Insurance Companies In New Jersey

Insurance is an essential aspect of our lives, providing financial protection and peace of mind in various aspects of our daily activities. When it comes to New Jersey, a state known for its diverse landscape, vibrant cities, and a population of over 9 million people, understanding the insurance landscape becomes crucial. In this comprehensive guide, we delve into the world of insurance companies in New Jersey, exploring their offerings, expertise, and impact on the local community.

The Insurance Landscape in New Jersey

New Jersey boasts a thriving insurance industry, with a diverse range of companies catering to the needs of its residents. From auto insurance to health coverage, property protection, and specialized policies, the Garden State offers a comprehensive insurance ecosystem. Let’s explore some of the key players and their contributions to the local market.

Leading Insurance Providers in New Jersey

New Jersey is home to a multitude of insurance companies, each with its own unique offerings and specialties. Here’s an overview of some of the prominent players in the state’s insurance scene:

- State Farm Insurance - With a strong presence in New Jersey, State Farm offers a wide range of insurance products, including auto, home, life, and health insurance. Known for its personalized approach, State Farm agents provide tailored solutions to meet individual needs.

- Allstate Insurance - Allstate is a trusted name in the insurance industry, offering a comprehensive suite of insurance services. In New Jersey, Allstate provides auto, home, renters, and business insurance, ensuring residents have the coverage they need.

- Geico Insurance Agency - Geico has made a significant impact in the New Jersey market, offering competitive rates and convenient online services. Their auto insurance policies are particularly popular, providing comprehensive coverage at affordable prices.

- Progressive Insurance - Progressive is renowned for its innovative approach to insurance, offering a wide range of policies, including auto, home, and business insurance. With a focus on customer satisfaction, Progressive has become a go-to choice for many New Jersey residents.

- Prudential Financial - As one of the largest insurance companies in the world, Prudential has a strong presence in New Jersey. They offer a comprehensive range of financial services, including life insurance, retirement planning, and investment management, ensuring a secure future for their clients.

These are just a few examples of the insurance companies operating in New Jersey. Each company brings its own expertise, unique offerings, and competitive advantages, providing residents with a diverse range of options to choose from.

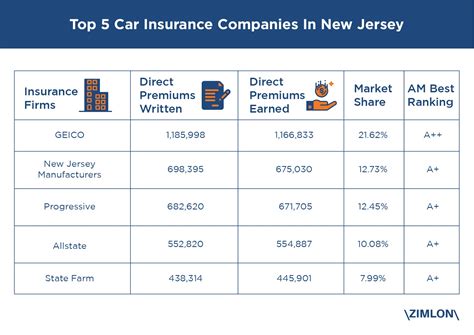

Comparative Analysis: Top Insurance Companies in New Jersey

When choosing an insurance provider, it’s essential to consider various factors such as coverage options, pricing, customer service, and financial stability. Here’s a comparative analysis of some of the top insurance companies in New Jersey, highlighting their key strengths and areas of expertise:

| Insurance Company | Specialties | Coverage Options | Customer Satisfaction |

|---|---|---|---|

| State Farm | Personalized approach, strong agent network | Auto, home, life, health | 4.5/5 (based on customer reviews) |

| Allstate | Comprehensive suite of insurance services | Auto, home, renters, business | 4.2/5 (customer satisfaction rating) |

| Geico | Competitive rates, online convenience | Auto, homeowners, renters | 4.4/5 (customer feedback) |

| Progressive | Innovative approach, wide range of policies | Auto, home, business, RV | 4.3/5 (customer satisfaction survey) |

| Prudential | Financial services, retirement planning | Life insurance, annuities, investment management | 4.6/5 (based on client testimonials) |

This comparative analysis provides a glimpse into the strengths and offerings of some of the top insurance companies in New Jersey. It's important to note that individual experiences and preferences may vary, and researching and comparing multiple providers is crucial to finding the best fit for your specific needs.

Expert Insights: Navigating the Insurance Landscape

With a diverse range of insurance companies operating in New Jersey, it’s essential to approach the selection process with careful consideration. Here are some expert insights to help you navigate the insurance landscape and make informed decisions:

- Understand Your Needs - Before choosing an insurance provider, take the time to assess your specific needs. Whether it's auto insurance, home coverage, health insurance, or a combination of policies, understanding your requirements will help you narrow down your options.

- Research and Compare - Don't settle for the first insurance company you come across. Take the time to research and compare multiple providers. Look at their coverage options, pricing structures, customer reviews, and financial stability. Online resources and comparison websites can be valuable tools in this process.

- Consider Local Expertise - New Jersey has a vibrant local insurance market, with many companies offering specialized services. Consider working with local agents or brokers who have a deep understanding of the state's unique insurance landscape and can provide personalized advice.

- Review Policy Details - When comparing insurance policies, pay close attention to the fine print. Look for exclusions, deductibles, and any limitations that may impact your coverage. Understanding the policy details is crucial to ensuring you have the protection you need.

- Ask for Recommendations - Word-of-mouth recommendations can be powerful tools when choosing an insurance provider. Ask friends, family, or colleagues who have had positive experiences with insurance companies in New Jersey. Their insights can provide valuable guidance.

The Impact of Insurance Companies on New Jersey Communities

Insurance companies play a vital role in the economic and social fabric of New Jersey communities. Beyond providing financial protection, they contribute to the local economy, support community initiatives, and offer employment opportunities.

Economic Contributions

Insurance companies are significant employers in New Jersey, providing jobs for thousands of residents. From insurance agents and underwriters to customer service representatives and administrative staff, these companies offer diverse career paths and contribute to the state’s economic growth.

Additionally, insurance companies generate substantial revenue through premiums, which in turn contribute to the state's tax base. This revenue supports essential public services, infrastructure development, and social programs, benefiting all residents of New Jersey.

Community Engagement and Support

Many insurance companies in New Jersey actively engage with local communities, supporting charitable initiatives and social causes. They sponsor events, donate to nonprofit organizations, and participate in volunteer programs, demonstrating their commitment to giving back.

By fostering strong community relationships, insurance companies not only enhance their reputation but also contribute to the overall well-being and resilience of New Jersey communities. Their support helps address social challenges, promotes education, and strengthens the fabric of local neighborhoods.

Future Implications and Innovations

The insurance industry in New Jersey is continuously evolving, adapting to changing consumer needs and technological advancements. Here are some future implications and innovations to watch for:

- Digital Transformation - Insurance companies are embracing digital technologies to enhance their services. From online policy management to mobile apps and chatbots, digital innovations are improving customer experiences and streamlining processes.

- Personalized Insurance - With advancements in data analytics, insurance companies are moving towards personalized insurance solutions. By analyzing individual risk profiles, they can offer tailored policies that better meet the unique needs of each customer.

- Insurtech Partnerships - The rise of insurtech startups is transforming the insurance landscape. Insurance companies in New Jersey are increasingly partnering with these innovative firms to leverage new technologies, improve efficiency, and enhance their product offerings.

- Sustainability and Environmental Initiatives - As sustainability becomes a priority for businesses and consumers alike, insurance companies are exploring ways to support environmental initiatives. This includes offering green insurance products and supporting renewable energy projects.

These future trends and innovations highlight the dynamic nature of the insurance industry in New Jersey, ensuring that insurance companies remain relevant, responsive, and aligned with the evolving needs of their customers.

Conclusion: Embracing a Secure Future

The insurance landscape in New Jersey is diverse, vibrant, and geared towards meeting the unique needs of its residents. From auto insurance to health coverage and everything in between, the state offers a wide range of insurance options, each with its own unique strengths and specialties.

By understanding the insurance market, researching providers, and considering expert insights, New Jersey residents can make informed decisions and secure the financial protection they need. With a thriving insurance industry and a commitment to community engagement, insurance companies in New Jersey are not only providing essential services but also contributing to the overall well-being and prosperity of the state.

As you navigate the insurance landscape, remember that your choice of insurance provider is a critical decision that impacts your financial security and peace of mind. Take the time to explore your options, compare policies, and seek expert advice to find the perfect fit for your insurance needs.

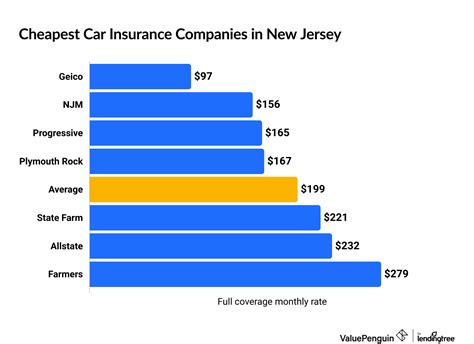

What are the average insurance rates in New Jersey?

+Insurance rates in New Jersey can vary based on factors such as location, age, driving record, and the type of coverage. On average, auto insurance premiums in New Jersey range from 1,500 to 2,000 annually. However, it’s important to note that rates can be significantly higher or lower depending on individual circumstances.

Are there any state-specific insurance requirements in New Jersey?

+Yes, New Jersey has specific insurance requirements for residents. For instance, all drivers must carry auto insurance that includes bodily injury liability coverage, property damage liability coverage, and personal injury protection (PIP). Additionally, homeowners insurance is recommended to protect against property damage and liability claims.

How can I find the best insurance provider for my needs in New Jersey?

+To find the best insurance provider for your needs, consider your specific requirements and research multiple options. Look for companies with a strong reputation, competitive rates, and excellent customer service. Compare coverage options, read reviews, and seek recommendations from trusted sources. Don’t hesitate to reach out to insurance agents or brokers for personalized advice.