Home Insurance Companies In Texas

Home insurance is an essential aspect of protecting your largest investment, your home. In the state of Texas, with its diverse landscapes and varying weather conditions, having comprehensive home insurance coverage is crucial. Texas is known for its unique insurance market, and understanding the landscape of home insurance companies operating in the state can help homeowners make informed decisions. This article aims to provide an in-depth analysis of the home insurance companies in Texas, offering insights into their policies, coverage options, and unique features.

Understanding the Texas Home Insurance Market

The Lone Star State boasts a thriving home insurance market, catering to the diverse needs of its residents. Texas is home to numerous insurance providers, ranging from large national companies to smaller, regional insurers. This competitive environment often results in a wide array of coverage options and pricing structures, providing homeowners with ample choices to find the right fit for their specific needs.

One distinctive aspect of the Texas home insurance market is its vulnerability to natural disasters. The state is no stranger to hurricanes, tornadoes, and hailstorms, which can cause significant damage to properties. As a result, many insurance companies in Texas offer comprehensive coverage options to address these risks. Additionally, the state's unique windstorm coverage laws and the presence of the Texas Windstorm Insurance Association (TWIA) further shape the insurance landscape, influencing the policies and premiums offered by insurers.

Top Home Insurance Companies in Texas

When it comes to choosing a home insurance provider in Texas, several reputable companies stand out. Here’s an overview of some of the leading players in the market, along with their unique offerings and policies.

State Farm

State Farm is a prominent name in the Texas home insurance market, known for its comprehensive coverage options and competitive pricing. The company offers a range of policies tailored to meet the diverse needs of Texas homeowners. State Farm’s policies typically include coverage for dwelling damage, personal property, liability, and additional living expenses. They also provide optional coverage enhancements, such as personal article policies for high-value items and identity restoration coverage.

One notable feature of State Farm's home insurance policies in Texas is their "Newly Purchased Residence" option. This add-on coverage provides protection for a newly purchased home for a limited period, ensuring that homeowners have coverage during the transition period.

| Policy Type | Coverage Options |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home |

| Personal Property Coverage | Covers belongings inside the home |

| Liability Coverage | Provides financial protection against lawsuits |

| Additional Living Expenses | Covers costs if your home becomes uninhabitable |

Allstate

Allstate is another major player in the Texas home insurance market, offering a comprehensive suite of insurance products. Their home insurance policies are designed to provide extensive coverage for Texas residents, addressing the unique challenges posed by the state’s climate and natural disasters.

Allstate's home insurance policies typically include coverage for the dwelling, personal property, liability, and loss of use. Additionally, they offer optional endorsements to enhance coverage, such as water backup coverage, identity theft protection, and coverage for high-value items. Allstate's "Claim Satisfaction Guarantee" is a unique feature that ensures customers receive prompt and fair claim settlements.

| Policy Type | Coverage Options |

|---|---|

| Dwelling Protection | Covers the structure of your home |

| Personal Property Coverage | Protects belongings inside the home |

| Liability Coverage | Offers financial protection for legal claims |

| Loss of Use Coverage | Covers additional living expenses if you need to relocate temporarily |

USAA

USAA is a leading provider of insurance and financial services for military members, veterans, and their families. While their eligibility criteria are specific, USAA offers highly competitive home insurance policies in Texas. Their policies are designed to provide comprehensive coverage at affordable rates, catering to the unique needs of military families.

USAA's home insurance policies typically include coverage for dwelling, personal property, liability, and additional living expenses. They also offer unique coverage options such as "Valuable Personal Property" coverage, which provides enhanced protection for high-value items, and "Military Protection" coverage, which offers additional benefits tailored to military members and their families.

| Policy Type | Coverage Options |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home |

| Personal Property Coverage | Covers personal belongings |

| Liability Coverage | Provides financial protection against lawsuits |

| Additional Living Expenses | Covers temporary living costs if your home is uninhabitable |

Farmers Insurance

Farmers Insurance is a well-established insurance provider in Texas, offering a range of insurance products, including home insurance. Their policies are designed to provide comprehensive coverage for homeowners, addressing the specific needs of Texas residents.

Farmers Insurance's home insurance policies typically include coverage for dwelling, personal property, liability, and additional living expenses. They also offer optional coverage enhancements such as "Identity Theft Expense Coverage" and "Service Line Coverage," which provides protection for underground service lines. Farmers Insurance's "Claims Satisfaction Guarantee" ensures customers receive fair and prompt claim settlements.

| Policy Type | Coverage Options |

|---|---|

| Dwelling Coverage | Covers the physical structure of your home |

| Personal Property Coverage | Protects personal belongings |

| Liability Coverage | Offers financial protection for legal claims |

| Additional Living Expenses | Covers temporary living costs during repairs |

Liberty Mutual

Liberty Mutual is a prominent name in the Texas home insurance market, known for its comprehensive coverage options and innovative technology. Their policies are designed to provide Texas homeowners with peace of mind, addressing the unique challenges faced in the state.

Liberty Mutual's home insurance policies typically include coverage for dwelling, personal property, liability, and additional living expenses. They also offer unique coverage options such as "Replacement Cost Plus" coverage, which provides additional funds for upgrades during repairs, and "Home Identity Theft Coverage," which helps protect against identity theft.

| Policy Type | Coverage Options |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home |

| Personal Property Coverage | Covers personal belongings |

| Liability Coverage | Provides financial protection for legal claims |

| Additional Living Expenses | Covers temporary living costs during repairs |

Comparing Home Insurance Policies in Texas

When comparing home insurance policies in Texas, several key factors come into play. These include coverage options, deductibles, discounts, and customer service. Understanding these elements can help homeowners make an informed decision when choosing an insurance provider.

Coverage Options

Coverage options are a critical aspect of home insurance policies. Texas homeowners should consider the specific risks they face, such as hurricanes, tornadoes, or hailstorms, and ensure their policy provides adequate coverage for these perils. Additionally, optional coverage enhancements, such as personal article policies or water backup coverage, can provide added protection for specific needs.

Deductibles and Premiums

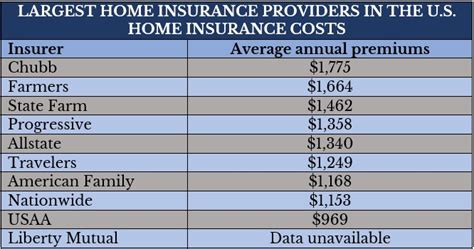

Deductibles and premiums are closely related in home insurance policies. A higher deductible often results in a lower premium, while a lower deductible may increase the premium. Homeowners should carefully consider their financial situation and the potential risks they face when choosing a deductible. It’s important to strike a balance between affordability and adequate coverage.

Discounts and Savings

Many home insurance companies in Texas offer discounts and savings opportunities to attract and retain customers. These can include multi-policy discounts (for bundling home and auto insurance), loyalty discounts, safety device discounts (for installing security systems or smoke detectors), and even discounts for certain professions or affiliations. It’s worth exploring these options to potentially reduce the overall cost of home insurance.

Customer Service and Claims Handling

The quality of customer service and claims handling is a crucial aspect of home insurance. Texas homeowners should consider the reputation and track record of insurance companies when it comes to claim settlements. Prompt and fair claim handling can make a significant difference during times of need. Reading customer reviews and seeking recommendations from trusted sources can provide valuable insights into the customer service experience of different insurance providers.

Tips for Choosing the Right Home Insurance Company in Texas

Selecting the right home insurance company in Texas can be a daunting task with so many options available. Here are some tips to help homeowners make an informed decision:

- Assess Your Needs: Evaluate the specific risks your home faces, such as natural disasters or theft, and ensure the insurance provider offers coverage for these perils.

- Compare Policies: Obtain multiple quotes from different insurance companies and compare coverage options, deductibles, and premiums to find the best value.

- Read Reviews: Research customer reviews and ratings to gain insights into the experiences of other homeowners with the insurance provider.

- Consider Customer Service: Evaluate the insurance company's reputation for customer service and claims handling to ensure they provide prompt and fair assistance when needed.

- Explore Discounts: Look for opportunities to save on premiums by bundling policies or taking advantage of safety device discounts.

The Future of Home Insurance in Texas

The home insurance landscape in Texas is continually evolving, driven by technological advancements, changing risk profiles, and consumer expectations. Insurance companies are increasingly leveraging technology to enhance their services, from digital claim processing to the use of artificial intelligence for risk assessment. Additionally, the growing focus on sustainability and eco-friendly practices is influencing insurance policies, with some companies offering discounts for green homes or solar panels.

Furthermore, the increasing frequency and severity of natural disasters in Texas are prompting insurance providers to adapt their policies and pricing structures. This includes a greater emphasis on windstorm coverage and the potential for rate adjustments based on risk assessments. As the insurance market in Texas continues to evolve, homeowners can expect more innovative coverage options and services to meet their evolving needs.

How often should I review my home insurance policy in Texas?

+It is recommended to review your home insurance policy annually to ensure it aligns with your current needs and any changes in your home’s value or location. Regular reviews can help you stay informed about any updates to coverage options or premiums.

What factors influence home insurance rates in Texas?

+Several factors influence home insurance rates in Texas, including the location of your home, its age and construction materials, the level of coverage you choose, and any discounts you qualify for. Additionally, your claims history and credit score can impact your premiums.

Are there any unique coverage options specific to Texas homeowners?

+Yes, given the unique natural disaster risks in Texas, many insurance companies offer specialized coverage options such as windstorm coverage, hail damage coverage, and flood insurance. These additional policies can provide valuable protection for Texas homeowners.