Comprehensive Car Insurance Meaning

When it comes to protecting your vehicle and yourself on the road, understanding the different types of car insurance is crucial. Comprehensive car insurance is a popular option that offers an extensive level of coverage, providing peace of mind for many drivers. In this expert-driven guide, we'll delve into the depths of comprehensive car insurance, exploring its meaning, benefits, and implications to help you make informed decisions about your automotive coverage.

The Essence of Comprehensive Car Insurance

Comprehensive car insurance is a broad policy designed to safeguard your vehicle and your interests from a wide range of potential risks and damages. Unlike basic liability insurance, which primarily covers damage caused to others, comprehensive insurance takes a holistic approach, addressing various scenarios that could affect your vehicle’s condition and your financial well-being.

This type of insurance is aptly named, as it truly aims to provide a comprehensive safety net for your automotive investments. By opting for comprehensive coverage, you're ensuring that your vehicle is protected from incidents that may not be covered by traditional liability policies.

Key Features and Benefits

-

Broad Coverage: Comprehensive insurance covers a wide spectrum of events, including damage caused by natural disasters, theft, vandalism, and even certain types of animal collisions. This comprehensive scope ensures that your vehicle is protected from unforeseen circumstances that could lead to costly repairs or replacements.

-

Peace of Mind: Knowing that your vehicle is insured against a multitude of risks can provide significant peace of mind. Whether you’re navigating through harsh weather conditions or parking in unfamiliar areas, comprehensive insurance offers a sense of security, allowing you to focus on the road ahead without constant worry.

-

Financial Protection: In the event of a covered incident, comprehensive insurance steps in to cover the costs of repairs or, in some cases, the replacement of your vehicle. This financial protection is especially valuable for those with newer or more expensive vehicles, as it helps mitigate the financial burden associated with unexpected damages.

Understanding the Coverage Details

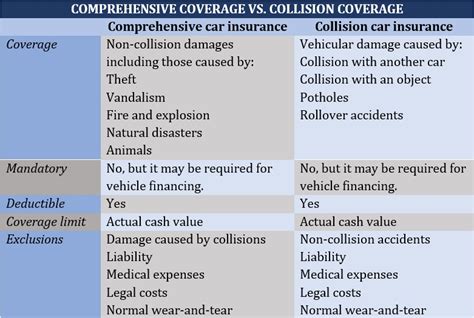

While comprehensive car insurance offers extensive coverage, it’s important to understand the specific details and limitations of your policy. Here’s a closer look at what’s typically included and what may require additional coverage:

Included Coverages

-

Natural Disasters: From hurricanes and floods to wildfires and earthquakes, comprehensive insurance often covers damages caused by natural disasters. This coverage is particularly valuable in regions prone to severe weather events.

-

Theft and Vandalism: If your vehicle is stolen or vandalized, comprehensive insurance will typically cover the costs associated with replacing or repairing the vehicle. This coverage provides protection against intentional acts of harm or unauthorized use.

-

Collision with Animals: Comprehensive insurance may cover damages resulting from collisions with animals, such as deer or other wildlife. This coverage is essential for drivers in rural or forested areas, where animal-vehicle encounters are more common.

-

Falling Objects: In the event that your vehicle is damaged by a falling tree branch, debris from a construction site, or other similar incidents, comprehensive insurance can provide coverage for repairs.

Potential Exclusions

While comprehensive insurance offers broad coverage, there are certain situations and damages that may not be included in the standard policy. Some common exclusions include:

-

Normal Wear and Tear: Comprehensive insurance does not cover the natural degradation of vehicle components due to regular use and aging. This includes issues like worn-out tires, rust, or mechanical failures resulting from regular wear.

-

Maintenance-Related Issues: Regular maintenance tasks, such as oil changes, brake repairs, or battery replacements, are typically not covered by comprehensive insurance. These expenses are considered the responsibility of the vehicle owner.

-

Mechanical Breakdowns: Unless specifically covered by an additional endorsement or policy add-on, comprehensive insurance does not typically cover mechanical breakdowns or failures that are not the result of an accident or covered event.

Customizing Your Coverage

One of the advantages of comprehensive car insurance is the flexibility it offers in tailoring your coverage to your specific needs. Insurance providers often allow you to customize your policy by adding optional endorsements or riders, which can enhance your coverage and provide additional peace of mind.

Optional Endorsements

-

Rental Car Coverage: If you frequently travel or rely on your vehicle for business purposes, adding rental car coverage to your comprehensive policy can ensure that you have a temporary vehicle available in the event of a covered incident.

-

Gap Insurance: Gap insurance is particularly beneficial for individuals who have leased or financed their vehicles. It covers the difference between the actual cash value of your vehicle and the remaining balance on your lease or loan, ensuring that you’re not left with a financial gap in the event of a total loss.

-

Personal Effects Coverage: In the unfortunate event of a covered loss, comprehensive insurance typically covers the value of personal belongings inside your vehicle. However, if you have high-value items like electronics or jewelry, you may want to consider adding personal effects coverage to ensure they’re adequately insured.

Performance and Implications

Comprehensive car insurance plays a critical role in the overall performance and financial stability of both drivers and insurance providers. Let’s explore some key performance indicators and implications associated with this type of coverage.

Claim Ratios and Performance

Claim ratios are a vital metric used by insurance providers to assess the performance of their policies. In the context of comprehensive car insurance, claim ratios measure the relationship between the total value of claims paid out and the total premiums collected. A well-performing comprehensive policy will have a favorable claim ratio, indicating that the premiums collected are effectively covering the costs of claims without excessive strain on the insurer’s finances.

For drivers, a low claim ratio can be an indicator of a stable and reliable insurance provider. It suggests that the insurer has a strong financial foundation and is capable of honoring claims without significant financial strain. This stability is crucial, especially in the event of a major incident where multiple claims may be filed simultaneously.

Financial Implications

Comprehensive car insurance can have significant financial implications for both drivers and insurance providers. For drivers, the cost of comprehensive coverage can vary based on a multitude of factors, including the make and model of the vehicle, the driver’s age and driving history, and the geographic location. It’s important to carefully assess the cost of comprehensive insurance and ensure that it aligns with your budget and risk tolerance.

For insurance providers, comprehensive coverage represents a delicate balance between offering an attractive and comprehensive product to customers while maintaining financial stability. Providers must carefully assess the risks associated with various scenarios and adjust premiums accordingly to ensure profitability. This balance is essential to sustain the long-term viability of the insurance provider and to continue offering competitive and comprehensive coverage options to drivers.

Conclusion: Making an Informed Decision

Comprehensive car insurance is a powerful tool for safeguarding your vehicle and your financial interests. By understanding the scope of coverage, potential exclusions, and customization options, you can make an informed decision about whether comprehensive insurance is the right choice for your needs. Remember, while comprehensive coverage offers an extensive safety net, it’s important to carefully assess your budget and risk tolerance to ensure that your insurance choices align with your overall financial strategy.

In the ever-evolving world of automotive insurance, staying informed and proactive is key. Regularly reviewing and updating your insurance policies ensures that you're adequately protected against the evolving risks and challenges of the road. With the right coverage in place, you can drive with confidence, knowing that you're prepared for whatever lies ahead.

What is the difference between comprehensive and liability insurance?

+

Comprehensive insurance provides coverage for a wide range of events, including natural disasters, theft, and vandalism, while liability insurance primarily covers damage caused to others. Liability insurance is mandatory in most states and covers bodily injury and property damage caused by the policyholder.

Is comprehensive insurance more expensive than other types of coverage?

+

Comprehensive insurance can be more expensive than basic liability coverage due to the broader scope of protection it offers. However, the cost can vary significantly based on factors such as the vehicle’s make and model, the driver’s profile, and the geographic location.

Can I customize my comprehensive insurance policy to fit my needs?

+

Yes, comprehensive insurance policies often allow for customization through optional endorsements or riders. You can add coverage for rental cars, gap insurance, or personal effects to enhance your policy and address specific needs.