Lemon Rental Insurance

Lemon laws are a vital part of consumer protection, ensuring that individuals who purchase vehicles are not left with a defective product that could potentially cost them a significant amount of money in repairs and cause safety hazards. While these laws vary across jurisdictions, they provide a crucial safeguard for car buyers. However, what happens when a leased vehicle turns out to be a lemon? This article explores the intricacies of lemon laws in the context of vehicle leasing and delves into the world of lemon rental insurance, a relatively new concept that offers a unique solution to lessees facing potential lemon situations.

Understanding Lemon Laws and Leased Vehicles

Lemon laws are statutes enacted by state governments to protect consumers from defective vehicles. These laws typically apply to vehicles purchased or leased for personal, family, or household use. While the specifics of lemon laws vary from state to state, they generally provide a remedy for buyers or lessees of vehicles that repeatedly fail to meet certain standards of performance or safety due to defects or nonconformities.

When a vehicle is deemed a lemon, the manufacturer is typically required to provide a refund, replacement, or a suitable repair solution. However, the process of determining whether a vehicle is a lemon can be complex and often requires a thorough understanding of the specific lemon law in the jurisdiction where the vehicle was purchased or leased.

Challenges with Leased Vehicles

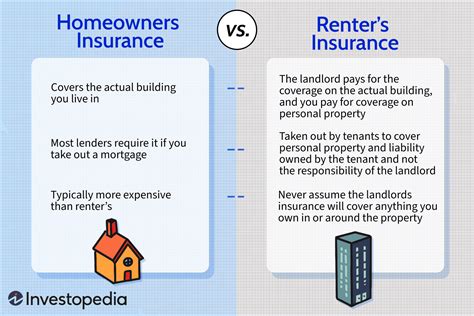

In the context of leased vehicles, lemon laws present a unique challenge. Unlike traditional vehicle purchases, where the buyer has full ownership and control over the vehicle, leased vehicles involve a complex arrangement between the lessee (the driver) and the leasing company (the owner). This arrangement can complicate the application of lemon laws, as the lessee may not have the same rights and remedies as a traditional vehicle owner.

Furthermore, leased vehicles often have mileage limits and specific terms and conditions outlined in the lease agreement. These factors can impact the lessee's ability to claim a vehicle as a lemon, as the lemon law criteria may not align perfectly with the terms of the lease.

| State | Lemon Law Criteria |

|---|---|

| California | Vehicle must have a substantial defect that affects its use, value, or safety and has been subject to repair attempts by an authorized dealer for at least two times, or has been out of service for a cumulative total of 30 days. |

| New York | Vehicle must have a defect or condition that substantially impairs its use, value, or safety, and the defect has not been repaired after a reasonable number of attempts by an authorized dealer. |

| Texas | Vehicle must have a defect or condition that substantially impairs its use, value, or safety and has been subject to at least two repair attempts for the same issue, or has been out of service for a total of 30 days or more. |

| Florida | Vehicle must have a nonconformity that substantially impairs its use, value, or safety and has been subject to repair attempts by an authorized dealer for at least three times, or has been out of service for a cumulative total of 30 days. |

Introducing Lemon Rental Insurance

Lemon rental insurance is a novel concept designed to address the unique challenges posed by leased vehicles and lemon laws. This type of insurance provides coverage for lessees who find themselves in a situation where their leased vehicle is deemed a lemon.

Lemon rental insurance typically covers the costs associated with lemon law claims, including legal fees, transportation expenses, and potential compensation for the lessee. It offers a safety net for individuals who may not be aware of their rights under lemon laws or who may not have the financial means to pursue a lemon law claim without insurance coverage.

Key Features of Lemon Rental Insurance

- Legal Expense Coverage: Lemon rental insurance often includes coverage for legal fees associated with pursuing a lemon law claim. This can be a significant benefit, as legal representation is often crucial in successfully navigating the complex lemon law process.

- Transportation Reimbursement: Many policies provide reimbursement for transportation costs incurred while the lessee’s vehicle is being repaired or replaced. This ensures that the lessee is not left without a means of transportation during the lemon law process.

- Compensation for Loss of Use: In some cases, lemon rental insurance may provide compensation for the loss of use of the leased vehicle. This can be particularly beneficial for individuals who rely on their vehicles for work or daily activities.

- Lease Termination Assistance: Some policies offer assistance with the termination of the lease agreement if the vehicle is deemed a lemon. This can include guidance on the necessary steps to end the lease and claim any refunds or compensation owed.

It's important to note that lemon rental insurance is not a replacement for traditional vehicle insurance. It is a specialized form of coverage designed to address the unique challenges of leased vehicles and lemon laws.

The Process of Making a Lemon Rental Insurance Claim

The process of making a claim with lemon rental insurance typically involves the following steps:

- Documenting the Defect: The lessee must thoroughly document the defect or nonconformity in the vehicle. This includes keeping a detailed record of repair attempts, service appointments, and any communication with the leasing company or manufacturer.

- Notifying the Insurer: Once the lessee has sufficient evidence of the defect, they must notify their lemon rental insurance provider. The insurer will then review the claim and determine whether it meets the policy's criteria for coverage.

- Legal Representation (if necessary): Depending on the complexity of the case, the insurer may assign a legal representative to assist the lessee in navigating the lemon law process. This legal support can be crucial in ensuring the lessee's rights are protected.

- Pursuing a Lemon Law Claim: With the support of their insurance provider and legal representation (if applicable), the lessee can then pursue a lemon law claim against the manufacturer or leasing company. This process may involve mediation, arbitration, or litigation, depending on the jurisdiction and the specifics of the case.

- Claim Resolution: Once the lemon law claim is resolved, the insurer will provide the lessee with the coverage outlined in their policy. This may include reimbursement for legal fees, transportation costs, and any other covered expenses.

Case Study: A Real-World Example

To illustrate the benefits of lemon rental insurance, let’s consider a hypothetical case study:

John, a resident of California, leased a new SUV from a local dealership. After a few months of ownership, John began experiencing persistent issues with the vehicle's transmission. Despite multiple repair attempts by the authorized dealer, the problem persisted, significantly impairing the vehicle's use and safety.

Recognizing the potential for a lemon law claim, John contacted his lemon rental insurance provider. With the support of his insurer, John was able to gather the necessary evidence and pursue a lemon law claim against the vehicle manufacturer. The process involved several rounds of mediation and eventually led to a successful resolution, with John receiving a full refund of his lease payments and a termination of the lease agreement.

Without lemon rental insurance, John may have faced significant financial and legal hurdles in pursuing his claim. The insurance coverage provided him with the necessary resources and support to navigate the complex lemon law process, ultimately resulting in a favorable outcome.

The Future of Lemon Rental Insurance

Lemon rental insurance is a relatively new concept, but it is gaining traction as more consumers become aware of their rights under lemon laws and the potential challenges of leased vehicles. As the automotive industry continues to evolve, with an increasing focus on electric vehicles and innovative leasing models, the demand for specialized insurance products like lemon rental insurance is likely to grow.

Furthermore, as consumers become more educated about their rights and the potential pitfalls of vehicle leasing, the need for comprehensive protection will only increase. Lemon rental insurance provides a unique solution to this growing demand, offering lessees a safety net against the financial and legal challenges posed by defective leased vehicles.

Looking ahead, the development of lemon rental insurance could have significant implications for the automotive industry. It may encourage manufacturers to prioritize quality control and customer satisfaction, knowing that their products are subject to increased scrutiny and potential legal consequences if they fall short of expectations.

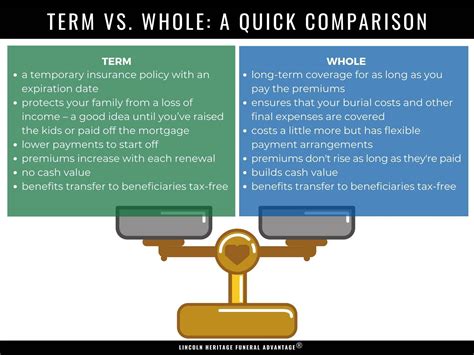

What is the difference between traditional vehicle insurance and lemon rental insurance?

+Traditional vehicle insurance primarily covers damages to the vehicle itself, such as accidents, theft, or natural disasters. On the other hand, lemon rental insurance is a specialized type of coverage designed specifically for leased vehicles that have been deemed lemons. It provides protection for lessees facing lemon law claims, covering legal fees, transportation expenses, and potential compensation.

How can I determine if my leased vehicle qualifies as a lemon under my state’s lemon law?

+The criteria for determining whether a leased vehicle is a lemon can vary by state. Generally, a leased vehicle is considered a lemon if it has a substantial defect or nonconformity that affects its use, value, or safety, and the defect has not been successfully repaired after a reasonable number of attempts by an authorized dealer. It’s important to review your state’s specific lemon law criteria and consult with legal experts if needed.

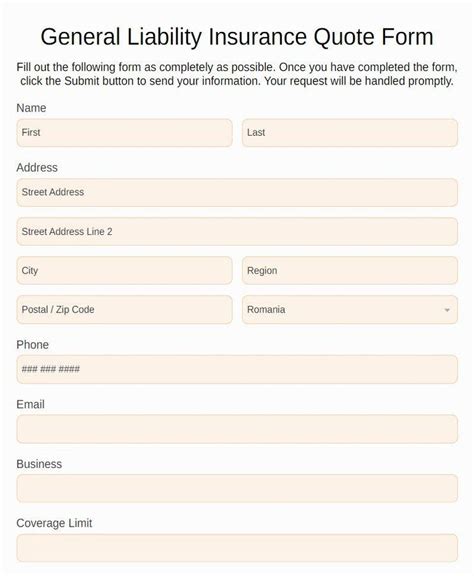

Can I purchase lemon rental insurance after I’ve already leased my vehicle?

+The availability and terms of purchasing lemon rental insurance after leasing a vehicle can vary depending on the insurance provider and your specific circumstances. Some insurers may offer coverage for existing leases, while others may only provide coverage for newly leased vehicles. It’s best to contact insurance providers directly to inquire about their specific policies and eligibility requirements.