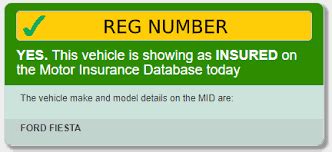

Motor Insurance Database

Welcome to an in-depth exploration of the Motor Insurance Database (MID), a crucial aspect of the insurance industry and road safety. The MID is a comprehensive electronic database that contains essential information about all insured vehicles in the United Kingdom. This article aims to provide a comprehensive guide, delving into its history, significance, impact on the insurance industry, and its role in promoting road safety.

The Evolution of the Motor Insurance Database

The concept of a centralized database for motor insurance was pioneered in the United Kingdom to address the challenges of managing insurance records and ensuring compliance with the Road Traffic Act. The Motor Insurers’ Bureau (MIB), a non-profit organization, took the lead in developing the MID, which was officially launched in 1997.

The initial purpose of the MID was to maintain a record of all insured vehicles to facilitate efficient claims handling and reduce uninsured driving. Over the years, the database has evolved significantly, incorporating advanced technologies and expanding its scope to meet the evolving needs of the insurance industry and road safety initiatives.

Key Milestones in MID’s Journey

The journey of the MID has been marked by several significant milestones that have shaped its current form and functionality.

- 1997: The MID was launched, revolutionizing the way insurance data was managed and accessed.

- 2005: The MID underwent a major upgrade, introducing real-time updates and enhancing data accuracy.

- 2013: The introduction of Automated Number Plate Recognition (ANPR) technology integrated with the MID, enabling efficient enforcement of insurance laws.

- 2018: The MID implemented Open Banking standards, improving data security and customer experience.

- 2020: The database expanded its scope to include additional vehicle-related data, such as vehicle tax and MOT status.

These milestones reflect the continuous efforts to enhance the MID's capabilities, ensuring it remains a vital tool for the insurance industry and road safety authorities.

The Role and Significance of the MID

The Motor Insurance Database plays a pivotal role in the insurance landscape and road safety initiatives. Here’s a detailed look at its significance:

Ensuring Compliance and Reducing Uninsured Driving

One of the primary objectives of the MID is to ensure that all vehicles on UK roads are insured as per the Road Traffic Act. By maintaining a comprehensive database of insured vehicles, the MID facilitates easy verification of insurance status. This helps in identifying and addressing instances of uninsured driving, a significant road safety concern.

| Statistical Insight | Uninsured Driving Impact |

|---|---|

| The MID contributes to a significant reduction in uninsured driving, with estimates suggesting a drop of over 20% since its inception. | Uninsured drivers pose a serious risk to road safety, often leading to financial burdens for victims and increased insurance premiums for law-abiding drivers. |

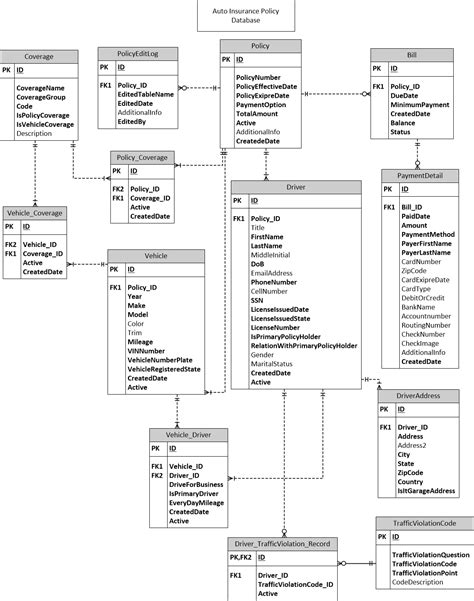

Efficient Claims Handling and Fraud Prevention

The MID streamlines the claims process by providing quick access to insurance details. This enables insurance companies to process claims more efficiently, reducing the time and resources required. Additionally, the MID’s robust data validation and verification processes help identify potential insurance fraud, protecting both insurance companies and policyholders.

Supporting Road Safety Initiatives

The MID is a valuable resource for road safety authorities and research institutions. It provides access to real-time data on vehicle ownership and insurance, enabling the development of targeted road safety campaigns and initiatives. By analyzing MID data, authorities can identify high-risk areas and implement effective measures to enhance road safety.

Impact on the Insurance Industry

The introduction and continuous development of the MID have had a profound impact on the insurance industry, revolutionizing the way insurance is managed and administered.

Enhanced Customer Experience

The MID has significantly improved the customer experience by providing insurance companies with real-time data access. This enables quick verification of insurance details, reducing the time taken to process policies and claims. Customers benefit from faster and more efficient services, enhancing their overall satisfaction.

Improved Data Accuracy and Security

The MID’s rigorous data validation processes ensure high accuracy and integrity of insurance records. This reduces the chances of errors and fraud, benefiting both insurance companies and policyholders. Moreover, the implementation of Open Banking standards has enhanced data security, protecting customer information.

Advanced Analytics and Insights

The MID’s comprehensive dataset allows insurance companies to conduct advanced analytics and gain valuable insights. By analyzing trends and patterns, insurers can develop more accurate risk assessment models, optimize pricing strategies, and offer tailored insurance products. This data-driven approach enhances the competitiveness and profitability of insurance providers.

Future Prospects and Innovations

The MID continues to evolve, embracing new technologies and adapting to the changing landscape of the insurance industry and road safety. Here’s a glimpse into the future of the MID:

Integration with Autonomous Vehicles

As the world moves towards autonomous driving, the MID is poised to play a crucial role. It will integrate with autonomous vehicle technologies, ensuring that these vehicles are insured and compliant with relevant regulations. The MID’s data will be vital in developing insurance models for this emerging segment.

Blockchain Technology and Smart Contracts

The adoption of blockchain technology and smart contracts can further enhance the MID’s security and efficiency. By leveraging blockchain’s decentralized nature, insurance transactions can be recorded and verified securely, reducing fraud and enhancing data integrity.

Artificial Intelligence and Predictive Analytics

Integrating AI and predictive analytics into the MID can revolutionize risk assessment and fraud detection. Advanced algorithms can analyze vast datasets, identifying patterns and anomalies to predict potential insurance-related risks and fraud attempts. This proactive approach can significantly enhance the efficiency and effectiveness of insurance processes.

Conclusion

The Motor Insurance Database has emerged as a cornerstone of the insurance industry and road safety initiatives in the United Kingdom. Its evolution over the years has transformed the way insurance data is managed, accessed, and utilized. The MID’s impact on reducing uninsured driving, streamlining claims processes, and supporting road safety efforts cannot be overstated.

As the insurance landscape continues to evolve, the MID is well-positioned to adapt and integrate new technologies, ensuring it remains a vital tool for the industry and society at large. The future prospects of the MID, especially in the context of autonomous vehicles and advanced analytics, are promising, offering new opportunities for innovation and enhanced road safety.

How does the MID impact insurance companies’ profitability?

+The MID’s accurate and real-time data enable insurance companies to make informed decisions, optimize pricing, and reduce fraud, ultimately improving their profitability.

What measures are in place to protect customer data within the MID?

+The MID adheres to strict data protection regulations, including the implementation of Open Banking standards, ensuring the security and confidentiality of customer information.

How does the MID contribute to road safety initiatives?

+By providing real-time data on vehicle ownership and insurance, the MID enables authorities to identify high-risk areas, develop targeted campaigns, and implement effective measures to enhance road safety.