Life Insurance Policy Prices

Understanding the intricacies of life insurance policies and their associated costs is crucial for anyone seeking financial protection for their loved ones. The world of life insurance is diverse, with various policy types, coverage options, and pricing structures. This comprehensive guide aims to demystify the factors that influence life insurance policy prices, providing a detailed analysis to help individuals make informed decisions.

The Landscape of Life Insurance Policies

Life insurance is a cornerstone of financial planning, offering a safety net for families and individuals. With a wide array of policies available, from term life to whole life insurance, the market caters to diverse needs. Term life insurance provides coverage for a specific period, typically offering more affordable premiums. On the other hand, whole life insurance offers lifelong coverage and builds cash value over time, appealing to those seeking long-term financial security.

Factors Influencing Policy Prices

The cost of a life insurance policy is influenced by a multitude of factors, each playing a unique role in determining the final price. These factors include:

Age and Health

One of the most significant determinants of life insurance prices is an individual’s age and health status. Generally, younger individuals, especially those in good health, enjoy more affordable premiums. This is because younger applicants are seen as lower-risk by insurance providers. As we age, the likelihood of health issues increases, leading to higher policy prices.

For instance, a 30-year-old non-smoker in excellent health may secure a $500,000 term life insurance policy for as little as $20 per month, while a 55-year-old with pre-existing health conditions could pay upwards of $100 per month for the same coverage.

Policy Type and Coverage

The type of policy chosen significantly impacts the cost. As mentioned earlier, term life insurance tends to be more affordable, especially for those seeking coverage for a specific period, such as to protect their family during their working years. Whole life insurance, while offering lifelong coverage, often comes with higher premiums due to its additional benefits and cash value accumulation.

Consider a 20-year term life policy with a $1,000,000 coverage for a 35-year-old individual. This policy might cost around $30 to $40 per month, depending on the insurer and the individual's health. In contrast, a whole life policy with the same coverage could start at $100 per month and increase over time as the cash value grows.

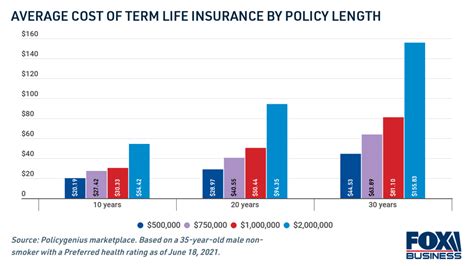

Coverage Amount and Term

The amount of coverage desired is another crucial factor. Higher coverage amounts naturally result in higher premiums. Additionally, the term of the policy matters. Longer policy terms provide coverage for a more extended period but typically come with higher costs.

For example, a 30-year-old individual looking for a $500,000 term life policy for a 10-year term might pay $15 per month, whereas extending the term to 30 years could increase the premium to $25 per month.

Lifestyle and Occupation

Your lifestyle choices and occupation can also affect policy prices. Insurance providers consider factors like smoking, alcohol consumption, and high-risk hobbies. Additionally, certain occupations, such as those in high-risk industries, may face higher premiums due to the increased likelihood of accidents or health issues.

A professional athlete, for instance, might pay a premium surcharge of 10% to 20% on their policy due to the physical demands and potential risks associated with their career.

Gender and Family History

Insurance providers also consider gender and family history when determining policy prices. Statistical data suggests that men, on average, have a shorter life expectancy than women, leading to slightly higher premiums for male applicants. Additionally, a history of certain illnesses or conditions in the family can impact the cost of coverage.

A 35-year-old female non-smoker with a family history of heart disease might pay 5% to 10% more for a life insurance policy compared to a similar applicant without such a family history.

Insurance Company and Rider Options

The insurance company chosen can significantly impact policy prices. Different insurers offer varying rates based on their underwriting guidelines and market positioning. Additionally, the selection of rider options, such as accelerated death benefits or waiver of premium riders, can increase the overall cost of the policy.

When comparing quotes from five major insurance providers for a 30-year-old male seeking a $1,000,000 term life policy, the premiums can range from $25 to $40 per month, highlighting the importance of shopping around for the best rates.

Strategies for Affordability

Understanding these factors allows individuals to strategize and make informed decisions to secure the best life insurance policy for their needs. Here are some strategies to consider:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates for your specific circumstances.

- Term Life Insurance: Opt for term life insurance if you're seeking coverage for a specific period, such as until your children become financially independent.

- Review and Adjust Coverage: Regularly review your coverage needs and adjust your policy as your life circumstances change. This can help prevent overpaying for coverage you no longer require.

- Bundle Policies: Consider bundling your life insurance with other policies, such as home or auto insurance, to potentially secure better rates.

- Maintain a Healthy Lifestyle: Leading a healthy lifestyle can result in more affordable premiums. This includes regular exercise, a balanced diet, and avoiding tobacco products.

The Future of Life Insurance Pricing

The landscape of life insurance pricing is evolving. With advancements in technology and data analytics, insurance providers are increasingly using big data and artificial intelligence to refine their underwriting processes. This shift towards precision underwriting allows for more accurate risk assessment, potentially leading to fairer and more personalized policy pricing.

For instance, some insurers now offer health monitoring devices to policyholders, which can track health metrics and lifestyle choices. This data can then be used to offer incentives, such as premium discounts, for those who maintain healthy habits.

Additionally, the rise of parametric life insurance is worth noting. This innovative approach to life insurance coverage provides payouts based on specific parameters, such as the severity of a health event, rather than traditional death benefits. Parametric life insurance policies are often more affordable and can provide a level of coverage for those who may not qualify for traditional policies due to health or age.

In conclusion, the cost of a life insurance policy is influenced by a multitude of factors, each offering an opportunity for individuals to tailor their coverage to their unique needs and budget. By understanding these factors and exploring the evolving landscape of life insurance pricing, individuals can make informed decisions to secure the financial protection their loved ones deserve.

How does the age of the policyholder impact life insurance prices?

+Age is a significant factor in life insurance pricing. Younger individuals typically enjoy more affordable premiums due to their lower risk profile. As we age, the likelihood of health issues increases, leading to higher policy prices. For instance, a 30-year-old might pay a fraction of what a 60-year-old pays for the same coverage.

What are the differences between term life and whole life insurance policies, and how do they impact cost?

+Term life insurance provides coverage for a specific period, typically offering more affordable premiums. It is ideal for those seeking coverage for a defined term, such as to protect their family during their working years. Whole life insurance, on the other hand, offers lifelong coverage and builds cash value over time. It is more expensive but provides long-term financial security and potential investment opportunities.

Can lifestyle choices and occupation impact life insurance policy prices?

+Yes, insurance providers consider lifestyle choices and occupation when determining policy prices. Factors like smoking, alcohol consumption, and high-risk hobbies can lead to higher premiums. Additionally, certain occupations in high-risk industries may face higher costs due to the increased likelihood of accidents or health issues.