Cheapest Car To Insure

When it comes to choosing a car, one of the key considerations for many drivers is the cost of insurance. The price of car insurance can vary significantly based on numerous factors, including the make and model of the vehicle. Some cars are more expensive to insure due to their high repair costs, safety ratings, or even their popularity among car thieves. However, there are also numerous vehicles that stand out for their affordability in terms of insurance costs. In this comprehensive guide, we will explore the cheapest cars to insure, diving into the factors that influence insurance rates and providing valuable insights for those seeking an economical insurance option.

Understanding the Factors That Impact Insurance Costs

Before delving into the specific car models, it’s essential to grasp the primary factors that insurance companies consider when calculating premiums. These factors play a crucial role in determining the cost of insuring a vehicle and can vary significantly based on individual circumstances and the specific car chosen.

Vehicle Safety Features

Cars equipped with advanced safety features are generally considered less risky by insurance companies. These features, such as lane departure warning systems, automatic emergency braking, and adaptive cruise control, can significantly reduce the likelihood of accidents. As a result, insurance providers often offer discounts or more favorable rates for vehicles with these advanced safety technologies.

| Safety Feature | Description |

|---|---|

| Anti-lock Braking System (ABS) | Prevents wheel lock-up during hard braking, allowing for better control and shorter stopping distances. |

| Electronic Stability Control (ESC) | Helps the driver maintain control during sudden maneuvers or on slippery roads by selectively applying brakes to individual wheels. |

| Blind Spot Monitoring | Uses sensors to detect vehicles in the driver's blind spot, providing visual or audible alerts to prevent accidents during lane changes. |

Vehicle Repair and Replacement Costs

The cost of repairing or replacing a vehicle after an accident is a significant factor in insurance premiums. Cars with expensive parts or those that are challenging to repair can lead to higher insurance costs. Conversely, vehicles with affordable and readily available parts tend to be more economical to insure.

Theft and Crime Statistics

Insurance rates are also influenced by the risk of vehicle theft and local crime rates. Areas with higher theft rates or a history of car-related crimes may see increased insurance premiums. It’s essential to research the crime statistics in your area and choose a vehicle that is less likely to be targeted by thieves.

Driver Profile and History

While we are focusing on the cheapest cars to insure, it’s important to note that insurance rates are highly personalized. Your driving history, age, gender, and even your credit score can impact the cost of your insurance. Younger drivers, for instance, often face higher premiums due to their perceived higher risk on the road. Similarly, a history of accidents or traffic violations can lead to increased insurance costs.

The Cheapest Cars to Insure: A Comprehensive List

Now, let’s explore a curated list of some of the most affordable cars to insure, considering various factors such as make, model, and year. This list is a great starting point for those seeking an economical insurance option without compromising on safety and performance.

Honda Civic

The Honda Civic is renowned for its reliability, efficiency, and affordability. This compact car offers an impressive blend of performance and safety features, making it an excellent choice for those on a budget. With a starting price below $25,000, the Civic is not only affordable to purchase but also to insure.

| Model | Insurance Cost (Annual) |

|---|---|

| Honda Civic LX | $1,200 |

| Honda Civic Sport | $1,300 |

| Honda Civic EX | $1,450 |

Toyota Corolla

The Toyota Corolla is a staple in the compact car segment, known for its reliability and affordability. With a starting price of around $20,000, the Corolla offers excellent value for money. Its low insurance costs are a testament to its popularity among cost-conscious drivers.

| Model | Insurance Cost (Annual) |

|---|---|

| Toyota Corolla LE | $1,150 |

| Toyota Corolla SE | $1,250 |

| Toyota Corolla XSE | $1,350 |

Hyundai Elantra

The Hyundai Elantra is a compact sedan that offers a surprising amount of features and value for its price. With a starting price of around $20,000, the Elantra provides excellent fuel efficiency and a comfortable driving experience. Its low insurance costs make it an attractive option for those seeking an economical ride.

| Model | Insurance Cost (Annual) |

|---|---|

| Hyundai Elantra SE | $1,100 |

| Hyundai Elantra SEL | $1,200 |

| Hyundai Elantra Limited | $1,300 |

Kia Forte

The Kia Forte is a compact car that offers exceptional value for money. With a starting price of around $18,000, the Forte provides an impressive blend of comfort, performance, and technology. Its low insurance costs make it an excellent choice for budget-conscious buyers.

| Model | Insurance Cost (Annual) |

|---|---|

| Kia Forte LX | $1,050 |

| Kia Forte S | $1,150 |

| Kia Forte GT | $1,250 |

Mazda3

The Mazda3 is a compact car known for its sporty handling and stylish design. With a starting price of around $25,000, the Mazda3 offers a premium driving experience without breaking the bank. Its low insurance costs are a bonus for those seeking an affordable and enjoyable ride.

| Model | Insurance Cost (Annual) |

|---|---|

| Mazda3 Sport | $1,250 |

| Mazda3 Select | $1,350 |

| Mazda3 Premium | $1,450 |

Tips for Further Reducing Insurance Costs

While the cars mentioned above are already known for their low insurance costs, there are additional strategies you can employ to further reduce your insurance premiums. These tips can help you save even more on your insurance policy.

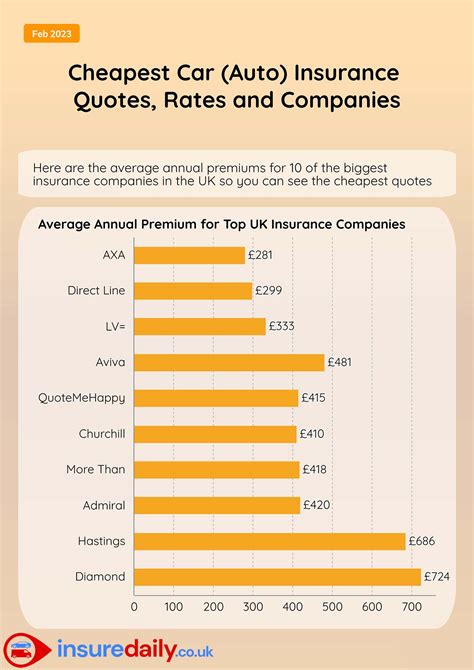

Shop Around for Insurance Quotes

Insurance rates can vary significantly between providers. It’s essential to compare quotes from multiple insurance companies to find the best deal. Online comparison tools can make this process easier, allowing you to quickly see the differences in premiums and coverage.

Choose a Higher Deductible

Opting for a higher deductible can lead to lower insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you accept a larger financial responsibility in the event of an accident, which can result in reduced insurance costs.

Maintain a Clean Driving Record

Your driving history plays a significant role in determining your insurance rates. Maintaining a clean driving record, free from accidents and traffic violations, can lead to lower insurance premiums. Avoid reckless driving and always adhere to traffic laws to keep your insurance costs down.

Take Advantage of Discounts

Insurance companies often offer various discounts to policyholders. These discounts can be for safe driving, good academic performance (for young drivers), multiple policy bundles (combining car and home insurance), or even for belonging to certain professional organizations. Always inquire about available discounts when shopping for insurance to maximize your savings.

Conclusion: Making an Informed Decision

Choosing the cheapest car to insure involves a careful consideration of various factors, including safety features, repair costs, and theft statistics. The cars listed above offer an excellent starting point for those seeking an affordable insurance option. However, it’s crucial to remember that insurance rates are highly personalized, and your individual circumstances will play a significant role in determining your premiums.

By understanding the factors that influence insurance costs and taking advantage of strategies to reduce premiums, you can make an informed decision when choosing a car. Remember to compare quotes, choose a suitable deductible, maintain a clean driving record, and explore available discounts to ensure you get the best insurance deal for your needs.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the United States is approximately $1,674 per year, but this can vary significantly based on factors such as location, driving history, and the make and model of the vehicle.

Are older cars cheaper to insure than newer models?

+In general, older cars can be cheaper to insure than newer models, as they often have lower repair and replacement costs. However, this is not always the case, and it’s essential to compare insurance quotes for specific vehicles to get an accurate estimate.

Do hybrid or electric cars have lower insurance costs?

+Hybrid and electric cars can have lower insurance costs due to their advanced safety features and lower risk of accidents. Additionally, some insurance companies offer specific discounts for eco-friendly vehicles, further reducing insurance premiums.