Single Medical Insurance Cost

Understanding the cost of single medical insurance is essential for individuals navigating the healthcare system independently. This comprehensive guide delves into the factors influencing the cost of single medical insurance, providing an in-depth analysis of the variables and strategies to manage expenses effectively.

The Landscape of Single Medical Insurance Costs

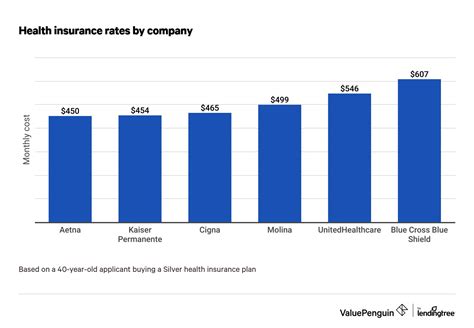

The price of single medical insurance varies significantly across different regions and healthcare systems. In the United States, for instance, the cost of individual health plans can range from a few hundred dollars to over a thousand dollars per month, depending on various factors. These factors include age, location, tobacco use, and the level of coverage chosen.

In Europe, the cost structure differs, with some countries offering universal healthcare coverage and others relying on a mix of public and private insurance. For those opting for private insurance, the cost can vary based on the insurer, the level of coverage, and the individual's health status.

In Asia, the healthcare landscape is diverse, with some countries providing comprehensive public healthcare and others relying on a combination of public and private systems. The cost of single medical insurance in this region can be influenced by factors such as the level of economic development, the individual's nationality, and the chosen level of coverage.

Key Factors Influencing Insurance Premiums

Several factors contribute to the cost of single medical insurance. One of the primary influences is the individual’s age. Generally, younger individuals pay lower premiums as they are statistically less likely to require extensive medical care. As one ages, the risk of health issues increases, leading to higher insurance costs.

The geographical location is another significant factor. Healthcare costs can vary drastically between different states or regions within a country, influenced by factors such as the cost of living, the availability of healthcare facilities, and the overall healthcare infrastructure.

Tobacco use is often a key determinant in insurance premiums. Individuals who use tobacco products, including cigarettes, cigars, or e-cigarettes, are typically charged higher premiums due to the increased health risks associated with tobacco consumption.

| Age Group | Average Monthly Premium |

|---|---|

| 18-24 | $250 - $400 |

| 25-34 | $300 - $500 |

| 35-44 | $400 - $650 |

| 45-54 | $500 - $800 |

| 55-64 | $650 - $1,000 |

The level of coverage chosen is a critical factor in determining the cost of insurance. Basic coverage plans, which typically cover essential healthcare services, often come with lower premiums. Conversely, comprehensive plans that offer a wide range of benefits and cover a broader spectrum of medical services carry higher costs.

Strategies to Manage Single Medical Insurance Costs

While the cost of single medical insurance can be daunting, there are strategies to manage these expenses effectively. One approach is to compare quotes from multiple insurance providers. By shopping around, individuals can find plans that offer the best value for their specific needs.

Choosing a higher deductible can also reduce monthly premiums. A deductible is the amount an insured person pays out of pocket before the insurance coverage kicks in. While this strategy can lower monthly costs, it means that individuals will have to pay more if they require extensive medical care.

Another strategy is to enroll in health-based programs offered by insurance companies. These programs often reward individuals for maintaining a healthy lifestyle by offering discounts or rebates on insurance premiums. For example, some insurers provide incentives for quitting smoking, maintaining a healthy weight, or participating in fitness programs.

Additionally, staying informed about insurance coverage options and understanding the fine print of insurance policies is crucial. This knowledge can help individuals make informed decisions about their healthcare and insurance needs.

The Role of Technology in Managing Insurance Costs

In today’s digital age, technology plays a significant role in managing insurance costs. Online platforms and mobile applications offer convenient ways to compare insurance plans, understand coverage details, and enroll in policies. These tools provide transparency and ease of access, empowering individuals to make informed choices about their healthcare coverage.

Furthermore, technology-driven solutions can help individuals track their health metrics, monitor their insurance usage, and stay on top of their healthcare needs. For instance, fitness tracking apps and digital health platforms can provide insights into an individual's health status, potentially influencing their insurance costs.

In conclusion, the cost of single medical insurance is influenced by a multitude of factors, and managing these costs requires a strategic approach. By understanding these factors, comparing insurance options, and utilizing technology, individuals can navigate the healthcare system effectively and make informed decisions about their health and financial well-being.

What is the average cost of single medical insurance in the United States?

+The average cost of single medical insurance in the U.S. varies significantly based on factors such as age, location, and coverage level. However, on average, one can expect to pay anywhere between 300 to 800 per month for individual health plans.

Are there any ways to reduce the cost of single medical insurance?

+Yes, there are strategies to manage insurance costs. These include comparing quotes, choosing plans with higher deductibles, participating in health-based programs, and staying informed about coverage options.

How does tobacco use impact insurance premiums?

+Tobacco use is a significant factor in determining insurance premiums. Individuals who use tobacco products are typically charged higher premiums due to the increased health risks associated with tobacco consumption.