Amfam Auto Insurance Quote

In the world of auto insurance, having a trusted partner that understands your unique needs is invaluable. AmFam Auto Insurance, a leading provider in the industry, offers personalized quotes tailored to your specific circumstances. With a focus on providing comprehensive coverage and exceptional service, AmFam has established itself as a reliable choice for many drivers. In this article, we will delve into the process of obtaining an AmFam Auto Insurance quote, exploring the factors that influence your premium and the benefits you can expect as a policyholder.

Understanding the AmFam Auto Insurance Quote Process

Obtaining an AmFam Auto Insurance quote is a straightforward and transparent process. The company’s online platform allows you to input your details and receive a personalized quote in just a few minutes. Here’s a step-by-step breakdown of what you can expect:

Step 1: Personal Information

The quote process begins by collecting your basic personal details. This includes your name, date of birth, and contact information. AmFam values your privacy and ensures that your personal data is handled securely.

Step 2: Vehicle Information

Next, you’ll provide information about your vehicle. This includes the make, model, year, and any additional modifications or features. AmFam considers the vehicle’s safety ratings, mileage, and overall condition when determining your premium.

Step 3: Coverage Preferences

At this stage, you have the opportunity to choose the level of coverage you desire. AmFam offers a range of options, including liability, collision, comprehensive, and additional coverage endorsements. You can customize your policy to align with your specific needs and budget.

Step 4: Driver Information

AmFam takes into account the driving history and experience of all licensed drivers in your household. Factors such as traffic violations, accidents, and claims history can impact your premium. The company believes in rewarding safe driving habits and offers discounts for drivers with clean records.

Step 5: Review and Personalize

Before finalizing your quote, AmFam presents you with a comprehensive overview of your coverage options and estimated premiums. This step allows you to review and make any necessary adjustments to ensure your policy meets your expectations. You can choose to increase or decrease coverage limits, add or remove drivers, or opt for additional discounts.

Step 6: Final Quote

Once you are satisfied with your coverage selections, AmFam provides you with a final quote. This quote outlines the estimated annual premium, as well as any applicable discounts or surcharges. You have the option to accept the quote and proceed with purchasing your policy or decline and explore alternative options.

Factors Influencing Your AmFam Auto Insurance Quote

Several factors play a role in determining your AmFam Auto Insurance quote. Understanding these factors can help you make informed decisions and potentially lower your premiums.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can significantly impact your insurance rates. AmFam considers factors such as the make and model of your vehicle, its age, and its safety features. Additionally, the primary purpose of your vehicle, whether for personal use, business, or pleasure, can affect your premium.

| Vehicle Type | Estimated Premium Impact |

|---|---|

| Sedan | Moderate |

| SUV | Higher |

| Sports Car | Significantly Higher |

Driving Record and Experience

Your driving history is a crucial factor in determining your insurance rates. AmFam assesses your record for traffic violations, accidents, and claims. A clean driving record with no recent incidents or claims typically results in lower premiums. Conversely, a history of accidents or violations may lead to higher rates.

Location and Geographic Factors

The area where you live and drive can influence your insurance costs. AmFam considers factors such as population density, crime rates, and the likelihood of natural disasters in your region. Areas with higher accident rates or a higher risk of theft may result in increased premiums.

Coverage Selections

The level of coverage you choose directly impacts your premium. AmFam offers a range of coverage options, including liability, collision, comprehensive, and additional endorsements. Selecting higher coverage limits or adding optional coverage can increase your premium, while opting for lower limits or excluding certain coverages can result in cost savings.

Benefits of Choosing AmFam Auto Insurance

Beyond the personalized quotes and comprehensive coverage options, AmFam Auto Insurance offers a range of benefits that set it apart from other providers.

Excellent Customer Service

AmFam prides itself on its exceptional customer service. The company’s dedicated team of insurance professionals is committed to providing timely and friendly assistance. Whether you have questions about your policy, need to file a claim, or require roadside assistance, AmFam’s customer service representatives are readily available to offer support.

Flexible Payment Options

AmFam understands that paying insurance premiums can be a financial commitment. To accommodate different financial situations, the company offers flexible payment plans. You can choose to pay your premium in full or opt for monthly installments, making it easier to manage your insurance costs.

Discounts and Rewards

AmFam believes in rewarding its policyholders for safe driving and loyalty. The company offers a variety of discounts, including multi-policy discounts for bundling your auto insurance with other AmFam policies, good student discounts for eligible students, and safe driver discounts for maintaining a clean driving record. These discounts can significantly reduce your overall insurance costs.

Accident Forgiveness

AmFam understands that accidents can happen, even to the safest drivers. With their accident forgiveness program, AmFam waives rate increases for your first at-fault accident, ensuring that one mistake doesn’t impact your future premiums.

Roadside Assistance

In the event of a breakdown or emergency, AmFam provides 24⁄7 roadside assistance. This includes services such as towing, battery jump-starts, flat tire changes, and fuel delivery. Having this added peace of mind can be invaluable when you’re stranded on the side of the road.

Comparative Analysis: AmFam vs. Other Auto Insurance Providers

When considering auto insurance options, it’s essential to evaluate the offerings of different providers. Here’s a comparative analysis of AmFam Auto Insurance against some of its competitors:

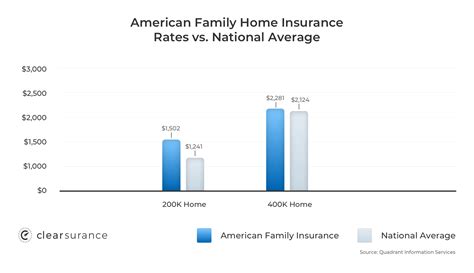

Pricing and Coverage

AmFam offers competitive pricing and a wide range of coverage options. While premiums may vary based on individual circumstances, AmFam’s comprehensive policies provide excellent value for money. In comparison, some competitors may offer lower base rates but have limited coverage options or higher deductibles.

Customer Satisfaction

AmFam consistently receives high customer satisfaction ratings. The company’s commitment to providing exceptional service and support sets it apart. Policyholders often praise AmFam for its efficient claims process, friendly customer service representatives, and overall satisfaction with their insurance experience.

Discounts and Rewards

AmFam’s extensive list of discounts and rewards is a significant advantage. By offering multi-policy, good student, and safe driver discounts, AmFam incentivizes policyholders to maintain safe driving habits and loyalty. In comparison, some competitors may have fewer discount options or require more stringent eligibility criteria.

Digital Tools and Resources

AmFam has invested in developing user-friendly digital tools and resources to enhance the customer experience. Their online platform allows for seamless policy management, including the ability to view and edit your policy, make payments, and access important documents. Additionally, AmFam provides educational resources and articles to help policyholders better understand their coverage and make informed decisions.

Future Implications and Industry Trends

As the auto insurance industry continues to evolve, AmFam remains committed to staying ahead of the curve. The company actively embraces emerging technologies and industry trends to enhance its services and meet the changing needs of its policyholders.

Telematics and Usage-Based Insurance

AmFam is exploring the potential of telematics and usage-based insurance. This innovative approach utilizes technology to monitor driving behavior and habits, allowing for more accurate risk assessment and personalized premiums. By incentivizing safe driving practices, AmFam aims to reward policyholders who demonstrate responsible driving behaviors.

Digital Transformation and Enhanced Customer Experience

AmFam recognizes the importance of digital transformation in the insurance industry. The company is investing in modernizing its digital platforms and enhancing its online services. By leveraging technology, AmFam aims to streamline the quote and policy management processes, providing policyholders with a seamless and efficient experience.

Collaborative Partnerships and Network Expansion

AmFam understands the value of collaborative partnerships within the insurance ecosystem. The company actively seeks partnerships with reputable repair shops, auto dealerships, and other industry players to expand its network and provide policyholders with a comprehensive range of services. By partnering with trusted businesses, AmFam ensures its policyholders have access to high-quality repairs, vehicle purchases, and other relevant services.

Environmental Sustainability Initiatives

AmFam is committed to environmental sustainability and is taking proactive steps to reduce its environmental impact. The company is exploring initiatives such as encouraging eco-friendly driving practices, offering discounts for hybrid or electric vehicles, and supporting sustainable business practices within its network of partners.

Conclusion

Obtaining an AmFam Auto Insurance quote is a straightforward and beneficial process. By considering the factors that influence your premium and understanding the advantages of choosing AmFam, you can make an informed decision about your auto insurance coverage. With its commitment to exceptional customer service, flexible payment options, and a range of discounts and rewards, AmFam stands out as a reliable and trusted provider in the auto insurance industry.

Can I customize my AmFam Auto Insurance policy to fit my specific needs?

+Absolutely! AmFam offers a range of coverage options, allowing you to tailor your policy to your unique circumstances. You can choose the level of liability, collision, and comprehensive coverage you desire, as well as add optional endorsements to enhance your protection.

What types of discounts does AmFam offer, and how can I qualify for them?

+AmFam provides various discounts, including multi-policy discounts for bundling your auto insurance with other AmFam policies, good student discounts for eligible students, and safe driver discounts for maintaining a clean driving record. To qualify, you must meet the eligibility criteria, which are typically based on factors such as your driving history, the number of policies you hold with AmFam, and your academic achievements.

How does AmFam’s accident forgiveness program work, and who is eligible?

+AmFam’s accident forgiveness program waives rate increases for your first at-fault accident. This means that if you have an accident and it’s your first at-fault incident, your premiums won’t be affected. Eligibility for the program typically requires maintaining a clean driving record and being a long-term AmFam policyholder.

Can I pay my AmFam Auto Insurance premiums monthly, and are there any additional fees for this option?

+Yes, AmFam offers flexible payment plans, including the option to pay your premiums monthly. There may be a small convenience fee associated with this option, but it provides a convenient way to manage your insurance costs without a large upfront payment.

How does AmFam’s usage-based insurance program work, and what are the potential benefits for policyholders?

+AmFam’s usage-based insurance program utilizes telematics technology to monitor driving behavior and habits. Policyholders who demonstrate safe driving practices may be eligible for discounted premiums. This program encourages responsible driving and allows AmFam to offer personalized rates based on actual driving data.