Insurance Nyc

In the bustling metropolis of New York City, insurance plays a vital role in protecting residents, businesses, and properties from various risks and uncertainties. From natural disasters to healthcare needs, insurance policies provide a crucial safety net for individuals and organizations alike. In this comprehensive guide, we will delve into the world of insurance in NYC, exploring its unique aspects, key considerations, and the impact it has on the lives of New Yorkers.

Understanding the NYC Insurance Landscape

New York City, with its diverse population and dynamic economy, presents a unique insurance landscape. The city’s high population density, extreme weather conditions, and complex infrastructure contribute to a range of insurance needs. Let’s explore some of the key aspects of insurance in the Big Apple.

Diverse Insurance Options

NYC offers a wide array of insurance products to cater to its diverse population. Whether it’s homeowners’ insurance, auto insurance, life insurance, or health insurance, residents have access to a multitude of options. The competitive market ensures that New Yorkers can find policies that suit their specific needs and budgets.

| Insurance Type | Coverage Highlights |

|---|---|

| Homeowners' Insurance | Covers damages to property, theft, and liability claims. Includes additional coverage for floods and earthquakes. |

| Auto Insurance | Offers liability, collision, and comprehensive coverage. Includes provisions for ridesharing services like Uber and Lyft. |

| Life Insurance | Provides financial protection for beneficiaries in case of the policyholder's death. Includes term life and whole life policies. |

| Health Insurance | Covers medical expenses, prescription drugs, and preventive care. Includes plans for individuals, families, and small businesses. |

Unique Challenges and Considerations

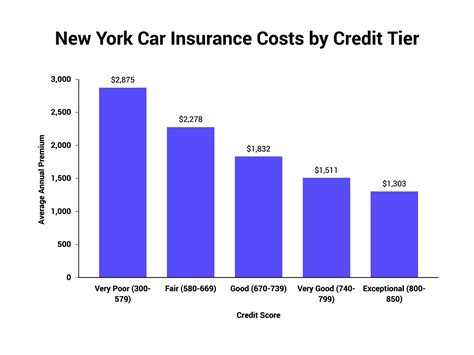

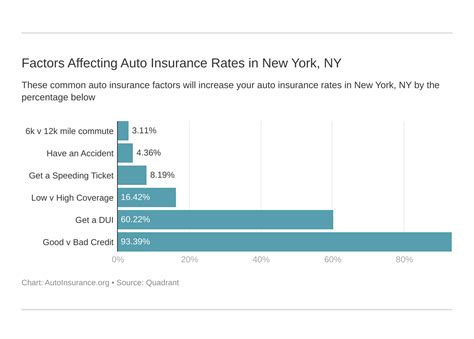

The NYC insurance market faces several unique challenges. One of the primary concerns is the high cost of living, which often translates to higher insurance premiums. Additionally, the city’s dense population and limited space can impact insurance rates, as the risk of accidents and claims is generally higher.

Another factor to consider is the city's exposure to natural disasters, such as hurricanes, floods, and extreme weather events. Insurance policies in NYC often include provisions for these risks, but it's essential for residents to understand their coverage and take necessary precautions.

Furthermore, the complex transportation network of NYC, including its extensive subway system and busy streets, poses unique challenges for auto insurance. Policyholders should ensure they have adequate coverage for accidents and consider the city's specific traffic regulations.

Navigating Insurance Options in NYC

With a vast array of insurance providers and policies available, navigating the NYC insurance market can be daunting. Here are some key considerations to help you make informed decisions.

Assessing Your Insurance Needs

The first step in choosing the right insurance is understanding your specific needs. Consider the following factors:

- Do you own a home or rent? If you're a homeowner, prioritize homeowners' insurance to protect your property and belongings.

- What type of vehicle do you drive? Evaluate your auto insurance needs based on your vehicle type, usage, and any additional coverage required for ridesharing.

- Do you have dependents or financial obligations? Consider the importance of life insurance to provide financial security for your loved ones.

- What are your healthcare needs? Evaluate health insurance options based on your medical requirements, prescription needs, and preferred healthcare providers.

Comparing Insurance Providers

Once you’ve assessed your needs, it’s time to compare insurance providers. NYC is home to numerous reputable insurance companies, each offering unique policies and pricing structures. Consider the following factors when making your choice:

- Coverage and Deductibles: Ensure the policy covers all your essential needs and offers reasonable deductibles.

- Reputation and Financial Stability: Research the insurer's reputation and financial health to ensure they can provide long-term coverage.

- Customer Service and Claims Handling: Look for providers with a strong track record of prompt and efficient claims processing.

- Discounts and Additional Benefits: Explore providers that offer discounts for multiple policies, safe driving, or other relevant factors.

Seeking Professional Advice

Given the complexity of the NYC insurance market, seeking professional advice can be beneficial. Insurance brokers and agents can provide personalized recommendations based on your specific circumstances. They can also guide you through the process of obtaining quotes, understanding policy terms, and making informed decisions.

Insurance Trends and Innovations in NYC

The insurance industry in NYC is continuously evolving, driven by technological advancements and changing consumer needs. Here are some key trends and innovations shaping the future of insurance in the city.

Digitalization and Online Platforms

The rise of digital technology has revolutionized the insurance industry, and NYC is at the forefront of this transformation. Online platforms and mobile apps have made it easier for New Yorkers to compare policies, obtain quotes, and manage their insurance portfolios.

Insurance companies are investing in digital infrastructure to enhance customer experiences, streamline claims processes, and offer personalized coverage options. From digital claims submission to real-time policy updates, the digitalization of insurance is making it more accessible and efficient for NYC residents.

Data-Driven Insurance Models

Advancements in data analytics and machine learning are shaping the future of insurance. NYC insurers are leveraging big data to develop more accurate risk assessment models and offer tailored coverage options. By analyzing vast amounts of data, insurers can identify patterns, predict risks, and provide more precise pricing for policies.

For example, data-driven models can help insurers better understand the risk of natural disasters in specific areas of NYC, allowing for more accurate coverage and pricing. This innovation ensures that policyholders receive fair and appropriate coverage based on their unique circumstances.

Insurtech Startups and Disruption

The emergence of Insurtech startups is disrupting the traditional insurance landscape in NYC. These innovative companies are challenging the status quo by offering tech-driven solutions, such as peer-to-peer insurance, usage-based coverage, and on-demand policies.

Insurtech startups often leverage blockchain technology and artificial intelligence to provide transparent and efficient insurance services. They are attracting a new generation of consumers who value convenience, customization, and digital-first experiences. As a result, traditional insurers in NYC are also embracing these technologies to stay competitive.

Conclusion: The Future of Insurance in NYC

Insurance in NYC is a dynamic and evolving landscape, shaped by the city’s unique challenges and opportunities. From diverse insurance options to technological innovations, New Yorkers have access to a wide range of coverage choices to protect their assets, health, and livelihoods.

As the insurance industry continues to embrace digitalization, data-driven models, and disruptive startups, the future of insurance in NYC looks promising. Residents can expect more personalized, efficient, and accessible insurance solutions tailored to their specific needs. By staying informed and proactive, New Yorkers can navigate the insurance market with confidence and peace of mind.

How do I find the best insurance rates in NYC?

+To find the best insurance rates in NYC, compare quotes from multiple providers. Use online platforms and insurance brokers to get a comprehensive view of the market. Consider factors like coverage, deductibles, and customer service when making your decision.

Are there any discounts available for NYC insurance policies?

+Yes, many insurance providers offer discounts for various reasons. Common discounts include multiple policy discounts, safe driving records, loyalty programs, and discounts for specific occupations or memberships. It’s worth inquiring about available discounts when obtaining quotes.

What should I do if I have a claim in NYC?

+If you need to file a claim, contact your insurance provider promptly. Provide all the necessary details and documentation, and follow their claims process. Be prepared to cooperate with any investigations and provide additional information as required. It’s important to keep records of all communications and claim-related expenses.