Usaa Trip Insurance

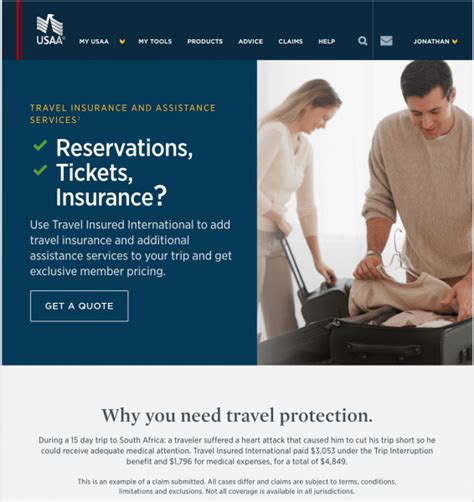

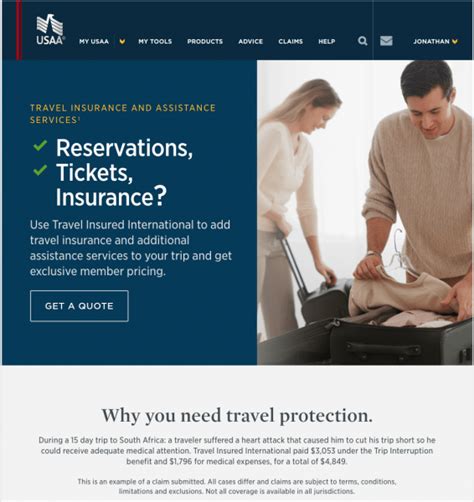

Traveling is an enriching experience that opens doors to new cultures, adventures, and unforgettable memories. However, unforeseen circumstances can arise during our journeys, and it's crucial to be prepared. This is where USAA Trip Insurance steps in, offering comprehensive coverage to protect your travels and ensure peace of mind.

Understanding USAA Trip Insurance

USAA Trip Insurance is a specialized insurance product designed to safeguard travelers against various risks and unexpected events that may occur during their trips. Backed by the trusted name of USAA, a leading financial services provider, this insurance offers a range of benefits tailored to the unique needs of travelers.

Whether you're embarking on a leisure trip, a business journey, or even a study abroad program, USAA Trip Insurance aims to provide the necessary coverage to address common travel concerns. From trip cancellations and delays to medical emergencies and lost luggage, this insurance aims to cover a wide spectrum of potential issues.

Key Features and Benefits

USAA Trip Insurance offers a comprehensive suite of features designed to address the diverse needs of travelers. Some of the key benefits include:

- Trip Cancellation and Interruption Coverage: This feature provides reimbursement for prepaid and non-refundable trip expenses if your travel plans are canceled or interrupted due to covered reasons. This can include personal illness or injury, travel companion's illness, or even natural disasters at your destination.

- Emergency Medical and Dental Coverage: In the event of a medical or dental emergency during your trip, this coverage ensures you receive the necessary treatment without worrying about the financial burden. It covers expenses such as doctor visits, hospital stays, and even emergency dental procedures.

- Travel Delay Reimbursement: If your trip is delayed due to reasons beyond your control, such as severe weather or common carrier delays, this coverage reimburses you for additional expenses incurred during the delay, including accommodation and meals.

- Baggage and Personal Effects Protection: USAA Trip Insurance provides coverage for lost, stolen, or damaged baggage and personal items. This ensures you can replace essential items without incurring significant costs.

- 24/7 Travel Assistance Services: Access to a dedicated team of travel assistance specialists who can provide support and guidance during emergencies. This includes assistance with medical referrals, legal referrals, and even language interpretation services.

Additionally, USAA Trip Insurance offers flexible plan options to cater to different travel durations and needs. Whether you're planning a short weekend getaway or an extended international trip, there's a plan suited to your requirements.

Real-World Application

Let’s consider a scenario to understand the practical benefits of USAA Trip Insurance. Imagine you’re planning a dream vacation to Europe, and you’ve booked flights, accommodations, and various tours months in advance. Unfortunately, just a few days before your departure, you fall ill and your doctor advises against traveling. With USAA Trip Insurance, you can file a claim for trip cancellation, and the insurance provider will reimburse you for the non-refundable expenses associated with your canceled trip.

Not only does this coverage provide financial relief, but it also alleviates the stress and anxiety associated with unexpected events. You can rest assured knowing that your travel investments are protected, and you can plan your trip again when you're fully recovered.

Eligibility and Enrollment

USAA Trip Insurance is primarily available to USAA members, who typically include active, retired, and separated U.S. military members and their families. However, it’s important to note that eligibility criteria and plan availability may vary based on individual circumstances and the specific insurance plan.

To enroll in USAA Trip Insurance, you can visit the USAA website or contact their customer service team. The enrollment process typically involves providing personal details, trip information, and selecting the appropriate coverage plan based on your needs. It's recommended to review the policy terms and conditions carefully to understand the coverage limits, exclusions, and any applicable deductibles.

Coverage Limits and Exclusions

While USAA Trip Insurance offers comprehensive coverage, it’s essential to be aware of the coverage limits and any potential exclusions. These may include pre-existing medical conditions, high-risk activities, and certain types of travel, such as adventure sports or trips to politically unstable regions. It’s crucial to review the policy documents thoroughly to understand what is and isn’t covered.

| Coverage Category | Coverage Limit |

|---|---|

| Trip Cancellation | $10,000 per insured person |

| Emergency Medical Expenses | $500,000 per insured person |

| Travel Delay | $200 per day, up to $1,000 |

| Baggage Delay | $200 per trip |

| Lost or Damaged Baggage | $1,000 per trip |

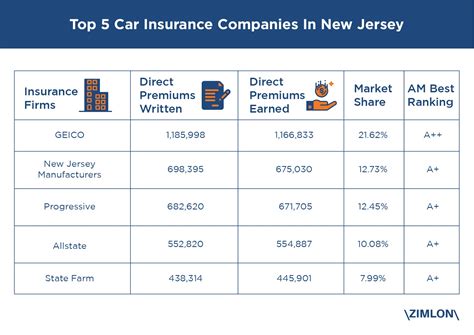

Comparison with Other Trip Insurance Providers

When considering trip insurance, it’s beneficial to explore multiple options and compare providers. While USAA Trip Insurance offers robust coverage, other reputable providers like Allianz, Travelex, and Travel Insured International also provide comprehensive trip insurance plans.

Comparing factors such as coverage limits, policy exclusions, and customer reviews can help you make an informed decision. Additionally, consider the reputation and financial stability of the insurance provider to ensure your coverage is reliable and trustworthy.

Customer Testimonials and Reviews

Hearing from real customers who have utilized USAA Trip Insurance can provide valuable insights into the effectiveness and reliability of the coverage. Here are a few testimonials:

"USAA Trip Insurance gave me the peace of mind I needed when traveling internationally. Knowing that I was covered for medical emergencies and trip cancellations made my trip much less stressful."

- John M., USAA Member

"I was impressed with the prompt and efficient claims process after my trip was canceled due to a family emergency. USAA made the reimbursement process seamless, and I highly recommend their trip insurance."

- Sarah B., Satisfied Customer

Future Trends and Developments

The travel insurance industry is continuously evolving to meet the changing needs and expectations of travelers. As technology advances, we can expect to see improvements in the efficiency and convenience of trip insurance processes. This includes digital claims submissions, real-time trip monitoring, and personalized coverage recommendations based on individual travel profiles.

Additionally, with the increasing awareness of environmental concerns, there may be a growing demand for sustainable travel insurance options. Insurers may explore ways to incorporate eco-friendly practices and support sustainable travel initiatives.

Conclusion

USAA Trip Insurance stands as a reliable and comprehensive solution for travelers seeking peace of mind during their journeys. With a range of coverage options, flexible plans, and dedicated support services, USAA ensures that its members can travel with confidence. By understanding the key features, eligibility criteria, and coverage limits, travelers can make informed decisions and protect their travel investments effectively.

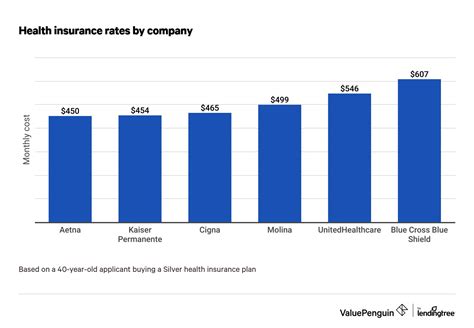

What is the cost of USAA Trip Insurance?

+The cost of USAA Trip Insurance varies based on factors such as the duration of the trip, the destination, and the chosen coverage plan. It’s recommended to obtain a quote specific to your travel needs to determine the exact cost.

Does USAA Trip Insurance cover pre-existing medical conditions?

+While USAA Trip Insurance offers coverage for certain pre-existing medical conditions, it’s important to review the policy terms carefully. Some conditions may require additional coverage or may not be covered at all. It’s advisable to discuss your specific situation with a USAA representative.

Can I purchase USAA Trip Insurance for a single trip or is it only available for multiple trips?

+USAA Trip Insurance offers both single-trip and multi-trip plans. The choice depends on your travel frequency and preferences. Single-trip plans are ideal for occasional travelers, while multi-trip plans provide coverage for multiple trips within a specified period.