State Vehicle Insurance

In the complex world of vehicle ownership, understanding the intricacies of state vehicle insurance is paramount. This legal and financial framework, often overlooked, plays a pivotal role in ensuring the safety and security of drivers and their vehicles across the nation. Let's delve into the specifics, exploring the various facets of state vehicle insurance, its purpose, and its impact on everyday motorists.

The Foundation of State Vehicle Insurance

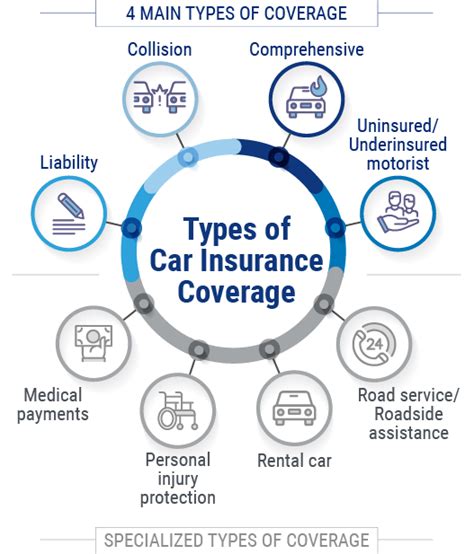

At its core, state vehicle insurance is a mandated system designed to provide financial protection to drivers and passengers involved in automobile accidents. This comprehensive coverage extends beyond personal injury, encompassing property damage and liability issues. It is a legal requirement in every state, ensuring that motorists are adequately insured against potential risks and liabilities associated with operating a motor vehicle.

The underlying principle of state vehicle insurance is to promote safety and accountability on the roads. By requiring all drivers to carry insurance, states aim to minimize the financial burden and potential hardship that can arise from automobile accidents. This mandatory insurance coverage serves as a safety net, offering protection and peace of mind to drivers, passengers, and pedestrians alike.

Mandatory Coverage: A State-by-State Breakdown

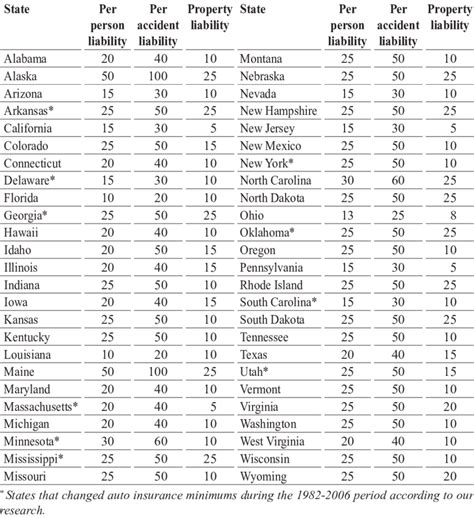

While the basic premise of state vehicle insurance remains consistent across the nation, the specific coverage requirements can vary significantly from one state to another. These variations are often influenced by a range of factors, including local traffic patterns, accident statistics, and regional economic conditions.

Liability Coverage

Liability coverage is a cornerstone of state vehicle insurance, designed to protect drivers from financial liability in the event of an accident. This coverage is mandatory in all states and typically includes bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and lost wages for individuals injured in an accident, while property damage liability covers the cost of repairing or replacing damaged property.

| State | Minimum Liability Coverage |

|---|---|

| California | $15,000 bodily injury per person / $30,000 bodily injury per accident / $5,000 property damage |

| Texas | $30,000 bodily injury per person / $60,000 bodily injury per accident / $25,000 property damage |

| New York | $25,000 bodily injury per person / $50,000 bodily injury per accident / $10,000 property damage |

Collision and Comprehensive Coverage

Beyond liability coverage, many states also require drivers to carry collision and comprehensive insurance. Collision coverage pays for repairs or replacements of the insured vehicle after an accident, regardless of fault. Comprehensive coverage, on the other hand, provides protection against non-accident related damages, such as theft, vandalism, or natural disasters.

| State | Collision and Comprehensive Coverage |

|---|---|

| Illinois | Required for leased or financed vehicles |

| Florida | Optional, but highly recommended |

| Washington | Not mandatory, but often required by lenders |

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is another crucial aspect of state vehicle insurance. This coverage protects insured drivers when involved in an accident with a driver who either lacks insurance or has insufficient coverage. It ensures that the insured driver is compensated for their losses, even if the at-fault driver is unable to provide adequate financial support.

| State | Uninsured/Underinsured Motorist Coverage |

|---|---|

| Massachusetts | Mandatory with minimum limits of $20,000 per person / $40,000 per accident |

| New Jersey | Required with limits of $15,000 per person / $30,000 per accident |

| Pennsylvania | Optional, but highly recommended |

The Impact of State Vehicle Insurance

State vehicle insurance has a profound impact on the overall safety and financial well-being of drivers and their communities. By enforcing mandatory insurance coverage, states aim to reduce the financial strain and potential hardship that can result from automobile accidents. This comprehensive approach ensures that drivers are prepared for the unexpected, providing a sense of security and peace of mind.

Furthermore, state vehicle insurance plays a critical role in promoting responsible driving behavior. With the knowledge that they are financially protected, drivers are more likely to exercise caution and adhere to traffic laws. This, in turn, contributes to a safer and more orderly road environment, benefiting all road users.

Navigating the Complexities: Tips for Motorists

Understanding and navigating the intricacies of state vehicle insurance can be a daunting task. Here are some key tips to help motorists make informed decisions and ensure they have adequate coverage:

- Research State-Specific Requirements: Familiarize yourself with the specific insurance requirements in your state. This knowledge will help you understand the minimum coverage you need and any additional coverage that may be beneficial.

- Understand Your Policy: Take the time to thoroughly review your insurance policy. Understand the types of coverage you have, the limits of your policy, and any exclusions or limitations that may apply.

- Tailor Your Coverage: Work with an insurance professional to tailor your coverage to your unique needs and circumstances. Consider factors such as the value of your vehicle, your driving habits, and any additional coverage options that may provide added protection.

- Compare Quotes: Shop around and compare insurance quotes from multiple providers. This can help you find the best coverage at the most competitive rates.

- Stay Informed: Keep yourself updated on any changes to state insurance laws or regulations. This will ensure that you remain compliant and have the most up-to-date coverage.

Conclusion: A Comprehensive Approach to Safety

State vehicle insurance is a vital component of the driving experience, offering a comprehensive approach to safety and financial protection. By understanding the intricacies of this system and staying informed about state-specific requirements, motorists can make informed decisions and ensure they have the coverage they need. With the right insurance coverage, drivers can navigate the roads with confidence, knowing they are protected against the unexpected.

What happens if I don’t have state vehicle insurance?

+Operating a vehicle without state-mandated insurance can result in severe penalties, including fines, license suspension, and even imprisonment in some states. It’s crucial to understand the legal requirements and ensure you have the necessary coverage.

Can I choose my insurance provider?

+Yes, you have the freedom to choose your insurance provider. Shopping around and comparing quotes can help you find the best coverage and rates that suit your needs.

How often should I review my insurance policy?

+It’s recommended to review your insurance policy annually or whenever your circumstances change, such as purchasing a new vehicle, moving to a different state, or experiencing a significant life event. Regular reviews ensure your coverage remains up-to-date and adequate.