Medicare Supplemental Insurance

Medicare Supplemental Insurance, commonly known as Medigap, is an essential topic for anyone approaching retirement age or already enrolled in Medicare. This comprehensive guide will delve into the intricacies of Medigap, providing valuable insights and practical information to help you make informed decisions about your healthcare coverage.

Understanding Medicare Supplemental Insurance (Medigap)

Medigap policies are designed to supplement the coverage provided by Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance). While Original Medicare offers a solid foundation for healthcare coverage, it has certain limitations and gaps that can lead to unexpected out-of-pocket expenses. This is where Medicare Supplemental Insurance steps in to fill those gaps and provide additional financial protection.

Medigap policies are offered by private insurance companies that are licensed and regulated by both the federal government and individual states. These policies are standardized, meaning that Plan A in one state will offer the same benefits as Plan A in another state, making it easier to compare and understand coverage options.

The Benefits of Medigap

Medigap policies offer a wide range of benefits, each tailored to address specific healthcare needs. These policies typically cover the deductibles, coinsurance, and copayments that Original Medicare doesn’t cover. This can include expenses such as:

- Part A Deductible: The annual deductible for Medicare Part A, which is currently 1,556 per benefit period.</li> <li><strong>Part B Deductible:</strong> The annual deductible for Medicare Part B, which is 233 in 2023.

- Coinsurance or Copayments: These are the costs you pay for healthcare services after you’ve met your deductibles. For instance, Original Medicare typically covers 80% of the Medicare-approved amount for Part B services, leaving you responsible for the remaining 20%.

- Foreign Travel Emergency: Some Medigap policies cover emergency healthcare services you receive while traveling outside the U.S.

Additionally, Medigap policies can offer benefits for prescription drugs, although these plans are often more expensive. It's important to note that Medigap plans don't cover long-term care, dental care, vision, or private nursing services.

Medigap Plan Options

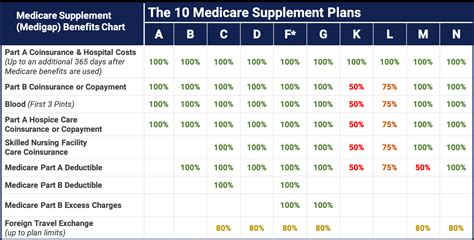

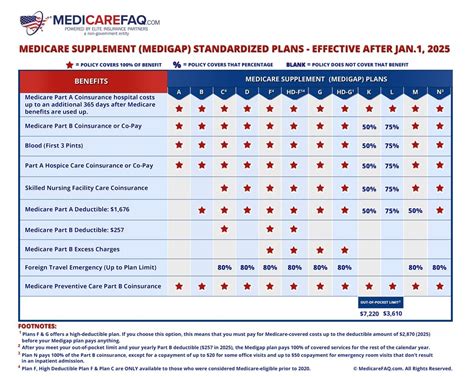

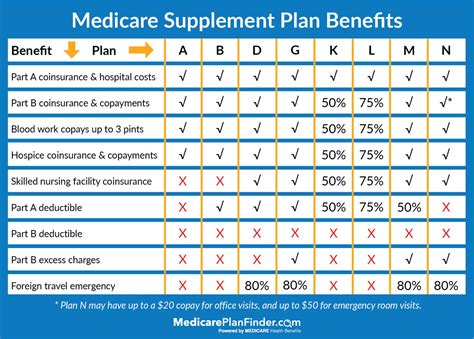

There are 10 standardized Medigap plans (labeled A through N, excluding J) available in most states. Each plan offers a different combination of benefits, allowing you to choose the plan that best suits your healthcare needs and budget. Here’s a breakdown of the most common Medigap plans and their coverage:

| Plan | Coverage |

|---|---|

| Plan A | Basic coverage, including Part A coinsurance and Part B coinsurance. |

| Plan B | Offers more comprehensive coverage, including Part A deductible, Part B deductible, and Part B coinsurance. |

| Plan C | Similar to Plan B, but also covers the Part A deductible. |

| Plan D | Covers all the benefits of Plan C, plus the first three pints of blood each year. |

| Plan F | The most comprehensive plan, covering all the gaps in Original Medicare. (Note: Plan F is only available to those who were eligible for Medicare before January 1, 2020) |

| Plan G | Very similar to Plan F, but it doesn't cover the Part B deductible. (Plan G will be the most comprehensive plan available after January 1, 2020) |

| Plan K and L | These plans offer a lower premium option, but they cover only a portion of the gaps in Original Medicare. They also have an out-of-pocket limit, after which the plan pays 100% of covered services for the rest of the year. |

It's crucial to evaluate your healthcare needs and budget to determine which plan is the best fit for you. Additionally, keep in mind that Medigap policies only cover one person, so if you and your spouse both need coverage, you'll each need a separate policy.

Enrolling in Medigap

The process of enrolling in a Medigap policy is straightforward. You can purchase a Medigap policy from any insurance company that is licensed to sell these policies in your state. However, it’s important to note that you must have Original Medicare coverage (Part A and Part B) to enroll in a Medigap plan. You cannot have a Medigap policy if you have a Medicare Advantage Plan (Part C).

There are specific enrollment periods when you can purchase a Medigap policy without undergoing a medical underwriting process. These periods include:

- Initial Enrollment Period: This period begins the month you turn 65 and are enrolled in Medicare Part B, and it lasts for six months.

- Open Enrollment Period: If you already have Medicare Part A and Part B, you can enroll during the six-month period that begins the month after your 65th birthday.

- Guaranteed Issue Rights: These rights give you the opportunity to buy a Medigap policy without being subject to medical underwriting if certain events occur, such as losing your current Medigap coverage or your Medicare Advantage Plan.

Choosing the Right Medigap Policy

Selecting the appropriate Medigap policy can be a complex decision. Here are some key factors to consider:

- Coverage Needs: Evaluate your healthcare needs and choose a plan that covers the services you're most likely to require.

- Budget: Medigap policies come with varying premium costs. Choose a plan that fits your financial situation.

- Insurance Company Reputation: Research the insurance company offering the plan to ensure they have a solid reputation for claims processing and customer service.

- Plan Availability: Not all Medigap plans are available in every state. Check which plans are offered in your area.

- Plan Changes: Medigap plans can change over time, so stay informed about any updates or modifications to your plan.

Medicare Supplemental Insurance: A Comprehensive Comparison

When it comes to choosing a Medigap policy, it's essential to compare different plans to find the one that aligns with your healthcare needs and budget. Here's a detailed comparison of the most popular Medigap plans:

Plan A vs. Plan B

Plan A and Plan B are two of the most basic Medigap plans, offering essential coverage at a relatively low cost. Plan A covers the Part A coinsurance and Part B coinsurance, while Plan B includes coverage for the Part A deductible and Part B deductible, in addition to the coinsurance.

If you anticipate frequent hospital stays or need coverage for more expensive medical procedures, Plan B might be a better option as it covers the Part A deductible, which can be substantial. However, if you're generally healthy and don't foresee needing extensive hospital care, Plan A could be a more cost-effective choice.

Plan C vs. Plan F

Plan C and Plan F are among the most comprehensive Medigap plans available. Both plans cover all the gaps in Original Medicare, including the Part A deductible, Part B deductible, and coinsurance. The primary difference between these plans is that Plan C covers the first three pints of blood each year, while Plan F covers the first three pints and also provides coverage for excess charges, which can be beneficial if you require specialized medical care.

Plan F is often considered the gold standard of Medigap plans due to its comprehensive coverage. However, it's important to note that this plan is only available to those who were eligible for Medicare before January 1, 2020. After this date, Plan G will become the most comprehensive option.

Plan G vs. Plan N

Plan G and Plan N are two popular Medigap plans that offer a balance between coverage and cost. Plan G covers all the gaps in Original Medicare, similar to Plan F, but it doesn’t cover the Part B deductible. This makes Plan G a more affordable option for those who are comfortable paying the Part B deductible out-of-pocket.

Plan N, on the other hand, is designed for individuals who are willing to pay a small amount for certain services. This plan covers all the gaps in Original Medicare except for a few specific services, such as the Part B deductible and some preventive care services. Plan N policyholders may also be required to pay up to $20 for some office visits and up to $50 for emergency room visits that don't result in admission.

Plan K and Plan L

Plan K and Plan L are unique in the Medigap landscape as they offer a lower premium option. These plans cover a portion of the gaps in Original Medicare, but they also have an out-of-pocket limit. Once you reach this limit, the plan pays 100% of covered services for the rest of the year.

Plan K covers 50% of the Part A deductible, while Plan L covers 75%. Both plans also cover 50% of the excess charges that may occur when a healthcare provider charges more than Medicare approves. These plans can be a good choice for those who are generally healthy and don't anticipate needing extensive medical care but want the peace of mind of having coverage for unexpected illnesses or accidents.

The Future of Medicare Supplemental Insurance

The world of Medicare and Medigap is constantly evolving, with new plans, rules, and regulations being introduced. Here’s a glimpse into the future of Medicare Supplemental Insurance:

Medicare Advantage Plans

Medicare Advantage Plans, also known as Part C, are becoming increasingly popular. These plans are an alternative to Original Medicare and often include prescription drug coverage. While Medigap plans are designed to supplement Original Medicare, they cannot be used with Medicare Advantage Plans. As Medicare Advantage Plans continue to gain traction, it’s important to carefully consider your options and understand the differences between these plans and Medigap.

Medicare Part D

Medicare Part D, which covers prescription drugs, is an essential component of Medicare coverage. While Medigap plans can offer prescription drug coverage, it’s often more cost-effective to enroll in a stand-alone Medicare Part D plan. These plans are offered by private insurance companies and can be a better option for those who require extensive prescription drug coverage.

Medicare Annual Enrollment Period

The Medicare Annual Enrollment Period, which runs from October 15 to December 7 each year, is a crucial time for Medicare beneficiaries to review their coverage and make changes if necessary. During this period, you can switch from Original Medicare to a Medicare Advantage Plan, change Medicare Advantage Plans, or switch Medigap plans. It’s important to stay informed about any changes to your coverage and take advantage of this annual opportunity to ensure you have the best plan for your needs.

FAQs

Can I have both a Medigap policy and a Medicare Advantage Plan (Part C)?

+

No, you cannot have both a Medigap policy and a Medicare Advantage Plan. Medigap policies are designed to supplement Original Medicare (Part A and Part B), while Medicare Advantage Plans are an alternative to Original Medicare. If you enroll in a Medicare Advantage Plan, you will not be able to have a Medigap policy.

Do I need to enroll in Medicare Part D for prescription drug coverage if I have a Medigap policy?

+

While some Medigap policies offer prescription drug coverage, it is often more cost-effective to enroll in a stand-alone Medicare Part D plan. Medicare Part D plans are designed specifically for prescription drug coverage and can provide more comprehensive and tailored coverage for your medication needs.

Can I switch Medigap plans after I enroll?

+

Yes, you can switch Medigap plans during certain enrollment periods. The Medicare Annual Enrollment Period, which runs from October 15 to December 7, is a time when you can make changes to your Medicare coverage, including switching Medigap plans. Additionally, you may have guaranteed issue rights to switch plans if you lose your current Medigap coverage or move to a new Medicare Advantage Plan.

What happens if I have a Medigap policy and need to enter a skilled nursing facility (SNF)?

+

Medigap policies generally do not cover long-term care services, including those provided in skilled nursing facilities. Original Medicare covers skilled nursing facility care for a limited time under specific conditions. If you require long-term care, it’s important to consider other insurance options, such as a Medigap policy that covers some skilled nursing care or a long-term care insurance policy.

Are Medigap policies renewable?

+

Yes, Medigap policies are guaranteed renewable, which means the insurance company cannot cancel your policy as long as you pay your premiums. However, the insurance company may increase your premium based on certain factors, such as your age or the cost of providing coverage. It’s important to review your policy and understand the renewal terms to ensure you maintain coverage.