Car Insurance Payment Calculator

When it comes to car insurance, one of the most important aspects for drivers is understanding the costs and how to estimate their insurance payments. The Car Insurance Payment Calculator is a powerful tool that provides an accurate and personalized estimate of your insurance premiums, helping you make informed decisions about your coverage and budget.

In this comprehensive guide, we will delve into the world of car insurance payment calculators, exploring their features, benefits, and how they can assist you in navigating the complex landscape of insurance policies. By the end, you'll have a clear understanding of how these calculators work and why they are an essential resource for every vehicle owner.

The Importance of Car Insurance Payment Calculators

Car insurance is a necessity for any vehicle owner, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. However, the cost of insurance can vary significantly based on numerous factors, making it challenging to predict your exact premium.

This is where Car Insurance Payment Calculators step in as invaluable tools. These calculators are designed to offer accurate estimates of your insurance payments, taking into account various variables that influence the cost of your policy. By utilizing these calculators, you can gain a clearer picture of your insurance expenses and make more informed choices about your coverage.

How Car Insurance Payment Calculators Work

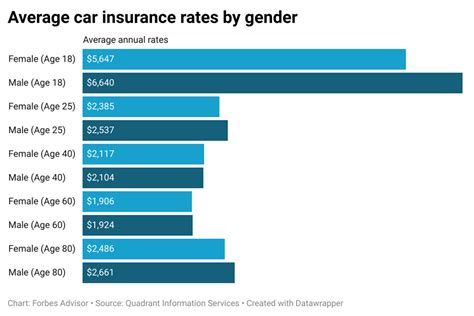

Car insurance payment calculators employ sophisticated algorithms and data analysis to generate precise estimates of your insurance premiums. They consider a multitude of factors that insurance companies use to assess risk and determine the cost of coverage.

Here are some of the key factors that Car Insurance Payment Calculators take into account:

- Vehicle Type and Age: Different types of vehicles have varying insurance costs. Newer models, high-performance cars, and luxury vehicles often have higher premiums due to their replacement and repair costs. The age of your vehicle also plays a role, as older cars may be cheaper to insure.

- Driving History: Your driving record is a significant factor in determining your insurance rates. A clean driving history with no accidents or violations can lead to lower premiums, while multiple accidents or traffic violations may result in higher costs.

- Location: The area where you live and drive has a substantial impact on your insurance rates. Factors such as crime rates, traffic density, and weather conditions can influence the likelihood of accidents and claims, affecting your insurance costs.

- Coverage Options: The type and extent of coverage you choose will impact your insurance payments. Comprehensive and collision coverage, for instance, can add to the overall cost, while liability-only coverage may be more affordable.

- Deductibles: Your chosen deductible amount can significantly affect your insurance premiums. Higher deductibles typically result in lower premiums, as you are responsible for a larger portion of the costs in the event of a claim.

- Discounts and Rewards: Many insurance companies offer discounts for various reasons, such as safe driving, bundling multiple policies, or having certain safety features in your vehicle. Car insurance payment calculators can help you identify potential discounts and estimate the impact on your premiums.

Benefits of Using a Car Insurance Payment Calculator

Utilizing a Car Insurance Payment Calculator offers several advantages that can greatly benefit vehicle owners.

1. Personalized Estimates

Car insurance payment calculators provide tailored estimates based on your specific circumstances. By inputting your vehicle details, driving history, and desired coverage options, you’ll receive an accurate estimate of your insurance premiums. This allows you to compare different policies and make informed decisions about your coverage.

2. Cost Comparison

With a car insurance payment calculator, you can easily compare the estimated costs of various insurance providers. This feature empowers you to find the most competitive rates and identify the best value for your insurance needs.

3. Understanding Coverage Options

Car insurance payment calculators often provide detailed explanations of different coverage options and their associated costs. This helps you understand the implications of choosing certain coverage levels and makes it easier to tailor your policy to your specific requirements.

4. Savings Identification

By using a car insurance payment calculator, you can identify potential savings opportunities. The calculator can highlight discounts and rewards you may be eligible for, allowing you to take advantage of these benefits and reduce your insurance costs.

5. Peace of Mind

Having a clear understanding of your insurance payments provides peace of mind. With accurate estimates, you can budget effectively and plan your insurance expenses, ensuring you have the necessary coverage without any unexpected financial burdens.

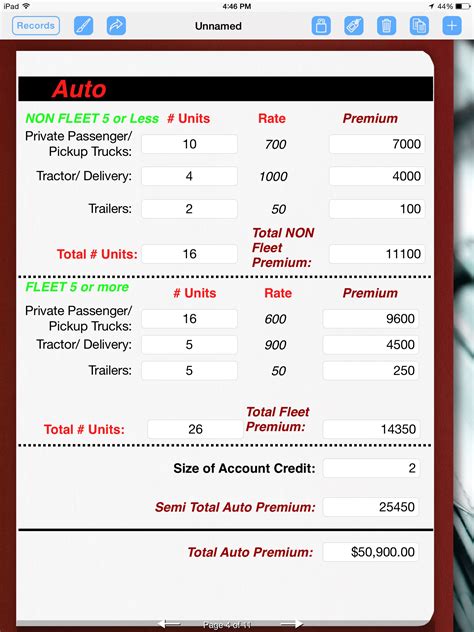

Real-World Example: Estimating Insurance Costs

Let’s look at a real-world example to illustrate how a car insurance payment calculator can be used to estimate insurance costs. Imagine you own a 2018 Toyota Camry, and you’re considering different insurance options.

| Coverage Type | Estimated Premium |

|---|---|

| Liability Only | $650 per year |

| Comprehensive and Collision | $1,200 per year |

| High-Risk Driver (with violations) | $1,800 per year |

In this example, the car insurance payment calculator estimates the cost of insurance based on different coverage options and driving profiles. By comparing these estimates, you can make an informed decision about the type of coverage that best suits your needs and budget.

Tips for Using Car Insurance Payment Calculators

To maximize the benefits of a car insurance payment calculator, here are some tips to keep in mind:

- Provide Accurate Information: Ensure that you input correct and up-to-date details about your vehicle, driving history, and desired coverage options. Inaccurate information can lead to inaccurate estimates.

- Compare Multiple Calculators: Different insurance providers may have their own calculators with unique algorithms. Compare estimates from multiple calculators to get a comprehensive view of your insurance costs.

- Research Coverage Options: Take the time to understand the different coverage types and their implications. This will help you make informed decisions about the level of coverage you require.

- Explore Discounts: Car insurance payment calculators can highlight potential discounts and rewards. Research these further to ensure you're taking advantage of all available savings opportunities.

- Contact Insurance Providers: While calculators provide estimates, it's essential to contact insurance providers directly for accurate quotes. This allows you to discuss your specific circumstances and obtain precise insurance costs.

Future Implications and Innovations

As technology advances, car insurance payment calculators are expected to become even more sophisticated and accurate. Here are some potential future developments:

- Advanced Data Analysis: With the integration of big data and machine learning, car insurance payment calculators may utilize real-time data and advanced analytics to provide even more precise estimates.

- Telematics Integration: Some insurance companies are already using telematics devices to track driving behavior and offer usage-based insurance. Car insurance payment calculators could incorporate this data to provide more personalized estimates based on your actual driving habits.

- Enhanced User Experience: Future calculators may offer more intuitive interfaces, allowing users to easily compare estimates, explore different coverage scenarios, and receive personalized recommendations.

- Real-Time Updates: With real-time data feeds, car insurance payment calculators could provide up-to-date estimates based on changing factors, such as market fluctuations or new discounts.

Conclusion

Car insurance payment calculators are invaluable resources for vehicle owners, offering accurate and personalized estimates of insurance premiums. By understanding the factors that influence insurance costs and utilizing these calculators effectively, you can make informed decisions about your coverage and budget.

As the insurance industry continues to evolve, car insurance payment calculators will play an increasingly important role in helping drivers navigate the complex world of insurance policies. With their advanced features and benefits, these calculators empower vehicle owners to take control of their insurance expenses and find the best coverage for their needs.

Can car insurance payment calculators provide exact quotes?

+Car insurance payment calculators provide estimates based on the information you input. While they offer accurate predictions, exact quotes can only be obtained from insurance providers after a thorough evaluation of your circumstances.

Are car insurance payment calculators free to use?

+Yes, most reputable car insurance payment calculators are available for free online. These tools are designed to assist users in estimating their insurance costs without any cost to the user.

Can I use a car insurance payment calculator to compare multiple insurance providers at once?

+Some advanced car insurance payment calculators allow you to input your details and compare estimates from multiple insurance providers simultaneously. This feature simplifies the comparison process and helps you identify the best rates quickly.