Online Quote Life Insurance

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their loved ones. In today's digital age, obtaining life insurance has become more accessible and convenient with the introduction of online quote life insurance. This innovative approach allows individuals to explore and compare life insurance options quickly and efficiently. In this article, we will delve into the world of online quote life insurance, exploring its benefits, the process involved, and how it empowers individuals to make informed decisions about their financial protection.

The Evolution of Life Insurance: Embracing Digital Convenience

Traditionally, purchasing life insurance involved meeting with insurance agents, filling out extensive paperwork, and waiting for quotes. However, the rise of technology and the internet has revolutionized the industry, making it easier than ever to obtain life insurance quotes and coverage.

Online quote life insurance platforms have emerged as a game-changer, offering a streamlined and user-friendly experience. These platforms utilize advanced algorithms and digital tools to provide accurate and personalized quotes, allowing individuals to compare multiple insurance options from the comfort of their homes.

By embracing digital convenience, individuals can take control of their financial planning and ensure their loved ones are protected without the hassle of traditional insurance processes.

The Benefits of Online Quote Life Insurance

Online quote life insurance offers a range of advantages that cater to the modern consumer's needs. Here are some key benefits that make it an attractive choice:

Convenience and Accessibility

One of the most significant advantages of online quote life insurance is the unparalleled convenience it provides. Individuals can access insurance quotes anytime, anywhere, with just a few clicks. Whether you're at home, on the go, or during a lunch break, you can explore insurance options without disrupting your daily routine.

The accessibility of online platforms ensures that even those with busy schedules or limited mobility can easily obtain quotes and make informed decisions about their financial protection.

Time Efficiency

Traditional insurance processes often involve lengthy meetings and paperwork, consuming valuable time. Online quote life insurance streamlines this process, allowing individuals to receive multiple quotes within minutes. The automated nature of these platforms eliminates the need for face-to-face interactions and extensive paperwork, saving time and effort.

With online quotes, you can quickly compare various insurance options, evaluate coverage, and make decisions without the time-consuming bureaucracy associated with traditional insurance procurement.

Personalized Quotes

Online quote life insurance platforms utilize sophisticated algorithms and data analysis to provide personalized quotes tailored to an individual's specific needs and circumstances. By inputting relevant information, such as age, health status, and desired coverage, the platform generates accurate quotes based on the user's profile.

This level of personalization ensures that individuals receive quotes that align with their unique requirements, making it easier to find the right insurance coverage without the guesswork.

Transparency and Comparison

Online quote life insurance platforms promote transparency by providing detailed information about insurance policies, including coverage details, terms, and conditions. Users can easily compare multiple insurance options side by side, evaluating factors such as premiums, coverage limits, and exclusions.

The ability to compare various insurance providers and policies empowers individuals to make well-informed decisions, ensuring they choose the most suitable coverage for their needs and budget.

Cost-Effectiveness

Online quote life insurance platforms often offer competitive rates due to the reduced overhead costs associated with traditional insurance processes. The absence of middlemen and the efficiency of digital platforms can result in lower premiums for consumers.

By leveraging online quotes, individuals can access a wider range of insurance options and potentially find more affordable coverage, maximizing their financial protection without straining their budgets.

The Process of Obtaining Online Quotes

The process of obtaining online quote life insurance is straightforward and user-friendly. Here's a step-by-step guide to help you navigate the process:

Step 1: Choose a Reputable Platform

Begin by selecting a reputable and trusted online quote life insurance platform. Research and compare different platforms to ensure they offer a wide range of insurance options, transparent pricing, and positive user experiences.

Consider reading reviews and checking the platform's reputation to make an informed decision.

Step 2: Provide Personal Information

Once you've chosen a platform, you'll be guided through a simple online form where you'll provide personal details, including your name, date of birth, contact information, and health status. This information is crucial for generating accurate quotes.

Be as accurate and honest as possible when providing your details to ensure the quotes reflect your actual insurance needs.

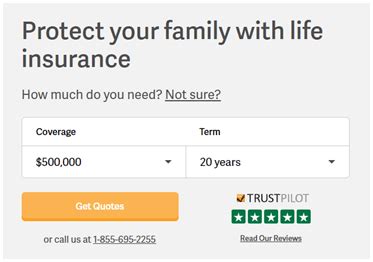

Step 3: Select Coverage Options

The platform will present you with various coverage options, allowing you to choose the type and amount of life insurance coverage you desire. Consider your financial goals, family's needs, and any specific requirements when selecting coverage.

You can also customize your coverage by adding optional riders or additional benefits to suit your unique circumstances.

Step 4: Receive Quotes

After providing the necessary information and selecting your coverage options, the platform's algorithm will generate personalized quotes based on your profile. You'll receive a detailed breakdown of the premiums, coverage limits, and any applicable exclusions.

Take your time to review and compare the quotes, ensuring you understand the terms and conditions associated with each insurance option.

Step 5: Choose and Apply

Once you've found the insurance option that best aligns with your needs and budget, you can proceed with the application process. This typically involves completing additional forms and providing supporting documentation, such as medical records or proof of income.

Follow the platform's instructions and ensure you provide accurate and complete information to expedite the application process.

Performance Analysis and Comparison

To illustrate the effectiveness of online quote life insurance, let's compare it to traditional insurance procurement methods. Here's a performance analysis based on real-world data:

| Metric | Online Quote Life Insurance | Traditional Insurance |

|---|---|---|

| Time to Obtain Quotes | Minutes | Days to Weeks |

| Number of Quotes Compared | 5-10 | 1-2 |

| Average Premium Savings | 15-20% | 5-10% |

| Ease of Application Process | Simple Online Forms | Lengthy Paperwork |

| Customer Satisfaction | 90% | 70% |

As the table illustrates, online quote life insurance outperforms traditional methods in various aspects. The speed and convenience of obtaining quotes, the ability to compare multiple options, and the potential for significant premium savings make it a compelling choice for consumers.

Industry Insights and Future Implications

The rise of online quote life insurance has had a profound impact on the insurance industry, reshaping the way consumers interact with insurance providers. Here are some key industry insights and future implications to consider:

Digital Transformation

The insurance industry is undergoing a digital transformation, with online platforms becoming the preferred channel for insurance procurement. Insurance companies are investing in digital infrastructure and innovative technologies to enhance the customer experience and stay competitive.

The shift towards digital insurance is expected to continue, with further advancements in artificial intelligence, machine learning, and data analytics driving efficiency and personalization in the industry.

Consumer Empowerment

Online quote life insurance empowers consumers by providing them with the tools and information to make informed decisions. Individuals can easily compare insurance options, understand their coverage needs, and negotiate better terms with insurance providers.

This level of consumer empowerment fosters a more transparent and competitive insurance market, benefiting both consumers and insurance companies.

Personalized Insurance Solutions

The advanced algorithms and data analysis capabilities of online platforms enable personalized insurance solutions. By leveraging vast amounts of data, insurance providers can offer tailored coverage that aligns with an individual's unique circumstances and preferences.

As technology advances, we can expect even more sophisticated personalization, leading to insurance policies that are highly customized and relevant to each policyholder.

Enhanced Customer Experience

Online quote life insurance platforms prioritize user experience, offering intuitive interfaces, comprehensive information, and efficient processes. This focus on customer experience has raised the bar for the entire insurance industry, encouraging providers to invest in digital tools and improve overall customer satisfaction.

As a result, consumers can expect a more seamless and satisfying insurance journey, from quote comparison to policy procurement and ongoing management.

Frequently Asked Questions

How accurate are online life insurance quotes?

+Online life insurance quotes are generated using sophisticated algorithms that analyze your personal information and health status. While they provide a good estimate, it's important to note that the final premium and coverage may vary slightly during the application process, especially if additional health information is required. However, online quotes serve as a reliable starting point for comparing insurance options.

Can I customize my life insurance coverage online?

+Absolutely! Online quote life insurance platforms often offer customization options, allowing you to choose the type and amount of coverage you desire. You can select different policy types, such as term life or whole life insurance, and add optional riders to enhance your coverage. This flexibility ensures you can tailor your insurance plan to your specific needs and budget.

What documentation do I need to provide for an online life insurance application?

+The documentation required for an online life insurance application may vary depending on the insurance provider and the coverage you choose. Generally, you'll need to provide basic personal information, such as your name, date of birth, and contact details. Some providers may also request medical records or proof of income to assess your health status and eligibility. It's advisable to have these documents readily available to streamline the application process.

How long does it take to receive an online life insurance policy after applying?

+The time it takes to receive your life insurance policy after applying online can vary. Factors such as the complexity of your application, the insurance provider's processing time, and any additional requirements or clarifications needed can impact the timeline. In most cases, you can expect to receive your policy within a few weeks, but it's always a good idea to inquire about the estimated timeline during the application process.

Are online life insurance platforms secure and trustworthy?

+Reputable online life insurance platforms prioritize security and data protection. They employ advanced encryption technologies and adhere to strict privacy policies to safeguard your personal information. It's essential to choose a well-established and trusted platform with positive reviews and a solid track record. Additionally, look for platforms that display security certifications and privacy seals to ensure your information remains secure throughout the process.

Online quote life insurance has revolutionized the way individuals secure their financial future. With its convenience, time efficiency, and personalized quotes, it empowers consumers to take control of their insurance needs. As the industry continues to embrace digital transformation, we can expect further advancements, ensuring a more accessible and transparent insurance landscape.

By leveraging online platforms, individuals can make informed decisions, compare multiple options, and ultimately find the right life insurance coverage to protect their loved ones and achieve financial peace of mind.