Best Medicare Supplemental Insurance Plans

Medicare Supplemental Insurance, also known as Medigap, plays a crucial role in filling the gaps left by original Medicare plans. With various options available, choosing the best Medigap plan can be a complex decision. This article aims to provide an in-depth analysis of the top Medicare Supplemental Insurance plans, offering a comprehensive guide to help you make an informed choice.

Understanding Medicare Supplemental Insurance Plans

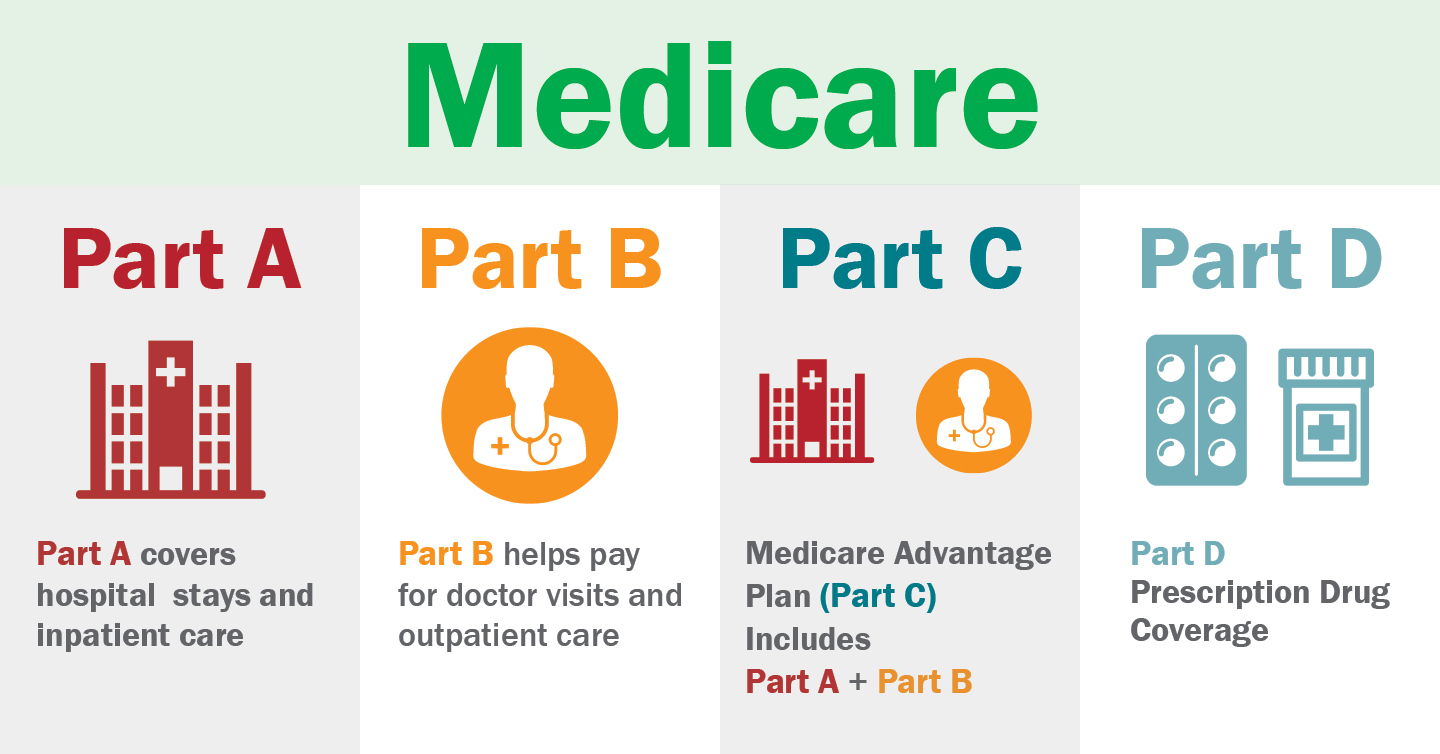

Medicare Supplemental Insurance, or Medigap, is designed to cover the out-of-pocket costs that original Medicare plans (Parts A and B) may not cover. These costs include deductibles, coinsurance, and copayments. Medigap plans are standardized, meaning that each plan type (labeled A through N) offers the same benefits regardless of the insurance company providing it. However, the cost and specific features can vary between providers.

Medicare Supplemental Insurance plans are an essential part of retirement planning, offering financial protection and peace of mind for seniors. With the right plan, you can significantly reduce your healthcare expenses and gain access to a wider range of medical services.

Standardized Benefits of Medigap Plans

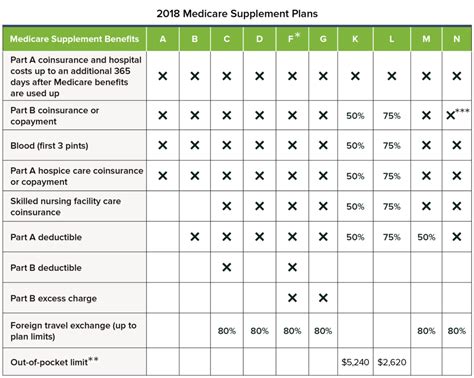

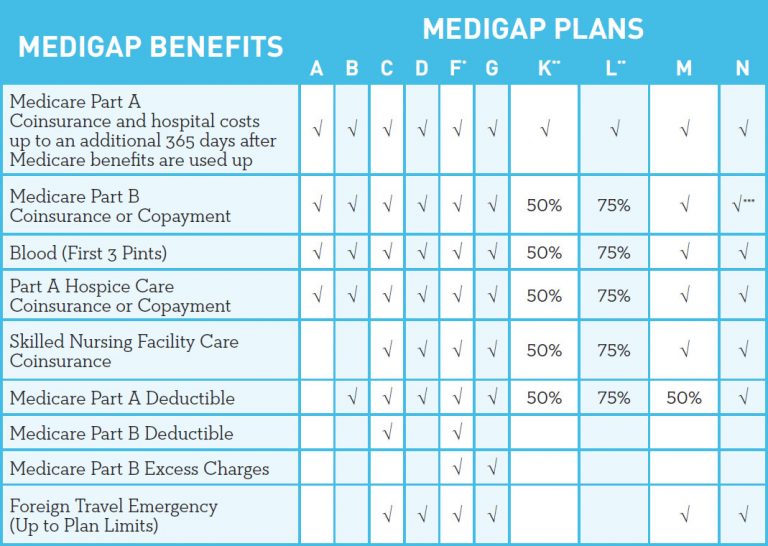

Each Medigap plan is designated by a letter (A through N) and offers a specific set of benefits. These plans are standardized, ensuring that Plan A from one insurance company provides the same coverage as Plan A from another company. The key differences between plans lie in their coverage and cost.

| Plan | Benefits |

|---|---|

| Plan A | Basic coverage for deductibles, coinsurance, and blood. |

| Plan B | Includes all benefits of Plan A plus coverage for Part A hospice care coinsurance. |

| Plan C | Offers more comprehensive coverage, including benefits of Plans A and B, and additional coverage for Part B excess charges. |

| Plan D | Provides similar coverage to Plan C, but with the added benefit of covering the Part B deductible. |

| Plan F | Known as the most comprehensive plan, it covers all Medicare Part A and B deductibles, coinsurance, and copayments, as well as the Part B excess charges. |

| Plan G | Very similar to Plan F, but it does not cover the Part B deductible. This plan is a good alternative for those who do not qualify for Plan F. |

| Plan N | A cost-effective option, covering the same benefits as Plan F except for Part B excess charges and some copayments. |

It's important to note that not all insurance companies offer all Medigap plan types, and some plans may be unavailable in certain states. Additionally, Medigap plans do not cover prescription drugs, so you may need to enroll in a separate Medicare Part D plan for drug coverage.

Top Medicare Supplemental Insurance Plans

When it comes to choosing the best Medigap plan, several factors come into play, including your specific healthcare needs, budget, and the level of coverage you desire. Here's an in-depth look at some of the top Medicare Supplemental Insurance plans currently available.

Plan F: The Comprehensive Choice

Plan F is often considered the most comprehensive Medigap plan available. It covers all Medicare Part A and B deductibles, coinsurance, and copayments, as well as the Part B excess charges. This plan provides the most extensive coverage, making it an excellent choice for those who want maximum protection against unexpected healthcare costs.

With Plan F, you won't have to worry about paying for any additional costs associated with your Medicare coverage. This plan is ideal for individuals with high medical needs or those who prefer to have all their healthcare expenses covered.

However, it's important to note that Plan F will be discontinued for new Medicare beneficiaries as of January 1, 2020. If you're eligible for Medicare before this date, you may still be able to enroll in Plan F. Otherwise, Plan G or N could be suitable alternatives.

Plan G: The Comprehensive Alternative

Plan G is very similar to Plan F, offering the same extensive coverage except for the Part B deductible. This plan covers all Medicare Part A and B deductibles, coinsurance, and copayments, as well as the Part B excess charges. Plan G is a great option for those who desire comprehensive coverage but don't qualify for Plan F.

While Plan G doesn't cover the Part B deductible, it still provides excellent protection against unexpected medical expenses. This plan is a popular choice for many Medicare beneficiaries, as it strikes a balance between comprehensive coverage and cost-effectiveness.

Plan N: The Cost-Effective Option

Plan N is designed for those seeking a more cost-effective Medigap plan without compromising on essential coverage. This plan covers all Medicare Part A and B deductibles, coinsurance, and copayments, except for Part B excess charges and some copayments. Plan N is a good choice for individuals who prioritize cost savings while still wanting reliable coverage.

With Plan N, you may have to pay small copayments for certain services, such as office visits or emergency room visits. However, these copayments are typically minimal compared to the overall cost savings of this plan. Plan N is an excellent option for those who are generally healthy and don't anticipate frequent use of medical services.

Plan C: The Flexible Alternative

Plan C offers more flexibility than other Medigap plans. It covers all benefits of Plans A and B, as well as additional coverage for Part B excess charges. This plan is ideal for those who want a comprehensive plan but also want the option to pay for certain services out-of-pocket.

Plan C provides excellent coverage for hospital stays, doctor visits, and other medical services. However, it's important to note that Plan C will also be discontinued for new Medicare beneficiaries as of January 1, 2020. If you're eligible for Medicare before this date, you may still be able to enroll in Plan C.

Plan D: The Balance of Coverage and Cost

Plan D is a popular choice for those seeking a balance between coverage and cost. This plan includes all the benefits of Plan C, but it also covers the Part B deductible. Plan D is an excellent option for those who want comprehensive coverage without the higher premiums of Plan F or G.

With Plan D, you'll have peace of mind knowing that your Medicare deductibles and coinsurance are covered, while also enjoying the flexibility to pay for certain services out-of-pocket.

Plan K and L: The High-Deductible Options

Plan K and L are unique Medigap plans with high deductibles. These plans cover a portion of your Medicare Part A and B deductibles, coinsurance, and copayments. The key difference between these plans is the amount they cover: Plan K covers 50% of these costs, while Plan L covers 75%.

These plans are designed for those who are generally healthy and don't anticipate frequent use of medical services. By choosing Plan K or L, you can significantly reduce your monthly premiums, but you'll have to pay a higher deductible when you need medical care. These plans are a great option for those who want to save on premiums but are prepared to pay more out-of-pocket when necessary.

Plan M: The Basic Coverage Option

Plan M is a basic Medigap plan that covers most of the Medicare Part A and B deductibles, coinsurance, and copayments. This plan is a good choice for those who are generally healthy and want to keep their monthly premiums low. Plan M covers a significant portion of your healthcare costs, but you'll still have to pay for certain services out-of-pocket.

With Plan M, you may have to pay for the Part B deductible and some copayments. However, this plan can be an affordable option for those who prioritize cost savings and don't anticipate frequent medical needs.

Choosing the Right Medicare Supplemental Insurance Plan

Selecting the best Medicare Supplemental Insurance plan depends on various factors, including your healthcare needs, budget, and personal preferences. Here are some key considerations to help you make an informed decision.

Assess Your Healthcare Needs

Start by evaluating your current and potential future healthcare needs. Consider factors such as your age, overall health, and any pre-existing conditions. If you have complex medical needs or anticipate frequent use of medical services, a more comprehensive plan like Plan F or G might be the best fit. On the other hand, if you're generally healthy and want to save on premiums, a plan like Plan N or K could be a suitable choice.

Consider Your Budget

Medigap plans come with varying monthly premiums, and it's essential to choose a plan that fits within your budget. While comprehensive plans like Plan F or G offer extensive coverage, they may come with higher premiums. On the other hand, plans like Plan N or K offer cost savings but require you to pay more out-of-pocket when you need medical care.

Evaluate your financial situation and determine how much you can comfortably afford for monthly premiums. Remember that your budget should also account for potential out-of-pocket expenses, especially if you choose a plan with a high deductible.

Compare Plans and Providers

It's crucial to compare different Medigap plans and insurance providers to find the best fit for your needs. Each insurance company may offer slightly different pricing and additional benefits, so it's worth shopping around. Consider factors such as the company's reputation, customer service, and financial stability when making your decision.

Additionally, don't forget to compare the specific benefits of each plan. While the basic coverage remains the same for each plan type, some insurance companies may offer additional perks or discounts. These extra benefits can make a significant difference in your overall healthcare experience.

Enroll During the Open Enrollment Period

Medicare has a specific open enrollment period for Medigap plans, which typically begins on the first day of the month you turn 65 and are enrolled in Medicare Part B. During this period, you have guaranteed issue rights, meaning you can't be turned down for coverage or charged a higher premium based on your health status. It's essential to enroll during this time to ensure you get the best plan for your needs.

If you miss the open enrollment period, you may still be able to enroll in a Medigap plan, but you may face medical underwriting. This means the insurance company can review your health history and charge you a higher premium or deny you coverage altogether.

Review and Update Your Plan Regularly

Your healthcare needs and financial situation may change over time. It's important to review your Medigap plan annually to ensure it still meets your needs. If your circumstances have changed, you may want to consider switching to a different plan or provider.

Additionally, keep an eye on any changes in Medicare policies or Medigap plan offerings. Medicare may make adjustments to its plans or introduce new options, which could impact your coverage and costs. Staying informed can help you make the best decisions for your healthcare and financial well-being.

FAQs about Medicare Supplemental Insurance Plans

Can I change my Medigap plan after the open enrollment period?

+Yes, you can change your Medigap plan after the open enrollment period, but you may face medical underwriting. This means the insurance company can review your health history and potentially charge you a higher premium or deny you coverage.

Do Medigap plans cover prescription drugs?

+No, Medigap plans do not cover prescription drugs. If you need prescription drug coverage, you'll need to enroll in a separate Medicare Part D plan.

Can I have both a Medigap plan and a Medicare Advantage plan?

+No, you cannot have both a Medigap plan and a Medicare Advantage plan at the same time. Medigap plans are designed to work with original Medicare (Parts A and B), while Medicare Advantage plans are an alternative to original Medicare.

What happens if I move to a different state?

+If you move to a different state, your Medigap plan may still be valid, but you should check with your insurance company to confirm. Some plans may have limitations on out-of-state coverage, so it's important to review your policy before making the move.

Are there any discounts or savings available for Medigap plans?

+Some insurance companies offer discounts or savings on Medigap plans, such as group discounts or loyalty discounts. It's worth shopping around and comparing different providers to find the best deal.

Choosing the best Medicare Supplemental Insurance plan is a crucial decision that can significantly impact your healthcare and financial well-being. By understanding the various Medigap plan options and considering your specific needs and budget, you can make an informed choice. Remember to review and update your plan regularly to ensure it continues to meet your changing healthcare requirements.