Insured Car

The world of car insurance is vast and complex, with a myriad of policies, coverage options, and terms that can be confusing for many vehicle owners. This article aims to provide an in-depth exploration of the topic, specifically focusing on the concept of an "insured car" and all the intricacies that come with it. By understanding the ins and outs of insured cars, vehicle owners can make informed decisions about their insurance coverage and ensure they are adequately protected on the road.

Understanding Insured Cars: Definition and Key Considerations

An insured car, at its core, is a vehicle that is protected by an insurance policy. This policy acts as a financial safeguard, offering coverage for various situations that may arise while driving or owning a car. However, the term "insured car" encompasses more than just the basic definition; it involves a comprehensive understanding of the different types of coverage, the factors that influence insurance rates, and the legal implications of having an insured vehicle.

In the realm of car insurance, there are several key aspects that vehicle owners should be aware of when considering an insured car. Firstly, the type of coverage chosen plays a pivotal role. Comprehensive coverage, for instance, provides protection against a wide range of incidents, including theft, fire, and natural disasters, whereas liability coverage focuses on the legal responsibility of the driver in an accident. Understanding the differences between these types of coverage is essential for choosing the right policy.

Factors Influencing Insurance Rates

Insurance rates for cars are not uniform; they vary based on a multitude of factors. One significant factor is the make and model of the car itself. Certain vehicles, especially those known for their safety features or low repair costs, often enjoy lower insurance rates. Additionally, the age and condition of the car can impact rates, with newer cars typically requiring higher premiums due to their higher replacement costs.

The driver's profile is another crucial aspect. Insurance companies consider factors like age, driving history, and even gender when determining rates. Younger drivers, for example, are often considered higher-risk due to their lack of experience on the road, leading to higher insurance premiums. Similarly, a driver's accident and claim history can significantly influence their insurance rates, with a clean record often resulting in lower premiums.

The geographical location where the car is primarily driven and parked also plays a role. Areas with a higher incidence of accidents, theft, or natural disasters may result in increased insurance rates. Furthermore, the use of the vehicle, whether for personal or business purposes, can affect the type of coverage required and, consequently, the insurance rates.

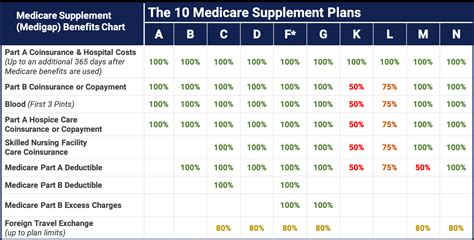

| Factor | Influence on Insurance Rates |

|---|---|

| Vehicle Make & Model | Cars with safety features or low repair costs may have lower rates. |

| Age & Condition of Car | Newer cars often require higher premiums due to higher replacement costs. |

| Driver's Profile | Younger drivers or those with a history of accidents may face higher premiums. |

| Geographical Location | Areas with higher accident or theft rates may result in increased rates. |

| Vehicle Usage | Business or personal use can affect coverage and rates. |

Types of Car Insurance Coverage: A Comprehensive Overview

Car insurance policies come in various forms, each designed to provide specific types of coverage. Understanding these different coverage options is crucial for vehicle owners to ensure they have the right protection in place.

Liability Coverage

Liability coverage is a fundamental aspect of car insurance. It safeguards the policyholder against financial liability in the event of an accident where they are deemed responsible. This coverage typically includes two main components: bodily injury liability and property damage liability.

Bodily injury liability covers the costs associated with injuries sustained by others in an accident caused by the policyholder. This can include medical expenses, lost wages, and pain and suffering damages. Property damage liability, on the other hand, covers the cost of repairing or replacing the other party's vehicle or any other property damaged in the accident.

Liability coverage is often mandatory in many states and is a critical component of any car insurance policy. It ensures that the policyholder is protected from potentially devastating financial consequences in the event of an accident.

Comprehensive Coverage

Comprehensive coverage, as the name suggests, provides a broad range of protection for insured vehicles. This type of coverage extends beyond the basic liability coverage, offering protection against damages or losses that are not necessarily the result of an accident.

Comprehensive coverage typically includes protection against theft, fire, vandalism, and natural disasters such as hail, storms, or floods. It also covers incidents like hitting an animal or damage caused by falling objects. This comprehensive protection ensures that the policyholder is financially covered for a wide array of unforeseen circumstances.

While comprehensive coverage is optional, it is highly recommended, especially for newer vehicles or those that are still being financed. The added protection can provide peace of mind and ensure that the vehicle is adequately protected against various risks.

Collision Coverage

Collision coverage is another critical component of car insurance. It provides protection in the event of an accident involving the insured vehicle, regardless of who is at fault. This coverage pays for the repair or replacement of the policyholder's vehicle if it's damaged in a collision.

Collision coverage is particularly important for newer or financed vehicles, as it can help cover the cost of repairs or replacement if the vehicle is damaged beyond repair. Without collision coverage, the policyholder would be responsible for these costs, which can be substantial.

However, it's worth noting that collision coverage does not typically cover damage to the policyholder's vehicle if they are involved in a collision with an uninsured or underinsured driver. This is where additional coverage, such as uninsured/underinsured motorist coverage, comes into play.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is designed to protect policyholders when they are involved in an accident with a driver who either does not have insurance or has inadequate insurance coverage. This type of coverage can help cover the policyholder's medical expenses, lost wages, and other damages that result from the accident.

In many states, uninsured/underinsured motorist coverage is optional. However, it's a crucial addition to any car insurance policy, as it provides an extra layer of protection against the financial burden that can result from an accident with an uninsured or underinsured driver.

Additional Coverage Options

Beyond the fundamental types of coverage, car insurance policies often offer a range of additional options to cater to the specific needs of vehicle owners. These can include:

- Personal Injury Protection (PIP): PIP coverage provides compensation for medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident.

- Medical Payments Coverage: This coverage specifically covers medical expenses for the policyholder and their passengers in the event of an accident.

- Rental Car Reimbursement: In the event that the insured vehicle is in the shop for repairs, this coverage can help cover the cost of renting a temporary vehicle.

- Gap Insurance: Gap insurance covers the difference between the actual cash value of the vehicle and the remaining balance on a lease or loan if the vehicle is totaled.

- Custom Parts and Equipment Coverage: For vehicles with custom modifications or expensive equipment, this coverage ensures that these additions are protected in the event of an accident or other covered incident.

The availability and specifics of these additional coverage options can vary depending on the insurance provider and the state in which the policy is purchased. It's important for vehicle owners to carefully review their policy and understand the extent of their coverage to ensure they have the protection they need.

The Legal Implications of an Insured Car

Having an insured car comes with certain legal responsibilities and implications. Understanding these aspects is crucial for vehicle owners to ensure they are compliant with the law and protected in the event of an accident or other incident.

Mandatory Insurance Requirements

In most states, vehicle owners are legally required to carry a minimum amount of liability insurance. This mandatory insurance ensures that drivers are financially responsible for any damages they cause in an accident. The specific requirements for liability coverage can vary by state, with some states requiring only basic liability coverage, while others may require additional types of coverage, such as uninsured/underinsured motorist coverage.

Failure to comply with these mandatory insurance requirements can result in serious legal consequences. Vehicle owners may face fines, the suspension of their driver's license or vehicle registration, and even criminal charges in some cases. It's crucial for vehicle owners to understand the specific insurance requirements in their state and ensure they maintain the necessary coverage.

Proof of Insurance

Vehicle owners are typically required to provide proof of insurance when registering their vehicle or when stopped by law enforcement. This proof can come in various forms, including an insurance card, a digital copy of the insurance policy, or a certificate of insurance. Failing to provide valid proof of insurance can result in legal penalties, including fines and the suspension of the vehicle's registration.

In some states, electronic verification systems are in place, allowing law enforcement to instantly check a vehicle's insurance status. This further emphasizes the importance of maintaining continuous insurance coverage and providing accurate proof when requested.

Insurance Claims and Legal Proceedings

In the event of an accident, understanding the insurance claims process and potential legal proceedings is crucial. Vehicle owners should be familiar with their policy's terms and conditions, including any deductibles or limitations on coverage. They should also understand the steps to take after an accident, such as reporting the incident to their insurance company and providing any necessary documentation.

If an accident results in legal proceedings, having adequate insurance coverage can provide significant protection. Liability coverage, for instance, can help cover legal fees and any damages awarded to the other party. However, it's important to note that insurance coverage does not guarantee a favorable outcome in legal proceedings, and vehicle owners should seek legal advice if they are involved in a complex or high-stakes case.

Changes in Insurance Coverage

Vehicle owners should be aware that their insurance coverage may change over time. This can occur due to various factors, such as changes in personal circumstances (e.g., moving to a different state or adding a young driver to the policy), changes in the vehicle (e.g., selling or buying a new car), or changes in insurance provider. It's crucial to review and update insurance coverage regularly to ensure it remains adequate and compliant with legal requirements.

Future Trends in Car Insurance for Insured Vehicles

The world of car insurance is constantly evolving, with new technologies and trends shaping the industry. As we look ahead, several key developments are expected to influence the future of car insurance for insured vehicles.

Telematics and Usage-Based Insurance

Telematics, the technology that enables the tracking of vehicle usage and driving behavior, is expected to play a significant role in the future of car insurance. Usage-based insurance, also known as pay-as-you-drive insurance, utilizes telematics data to offer insurance rates based on actual driving habits and miles driven. This data-driven approach allows insurance providers to offer more personalized and potentially more affordable insurance options.

With usage-based insurance, vehicle owners can benefit from lower premiums if they drive less or exhibit safer driving behaviors. This incentivizes safer driving and can lead to significant savings for responsible drivers. As telematics technology becomes more advanced and widespread, we can expect to see a greater adoption of usage-based insurance policies, offering a more dynamic and tailored approach to car insurance.

Autonomous Vehicle Insurance

The rise of autonomous vehicles (AVs) is set to bring about significant changes in the car insurance industry. As AVs become more prevalent on our roads, the traditional model of car insurance may need to adapt to accommodate the unique risks and liabilities associated with these vehicles.

In the case of AVs, the question of liability in an accident may shift from the driver to the vehicle manufacturer or software developer. This could lead to a shift in insurance coverage, with a greater focus on product liability insurance for AV manufacturers. Additionally, as AV technology continues to evolve, we may see the development of specialized insurance policies tailored to the unique risks and benefits of these vehicles.

Connected Car Technology and Insurance

Connected car technology, which enables vehicles to communicate with other devices and systems, is expected to have a significant impact on car insurance. This technology can provide valuable data on vehicle performance, driving behavior, and even potential mechanical issues. Insurance providers can leverage this data to offer more precise and tailored insurance policies.

Connected car technology can also enhance the claims process by providing real-time data on accidents, which can expedite the resolution of claims. Additionally, this technology can facilitate the development of preventative maintenance programs, which could reduce the likelihood of accidents and, in turn, lower insurance premiums.

Data-Driven Insurance Models

The increasing availability of data, coupled with advancements in analytics and artificial intelligence, is set to revolutionize the car insurance industry. Insurance providers will be able to utilize vast amounts of data to develop more accurate risk models, allowing for more precise pricing of insurance policies. This data-driven approach can lead to more equitable insurance rates, as pricing will be based on an individual's actual risk profile rather than broad generalizations.

Furthermore, data-driven insurance models can enable the development of dynamic insurance policies that adapt to an individual's changing circumstances and risks. For instance, insurance rates could be adjusted based on changes in driving behavior, geographical location, or even personal health data (with appropriate privacy protections in place). This dynamic approach to insurance could offer greater flexibility and cost-effectiveness for vehicle owners.

The Role of Insurtech Startups

Insurtech startups, which leverage technology to innovate in the insurance industry, are expected to play a significant role in shaping the future of car insurance. These startups are often more agile and adaptable, allowing them to quickly develop new insurance products and services that meet the evolving needs of vehicle owners.

Insurtech startups are likely to continue to innovate in areas such as usage-based insurance, digital claims processing, and personalized insurance policies. Their focus on technology and data-driven approaches can offer vehicle owners more efficient and tailored insurance options, potentially disrupting the traditional insurance market.

FAQ

What is the difference between comprehensive and collision coverage in car insurance?

+

Comprehensive coverage protects against non-collision incidents, such as theft, fire, and natural disasters. Collision coverage, on the other hand, covers damages resulting from a collision with another vehicle or object, regardless of fault. While both are important, comprehensive coverage is optional, whereas collision coverage is often mandatory for financed or leased vehicles.

How do insurance rates vary by state, and what factors contribute to these differences?

+

Insurance rates can vary significantly by state due to differences in mandatory coverage requirements, the frequency and cost of accidents, the prevalence of fraud, and even the average cost of living. States with higher rates of accidents or fraud, for instance, may have higher insurance premiums to cover these risks.

What is the process for filing an insurance claim after an accident, and how long does it typically take to receive a settlement?

+

The process for filing an insurance claim can vary depending on the insurance provider and the type of coverage involved. Generally, you’ll need to report the accident to your insurer, provide details of the incident, and submit any necessary documentation, such as police reports or estimates for repairs. The time it takes to receive a settlement can vary, but it’s often within a few weeks to a couple of months, depending on the complexity of the claim and any