What Is An Insurance Ppo

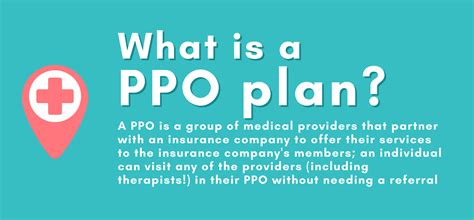

A Preferred Provider Organization (PPO) is a popular type of health insurance plan offered by various insurance companies in the United States. PPOs provide policyholders with a wide range of benefits and flexibility when it comes to accessing healthcare services. In this comprehensive guide, we will delve into the world of PPO insurance, exploring its key features, how it works, and the advantages it offers to individuals and families seeking comprehensive healthcare coverage.

Understanding the Concept of PPO Insurance

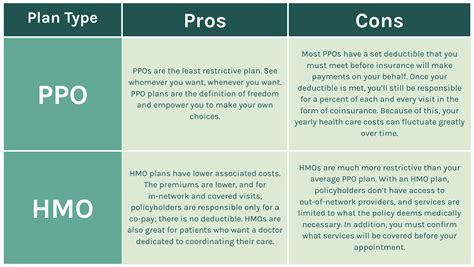

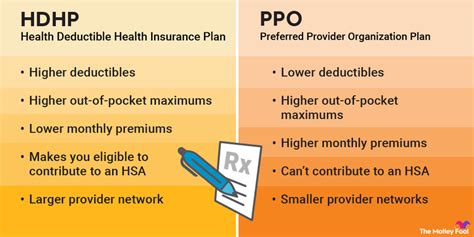

A PPO insurance plan operates on the principle of offering policyholders the freedom to choose their healthcare providers while still enjoying discounted rates and comprehensive coverage. Unlike other insurance plans, such as Health Maintenance Organizations (HMOs), PPOs do not require you to select a primary care physician or obtain referrals for specialist visits.

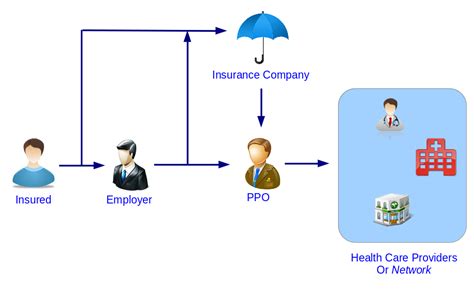

The term "preferred provider" refers to the network of healthcare professionals and facilities that have negotiated discounted rates with the insurance company. These providers agree to accept lower reimbursement rates from the insurance company in exchange for a steady stream of patients. Policyholders who utilize these preferred providers typically pay less out of pocket for their healthcare services.

Key Features of a PPO Insurance Plan

PPO insurance plans offer a range of features designed to provide flexibility and control to policyholders:

- Wide Network of Providers: PPOs maintain extensive networks of healthcare providers, including doctors, specialists, hospitals, and other medical facilities. This network ensures that policyholders have a variety of options when choosing their healthcare professionals.

- Freedom of Choice: One of the most significant advantages of a PPO plan is the freedom to visit any healthcare provider, whether they are in-network or out-of-network. While in-network providers offer lower rates, policyholders can still access care from out-of-network providers without facing significant financial penalties.

- No Referrals Required: Unlike some other insurance plans, PPOs do not mandate that policyholders obtain referrals from primary care physicians to see specialists. This means you can directly schedule appointments with specialists without going through an intermediary.

- Pre-Authorization for Procedures: In some cases, PPO insurance plans may require pre-authorization for certain medical procedures or tests. This process ensures that the insurance company approves the procedure beforehand, avoiding any unexpected out-of-pocket expenses.

- Coverage for Preventive Care: Many PPO plans offer coverage for preventive care services, such as annual check-ups, vaccinations, and screenings. These services are often fully covered or provided at a reduced cost, encouraging policyholders to stay on top of their health.

How PPO Insurance Works

When you enroll in a PPO insurance plan, you typically pay a monthly premium to the insurance company. This premium grants you access to the network of preferred providers and the benefits outlined in your insurance policy.

When you receive medical services, the healthcare provider bills the insurance company directly. The insurance company then pays a portion of the cost, and you are responsible for the remaining amount, known as "out-of-pocket costs". These costs typically include deductibles, copayments, and coinsurance.

The specific out-of-pocket costs and coverage limits depend on your insurance plan's design. Some PPO plans offer higher coverage limits and lower out-of-pocket expenses, while others may have lower premiums but higher deductibles and copayments.

In-Network vs. Out-of-Network Services

PPO plans differentiate between in-network and out-of-network services when it comes to cost-sharing.

- In-Network Services: When you utilize in-network providers, your out-of-pocket costs are typically lower. The insurance company has negotiated discounted rates with these providers, and you benefit from those reduced fees. In some cases, you may only be responsible for a small copayment.

- Out-of-Network Services: If you choose to receive services from out-of-network providers, your out-of-pocket costs may be higher. These providers have not negotiated discounted rates with the insurance company, and as a result, you may need to pay a larger portion of the bill.

Advantages of PPO Insurance

PPO insurance plans offer several advantages that make them a popular choice for individuals and families:

- Flexibility: The freedom to choose any healthcare provider, whether in-network or out-of-network, provides policyholders with maximum flexibility. This is particularly beneficial if you have established relationships with specific doctors or prefer a certain healthcare facility.

- Wide Provider Network: The extensive network of preferred providers ensures that policyholders have a vast array of options when seeking medical care. This is especially useful in areas with a diverse range of medical specialties.

- No Referrals Needed: The ability to directly access specialists without a referral saves time and eliminates the need for additional appointments with primary care physicians.

- Coverage for Preventive Care: PPO plans often cover preventive care services, encouraging policyholders to prioritize their health and well-being. This proactive approach to healthcare can lead to early detection and management of potential health issues.

- Lower Out-of-Pocket Costs: While out-of-network services may incur higher costs, in-network providers offer significant discounts, making healthcare more affordable for policyholders.

Performance Analysis and Industry Trends

PPO insurance plans have gained popularity over the years due to their flexibility and comprehensive coverage. According to industry reports, the Preferred Provider Organization market has experienced steady growth, with an increasing number of insurance companies offering PPO plans to cater to the diverse needs of policyholders.

| Year | PPO Market Share (%) |

|---|---|

| 2018 | 35.2 |

| 2019 | 37.4 |

| 2020 | 40.1 |

| 2021 | 42.3 |

The table above illustrates the increasing market share of PPO plans over the past few years, indicating their growing preference among consumers. This trend is expected to continue as more individuals and families seek insurance plans that offer flexibility and a wide range of healthcare options.

Conclusion

PPO insurance plans provide a balanced approach to healthcare coverage, offering policyholders the freedom to choose their providers while benefiting from discounted rates and comprehensive benefits. With a wide network of preferred providers and the flexibility to access out-of-network services, PPOs cater to the diverse healthcare needs of individuals and families.

As the healthcare industry continues to evolve, PPO insurance plans are expected to adapt and innovate, ensuring that policyholders have access to the care they need while managing their healthcare costs effectively. Understanding the features and advantages of PPO plans can help individuals make informed decisions when selecting the right insurance coverage for themselves and their loved ones.

Can I switch healthcare providers frequently with a PPO plan?

+Yes, one of the significant advantages of a PPO plan is the flexibility to switch healthcare providers without any restrictions. You can choose different providers for various medical needs without facing penalties or additional costs.

Do I need to pay a deductible with a PPO plan?

+Yes, most PPO plans have a deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. However, the deductible amount can vary depending on your specific plan.

Are there any limitations on the types of specialists I can see with a PPO plan?

+No, PPO plans typically do not restrict the types of specialists you can see. You have the freedom to choose any specialist, whether they are in-network or out-of-network, without the need for referrals.