What Insurance Does America's Best Take

America's Best, a renowned retailer of eyewear and optical services, understands the importance of comprehensive insurance coverage to protect its business operations and customer interests. With a commitment to providing affordable vision care, the company's insurance portfolio is designed to ensure a smooth and reliable experience for both its customers and employees.

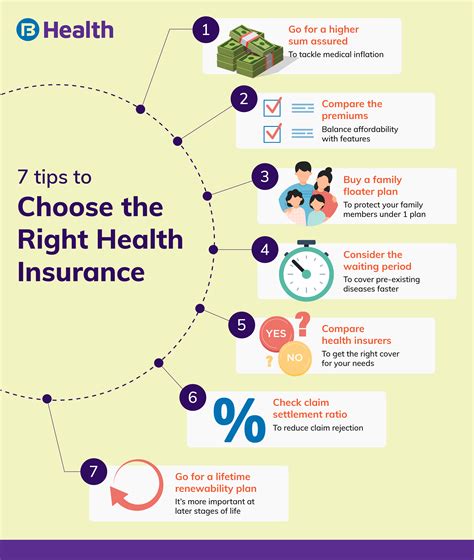

Health Insurance Coverage for Employees

America’s Best prioritizes the well-being of its employees by offering a range of health insurance options. The company’s benefits package typically includes:

- Medical Insurance: America's Best provides comprehensive medical insurance plans that cover a wide range of healthcare services, including doctor visits, hospital stays, and prescription medications. These plans often feature low deductibles and copays, ensuring employees can access necessary medical care without financial strain.

- Dental and Vision Insurance: Recognizing the importance of oral and eye health, America's Best extends its insurance coverage to include dental and vision benefits. Employees can choose from various plans that cover routine dental exams, cleanings, and essential vision care procedures.

- Flexible Spending Accounts (FSAs): To further support employees' healthcare needs, America's Best offers FSAs. These accounts allow employees to set aside pre-tax dollars to pay for eligible healthcare expenses, providing an additional layer of financial protection.

- Health Savings Accounts (HSAs): For employees enrolled in high-deductible health plans, America's Best provides the option of Health Savings Accounts. HSAs encourage employees to save for future medical expenses while enjoying tax benefits.

Workers’ Compensation Insurance

America’s Best understands the risks associated with its business operations and takes proactive measures to protect its employees. Workers’ compensation insurance is a vital component of its insurance strategy, ensuring that employees who suffer work-related injuries or illnesses receive the necessary medical treatment and compensation.

Key Features of Workers’ Compensation Insurance:

- Medical Benefits: This insurance covers the cost of medical treatment, including doctor visits, hospital stays, and prescription medications, for employees injured on the job.

- Wage Replacement: Injured employees may be entitled to wage replacement benefits, providing them with a portion of their regular earnings while they recover.

- Vocational Rehabilitation: In cases where an employee is unable to return to their original job due to a work-related injury, America’s Best’s insurance coverage may include vocational rehabilitation services to help the employee transition to a new role or career.

Professional Liability Insurance

As a provider of optical services and eyewear, America’s Best recognizes the potential risks associated with its profession. Professional liability insurance, often referred to as malpractice insurance, is a critical component of its insurance portfolio. This coverage protects the company and its employees from legal claims and financial liabilities arising from alleged negligence or errors in the delivery of optical services.

Coverage Highlights:

- Legal Defense Costs: Professional liability insurance covers the costs associated with defending against claims, including legal fees and court expenses.

- Settlement and Judgment Payouts: In the event that a claim is proven, this insurance provides financial protection by covering settlement amounts and court-ordered judgments.

- Risk Management Resources: America’s Best may also leverage the risk management resources offered by its insurance provider to implement best practices and reduce the likelihood of professional liability incidents.

Property and Casualty Insurance

Protecting its physical assets and mitigating potential liabilities is a priority for America’s Best. The company maintains property and casualty insurance to safeguard its stores, equipment, and inventory against various risks, including:

- Fire and Natural Disasters: Insurance coverage protects America's Best from financial losses resulting from fires, floods, earthquakes, and other natural disasters.

- Theft and Vandalism: The company's insurance extends to cover losses from theft, burglary, and vandalism, ensuring that its stores and inventory remain secure.

- Liability Protection: Property and casualty insurance also provides liability coverage, protecting America's Best from claims arising from customer injuries or property damage that occur on its premises.

Business Interruption Insurance

America’s Best understands the potential impact of unforeseen events, such as natural disasters or pandemics, on its business operations. To mitigate the financial consequences of such disruptions, the company invests in business interruption insurance. This coverage ensures that America’s Best can continue to pay its employees, maintain operations, and cover ongoing expenses even when its stores are temporarily closed or unable to operate as usual.

Key Benefits of Business Interruption Insurance:

- Continued Payroll: This insurance enables America’s Best to meet its payroll obligations, ensuring that employees receive their salaries during periods of business interruption.

- Coverage for Overhead Costs: Business interruption insurance covers essential overhead expenses, such as rent, utilities, and insurance premiums, during the interruption period.

- Financial Stability: By providing a financial safety net, this insurance helps America’s Best maintain its financial stability and emerge from challenging situations with its business operations intact.

Product Liability Insurance

America’s Best takes pride in offering high-quality eyewear and optical services. However, the company recognizes the potential risks associated with product defects or failures. Product liability insurance is a crucial component of its insurance portfolio, providing protection against claims arising from alleged defects in the company’s products.

Coverage Details:

- Defense and Legal Costs: Product liability insurance covers the costs associated with defending against claims, including legal fees and court expenses.

- Settlement and Judgment Payouts: In the event that a claim is proven, this insurance provides financial protection by covering settlement amounts and court-ordered judgments.

- Recall Coverage: Some product liability insurance policies may also include recall coverage, which helps America’s Best manage the financial impact of recalling defective products.

Cyber Liability Insurance

In an era of increasing cyber threats, America’s Best understands the importance of safeguarding its digital assets and customer data. Cyber liability insurance is a specialized form of coverage designed to protect the company from financial losses and legal liabilities arising from cyber incidents, such as data breaches, hacking, or cyber extortion.

Coverage Elements:

- Data Breach Response: This insurance provides resources and support to help America’s Best respond effectively to a data breach, including notification costs, credit monitoring for affected customers, and legal assistance.

- Network Security Protection: Cyber liability insurance covers the costs associated with investigating and repairing network security breaches, as well as any resulting business interruption.

- Cyber Extortion Coverage: In the event of a cyber extortion attempt, this insurance may cover the costs of negotiating with hackers and paying ransoms, if necessary.

Conclusion

America’s Best’s comprehensive insurance portfolio demonstrates its commitment to protecting its employees, customers, and business operations. By investing in a range of insurance coverages, the company ensures that it can weather various risks and challenges while continuing to provide high-quality vision care and eyewear products to its valued customers.

What types of insurance does America’s Best offer to its employees?

+America’s Best offers a comprehensive benefits package to its employees, including medical, dental, and vision insurance, as well as flexible spending accounts (FSAs) and health savings accounts (HSAs) for additional financial support.

How does America’s Best’s Workers’ Compensation insurance protect its employees?

+Workers’ Compensation insurance covers medical expenses, provides wage replacement, and offers vocational rehabilitation services for employees injured on the job, ensuring they receive the necessary support during their recovery.

What does Professional Liability insurance cover for America’s Best?

+Professional Liability insurance protects America’s Best from legal claims and financial liabilities arising from alleged negligence or errors in the delivery of optical services. It covers legal defense costs and provides financial protection for proven claims.