Office Of Unemployment Insurance

The Office of Unemployment Insurance (OUI) is a crucial governmental entity responsible for overseeing and administering unemployment insurance programs across the United States. This federal agency plays a vital role in providing financial support to individuals who have lost their jobs through no fault of their own, ensuring they can maintain some level of financial stability during challenging times.

In this comprehensive guide, we will delve into the intricacies of the Office of Unemployment Insurance, exploring its history, purpose, and the significant impact it has on the lives of millions of Americans. We will navigate through the various programs, policies, and processes that define this essential social safety net, shedding light on the complex yet critical work performed by the OUI.

A Brief History of the Office of Unemployment Insurance

The origins of the Office of Unemployment Insurance can be traced back to the Great Depression era, a period of immense economic turmoil in the United States. As millions of Americans faced unemployment and financial hardship, the need for a comprehensive social safety net became evident. In response, the federal government established the OUI as a key component of the Social Security Act of 1935.

The Social Security Act aimed to provide relief to those suffering from poverty and unemployment, introducing a range of programs to support the most vulnerable populations. The OUI was tasked with administering the unemployment insurance program, which offered temporary financial assistance to eligible individuals who had lost their jobs.

Over the decades, the OUI has evolved and adapted to meet the changing needs of the American workforce. It has played a pivotal role during various economic downturns, including the post-World War II recession, the oil crisis of the 1970s, and, more recently, the global financial crisis of 2008 and the COVID-19 pandemic.

The Role and Responsibilities of the Office of Unemployment Insurance

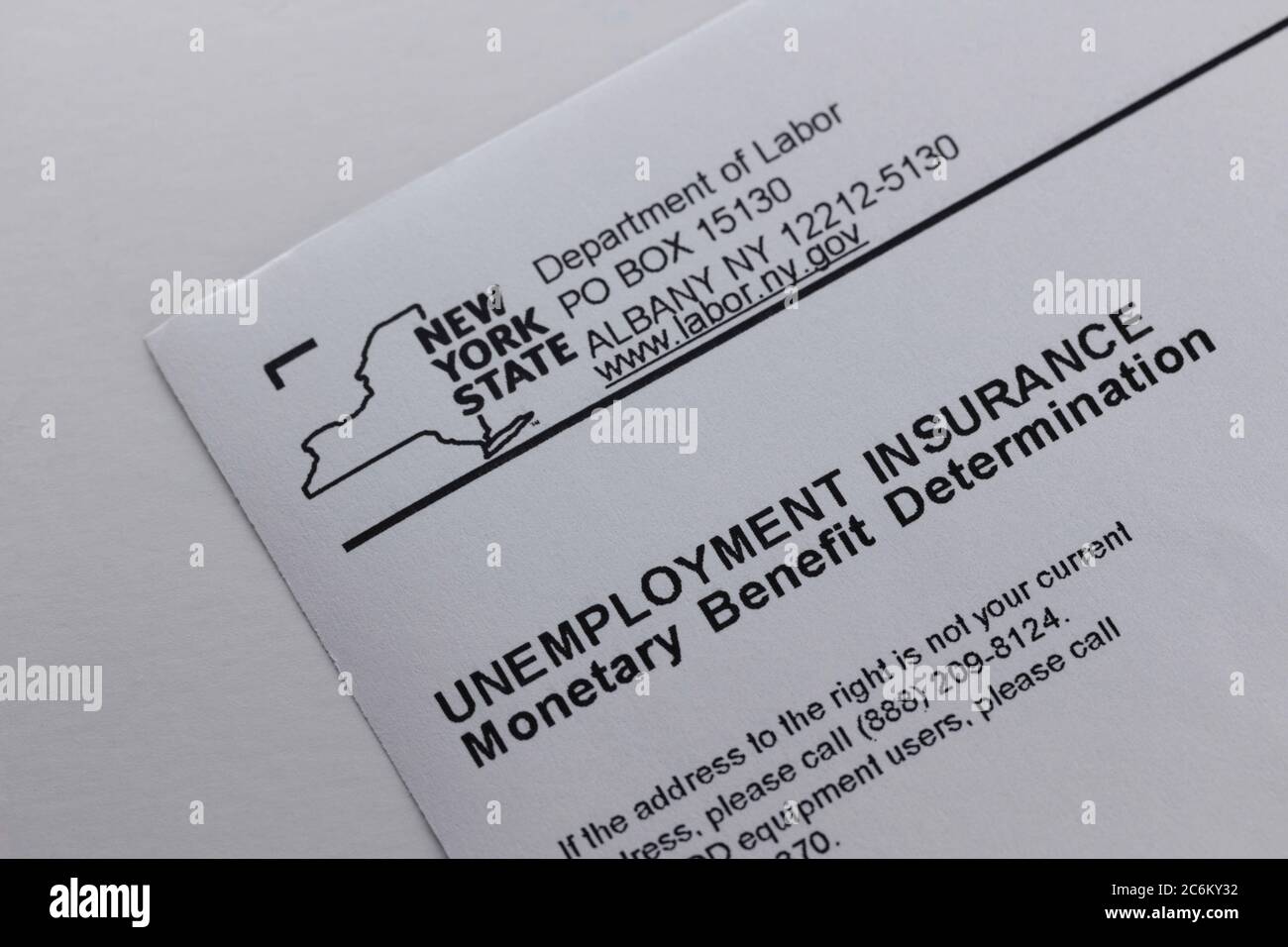

The primary mission of the Office of Unemployment Insurance is to ensure the timely and accurate distribution of unemployment benefits to eligible individuals. This involves a complex process that encompasses various stages, from application and eligibility determination to benefit calculation and payment.

Eligibility Determination

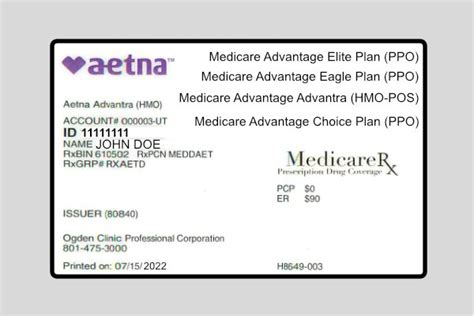

One of the key responsibilities of the OUI is to establish eligibility criteria and assess whether applicants meet the requirements to receive unemployment benefits. This process involves verifying employment history, ensuring the individual has worked a minimum number of hours or weeks, and confirming the circumstances of their job loss.

The OUI works closely with state unemployment agencies to gather and review the necessary information, ensuring a fair and efficient eligibility determination process.

Benefit Calculation

Once eligibility is established, the OUI calculates the amount of unemployment benefits an individual is entitled to receive. This calculation is based on several factors, including the applicant’s previous earnings, the duration of their employment, and the state’s benefit formula.

The OUI ensures that benefit amounts are fair and consistent, providing a crucial financial cushion for those in need.

Payment and Disbursement

After determining eligibility and calculating benefits, the OUI facilitates the payment and disbursement of unemployment benefits. This involves partnering with financial institutions and state agencies to ensure timely and secure payments to eligible recipients.

The OUI continuously improves its payment systems to enhance efficiency and security, making it easier for individuals to access their benefits when they need them most.

Unemployment Insurance Programs and Extensions

The Office of Unemployment Insurance administers a range of unemployment insurance programs, each designed to meet the diverse needs of the American workforce. These programs provide a safety net for individuals facing unemployment due to various reasons, offering financial support and resources to help them transition back into the job market.

Regular Unemployment Insurance (UI)

The Regular Unemployment Insurance program is the foundation of the OUI’s efforts. It provides temporary income support to individuals who have lost their jobs through no fault of their own, such as due to company closures, layoffs, or reductions in force.

To qualify for regular UI, individuals must meet specific criteria, including having worked a minimum number of hours or weeks and being actively seeking employment.

Extended Benefits (EB)

In times of high unemployment, the OUI offers Extended Benefits to individuals who have exhausted their regular UI benefits but remain unemployed. EB provides additional weeks of financial assistance, helping individuals bridge the gap until they can secure new employment.

The availability and duration of EB depend on the economic conditions in a particular state, with the OUI working closely with state agencies to determine the need for extended benefits.

Pandemic Unemployment Assistance (PUA)

The COVID-19 pandemic brought unprecedented challenges to the American workforce, leading to widespread job losses and economic uncertainty. In response, the OUI introduced the Pandemic Unemployment Assistance program to provide financial support to individuals who may not have otherwise qualified for regular UI.

PUA extended unemployment benefits to self-employed individuals, independent contractors, gig workers, and others who were impacted by the pandemic but did not meet the traditional UI eligibility criteria.

The Impact of the Office of Unemployment Insurance

The Office of Unemployment Insurance has had a profound impact on the lives of millions of Americans, providing much-needed financial support during times of unemployment. The benefits offered by the OUI not only help individuals meet their basic needs but also contribute to the overall stability of the economy.

By ensuring a reliable income for those who have lost their jobs, the OUI helps reduce poverty and inequality, promoting social and economic well-being. It also enables individuals to continue contributing to the economy through their spending and consumption, stimulating economic growth and recovery.

Case Study: The Impact of Unemployment Benefits

Let’s consider a real-life example to illustrate the impact of unemployment benefits provided by the OUI. Imagine a single mother named Sarah who lost her job due to a company downsizing. With two young children to support, Sarah’s unemployment benefits became a lifeline, allowing her to cover essential expenses such as rent, groceries, and childcare.

Thanks to the timely support from the OUI, Sarah was able to maintain her housing stability, ensuring her children had a safe and secure home. The financial assistance also enabled her to explore new job opportunities without the immediate pressure of finding employment to cover her basic needs. With the support of unemployment benefits, Sarah was able to successfully transition into a new role, improving her family's overall well-being.

The Future of Unemployment Insurance: Adapting to Change

As the American workforce continues to evolve and face new challenges, the Office of Unemployment Insurance must adapt to meet the changing needs of unemployed individuals. The COVID-19 pandemic highlighted the importance of flexible and inclusive unemployment insurance programs, prompting the OUI to explore innovative solutions.

One key area of focus for the OUI is improving the accessibility and user experience of its online platforms and applications. By investing in digital transformation, the OUI aims to streamline the application process, making it easier for individuals to navigate the system and access the benefits they are entitled to.

Additionally, the OUI is exploring ways to enhance its data analytics capabilities, leveraging advanced technologies to identify trends, detect fraud, and optimize benefit distribution. By harnessing the power of data, the OUI can make more informed decisions and ensure the efficient allocation of resources.

Addressing the Challenges of Remote Work and Gig Economy

The rise of remote work and the gig economy presents unique challenges for unemployment insurance programs. Traditional eligibility criteria may not adequately capture the diverse employment arrangements and income streams of gig workers and remote employees.

To address these challenges, the OUI is working towards developing more flexible and inclusive eligibility criteria. This involves reevaluating the definition of employment and considering alternative methods of verifying income and employment history for non-traditional workers.

Conclusion: Strengthening the Social Safety Net

The Office of Unemployment Insurance stands as a critical pillar of the American social safety net, providing essential support to individuals facing unemployment. Through its various programs and initiatives, the OUI has helped millions of Americans weather economic storms, maintain their financial stability, and transition back into the workforce.

As we look to the future, the OUI must continue to adapt and innovate, ensuring that its programs remain relevant and accessible to all who need them. By embracing digital transformation, enhancing data analytics, and addressing the challenges of the modern workforce, the OUI can strengthen its role as a vital lifeline for unemployed Americans.

How can I apply for unemployment benefits?

+To apply for unemployment benefits, you can visit your state’s unemployment agency website or contact their office directly. Each state has its own application process, so it’s important to follow the guidelines provided by your state’s agency. You will typically need to provide information about your employment history, earnings, and the circumstances of your job loss.

What are the eligibility requirements for unemployment insurance?

+Eligibility requirements for unemployment insurance vary by state. Generally, you must have worked a minimum number of hours or weeks, and your job loss must be through no fault of your own. It’s recommended to check with your state’s unemployment agency to understand the specific criteria and requirements.

How long do unemployment benefits last?

+The duration of unemployment benefits depends on several factors, including the economic conditions in your state and the type of unemployment insurance program you qualify for. Regular unemployment insurance typically provides benefits for a set number of weeks, while extended benefits may offer additional weeks of support. It’s important to check with your state’s unemployment agency for specific information.