Affordable Car Insurance Quote Online

Finding affordable car insurance is a priority for many vehicle owners, and the process of getting an online quote can be a complex and time-consuming task. However, with the right knowledge and understanding of the factors that influence insurance rates, you can navigate the world of car insurance quotes more effectively. This comprehensive guide will take you through the key aspects of obtaining an affordable car insurance quote online, offering insights and strategies to make the process smoother and more cost-efficient.

Understanding the Basics of Car Insurance

Car insurance is a contract between you and an insurance provider, which offers financial protection against various risks associated with owning and operating a motor vehicle. It covers a range of potential damages, from accidents involving other vehicles or property to injuries sustained by passengers or pedestrians. Understanding the fundamentals of car insurance is crucial before diving into the world of online quotes.

Types of Car Insurance Coverage

Car insurance typically consists of several types of coverage, each designed to address specific risks. These include:

- Liability Coverage: This covers damages you cause to others’ property or injuries you cause to others in an accident.

- Comprehensive Coverage: It protects against non-collision incidents like theft, vandalism, natural disasters, or animal collisions.

- Collision Coverage: Collision coverage pays for damages to your vehicle if you’re involved in an accident, regardless of fault.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this covers medical expenses for you and your passengers after an accident.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re in an accident with a driver who has no insurance or insufficient coverage.

Factors Affecting Insurance Rates

Insurance providers use a variety of factors to determine the cost of your car insurance. Understanding these factors can help you anticipate and influence your insurance rates.

- Vehicle Type: The make, model, and year of your car can impact your insurance rates. Sports cars and luxury vehicles often have higher premiums due to their repair costs.

- Driving History: Your driving record is a significant factor. A clean driving history with no accidents or violations can lead to lower rates, while a history of accidents or traffic violations may result in higher premiums.

- Location: Where you live and where you park your car can affect your rates. Urban areas with higher crime rates or congested traffic may result in higher insurance costs.

- Age and Gender: Insurance rates often vary based on age and gender, with younger drivers and males typically paying higher premiums.

- Credit Score: In many states, insurance companies use credit-based insurance scores to assess risk, which can impact your insurance rates.

Navigating the Online Quote Process

Getting an online car insurance quote is a convenient and efficient way to compare rates from multiple providers. Here’s a step-by-step guide to help you navigate the process effectively.

Gathering Necessary Information

Before starting your online quote journey, gather the following information:

- Personal details: Your name, date of birth, driver’s license number, and social security number.

- Vehicle details: Make, model, year, VIN number, and current mileage.

- Driving history: Records of accidents, traffic violations, and any ongoing traffic offenses.

- Current insurance policy: If you have an existing policy, gather details like coverage limits and any discounts you receive.

Comparing Insurance Providers

When comparing insurance providers, consider the following factors:

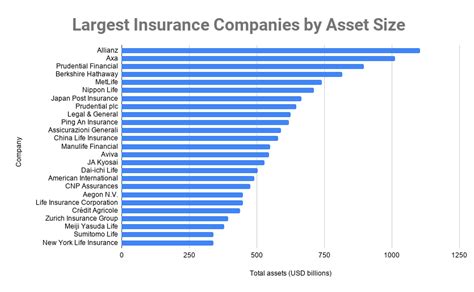

- Financial Strength: Choose providers with a strong financial rating to ensure they can pay out claims.

- Coverage Options: Look for providers that offer a range of coverage options to suit your needs.

- Discounts: Many providers offer discounts for various factors, such as good driving records, loyalty, or safety features in your vehicle.

- Customer Service: Read reviews and check the provider’s reputation for customer service and claim handling.

Using Online Quote Tools

Most insurance providers offer online quote tools on their websites. These tools guide you through a series of questions to gather the necessary information and provide an estimated quote. Ensure you answer these questions accurately to get an accurate quote.

Exploring Discount Opportunities

Insurance providers offer a variety of discounts to attract customers and reward safe driving behavior. Some common discounts include:

- Safe Driver Discount: Provided for a clean driving record without accidents or violations.

- Multi-Policy Discount: Offered when you bundle your car insurance with other policies, such as homeowners or renters insurance.

- Loyalty Discount: Awarded for maintaining your policy with the same provider for a certain period.

- Good Student Discount: Available for young drivers who maintain a certain GPA or academic standing.

- Defensive Driving Course Discount: Offered to drivers who complete an approved defensive driving course.

Optimizing Your Insurance Quote

Once you’ve gathered quotes from multiple providers, it’s time to analyze and optimize your options to find the most affordable car insurance.

Assessing Your Coverage Needs

Evaluate your coverage needs based on your personal circumstances and financial situation. Consider the following:

- State Minimum Requirements: Every state has minimum car insurance requirements. Ensure you meet these requirements at the very least.

- Liability Coverage: Evaluate your liability coverage based on your assets and potential risks. Higher liability limits can provide more protection but may increase your premiums.

- Deductibles: Consider raising your deductibles to lower your premiums. However, ensure you can afford the deductible in case of a claim.

Comparing Rates and Providers

Use the information you’ve gathered to compare rates and providers. Consider the following aspects:

- Coverage Options: Ensure each provider offers the coverage types you require.

- Discounts: Compare the discounts offered by each provider to see which one provides the most savings.

- Customer Service: Research each provider’s customer service reputation and claim handling process to ensure a positive experience.

Negotiating and Finalizing Your Policy

Once you’ve chosen a provider, you can negotiate your policy terms and conditions. Here are some tips:

- Discuss your coverage needs and any concerns you have about the policy.

- Negotiate for additional discounts or lower premiums if possible.

- Review the policy documents thoroughly before finalizing the purchase.

Maintaining Affordable Car Insurance

Getting an affordable car insurance quote is just the first step. Maintaining that affordability over time requires ongoing effort and attention.

Regularly Review and Adjust Your Policy

Insurance needs can change over time. Review your policy annually or whenever your circumstances change. This includes changes in your driving habits, vehicle usage, or personal situation.

Monitor Your Credit Score

In states where credit-based insurance scores are used, keeping a good credit score can help maintain lower insurance rates. Regularly check your credit report and take steps to improve your score if needed.

Practice Safe Driving

A clean driving record is one of the best ways to keep your insurance rates low. Avoid accidents and traffic violations to maintain a good driving history.

Explore Alternative Insurance Options

Consider alternative insurance options, such as usage-based insurance or pay-per-mile insurance. These options can provide more personalized rates based on your actual driving behavior.

| Insurance Provider | Average Annual Premium |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,150 |

| Provider C | $1,300 |

Frequently Asked Questions

What factors can I control to lower my car insurance rates?

+You can control several factors to lower your car insurance rates, including maintaining a clean driving record, reducing annual mileage, and taking advantage of discounts offered by insurance providers. Additionally, consider comparing quotes from multiple providers to find the most competitive rates.

How do insurance providers determine my quote?

+Insurance providers use a variety of factors to determine your quote, including your driving history, the type of vehicle you drive, your location, and your age. They also consider factors like your credit score (in some states) and any discounts you may qualify for.

Can I get car insurance without a quote first?

+While it is possible to purchase car insurance without getting a quote first, it is generally not recommended. Getting a quote allows you to compare prices and coverage options from different providers, ensuring you get the best value for your insurance needs.

What happens if I switch insurance providers mid-policy term?

+Switching insurance providers mid-policy term is possible, but it may result in a refund or penalty for the remaining portion of your old policy. It’s essential to carefully review the terms and conditions of your current policy and the new provider’s policy to understand any potential consequences.

Are there any tips for negotiating car insurance rates?

+Yes, when negotiating car insurance rates, emphasize your safe driving record, ask about loyalty or multi-policy discounts, and consider increasing your deductibles to lower premiums. Additionally, provide accurate and complete information to insurance providers to avoid surprises later.