Biggest Insurance Company

In the realm of the global insurance industry, certain entities have risen to prominence, commanding significant market shares and wielding considerable influence. These insurance giants have not only weathered various economic and social storms but have also played pivotal roles in shaping the industry's landscape and standards.

The Giants of the Insurance World

When discussing the biggest insurance companies, several names instantly come to the forefront, each with its unique history, business model, and global reach.

China Life Insurance Company

Headquartered in Beijing, China Life Insurance Company is the world’s largest insurance company by revenue. With a rich history dating back to 1949, it has consistently ranked among the top insurance providers globally. China Life offers a comprehensive range of insurance products, including life, health, and property and casualty insurance.

Key facts about China Life:

- Market Capitalization: As of [most recent data], China Life’s market cap stands at approximately 172.89 billion.</li> <li><strong>Revenue</strong>: In [year], the company generated a staggering 117.35 billion in revenue.

- Assets Under Management: China Life boasts assets worth over $1.3 trillion, making it one of the largest asset managers globally.

Ping An Insurance (Group) Company of China, Ltd.

Another Chinese giant, Ping An, is a global leader in the insurance and financial services industry. Founded in 1988, Ping An has rapidly expanded its operations and now offers a diverse range of services, including insurance, banking, and asset management.

Notable insights on Ping An:

- Market Capitalization: Ping An’s market cap as of [recent data] is an impressive 180.14 billion.</li> <li><strong>Revenue</strong>: The company's revenue for [year] amounted to 137.14 billion.

- Innovative Approach: Ping An is known for its digital transformation initiatives, leveraging technology to enhance customer experience and operational efficiency.

AXA Group

AXA, a French multinational insurance giant, operates in over 60 countries and serves millions of customers worldwide. With a history spanning over 200 years, AXA has established itself as a leader in the insurance sector, offering a wide array of insurance and financial products.

Key highlights of AXA’s performance:

- Market Capitalization: AXA’s market cap as of [recent data] is approximately 76.25 billion.</li> <li><strong>Revenue</strong>: In [year], AXA generated 119.29 billion in revenue.

- Diverse Portfolio: AXA’s portfolio encompasses life, health, and property and casualty insurance, along with asset management and other financial services.

Prudential Financial, Inc.

Headquartered in Newark, New Jersey, Prudential Financial is a leading global financial services company with a strong presence in the insurance sector. Founded in 1875, Prudential has grown into a diversified provider of life insurance, annuities, retirement-related services, and asset management products.

Notable facts about Prudential Financial:

- Market Capitalization: As of [most recent data], Prudential’s market cap is around 35.69 billion.</li> <li><strong>Revenue</strong>: The company's revenue for [year] was 61.42 billion.

- Global Reach: Prudential operates in the United States, Asia, Europe, and Latin America, serving customers across these regions.

MetLife, Inc.

MetLife, often referred to as the “MetLife Insurance Company,” is a prominent player in the global insurance market. With a history dating back to 1868, MetLife has consistently ranked among the top insurance providers. The company offers a comprehensive range of insurance products, including life, health, and property and casualty insurance.

Key insights into MetLife’s performance:

- Market Capitalization: MetLife’s market cap as of [recent data] is approximately 44.63 billion.</li> <li><strong>Revenue</strong>: In [year], the company generated 68.19 billion in revenue.

- Diversification: MetLife has expanded its business beyond traditional insurance, offering financial services and employee benefit programs.

Allianz SE

Allianz, a German multinational financial services company, is a leading provider of insurance and asset management services. With a global presence, Allianz offers a diverse range of products, including life, health, and property and casualty insurance.

Highlights of Allianz’s performance include:

- Market Capitalization: Allianz’s market cap as of [recent data] is an impressive 106.98 billion.</li> <li><strong>Revenue</strong>: The company's revenue for [year] amounted to 155.68 billion.

- Sustainable Approach: Allianz is known for its commitment to sustainability and has set ambitious goals to reduce its environmental impact.

Japan Post Holdings Co., Ltd.

Japan Post Holdings is a Japanese government-owned holding company that operates in the postal and financial services sectors. The company’s insurance division, Japan Post Insurance, is a significant player in the Japanese insurance market.

Key facts about Japan Post Holdings:

- Market Capitalization: As of [most recent data], Japan Post Holdings’ market cap is approximately 30.14 billion.</li> <li><strong>Revenue</strong>: In [year], the company generated 19.74 billion in revenue.

- Government-Owned: Japan Post Holdings is unique in that it is owned by the Japanese government, which has significant influence over its operations.

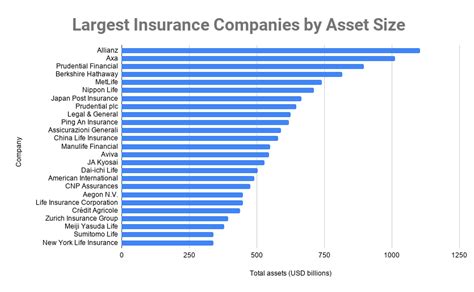

A Comparative Analysis

While each of these insurance giants has its strengths and unique selling points, a comparative analysis reveals some intriguing trends and insights.

| Company | Revenue (in billions) | Market Capitalization (in billions) | Assets Under Management (in trillions) |

|---|---|---|---|

| China Life Insurance Company | 117.35 | 172.89 | 1.3 |

| Ping An Insurance (Group) Company of China, Ltd. | 137.14 | 180.14 | N/A |

| AXA Group | 119.29 | 76.25 | N/A |

| Prudential Financial, Inc. | 61.42 | 35.69 | N/A |

| MetLife, Inc. | 68.19 | 44.63 | N/A |

| Allianz SE | 155.68 | 106.98 | N/A |

| Japan Post Holdings Co., Ltd. | 19.74 | 30.14 | N/A |

This table offers a glimpse into the financial might of these insurance giants, showcasing their revenue, market capitalization, and, where available, assets under management.

The Future of Insurance Giants

The insurance industry is undergoing rapid transformation, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. As these giants continue to navigate this dynamic environment, several key trends and strategies are likely to shape their future.

Digital Transformation

Insurance companies are increasingly investing in digital technologies to enhance their operational efficiency, improve customer experience, and gain a competitive edge. This includes adopting artificial intelligence, blockchain, and advanced analytics to streamline processes, personalize offerings, and offer innovative products.

Sustainable and Ethical Practices

With growing awareness about environmental and social responsibilities, insurance companies are embracing sustainable and ethical practices. This involves adopting green initiatives, promoting diversity and inclusion, and ensuring fair and transparent practices across their value chains.

Expanding Global Presence

Many insurance giants are eyeing expansion into new markets, particularly in emerging economies, to tap into growing consumer bases and untapped potential. This expansion often involves strategic partnerships, acquisitions, and localized product offerings to cater to diverse market needs.

Focus on Customer Experience

In an increasingly competitive market, insurance companies are prioritizing customer experience to retain and attract new customers. This involves offering seamless digital interactions, personalized services, and innovative products that meet evolving customer needs and preferences.

Regulatory Compliance and Innovation

The insurance industry is highly regulated, and companies must navigate complex legal and compliance landscapes. While this presents challenges, it also opens up opportunities for innovation. Insurance giants are investing in regulatory technology (RegTech) to streamline compliance processes and develop innovative products that adhere to evolving regulatory standards.

Conclusion

The insurance industry is home to several global giants, each with its unique strengths, market reach, and financial might. As these companies continue to evolve and adapt to changing market dynamics, their strategies and innovations will play a pivotal role in shaping the future of the insurance sector. By embracing digital transformation, sustainable practices, and customer-centric approaches, these giants are well-positioned to thrive in an increasingly competitive and dynamic market landscape.

What are the key challenges faced by these insurance giants in today’s market?

+These insurance giants face several challenges, including intense competition, regulatory compliance, and the need to adapt to rapidly changing consumer preferences and technological advancements. They must also navigate economic uncertainties and manage complex risk profiles effectively.

How do these companies ensure customer satisfaction and loyalty in a competitive market?

+Insurance giants prioritize customer experience by offering personalized services, innovative products, and seamless digital interactions. They also invest in customer education and support to build trust and long-term relationships.

What role does technology play in the future of these insurance companies?

+Technology is pivotal in the future of insurance giants. It enables them to enhance operational efficiency, improve customer experience, and develop innovative products. Artificial intelligence, blockchain, and advanced analytics are some of the key technologies shaping the industry’s future.