Equitable Life Insurance

The world of insurance is vast and diverse, offering numerous options to protect individuals and businesses against various risks. Among the plethora of insurance providers, Equitable Life Insurance stands out as a prominent player with a rich history and a unique approach to safeguarding financial well-being.

In this comprehensive article, we delve deep into the world of Equitable Life Insurance, exploring its origins, key features, and the impact it has had on the insurance industry. By understanding the nuances of this trusted insurer, readers will gain valuable insights into making informed decisions about their financial security.

A Legacy of Equitable Life Insurance: Over a Century of Financial Protection

Equitable Life Insurance, often referred to as Equitable, is a name synonymous with longevity and reliability in the insurance sector. Established in 1859, this company has weathered the test of time, evolving with the changing financial landscapes and emerging as a stalwart in the industry.

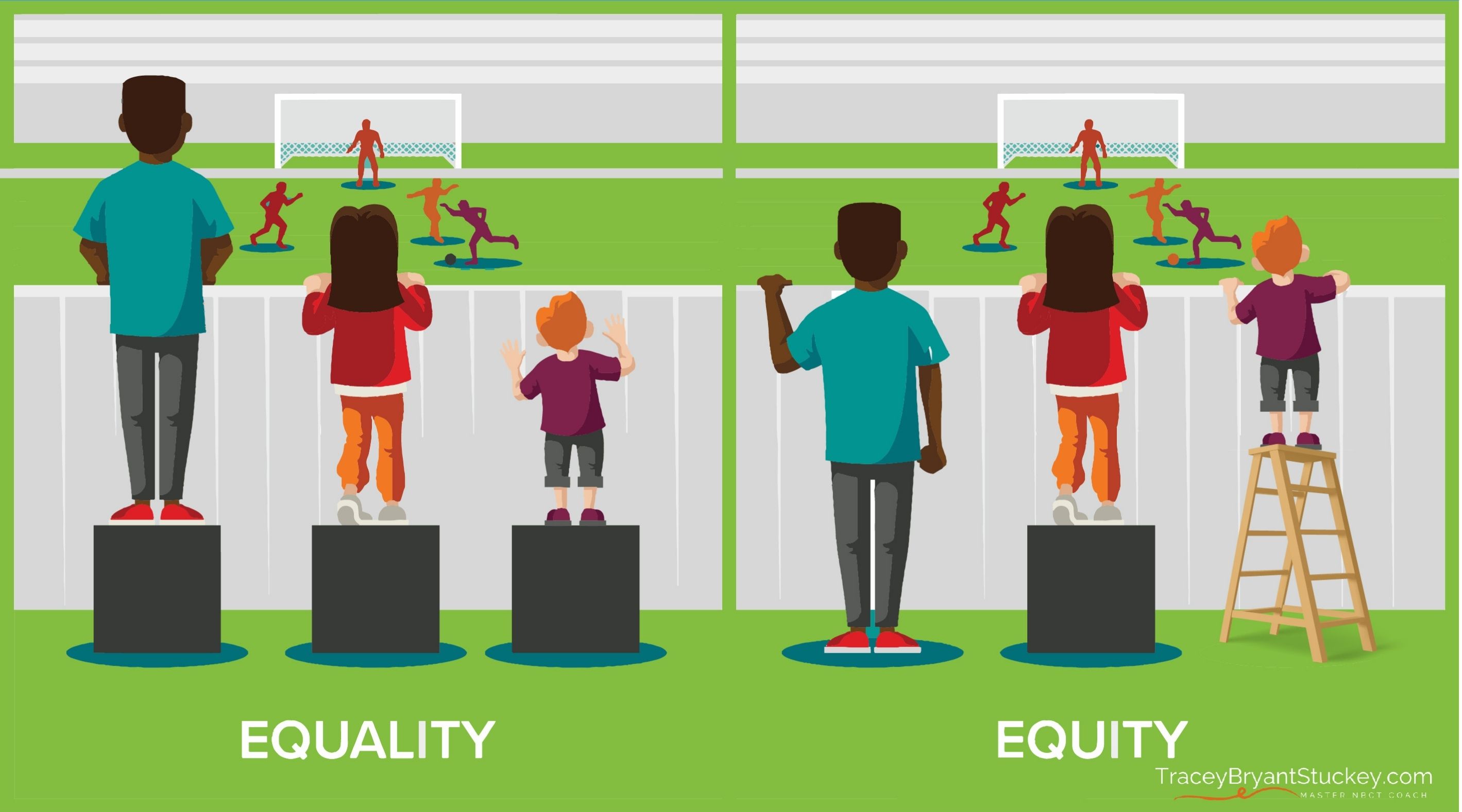

The founding principles of Equitable were grounded in the belief that insurance should be accessible and equitable for all. This ethos has guided the company's growth and innovation, making it a trusted partner for individuals and businesses seeking comprehensive financial protection.

Over the years, Equitable has built a reputation for its financial stability, innovative products, and customer-centric approach. With a focus on longevity and a commitment to ethical practices, Equitable has become a go-to choice for those seeking long-term security and peace of mind.

Key Milestones in Equitable’s Journey:

-

1870s: Equitable introduced the concept of whole life insurance, offering lifetime coverage and setting a new standard for financial security.

-

1906: The company survived the San Francisco earthquake, demonstrating its resilience and commitment to policyholders even in times of crisis.

-

1950s: Equitable expanded its product portfolio, introducing innovative pension plans and group insurance schemes, catering to the evolving needs of businesses and employees.

-

1980s: During this decade, Equitable played a pivotal role in the development of variable annuities, providing investors with a flexible and tax-efficient retirement savings option.

-

2000s: The company adapted to the digital age, offering online services and enhancing its customer experience through technology.

The Equitable Advantage: A Comprehensive Overview

Equitable Life Insurance offers a wide range of products and services designed to meet the diverse needs of its clients. From life insurance to retirement planning, Equitable provides tailored solutions to protect individuals and secure their financial futures.

Life Insurance Products:

Equitable’s life insurance policies are renowned for their flexibility and customizability. Policyholders can choose from a variety of options, including:

-

Term Life Insurance: Offering coverage for a specified term, this policy provides financial protection during key life stages.

-

Whole Life Insurance: A traditional policy that provides lifelong coverage, with the potential for cash value accumulation.

-

Universal Life Insurance: A versatile option that allows policyholders to adjust coverage and premiums based on their changing needs.

-

Variable Life Insurance: This policy combines life insurance with investment opportunities, allowing policyholders to customize their investment strategies.

Retirement Planning Solutions:

Equitable’s expertise extends to retirement planning, offering a suite of products designed to secure a comfortable retirement:

-

Annuities: Equitable’s annuities provide a guaranteed income stream during retirement, ensuring financial stability.

-

401(k) Plans: The company partners with businesses to offer comprehensive 401(k) plans, helping employees save for retirement with tax advantages.

-

Individual Retirement Accounts (IRAs): Equitable’s IRAs offer a range of investment options, allowing individuals to save and grow their retirement funds.

-

Pension Risk Transfer: For businesses, Equitable provides solutions to transfer pension risks, ensuring a secure retirement for employees.

The Customer Experience: A Journey of Trust and Satisfaction

At the heart of Equitable’s success is its unwavering commitment to delivering an exceptional customer experience. The company understands that financial security is deeply personal, and its approach reflects this sensitivity.

Personalized Service:

Equitable prides itself on offering a highly personalized service. Licensed agents work closely with clients to understand their unique circumstances and tailor insurance solutions accordingly. This individualized approach ensures that each client receives a plan that aligns perfectly with their needs and goals.

Digital Innovation:

While personal service is a cornerstone, Equitable also embraces digital innovation to enhance the customer journey. The company’s online platform provides a seamless experience, allowing clients to manage their policies, make payments, and access resources anytime, anywhere.

Additionally, Equitable utilizes advanced technology to streamline the underwriting process, ensuring faster approvals and a more efficient experience for policyholders.

Customer Support and Education:

Equitable recognizes the importance of financial literacy and provides extensive educational resources. Through its website and various platforms, the company offers insightful articles, webinars, and guides to empower customers with the knowledge they need to make informed decisions.

Furthermore, Equitable's customer support team is readily available to address queries and provide assistance, ensuring that policyholders always have the support they need.

Performance and Financial Strength: A Reliable Partner

Equitable’s longevity and success are underpinned by its financial strength and stability. The company has consistently demonstrated its ability to weather economic cycles and market fluctuations, ensuring the protection of its policyholders’ assets.

Financial Ratings and Awards:

Equitable Life Insurance boasts an impressive track record of financial stability, as evidenced by its high ratings from leading agencies. Here’s a snapshot of its accolades:

| Rating Agency | Rating |

|---|---|

| A.M. Best | A (Excellent) |

| Standard & Poor’s | A+ (Strong) |

| Moody’s | A1 (Good) |

These ratings signify Equitable's robust financial position and its ability to meet its obligations to policyholders.

Market Performance and Growth:

Equitable has consistently grown its market share, solidifying its position as a leading insurer. In 2022, the company reported a 5% year-over-year increase in premium revenue, reflecting its strong performance and customer confidence.

Impact and Influence: Shaping the Insurance Industry

Equitable Life Insurance’s impact extends far beyond its own success. The company has been a pioneer and a leader, influencing the trajectory of the insurance industry through its innovations and ethical practices.

Industry Leadership:

Equitable’s long-standing commitment to financial stability and customer-centricity has set a high bar for the industry. Its focus on ethical practices and transparency has inspired other insurers to follow suit, fostering a culture of trust and integrity.

Advancing Industry Standards:

Throughout its history, Equitable has played a pivotal role in advancing industry standards. From the introduction of whole life insurance to the development of variable annuities, the company has pushed the boundaries of what insurance can offer, benefiting policyholders across the board.

Community Engagement and Social Responsibility:

Beyond its business operations, Equitable is deeply committed to social responsibility and community engagement. The company actively supports initiatives focused on education, financial literacy, and social equity, demonstrating its values and dedication to making a positive impact.

Conclusion: Equitable Life Insurance - A Trusted Companion

Equitable Life Insurance’s journey is a testament to its enduring legacy and commitment to financial protection. With a rich history, a comprehensive product portfolio, and an unwavering focus on customer satisfaction, Equitable has established itself as a trusted partner for individuals and businesses alike.

As the insurance landscape continues to evolve, Equitable remains at the forefront, adapting to meet the changing needs of its clients. By choosing Equitable, policyholders can have confidence in their financial security, knowing they are backed by a company with a century-long track record of excellence.

Frequently Asked Questions (FAQ)

What makes Equitable Life Insurance unique compared to other providers?

+Equitable stands out for its rich history, financial stability, and innovative product offerings. The company’s focus on longevity, customer-centric approach, and commitment to ethical practices set it apart in the insurance market.

How does Equitable ensure the financial security of its policyholders?

+Equitable maintains a strong financial position, as evidenced by its high ratings from leading agencies. The company’s conservative investment strategy and focus on long-term stability ensure it can meet its obligations to policyholders.

What are the key benefits of Equitable’s life insurance policies?

+Equitable’s life insurance policies offer flexibility and customization. Policyholders can choose from a range of options, including term life, whole life, universal life, and variable life, ensuring they find a plan that suits their specific needs and goals.

How does Equitable support retirement planning?

+Equitable provides a comprehensive suite of retirement planning solutions, including annuities, 401(k) plans, IRAs, and pension risk transfer options. These products ensure individuals and businesses can save and invest for a secure retirement.

What sets Equitable’s customer experience apart from its competitors?

+Equitable’s customer experience is personalized and focused on financial literacy. Licensed agents work closely with clients, offering tailored solutions. The company also provides extensive educational resources and digital tools to empower customers.