Pet Insurance Policy

Pet insurance has become an increasingly popular topic among pet owners as they seek ways to ensure the health and well-being of their beloved companions. With rising veterinary costs and the desire to provide the best possible care, many are turning to pet insurance policies as a means of financial protection. This article aims to provide an in-depth analysis of pet insurance, exploring its benefits, coverage options, and considerations for pet owners. By delving into the world of pet insurance, we can help navigate the complexities and make informed decisions regarding the health and happiness of our furry friends.

Understanding Pet Insurance Policies

Pet insurance is a form of health insurance specifically designed to cover the medical expenses associated with pet ownership. It operates similarly to human health insurance, offering various coverage options and plans tailored to the needs of pets and their owners. By purchasing a pet insurance policy, pet owners can gain peace of mind, knowing that they have financial support to access veterinary care without incurring substantial out-of-pocket expenses.

The concept of pet insurance gained traction in the late 20th century, primarily in European countries. However, it has since gained popularity worldwide, with an increasing number of pet owners recognizing its value. As veterinary medicine has advanced, so too have the complexities and costs associated with pet healthcare. Pet insurance policies aim to bridge the gap between the need for quality veterinary care and the financial challenges that may arise.

Key Benefits of Pet Insurance

- Financial Protection: The primary benefit of pet insurance is financial security. Unexpected illnesses, injuries, or chronic conditions can lead to substantial veterinary bills. Pet insurance policies provide coverage for a range of medical procedures, medications, and treatments, helping to alleviate the financial burden on pet owners.

- Comprehensive Coverage: Pet insurance policies offer a wide range of coverage options. From routine check-ups and vaccinations to emergency surgeries and specialized treatments, pet insurance can cover various veterinary services. This comprehensive approach ensures that pet owners have access to a safety net for their pets' health needs.

- Peace of Mind: Knowing that your pet is insured provides a sense of reassurance. Pet owners can make informed decisions about their pet's healthcare without being constrained by financial worries. This peace of mind allows for prompt veterinary attention and access to the best possible care.

Coverage Options and Considerations

When selecting a pet insurance policy, it's crucial to understand the coverage options available and consider the specific needs of your pet. Here are some key aspects to keep in mind:

- Pre-Existing Conditions: Most pet insurance policies have exclusions for pre-existing conditions. These are health issues that your pet has had prior to enrolling in the insurance plan. It's essential to carefully review the policy's terms and conditions to understand what is covered and what may be excluded.

- Routine Care vs. Major Medical: Pet insurance policies often offer two main coverage types: routine care and major medical. Routine care coverage typically includes vaccinations, check-ups, and preventative treatments. Major medical coverage, on the other hand, provides protection for unexpected illnesses or injuries. Some policies combine both types, offering a comprehensive approach.

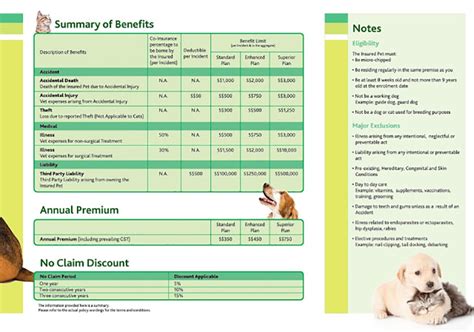

- Deductibles and Co-Payments: Like human health insurance, pet insurance policies may have deductibles and co-payments. A deductible is the amount you pay out of pocket before the insurance coverage kicks in. Co-payments are the portion of the bill you pay alongside the insurance company. Understanding these financial aspects is crucial when comparing policies.

- Breed-Specific Considerations: Certain breeds are predisposed to specific health conditions. When selecting a policy, consider the unique health risks associated with your pet's breed. Some policies offer breed-specific coverage, ensuring that common conditions are covered.

- Limitations and Exclusions: Review the policy's limitations and exclusions carefully. Certain procedures, treatments, or conditions may not be covered. Understanding these limitations will help you make an informed decision and manage expectations regarding the policy's coverage.

Choosing the Right Pet Insurance Policy

Selecting the most suitable pet insurance policy involves careful consideration of your pet's needs and your financial situation. Here are some key factors to guide your decision-making process:

Assessing Your Pet's Needs

Every pet is unique, and their healthcare requirements may vary. Consider the following aspects when evaluating your pet's needs:

- Age and Health Status: Younger, healthier pets may require different coverage compared to older pets with pre-existing conditions. Assess your pet's current health and consider the potential risks and challenges that may arise as they age.

- Breed-Specific Risks: As mentioned earlier, certain breeds are prone to specific health issues. Research the common health concerns associated with your pet's breed and ensure that the insurance policy provides adequate coverage for these conditions.

- Lifestyle and Activities: Consider your pet's lifestyle and the activities they engage in. Active pets or those with high-risk hobbies may require additional coverage for potential injuries. Tailor your insurance policy to match their unique lifestyle.

Financial Considerations

Understanding your financial situation is crucial when choosing a pet insurance policy. Here are some financial aspects to keep in mind:

- Premium Costs: Pet insurance policies come with varying premium costs. Assess your budget and determine the maximum amount you can afford for monthly or annual premiums. Remember that higher premiums often indicate more comprehensive coverage.

- Deductibles and Co-Payments: As mentioned earlier, deductibles and co-payments can significantly impact your out-of-pocket expenses. Consider your financial comfort level and choose a policy with deductibles and co-payments that align with your budget.

- Coverage Limits: Some policies have coverage limits, which are the maximum amounts they will pay out for specific conditions or overall expenses. Ensure that the coverage limits are sufficient to cover the potential costs associated with your pet's healthcare needs.

- Annual Benefit Caps: Certain policies may have annual benefit caps, limiting the total amount they will pay out in a year. Evaluate your pet's potential healthcare costs and choose a policy with an annual benefit cap that provides adequate coverage.

Performance Analysis and Case Studies

To further illustrate the impact and benefits of pet insurance, let's explore some real-life case studies:

Case Study 1: Emergency Surgery

Meet Max, a playful Labrador Retriever. One day, Max accidentally swallowed a foreign object, requiring emergency surgery. The surgery and associated medical costs amounted to $5,000. Fortunately, Max's owner had purchased a comprehensive pet insurance policy with a 20% co-payment. The insurance company covered $4,000 of the expenses, leaving the owner with a manageable co-payment of $1,000. Without insurance, the financial burden would have been significantly higher, potentially impacting Max's access to timely and necessary care.

| Expense | Amount |

|---|---|

| Emergency Surgery | $5,000 |

| Insurance Coverage | $4,000 |

| Owner's Co-payment | $1,000 |

Case Study 2: Chronic Condition Management

Bella, a senior Golden Retriever, was diagnosed with arthritis. Her owner opted for a pet insurance policy that covered chronic conditions. The policy included routine check-ups, medications, and specialized treatments. Over the course of a year, Bella's medical expenses amounted to $2,500. With insurance coverage, the owner only had to pay $500 out of pocket, as the insurance company covered the remaining $2,000. This allowed Bella's owner to provide the necessary care for her chronic condition without financial strain.

| Expense | Amount |

|---|---|

| Medical Expenses for Chronic Condition | $2,500 |

| Insurance Coverage | $2,000 |

| Owner's Out-of-Pocket Expenses | $500 |

Future Implications and Industry Trends

As the pet insurance industry continues to evolve, several trends and developments are shaping its future. Here are some key insights:

Increasing Awareness and Adoption

Pet insurance is gaining widespread recognition and acceptance among pet owners. With growing awareness of the financial risks associated with pet ownership, more individuals are opting for insurance coverage. This trend is expected to continue, driving the expansion of the pet insurance market.

Advanced Veterinary Technologies

Advancements in veterinary medicine are leading to improved diagnostic tools, treatments, and procedures. As a result, the costs associated with specialized veterinary care are likely to increase. Pet insurance policies will play a crucial role in ensuring that pet owners have access to these advanced technologies without financial barriers.

Tailored Coverage Options

The pet insurance industry is becoming increasingly personalized. Insurance providers are offering tailored coverage options based on pet breed, age, health status, and lifestyle. This customization allows pet owners to select policies that align with their pet's unique needs, providing comprehensive and cost-effective coverage.

Wellness and Preventative Care

Emphasis on wellness and preventative care is growing within the pet insurance industry. Many policies now include coverage for routine check-ups, vaccinations, and preventative treatments. This shift towards proactive healthcare management is expected to continue, promoting the overall well-being of pets and reducing the likelihood of costly illnesses or injuries.

Integration of Telemedicine

The integration of telemedicine services is gaining traction in the pet insurance industry. Telemedicine allows pet owners to access veterinary advice and consultations remotely, providing convenience and efficiency. Pet insurance policies that incorporate telemedicine services can offer added value and support to pet owners, especially in situations where in-person veterinary visits may not be feasible.

FAQ

How do I choose the right pet insurance provider?

+When selecting a pet insurance provider, consider their reputation, financial stability, and customer reviews. Look for providers with a track record of prompt claim processing and positive customer experiences. Additionally, compare the coverage options, deductibles, and co-payments offered by different providers to find the best fit for your pet's needs and your budget.

Are there any age restrictions for enrolling my pet in insurance?

+Some pet insurance policies have age restrictions for enrolling new pets. These restrictions may vary between providers. It's important to check the policy terms and conditions to understand the age limits and any potential exclusions or additional costs associated with enrolling older pets.

Can I switch pet insurance providers if I'm not satisfied with my current policy?

+Yes, you can switch pet insurance providers if you find a policy that better suits your needs or offers more comprehensive coverage. However, it's essential to carefully review the terms and conditions of the new policy, especially regarding pre-existing condition exclusions. Some providers may have waiting periods or restrictions for certain conditions, so ensure you understand the implications before making a switch.

What happens if my pet develops a pre-existing condition after enrolling in insurance?

+If your pet develops a pre-existing condition after enrolling in insurance, the condition may be covered if it meets the policy's criteria. Some policies may have waiting periods or exclusions for specific conditions. It's crucial to review the policy's terms and conditions and discuss any concerns with your insurance provider to understand the coverage for pre-existing conditions.

Pet insurance policies offer a vital safety net for pet owners, providing financial protection and peace of mind. By understanding the coverage options, considering your pet’s unique needs, and selecting the right policy, you can ensure your furry companion receives the best possible care throughout their lifetime. As the pet insurance industry continues to evolve, it will play an increasingly important role in promoting the health and well-being of our beloved pets.