Vehicle Insurance Texas

Vehicle insurance is a crucial aspect of vehicle ownership, and in Texas, it is not only a legal requirement but also a necessary protection for drivers and their assets. Texas has its own unique set of insurance regulations and requirements, which can sometimes be confusing for residents and newcomers alike. In this comprehensive guide, we will delve into the world of vehicle insurance in Texas, covering everything from understanding the state's laws to choosing the right coverage and navigating the claims process.

Understanding Vehicle Insurance Laws in Texas

Texas has a unique approach to vehicle insurance, which is primarily governed by the Texas Department of Insurance (TDI). The state follows a tort system, which means that if you are at fault in an accident, your insurance will cover the damages, and you may also be held personally liable for any additional costs. This system differs from no-fault insurance, where each party’s insurance covers their own damages regardless of fault.

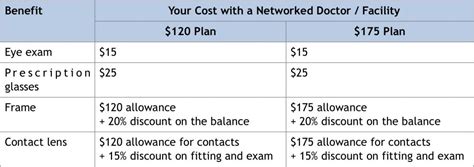

The state of Texas requires all drivers to carry a minimum amount of liability insurance, which includes:

- Bodily Injury Liability (BI): $30,000 per person / $60,000 per accident.

- Property Damage Liability (PD): $25,000 per accident.

These minimum limits are set by the Texas Minimum Liability Law and are designed to protect drivers from financial ruin in the event of an at-fault accident. However, many experts recommend carrying higher limits to ensure adequate protection, especially in a state like Texas where the cost of living and medical expenses can be significant.

Additional Coverage Options

While the state-mandated minimum liability coverage is a legal requirement, it is important to note that it may not provide sufficient protection for many drivers. Here are some additional coverage options that Texas drivers should consider:

- Collision Coverage: This optional coverage pays for damages to your vehicle if you’re in an accident, regardless of fault. It can be especially useful in Texas, where there is a high risk of severe weather events and accidents.

- Comprehensive Coverage: This coverage protects against damage to your vehicle caused by non-accident events, such as theft, vandalism, natural disasters, or collisions with animals. In a state like Texas, where wildlife encounters are common and severe weather can cause extensive damage, comprehensive coverage is highly recommended.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have enough insurance to cover the damages. In Texas, where uninsured drivers are a persistent problem, UM/UIM coverage is a smart choice.

- Medical Payments Coverage (MedPay): MedPay provides additional coverage for medical expenses, regardless of fault, which can be beneficial in a state with high medical costs.

Choosing the Right Insurance Provider

Texas is home to a diverse range of insurance providers, from national companies to local insurers. When selecting an insurance provider, it’s important to consider the following factors:

- Financial Strength: Choose an insurer with a strong financial rating to ensure they can pay out claims in the event of an accident.

- Coverage Options: Ensure the insurer offers the coverage options you need, such as the additional coverages mentioned above.

- Discounts: Many insurers offer discounts for various reasons, such as safe driving records, multiple vehicles insured, or certain vehicle safety features. Look for insurers that offer discounts that apply to your situation.

- Customer Service: A good insurance company should provide excellent customer service, including easy access to representatives and a straightforward claims process.

- Technology: Consider insurers that offer digital tools and apps for policy management and claims reporting, which can make the process more convenient.

Some of the top insurance providers in Texas include State Farm, Geico, Allstate, USAA, and Progressive. These companies often offer competitive rates and a wide range of coverage options, making them popular choices among Texas drivers.

Comparing Quotes

To ensure you’re getting the best deal, it’s important to compare quotes from multiple insurers. Factors that can influence your insurance rates include your driving history, the make and model of your vehicle, your age and gender, and your location. Texas has a diverse range of landscapes and cities, each with its own set of driving conditions and risks, so rates can vary significantly across the state.

When comparing quotes, pay attention to the policy limits and deductibles. Higher policy limits and lower deductibles generally provide better protection, but they also come at a higher cost. Strike a balance between the coverage you need and what you can afford.

| Insurers | Average Annual Premium (Texas) |

|---|---|

| State Farm | $1,037 |

| Geico | $1,174 |

| Allstate | $1,420 |

| USAA | $830 (restricted to military members and their families) |

| Progressive | $1,388 |

Note: These averages are for informational purposes only and may not reflect your personal quote. Rates can vary significantly based on individual factors.

Navigating the Claims Process

In the unfortunate event of an accident, knowing how to navigate the claims process is essential. Here’s a step-by-step guide:

- Contact Your Insurer: Immediately after an accident, contact your insurance company to report the incident. Most insurers have a 24⁄7 claims hotline for such situations.

- Gather Information: Collect as much information as possible at the scene of the accident, including photos, witness statements, and the other driver’s insurance information.

- Cooperate with the Investigation: Your insurer will investigate the accident to determine fault and liability. Provide any necessary documentation and cooperate fully with the investigation.

- Understand Your Coverage: Review your policy to understand what is covered and what your deductible is. This will help you manage your expectations during the claims process.

- Receive an Estimate: Your insurer will provide an estimate for the repairs or replacement of your vehicle. If you disagree with the estimate, you have the right to seek a second opinion or negotiate.

- Choose a Repair Shop: You have the right to choose your own repair shop. Some insurers may have preferred shops, but you are not obligated to use them. Look for reputable shops with good reviews and certifications.

- Monitor the Repair Process: Stay in touch with your repair shop and insurer to ensure the repairs are progressing smoothly. If there are any delays or additional damages discovered, inform your insurer promptly.

- Receive Payment: Once the repairs are complete and approved by your insurer, you will receive payment for the agreed-upon amount. Keep all receipts and documentation for your records.

Tips for a Smooth Claims Process

To ensure a smoother claims process, consider the following tips:

- Always carry your insurance card and a copy of your policy in your vehicle.

- Document everything related to the accident, including photos, videos, and notes.

- Keep a record of all communications with your insurer, including dates, times, and names of representatives.

- If you’re injured in an accident, seek medical attention immediately and keep records of your treatment.

- If the other driver is at fault, their insurance company may contact you. Be cautious and avoid providing any statements or admissions of fault.

Future of Vehicle Insurance in Texas

The world of vehicle insurance is constantly evolving, and Texas is no exception. With the rise of technology and autonomous vehicles, the insurance landscape is likely to change significantly in the coming years. Here are some potential future implications:

- Usage-Based Insurance (UBI): UBI programs, which are already offered by some insurers, could become more prevalent. These programs use telematics to track driving behavior and offer discounts to safe drivers.

- Autonomous Vehicle Insurance: As autonomous vehicles become more common, the insurance industry will need to adapt. Liability and coverage issues may shift as the concept of driver fault becomes less relevant.

- Digital Transformation: Insurance companies will continue to invest in digital technologies to improve the customer experience. This could include more advanced apps for policy management and claims reporting, as well as AI-powered chatbots for customer service.

- Climate Change and Natural Disasters: Texas is prone to severe weather events, and climate change may exacerbate these risks. Insurance companies may need to adjust their coverage and pricing strategies to account for increasing natural disaster claims.

Preparing for the Future

To stay ahead of these potential changes, Texas drivers can take the following steps:

- Stay informed about insurance industry trends and advancements.

- Review your policy annually to ensure it aligns with your current needs and circumstances.

- Consider new coverage options, such as UBI programs, that may provide cost savings or enhanced protection.

- Engage with your insurer and provide feedback on your experiences, helping them to improve their services.

What happens if I’m involved in an accident with an uninsured driver in Texas?

+

If you have uninsured motorist coverage (UM), your insurance will cover the damages caused by the uninsured driver. This coverage is highly recommended in Texas, where uninsured drivers are a persistent issue.

Can I switch insurance providers mid-policy in Texas?

+

Yes, you can switch insurance providers at any time. However, be sure to cancel your existing policy to avoid paying for overlapping coverage. You may also want to consider switching providers during your policy renewal period to take advantage of potential discounts.

How can I save money on my vehicle insurance in Texas?

+

There are several ways to save on your insurance premiums, including maintaining a clean driving record, taking defensive driving courses, and bundling your insurance policies (e.g., auto and home insurance). Additionally, shopping around and comparing quotes can help you find the best rates.

What should I do if my vehicle is declared a total loss in an accident?

+

If your vehicle is declared a total loss, your insurer will pay out the actual cash value of the vehicle, minus your deductible. You may also have the option to use the insurance payout to purchase a replacement vehicle. It’s important to carefully review the payout and ensure it aligns with the market value of your vehicle.