating |

|---|---|

| AM Best | A++ (Superior) |

| Standard & Poor's | AA+ (Very Strong) |

State Farm's financial strength allows it to offer competitive pricing and maintain stable insurance premiums, even during periods of economic uncertainty. This stability is a key factor in attracting and retaining customers, as it provides a sense of security and trust in the company's ability to deliver on its promises.

Community Engagement and Corporate Responsibility

Beyond its insurance offerings, State Farm is known for its commitment to community engagement and corporate responsibility. The company has a long history of supporting various causes and initiatives aimed at improving the communities it serves.

State Farm's community involvement includes sponsorship of youth sports programs, educational initiatives, and disaster relief efforts. The company also encourages and supports volunteerism among its employees, fostering a culture of giving back. State Farm's commitment to social responsibility enhances its reputation as a trusted and responsible corporate citizen.

The Digital Frontier: State Farm’s Technological Advancements

In recent years, State Farm has made significant investments in technology to enhance its services and improve the customer experience. The company has developed innovative digital tools and platforms to streamline processes, improve efficiency, and provide greater convenience for policyholders.

One notable example is State Farm's mobile app, which allows customers to manage their policies, view coverage details, and even file claims from their smartphones. The app also incorporates features such as digital ID cards and GPS-based accident assistance, making it easier for policyholders to access the information and support they need in the event of an incident.

State Farm has also embraced the use of telematics and usage-based insurance programs. These technologies allow the company to gather real-time data on driving behavior, which can be used to offer personalized insurance rates and provide feedback to drivers on how to improve their safety on the road.

The Future of State Farm: Growth and Innovation

Looking ahead, State Farm is poised for continued growth and innovation. The company is constantly evolving its business strategies and product offerings to meet the changing needs of its customers and stay ahead in a highly competitive market.

State Farm's focus on innovation is evident in its investments in emerging technologies. The company is exploring the potential of artificial intelligence, machine learning, and data analytics to enhance its underwriting processes, improve claims handling, and provide more personalized insurance solutions. By leveraging these technologies, State Farm aims to deliver even better value and service to its policyholders.

Additionally, State Farm is committed to expanding its reach and accessibility. The company is actively working to make its insurance products and services more accessible to a wider range of consumers, including those who may have previously faced barriers to obtaining coverage. This commitment to inclusivity and diversity is a key aspect of State Farm's future growth strategy.

Conclusion: A Trusted Partner for Your Insurance Needs

State Farm Insurance Company has established itself as a leading provider of insurance services across the United States. With a rich history, a diverse portfolio of offerings, and a commitment to exceptional customer service, State Farm has earned the trust and loyalty of millions of customers. As the company continues to innovate and adapt to the changing landscape of the insurance industry, it remains a reliable partner for individuals and businesses seeking comprehensive and affordable insurance solutions.

What types of insurance does State Farm offer?

+State Farm offers a comprehensive range of insurance products, including automobile insurance, homeowners insurance, renters insurance, life insurance, health insurance, and business insurance. They provide coverage for a wide variety of needs, from personal property and health to business risks.

How does State Farm’s customer service compare to other insurance companies?

+State Farm is renowned for its exceptional customer service. The company has a reputation for being responsive, empathetic, and dedicated to meeting its customers’ needs. State Farm’s customer service representatives are known for their knowledge and professionalism, and the company offers a range of convenient service options, including online account management and a network of local agents.

Is State Farm a financially stable company?

+Yes, State Farm is considered a financially stable and reliable insurance provider. The company has consistently maintained high financial strength ratings from independent agencies, such as AM Best and Standard & Poor’s. These ratings reflect State Farm’s ability to meet its financial obligations to policyholders and its resilience in challenging economic conditions.

What sets State Farm apart from its competitors in the insurance industry?

+State Farm’s commitment to exceptional customer service, combined with its diverse portfolio of insurance offerings, sets it apart from its competitors. The company’s focus on innovation and technological advancements, as well as its strong financial position, further enhances its competitive advantage in the insurance market.

How can I become a State Farm customer?

+Becoming a State Farm customer is easy. You can start by getting a quote online or contacting a local State Farm agent. The company offers a range of insurance products and services, and its agents can help you find the coverage that best fits your needs and budget. With State Farm’s commitment to customer service, you can expect a seamless and personalized experience throughout the process.