Average Cost Of Health Insurance For A Family Of 2

Health insurance is an essential aspect of financial planning for families, providing much-needed coverage for medical expenses. The cost of health insurance can vary significantly depending on various factors, including the plan's coverage, the family's location, and the insurance provider. This article aims to delve into the factors influencing the average cost of health insurance for a family of two and offer a comprehensive analysis of the topic.

Understanding the Landscape of Family Health Insurance

Health insurance plans for families typically cover the primary policyholder, their spouse, and any dependent children. The cost of these plans is influenced by several key factors, each of which can significantly impact the overall expense.

Coverage Options and Plan Types

Health insurance plans come in various forms, each offering different levels of coverage. For a family of two, the choice between comprehensive plans and catastrophic plans is a critical decision. Comprehensive plans generally provide more extensive coverage, including preventive care, specialist visits, and prescription medications. On the other hand, catastrophic plans are designed for unexpected, major medical events and typically have higher deductibles and out-of-pocket maximums.

The choice between these plan types can greatly affect the overall cost. Comprehensive plans may offer more peace of mind but come with higher premiums, while catastrophic plans can be more affordable upfront but may leave families vulnerable to higher costs in the event of a serious health issue.

Location-Based Differences

The cost of health insurance is not uniform across the United States. Factors such as the cost of living, the local healthcare market, and state-specific regulations can all influence the price of insurance plans. For instance, states with a higher concentration of healthcare providers and facilities may have higher insurance premiums due to increased competition and demand.

Furthermore, some states offer state-based marketplaces where residents can purchase insurance plans. These marketplaces often provide a wider range of options and potential subsidies, which can make insurance more affordable for families. Understanding the specific regulations and marketplace options in your state is crucial when evaluating health insurance costs.

The Role of Insurance Providers

The insurance provider you choose can also impact the cost of your family’s health insurance. Different providers offer varying levels of coverage and benefits, and their pricing structures can differ significantly. Some providers may specialize in certain types of plans or cater to specific demographics, which can affect the overall cost.

Additionally, the reputation and financial stability of the insurance provider can influence the reliability and consistency of coverage. Families should research and compare providers to find the best fit for their needs and budget.

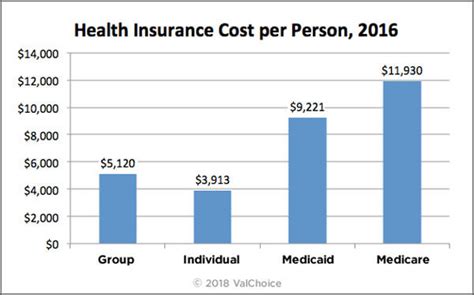

Analyzing Real-World Data: Average Costs for a Family of Two

To gain a clearer understanding of the average cost of health insurance for a family of two, let’s examine some real-world data. The following table presents average annual premiums for various plan types across different regions of the United States.

| Region | Average Annual Premium for Comprehensive Plan | Average Annual Premium for Catastrophic Plan |

|---|---|---|

| Northeast | $18,500 | $6,200 |

| Midwest | $16,800 | $5,800 |

| South | $17,200 | $5,600 |

| West | $19,000 | $6,500 |

These figures highlight the significant variation in costs based on region and plan type. For example, a family in the Northeast considering a comprehensive plan can expect to pay an average of $18,500 annually, while a similar family in the Midwest might pay around $16,800. On the other hand, catastrophic plans offer a more affordable option, with average premiums ranging from $5,600 to $6,500 across different regions.

The Impact of Age and Gender

Another critical factor in determining health insurance costs for a family of two is the age and gender of the primary policyholder and their spouse. Generally, younger individuals tend to pay lower premiums, as they are statistically less likely to require extensive medical care. However, as individuals age, their health insurance costs typically increase.

Additionally, gender can play a role in determining insurance costs. In some states, insurance providers are allowed to consider gender when calculating premiums, as men and women have different statistical health needs. This practice, known as gender rating, can lead to varying costs for male and female policyholders.

Out-of-Pocket Costs and Deductibles

When evaluating health insurance plans, it’s essential to consider not only the premium but also the out-of-pocket costs and deductibles. Out-of-pocket costs include expenses like deductibles, copayments, and coinsurance, which families must pay before their insurance coverage kicks in. These costs can add up quickly, especially for families with significant medical needs.

For instance, a family with a comprehensive plan might have a higher premium but a lower deductible, meaning they’ll pay less out-of-pocket for routine medical expenses. In contrast, a catastrophic plan might have a lower premium but a higher deductible, making it more suitable for families who prioritize lower monthly costs and can afford to pay more in the event of a major health issue.

Strategies for Managing Health Insurance Costs

Understanding the factors that influence health insurance costs is the first step toward making informed decisions. Here are some strategies families can employ to manage and potentially reduce their insurance expenses.

Utilize State-Based Marketplaces

As mentioned earlier, state-based marketplaces can offer a wide range of insurance options and potential subsidies. Families should explore these marketplaces to compare plans and find the best fit for their needs. These platforms often provide tools and resources to help families understand their coverage options and potential costs.

Consider High-Deductible Health Plans (HDHPs)

High-deductible health plans (HDHPs) are a type of insurance plan with higher deductibles and lower premiums. These plans are often paired with health savings accounts (HSAs), which allow individuals to save money pre-tax to pay for medical expenses. While HDHPs may not be suitable for families with immediate and extensive medical needs, they can be a cost-effective option for those who are generally healthy and can afford to save for potential future expenses.

Take Advantage of Employer-Sponsored Plans

If either of the family members is employed, it’s worth exploring the employer-sponsored health insurance options. Many employers offer comprehensive plans with a portion of the premium paid by the employer. This can significantly reduce the out-of-pocket cost for families. Additionally, some employers may offer incentives or subsidies to encourage employees to enroll in certain plans, further reducing the overall cost.

Research and Compare Providers

As previously discussed, the insurance provider can greatly impact the cost and coverage of a family’s health insurance plan. Families should research and compare multiple providers to find the best value. This includes examining the provider’s reputation, financial stability, and the specific benefits and coverage offered by their plans.

Future Implications and Considerations

The landscape of health insurance is constantly evolving, influenced by various factors such as healthcare policy changes, technological advancements, and shifts in the insurance market. Here are some key considerations and potential future implications for families navigating the world of health insurance.

The Impact of Healthcare Policy Changes

Changes in healthcare policy, both at the federal and state levels, can have a significant impact on the cost and availability of health insurance. For example, the implementation of the Affordable Care Act (ACA) brought about substantial changes, including the establishment of state-based marketplaces and the introduction of subsidies to make insurance more affordable. Future policy changes could similarly affect the insurance landscape, potentially impacting the costs and coverage options available to families.

The Rise of Telehealth and Digital Health Solutions

The COVID-19 pandemic has accelerated the adoption of telehealth and digital health solutions, and this trend is likely to continue. These technologies can offer more accessible and cost-effective healthcare options, particularly for routine check-ups and minor health concerns. Families can benefit from exploring these digital health solutions to manage their healthcare needs and potentially reduce their reliance on in-person medical visits, which can be more costly.

The Importance of Staying Informed

Given the dynamic nature of the healthcare industry, it’s crucial for families to stay informed about changes in insurance plans, coverage options, and potential cost-saving strategies. This includes keeping up with policy changes, exploring new technologies, and regularly reviewing their insurance plans to ensure they remain suitable for the family’s evolving needs and financial situation.

The Role of Preventive Care

Preventive care plays a vital role in maintaining good health and managing healthcare costs. By prioritizing regular check-ups, screenings, and vaccinations, families can potentially avoid more costly medical issues down the line. Many insurance plans, particularly comprehensive plans, cover preventive care services at no additional cost, making it a cost-effective strategy for maintaining overall health and well-being.

Conclusion

Navigating the world of health insurance can be complex, but with a thorough understanding of the factors that influence costs and the strategies available to manage those costs, families can make informed decisions to secure the best coverage for their needs. By staying informed, exploring various options, and leveraging the resources available, families can ensure they have the necessary protection while managing their financial responsibilities.

How often should I review my health insurance plan?

+It’s recommended to review your health insurance plan annually, especially during open enrollment periods. This allows you to assess if your current plan still meets your needs and explore any new options or changes in coverage.

Can I switch health insurance providers mid-year?

+In most cases, you can switch health insurance providers outside of the open enrollment period if you experience a qualifying life event, such as getting married, having a baby, or losing other health coverage. Check with your current provider and potential new providers to understand your options.

What is the difference between an HMO and a PPO plan?

+An HMO (Health Maintenance Organization) plan typically requires you to choose a primary care physician and obtain referrals for specialist care. HMO plans often have lower out-of-pocket costs but may have more limited provider networks. On the other hand, a PPO (Preferred Provider Organization) plan offers more flexibility, allowing you to see any provider without a referral, but it may come with higher out-of-pocket costs.