Wisconsin Health Insurance Marketplace

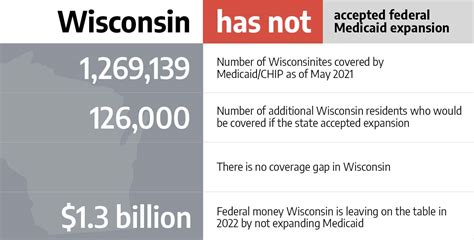

The Wisconsin Health Insurance Marketplace, also known as the Wisconsin Health Insurance Exchange, is a vital platform for residents of the state to access affordable healthcare options. Established under the Affordable Care Act (ACA), this marketplace offers a range of health insurance plans, catering to the diverse needs of Wisconsin's population. With a focus on providing accessible and comprehensive healthcare coverage, the Wisconsin Health Insurance Marketplace plays a crucial role in ensuring that individuals and families have the resources to maintain their well-being.

Navigating the Wisconsin Health Insurance Marketplace

The Wisconsin Health Insurance Marketplace offers a user-friendly online platform where individuals can compare and enroll in health insurance plans. The website provides a comprehensive overview of the available options, allowing users to filter and search for plans based on their specific needs and preferences. From major medical coverage to dental and vision plans, the marketplace ensures a wide range of choices for Wisconsin residents.

One of the key advantages of the Wisconsin Health Insurance Marketplace is its commitment to transparency. The platform provides clear and concise information about each plan's coverage, including details on deductibles, copays, and out-of-pocket maximums. This transparency empowers users to make informed decisions, ensuring they select a plan that aligns with their healthcare needs and financial situation.

Eligibility and Enrollment Periods

Eligibility for the Wisconsin Health Insurance Marketplace is based on several factors, including age, income, and family size. Generally, individuals and families with incomes up to 400% of the Federal Poverty Level are eligible for financial assistance to reduce their monthly premiums and out-of-pocket costs. The marketplace also offers tax credits and cost-sharing reductions to further support those with lower incomes.

Open enrollment for the Wisconsin Health Insurance Marketplace typically runs from November 1st to December 15th each year. During this period, individuals can enroll in a new plan, switch to a different plan, or renew their existing coverage for the upcoming year. It's important to note that outside of the open enrollment period, individuals can only make changes to their coverage if they experience a qualifying life event, such as marriage, birth of a child, or loss of other health coverage.

| Enrollment Period | Details |

|---|---|

| Open Enrollment | November 1st - December 15th |

| Special Enrollment | Triggered by qualifying life events |

Plan Options and Premiums

The Wisconsin Health Insurance Marketplace offers a variety of plan options, including Bronze, Silver, Gold, and Platinum plans. Each plan category represents a different level of coverage and cost-sharing. Bronze plans typically have lower premiums but higher out-of-pocket costs, while Platinum plans offer the highest level of coverage with lower out-of-pocket expenses.

Premiums for health insurance plans vary based on several factors, including the plan category, the insurer, and the user's location. On average, monthly premiums for a Silver plan in Wisconsin range from $250 to $400 for an individual, and from $600 to $1,000 for a family. However, these costs can be significantly reduced with the help of financial assistance and tax credits available through the marketplace.

| Plan Category | Description |

|---|---|

| Bronze | Lower premiums, higher out-of-pocket costs |

| Silver | Balanced coverage and cost-sharing |

| Gold | High coverage, slightly higher premiums |

| Platinum | Highest coverage, premium may vary |

Understanding Coverage and Benefits

The Wisconsin Health Insurance Marketplace ensures that all qualified health plans (QHPs) cover essential health benefits, as mandated by the Affordable Care Act. These benefits include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, laboratory services, preventive and wellness services, and chronic disease management.

In addition to these essential benefits, the marketplace offers a range of optional benefits that users can choose based on their specific needs. These optional benefits may include dental, vision, and hearing coverage, as well as additional prescription drug coverage. It's important for individuals to carefully review the details of each plan to ensure they understand the scope of their coverage.

Provider Networks and Out-of-Network Care

Each health insurance plan available on the Wisconsin Health Insurance Marketplace has its own network of healthcare providers, including doctors, hospitals, and other medical facilities. These networks can vary widely, with some plans offering a more limited network for cost-saving purposes, while others provide a broader range of options.

It's crucial for individuals to consider their preferred healthcare providers and facilities when choosing a plan. The marketplace provides detailed information about each plan's provider network, allowing users to verify if their preferred providers are in-network. While out-of-network care is typically more expensive, some plans may offer out-of-network benefits or have preferred provider organizations (PPOs) that provide more flexibility.

Assistance and Support for Wisconsin Residents

The Wisconsin Health Insurance Marketplace understands that navigating the world of health insurance can be complex, especially for those who are new to the process. To support residents, the marketplace offers a range of resources and assistance programs.

Consumer Assistance Programs

Consumer Assistance Programs (CAPs) are available to provide one-on-one support to Wisconsin residents navigating the health insurance marketplace. These programs offer guidance on eligibility, enrollment, and plan selection, ensuring that individuals have the information they need to make informed decisions. CAPs can be particularly beneficial for those with complex healthcare needs or financial concerns.

Additionally, the marketplace provides a dedicated help line, where trained specialists can answer questions and provide assistance. The help line is accessible via phone, email, and live chat, ensuring that residents have multiple channels to reach out for support.

Financial Assistance and Tax Credits

The Wisconsin Health Insurance Marketplace aims to make healthcare coverage affordable for all eligible residents. To achieve this, the marketplace offers financial assistance and tax credits to reduce the cost of premiums and out-of-pocket expenses. These benefits are based on the user’s income and family size, ensuring that those with lower incomes receive the support they need.

For individuals and families with incomes between 100% and 400% of the Federal Poverty Level, premium tax credits are available to reduce the cost of monthly premiums. Additionally, cost-sharing reductions can further lower out-of-pocket costs for those with incomes up to 250% of the Federal Poverty Level. These financial assistance programs ensure that healthcare coverage is accessible and affordable for a wide range of Wisconsin residents.

The Future of Healthcare in Wisconsin

The Wisconsin Health Insurance Marketplace continues to evolve and improve, with a focus on expanding access to quality healthcare for all residents. As the healthcare landscape changes, the marketplace remains committed to providing a transparent and user-friendly platform for individuals to find the right health insurance coverage.

Looking ahead, the marketplace aims to enhance its online platform, making it even more intuitive and accessible. By incorporating user feedback and industry best practices, the marketplace strives to create a seamless enrollment experience. Additionally, ongoing efforts are dedicated to expanding the network of healthcare providers, ensuring that Wisconsin residents have a wide range of high-quality options for their healthcare needs.

Furthermore, the Wisconsin Health Insurance Marketplace actively engages with stakeholders, including healthcare providers, insurers, and consumer advocacy groups, to gather insights and feedback. This collaborative approach ensures that the marketplace remains responsive to the evolving needs of Wisconsin's diverse population.

Can I enroll outside of the open enrollment period?

+Yes, you can enroll outside of the open enrollment period if you experience a qualifying life event, such as marriage, birth of a child, or loss of other health coverage. These events trigger a special enrollment period, allowing you to make changes to your coverage.

How do I know if I’m eligible for financial assistance?

+Eligibility for financial assistance is based on your income and family size. Generally, individuals and families with incomes up to 400% of the Federal Poverty Level may qualify for premium tax credits and cost-sharing reductions. You can use the marketplace’s eligibility tool to determine if you’re eligible.

What happens if I miss the open enrollment deadline?

+If you miss the open enrollment deadline, you may still be able to enroll in a health insurance plan if you qualify for a special enrollment period due to a qualifying life event. However, it’s important to note that missing the open enrollment deadline may limit your options and increase the cost of your coverage.