Auto Insurance Per Mile

The concept of auto insurance per mile, also known as pay-as-you-drive (PAYD) or usage-based insurance (UBI), has gained traction in recent years as an innovative approach to automotive coverage. Unlike traditional insurance policies that typically charge a flat rate based on various factors such as age, gender, and driving history, pay-per-mile insurance offers a more tailored and flexible pricing model. In this comprehensive article, we will delve into the intricacies of auto insurance per mile, exploring its benefits, how it works, and its potential impact on the future of automotive insurance.

Understanding Auto Insurance Per Mile

Auto insurance per mile is a revolutionary concept that aims to provide drivers with a more accurate and fair pricing structure for their insurance coverage. It operates on the principle of charging customers based on the actual distance they drive rather than the traditional factors mentioned earlier. This approach has the potential to revolutionize the insurance industry, offering drivers a more personalized and cost-effective insurance option.

The Benefits of Pay-Per-Mile Insurance

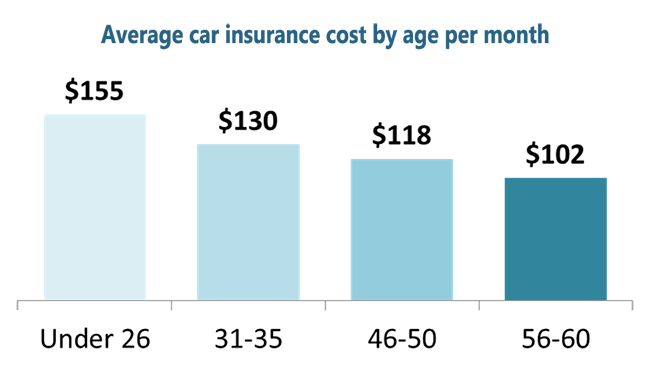

Pay-per-mile insurance offers several advantages that traditional insurance policies may lack. Firstly, it provides a significant cost-saving opportunity for low-mileage drivers. If you rarely use your vehicle or primarily drive short distances, this insurance model can lead to substantial savings. Additionally, it encourages safer driving habits as the insurance rates are directly linked to the miles driven. This incentive can potentially reduce accidents and improve road safety.

Furthermore, auto insurance per mile promotes environmental sustainability. By incentivizing fewer miles driven, it discourages unnecessary trips and contributes to reducing carbon emissions. This aligns with the growing global emphasis on eco-friendly practices and sustainability initiatives.

How Pay-As-You-Drive Insurance Works

PAYD insurance operates through the use of advanced telematics technology. This technology, often in the form of a small device installed in the vehicle, tracks various driving data points such as distance traveled, time of day, and driving behavior. Based on this information, insurance companies can accurately calculate the insurance premium.

Typically, drivers pay a base rate, which covers the vehicle and the driver's profile, and an additional per-mile rate for every mile driven. This per-mile rate can vary depending on the insurance company and the driver's specific circumstances. Some companies may offer discounts for low-mileage driving or provide incentives for safe driving behaviors.

| Pay-Per-Mile Insurance Provider | Per-Mile Rate (per mile) |

|---|---|

| Metromile | $0.07 - $0.10 |

| Root Insurance | Variable based on risk assessment |

| State Farm Drive Safe & Save | Varies by state; 4-15% discount |

It's important to note that while pay-per-mile insurance offers flexibility and potential savings, it may not be suitable for all drivers. Those who drive long distances regularly may find traditional insurance policies more cost-effective. However, for urban dwellers or individuals with limited driving needs, PAYD insurance can be a game-changer.

The Impact of Auto Insurance Per Mile on the Industry

The introduction of auto insurance per mile has sparked a wave of innovation and competition within the insurance industry. Traditional insurers are now forced to reconsider their pricing models and adapt to the changing preferences of modern drivers. This shift towards usage-based insurance has the potential to disrupt the industry, leading to more dynamic and customer-centric insurance offerings.

Changing Consumer Preferences

As consumer preferences evolve, there is a growing demand for personalized and flexible insurance options. Auto insurance per mile caters to this demand by providing a tailored coverage solution. This trend is particularly evident among younger generations who value convenience, affordability, and sustainability. By embracing PAYD insurance, insurers can attract a new demographic and stay relevant in a rapidly changing market.

Data-Driven Insurance

The utilization of telematics technology in pay-per-mile insurance has led to a wealth of data for insurers. This data allows companies to gain valuable insights into driving behaviors, accident patterns, and potential risks. With this information, insurers can make more informed decisions, refine their underwriting processes, and offer more accurate insurance rates.

Potential Challenges and Considerations

While auto insurance per mile presents numerous benefits, it also comes with certain challenges. One of the primary concerns is the potential for privacy invasion. With telematics devices tracking driving behavior, there is a need for robust data protection measures to ensure customer privacy. Additionally, the accuracy of the technology and the potential for misuse or manipulation must be addressed to maintain trust in the system.

Another consideration is the impact on high-mileage drivers. While PAYD insurance benefits low-mileage drivers, those who frequently drive long distances may face higher insurance costs. Balancing the needs of different driver profiles is crucial to ensure fairness and accessibility for all customers.

Future Implications and Innovations

The future of auto insurance per mile looks promising, with continuous advancements in technology and a growing demand for sustainable and personalized insurance solutions. Here are some potential future implications and innovations:

-

Advanced Telematics Integration: As technology evolves, we can expect more sophisticated telematics devices that offer real-time data analysis and improved accuracy. This could lead to more precise insurance pricing and better incentives for safe driving.

-

Integration with Electric Vehicles (EVs): With the rise of electric vehicles, auto insurance per mile could be further optimized to cater to EV owners. Insurance companies may offer incentives for driving eco-friendly vehicles or provide specialized coverage for unique EV features.

-

Pay-As-You-Go Models: The concept of pay-per-mile insurance may evolve into a pay-as-you-go model, where drivers pay only for the insurance coverage they need at a specific time. This could be particularly beneficial for occasional drivers or those who frequently rent vehicles.

-

Incentivizing Sustainable Practices: Insurance companies may introduce rewards or discounts for drivers who adopt eco-friendly practices, such as carpooling or using public transportation. This approach could further promote sustainability and reduce environmental impact.

Frequently Asked Questions (FAQ)

How does pay-per-mile insurance calculate the premium?

+Pay-per-mile insurance calculates the premium based on the actual distance traveled by the vehicle. This is done through the use of a telematics device that tracks the miles driven. The premium is typically a combination of a base rate and a per-mile rate, with the latter varying depending on the insurance provider and the driver’s profile.

Is pay-per-mile insurance suitable for long-distance drivers?

+While pay-per-mile insurance offers benefits for low-mileage drivers, it may not be the most cost-effective option for long-distance drivers. Those who frequently drive long distances may find traditional insurance policies more suitable, as the per-mile rate can add up significantly over time. It’s essential to compare different insurance options based on individual driving habits.

What are the privacy concerns associated with pay-per-mile insurance?

+Pay-per-mile insurance relies on telematics devices that track driving behavior, raising concerns about privacy and data protection. Insurance companies must implement robust security measures to ensure customer data is handled securely and ethically. Additionally, drivers should have control over their data and be aware of how it is used.

Can I switch to pay-per-mile insurance if I already have a traditional policy?

+Yes, it is possible to switch to pay-per-mile insurance even if you currently have a traditional policy. Many insurance companies offer the option to transition to PAYD insurance, allowing you to enjoy the benefits of a more personalized and potentially cost-saving coverage plan. It’s recommended to compare quotes and understand the terms before making the switch.