Cheapest House Insurance

When it comes to finding the cheapest house insurance, many homeowners seek a delicate balance between comprehensive coverage and affordability. The quest for the best value often involves understanding the various factors that influence insurance premiums and learning how to navigate the complex world of insurance policies. This comprehensive guide will delve into the intricacies of home insurance, offering expert insights and practical tips to help you secure the most cost-effective coverage for your home.

Understanding House Insurance Premiums

House insurance premiums are influenced by a myriad of factors, including the location of your home, the type of construction, and the level of coverage you require. Additionally, your personal factors such as your age, occupation, and claim history can also impact the cost of your insurance.

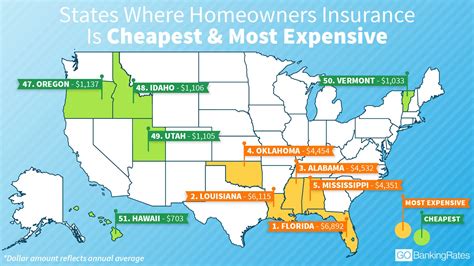

Location-based Factors

The geographical location of your home plays a significant role in determining insurance costs. Areas prone to natural disasters like hurricanes, floods, or earthquakes often carry higher insurance premiums due to the increased risk of claims. For instance, coastal regions vulnerable to hurricanes may experience significantly higher insurance rates compared to inland areas.

| Region | Average Annual Premium |

|---|---|

| Hurricane-prone Coastal Areas | $2,500 - $5,000 |

| Inland States | $1,200 - $2,000 |

Apart from natural disasters, crime rates and the proximity to emergency services can also affect insurance costs. Homes in high-crime areas or those located far from fire stations or police departments may face higher premiums due to the increased risk of break-ins or longer response times during emergencies.

Construction and Coverage Considerations

The type of construction and the materials used in your home can impact insurance premiums. Homes built with fire-resistant materials or those equipped with security systems and fire alarms may qualify for lower rates. Similarly, the age of your home and its maintenance history can also affect insurance costs. Older homes may require more extensive coverage due to potential wear and tear, which can influence insurance premiums.

The level of coverage you choose also significantly impacts your insurance costs. Policies offering higher coverage limits for property damage and personal liability tend to be more expensive. It's crucial to strike a balance between the coverage you need and what you can afford. Understanding your specific risks and potential liabilities can help you tailor your coverage to your needs, ensuring you're not paying for unnecessary extras.

Strategies to Find the Cheapest House Insurance

Navigating the world of house insurance to find the cheapest options requires a strategic approach. Here are some expert tips to help you secure the most affordable coverage:

Shop Around and Compare Quotes

One of the most effective ways to find cheap house insurance is to compare quotes from multiple insurers. Different companies offer varying rates and coverage options, so shopping around can help you identify the most competitive prices. Online comparison tools can be particularly useful for quickly gathering multiple quotes, but it’s essential to dig deeper and understand the specific coverage offered by each insurer.

Understand Your Coverage Needs

Before purchasing house insurance, take the time to assess your specific coverage needs. Consider the value of your home, the cost of rebuilding it, and the possessions you want to insure. Understanding your risks and potential liabilities can help you choose the right coverage limits and deductibles. By tailoring your policy to your needs, you can avoid overpaying for coverage you don’t require.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For instance, you can bundle your house insurance with your auto insurance or other personal policies to potentially save money. Bundling not only simplifies your insurance management but can also lead to significant cost savings.

Raise Your Deductibles

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially agreeing to pay more in the event of a claim, which can result in lower monthly premiums. However, it’s important to ensure that you can afford the higher deductible should the need arise.

Explore Discounts and Credits

Insurance companies often offer various discounts and credits to attract customers and reward safe behavior. Some common discounts include those for having a security system, smoke detectors, or a fire-resistant roof. You may also qualify for discounts if you’ve been claims-free for a certain period or if you’ve recently made safety improvements to your home. Be sure to ask your insurer about the discounts they offer and how you can qualify for them.

Review Your Policy Regularly

Insurance needs can change over time, so it’s essential to review your policy annually. Life events such as getting married, having children, or making significant home improvements can impact your insurance requirements. Regular policy reviews ensure that your coverage remains adequate and allow you to take advantage of any changes in your insurer’s offerings or market conditions that could lead to cost savings.

The Future of House Insurance

The house insurance landscape is evolving, driven by advancements in technology and changing consumer expectations. Here’s a glimpse into the future of house insurance and how it may impact your search for affordable coverage.

Technology-driven Changes

The rise of digital technology and data analytics is transforming the insurance industry. Insurers are increasingly leveraging data-driven insights to assess risk and price policies more accurately. This shift towards a more data-centric approach can lead to more personalized and competitive insurance offerings, potentially benefiting consumers by providing more affordable coverage options.

Sustainable and Green Homes

The growing emphasis on sustainability and environmental consciousness is influencing the insurance market. Insurers are beginning to offer incentives and discounts for homeowners who adopt green practices or install sustainable features in their homes. This trend not only benefits the environment but also presents an opportunity for homeowners to reduce their insurance costs by embracing eco-friendly initiatives.

Enhanced Risk Assessment

Advanced risk assessment tools are enabling insurers to more accurately evaluate the risks associated with individual properties. By leveraging data and analytics, insurers can offer more precise and tailored coverage, potentially leading to more affordable premiums for homeowners. This shift towards a more data-driven approach ensures that insurance policies are priced fairly and accurately, benefiting both insurers and policyholders.

How can I lower my house insurance premiums?

+

There are several strategies to reduce your house insurance premiums. These include shopping around for quotes, understanding your coverage needs, bundling policies, raising your deductibles, exploring discounts, and regularly reviewing your policy. Each of these steps can help you find the most affordable coverage for your home.

What factors influence the cost of house insurance?

+

The cost of house insurance is influenced by various factors, including the location of your home, the type of construction, the level of coverage required, your personal factors such as age and occupation, and your claim history. Understanding these factors can help you tailor your insurance coverage to your specific needs and budget.

Are there any discounts available for house insurance?

+

Yes, many insurance companies offer discounts for house insurance. Common discounts include those for having a security system, smoke detectors, a fire-resistant roof, or being claims-free for a certain period. Additionally, bundling multiple policies with the same insurer can often lead to cost savings. It’s worth exploring these discounts to reduce your insurance premiums.

How often should I review my house insurance policy?

+

It’s recommended to review your house insurance policy annually. Life events and changes in your home can impact your insurance needs. Regular policy reviews ensure that your coverage remains adequate and allow you to take advantage of any changes in the market or with your insurer that could lead to cost savings.

What is the future of house insurance?

+

The future of house insurance is expected to be shaped by technology and sustainability initiatives. The increasing use of data analytics will lead to more precise risk assessment and potentially more affordable, tailored coverage. Additionally, the growing focus on sustainable and green homes may result in incentives and discounts for homeowners who adopt eco-friendly practices.