Insurance Insurance Quotes

Insurance is an essential aspect of financial planning and risk management for individuals, businesses, and even governments. It provides a safety net against unexpected events, offering financial protection and peace of mind. Obtaining insurance quotes is a critical step in the process, as it allows individuals and entities to compare options, assess their needs, and make informed decisions about coverage.

The Significance of Insurance Quotes

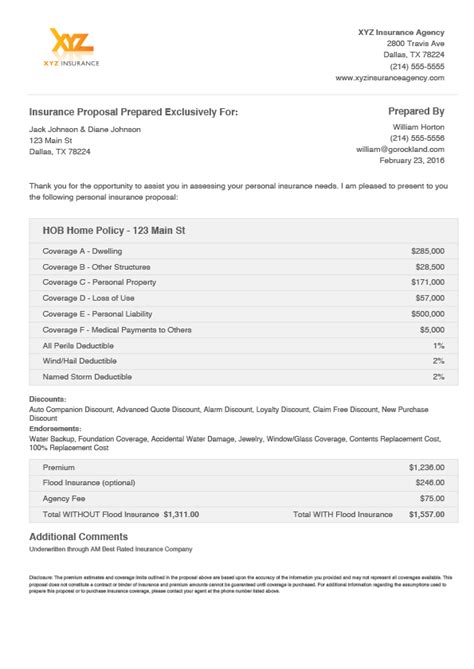

Insurance quotes serve as a cornerstone in the insurance industry, facilitating transparent and competitive pricing. They empower consumers to evaluate various insurance providers, coverage options, and policy terms. By soliciting quotes, individuals can tailor their insurance coverage to their specific requirements, ensuring they receive the protection they need without incurring unnecessary costs.

In today's digital age, obtaining insurance quotes has become more accessible and convenient than ever. Online platforms and comparison websites have revolutionized the insurance shopping experience, enabling users to quickly gather multiple quotes from different providers. This enhanced accessibility has fostered a more competitive market, driving down prices and improving overall consumer satisfaction.

Understanding the Insurance Quote Process

The insurance quote process is a comprehensive evaluation of an individual’s or entity’s risk profile. Insurance providers consider various factors to determine the appropriate premium, including the type of coverage sought, the individual’s or entity’s location, their claims history, and any specific circumstances that may impact risk.

For instance, when seeking auto insurance quotes, factors such as the driver's age, driving record, vehicle type, and geographical location all play a role in the quoted premium. Similarly, home insurance quotes consider the home's location, construction, and any additional features that may impact the risk of damage or loss.

Key Factors Influencing Insurance Quotes

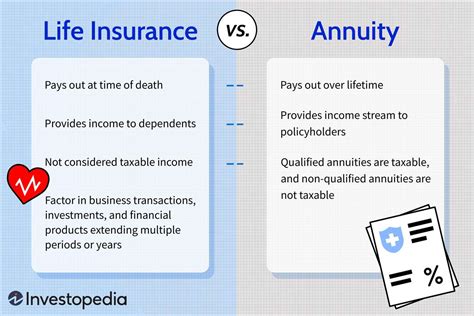

- Coverage Type and Amount: Different types of insurance, such as life, health, auto, or property, carry varying levels of risk and therefore, different premium rates.

- Location: Geographical location can significantly impact insurance quotes. Areas prone to natural disasters or with higher crime rates often result in higher premiums.

- Claims History: A history of frequent claims can lead to higher insurance quotes as it indicates a higher risk of future claims.

- Demographics: Factors like age, gender, occupation, and marital status can influence insurance quotes, especially for life and health insurance.

- Lifestyle and Hobbies: Certain hobbies or lifestyles, such as extreme sports or high-risk occupations, may increase insurance premiums due to the elevated risk associated with them.

Benefits of Comparing Insurance Quotes

Comparing insurance quotes offers numerous advantages to consumers, including:

- Cost Savings: By comparing quotes, individuals can identify the most competitive premiums, potentially saving hundreds or even thousands of dollars annually.

- Enhanced Coverage: Comparison shopping allows individuals to identify policies that offer better coverage for their specific needs, ensuring they are adequately protected.

- Provider Reputation: Reviewing multiple quotes provides insight into the reputation and reliability of different insurance providers, helping consumers choose a trustworthy partner.

- Customized Coverage: Different providers offer unique policy features and customization options. Comparing quotes enables individuals to find the policy that best suits their specific requirements.

- Understanding Coverage Gaps: Comparing quotes can highlight areas where an individual's current coverage may be lacking, prompting them to fill those gaps and ensure comprehensive protection.

Tips for Effective Insurance Quote Comparison

To make the most of insurance quote comparison, consider the following tips:

- Define Your Needs: Clearly identify the type of insurance you require and the level of coverage you need. This ensures you're comparing apples to apples when reviewing quotes.

- Utilize Online Tools: Online insurance quote comparison platforms can streamline the process, providing multiple quotes from various providers in one convenient location.

- Check Provider Ratings: Research the reputation and financial stability of the insurance providers you're considering. Check customer reviews and ratings to ensure they offer reliable service.

- Understand Policy Details: Carefully review the terms and conditions of each policy. Look for any exclusions, limitations, or restrictions that may impact your coverage.

- Consider Bundle Discounts: If you're obtaining quotes for multiple types of insurance, inquire about bundle discounts. Many providers offer reduced rates when you combine policies.

- Ask About Discounts: Inquire about any available discounts, such as safe driver discounts for auto insurance or loyalty discounts for long-term customers.

The Role of Technology in Insurance Quotes

Advancements in technology have transformed the insurance quote process, making it more efficient, accurate, and personalized. Insurtech, a fusion of insurance and technology, has introduced innovative tools and platforms that streamline quote generation and comparison.

For instance, telematics devices in auto insurance allow insurers to gather real-time driving data, enabling more accurate risk assessment and personalized quotes. Similarly, parametric insurance, which triggers payouts based on predefined parameters rather than individual claims, has gained traction in the industry, offering faster and more efficient claim settlements.

Insurtech Innovations Shaping Insurance Quotes

- Artificial Intelligence (AI): AI algorithms analyze vast amounts of data to provide accurate and personalized insurance quotes. AI-powered chatbots and virtual assistants also enhance the customer experience by providing instant support and guidance.

- Big Data Analytics: Insurance providers leverage big data analytics to identify patterns and trends, enabling more precise risk assessment and quote generation.

- Blockchain Technology: Blockchain offers enhanced security and transparency in insurance transactions, reducing fraud and improving claim processing efficiency.

- Mobile Apps: Insurance providers have developed mobile apps that allow users to easily obtain quotes, manage policies, and file claims, enhancing convenience and accessibility.

Future Trends in Insurance Quotes

The insurance industry is continuously evolving, and the future of insurance quotes is expected to be shaped by several key trends, including:

- Personalized Insurance: Advances in technology will enable insurers to offer increasingly personalized insurance products, tailoring coverage and premiums to individual risk profiles and preferences.

- On-Demand Insurance: The rise of the gig economy and the sharing economy has sparked interest in on-demand insurance solutions, providing flexible coverage options for short-term or project-based work.

- Insurtech Partnerships: Insurance providers are increasingly partnering with Insurtech startups to leverage their innovative technologies and enhance their quote generation and policy management processes.

- Sustainable Insurance: With growing environmental awareness, insurers are developing sustainable insurance products that mitigate climate-related risks and promote environmentally friendly practices.

- Regulatory Changes: Changes in insurance regulations, such as the General Data Protection Regulation (GDPR) in Europe, will continue to impact the insurance quote process, influencing data collection and privacy practices.

FAQ

How often should I review my insurance quotes?

+It’s generally recommended to review your insurance quotes annually or whenever your personal circumstances or coverage needs change. Regular reviews ensure you stay up-to-date with the most competitive rates and coverage options available.

Can I negotiate insurance quotes?

+While insurance quotes are typically based on standardized rates, some providers may offer flexibility in pricing, especially for loyal customers or those with unique circumstances. It’s worth inquiring about potential discounts or customized pricing options.

What should I do if I find a better insurance quote elsewhere?

+If you find a more competitive insurance quote, it’s a good idea to reach out to your current provider and inquire about matching or beating the quote. Many providers are willing to negotiate to retain loyal customers.