How To Obtain Health Insurance

In today's world, health insurance is an essential aspect of our lives, providing us with financial protection and peace of mind. Whether you're an individual seeking coverage or a business owner aiming to offer benefits to your employees, understanding the process of obtaining health insurance is crucial. This comprehensive guide will walk you through the steps, considerations, and options available to help you navigate the complex world of health insurance and make informed decisions.

Understanding Health Insurance: The Basics

Health insurance is a contract between an individual or a group and an insurance company, wherein the insurer agrees to cover a portion of the medical expenses incurred by the insured. This coverage typically includes a range of medical services, such as doctor visits, hospital stays, prescription medications, and specialized treatments. By paying a regular premium, policyholders gain access to a network of healthcare providers and can receive the necessary medical care without facing unaffordable out-of-pocket costs.

The concept of health insurance is rooted in the principle of risk sharing. Insurance companies pool the premiums paid by a large number of individuals or groups, allowing them to cover the medical expenses of those who require care. This collective risk management approach ensures that individuals with unexpected health issues do not bear the entire financial burden alone.

Health insurance plans can vary significantly in terms of coverage, cost, and provider networks. Understanding the different types of plans and their unique features is essential to making an informed choice. Here's an overview of some common health insurance plan types:

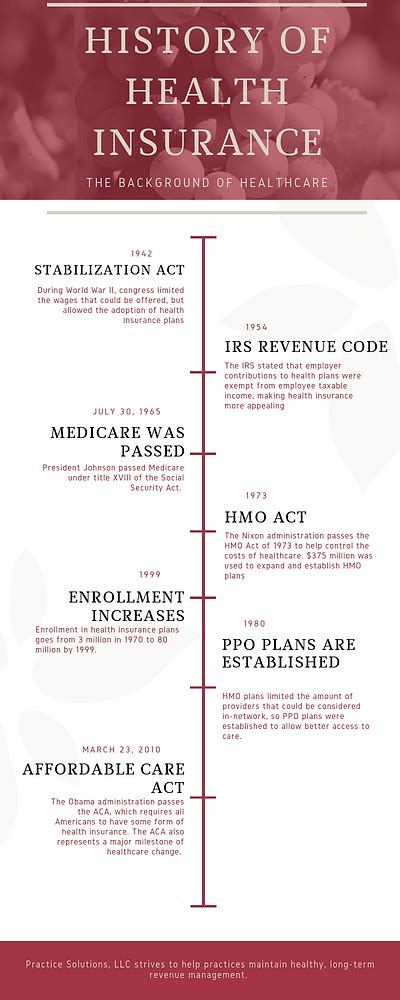

- Managed Care Plans: These plans, including Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), offer comprehensive coverage with a focus on preventative care. They typically require members to choose a primary care physician (PCP) and may require referrals for specialist visits. HMOs usually have more restricted provider networks, while PPOs offer more flexibility.

- Exclusive Provider Organizations (EPOs): Similar to PPOs, EPOs provide coverage for services within a specific network of healthcare providers. However, unlike PPOs, EPOs do not cover out-of-network care, except in emergencies.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs. Members typically select a PCP and receive coverage for in-network services, but they also have the option to seek out-of-network care with higher out-of-pocket costs.

- High-Deductible Health Plans (HDHPs): HDHPs are often paired with Health Savings Accounts (HSAs) and offer lower premiums but higher deductibles. They encourage policyholders to become more engaged in their healthcare decisions and can provide tax benefits through the HSA.

- Short-Term Health Insurance Plans: These plans offer temporary coverage for individuals facing gaps in their insurance, such as between jobs or during a transition period. They typically have lower premiums and more limited coverage compared to comprehensive plans.

Assessing Your Health Insurance Needs

Before diving into the process of obtaining health insurance, it’s crucial to assess your specific needs and circumstances. Consider the following factors to determine the type of coverage that aligns best with your requirements:

Your Health Status

Your current health status and medical history play a significant role in determining the level of coverage you need. If you have ongoing medical conditions or require regular specialist care, you may benefit from a plan with comprehensive coverage and a wide network of providers. On the other hand, if you’re generally healthy and rarely require medical attention, a plan with a higher deductible and lower premiums might be more suitable.

Family Considerations

If you have a family, their healthcare needs should be a primary consideration when choosing a health insurance plan. Plans that offer family coverage typically have higher premiums but provide peace of mind by covering the medical expenses of your entire household. It’s essential to evaluate the needs of each family member and choose a plan that accommodates their unique requirements.

Prescription Medication Needs

Prescription medications can be a significant expense, especially for individuals with chronic conditions. When assessing health insurance plans, pay close attention to their prescription drug coverage. Some plans have preferred pharmacies and offer discounted rates on certain medications, while others may have a more limited selection or require prior authorization for specific drugs. Understanding your medication needs and choosing a plan that covers them adequately is crucial.

Specialized Care Requirements

If you or your family members require specialized care, such as mental health services, maternity care, or treatment for specific conditions, ensure that the health insurance plan you choose provides coverage for these services. Some plans may have separate networks for specialized care, so it’s important to review the details carefully.

Financial Considerations

Health insurance can be a significant expense, so it’s essential to consider your financial situation when selecting a plan. Evaluate your budget and determine how much you can comfortably afford for premiums, deductibles, and out-of-pocket expenses. Remember that choosing a plan with lower premiums may result in higher out-of-pocket costs when you need medical care.

Exploring Health Insurance Options

Once you have a clear understanding of your health insurance needs, it’s time to explore the available options. Here are some common avenues to obtain health insurance coverage:

Employer-Sponsored Plans

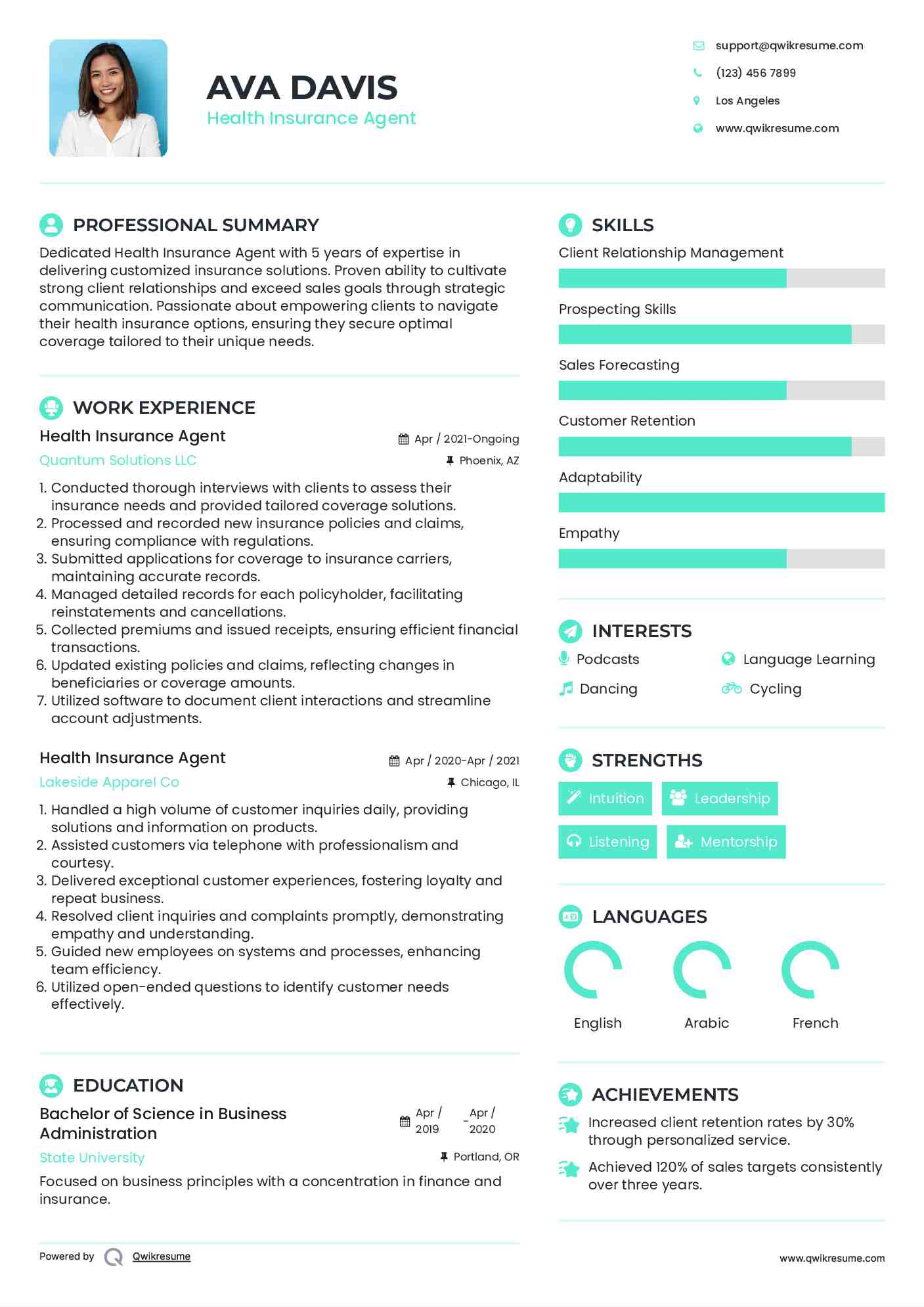

Many employers offer health insurance plans as part of their benefits package. These plans are often more cost-effective due to the employer’s contribution to the premiums. They may also provide a more comprehensive level of coverage tailored to the needs of the workforce. When considering employer-sponsored plans, compare the options available and understand the coverage, cost, and any potential limitations.

Individual and Family Plans

If you’re self-employed, unemployed, or your employer does not offer health insurance, you can purchase individual or family plans directly from insurance companies or through the Health Insurance Marketplace (also known as the Exchange) in your state. The Marketplace provides a platform to compare plans, offers subsidies for eligible individuals, and ensures that all plans meet certain standards.

Government Programs

Several government programs provide health insurance coverage to specific populations. These include:

- Medicare: A federal program for individuals aged 65 and older, as well as those with certain disabilities. Medicare has different parts, including Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage plans), and Part D (prescription drug coverage).

- Medicaid: A joint federal and state program that provides health coverage to low-income individuals and families. Eligibility and coverage can vary by state.

- Children's Health Insurance Program (CHIP): A program designed to provide health coverage to children in families with incomes that are too high to qualify for Medicaid but cannot afford private insurance.

Short-Term and Temporary Plans

If you’re between jobs, transitioning to a new insurance plan, or facing a temporary gap in coverage, short-term health insurance plans can provide temporary protection. These plans typically have lower premiums and more limited coverage compared to comprehensive plans. It’s important to note that pre-existing conditions may not be covered, and these plans may not meet the requirements of the Affordable Care Act (ACA) or state mandates.

The Process of Obtaining Health Insurance

Now that you have a solid understanding of your needs and the available options, let’s walk through the steps to obtain health insurance coverage:

Research and Compare Plans

Begin by researching and comparing different health insurance plans. Consider factors such as coverage, provider networks, premiums, deductibles, and out-of-pocket expenses. Online platforms and resources provided by insurance companies and government agencies can be valuable tools for gathering information and comparing plans.

When comparing plans, pay attention to the following:

- Coverage: Review the scope of coverage, including primary care, specialist visits, hospital stays, prescription drugs, and any additional benefits like mental health services or maternity care.

- Provider Networks: Check if your preferred healthcare providers are included in the plan's network. A wider network can provide more flexibility and access to a broader range of specialists.

- Premiums and Deductibles: Evaluate the cost of the premium and the amount of the deductible. Higher premiums may result in lower out-of-pocket costs when you need medical care, while lower premiums often come with higher deductibles.

- Out-of-Pocket Maximums: Understand the out-of-pocket maximum, which is the maximum amount you'll have to pay for covered services in a year. This can provide financial protection against unexpected medical expenses.

- Additional Benefits: Some plans offer extra benefits, such as wellness programs, telemedicine services, or discounted gym memberships. Consider whether these benefits align with your needs and preferences.

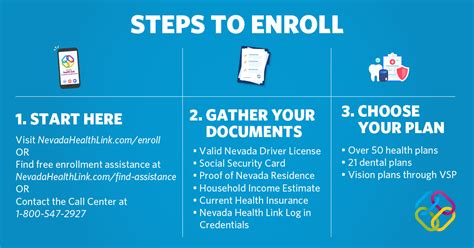

Apply for Coverage

Once you’ve identified the plan that best suits your needs, it’s time to apply for coverage. The application process can vary depending on the type of plan and the insurance company. Here are some common steps involved:

- Online Application: Many insurance companies offer online application forms, allowing you to apply for coverage conveniently from your computer or mobile device. These forms typically require personal information, such as your name, address, date of birth, and social security number.

- Paper Application: If online applications are not available or if you prefer a more traditional approach, you can request a paper application from the insurance company. Fill out the form and mail it back, along with any required supporting documents.

- Medical History: During the application process, you may be required to provide information about your medical history, including any pre-existing conditions or ongoing treatments. It's essential to be honest and accurate in your responses to ensure that your coverage is not impacted.

- Eligibility Verification: The insurance company will review your application and verify your eligibility for the chosen plan. This process may involve additional documentation or verification of your income or employment status.

Understanding Your Policy

Once your application is approved, you’ll receive a policy document outlining the terms and conditions of your health insurance coverage. It’s crucial to carefully review this document to ensure you understand your rights and responsibilities as a policyholder. Here are some key aspects to pay attention to:

- Coverage Details: Review the specifics of your coverage, including what is covered, any exclusions or limitations, and any requirements for obtaining certain services, such as referrals or prior authorization.

- Premiums and Payments: Understand the amount and frequency of your premium payments. Some plans may offer flexible payment options, such as monthly or quarterly installments.

- Deductibles and Out-of-Pocket Expenses: Be aware of the amount of your deductible and any other out-of-pocket expenses, such as copayments or coinsurance. These expenses are typically paid by you before the insurance coverage kicks in.

- Network Providers: Review the list of in-network providers to ensure that your preferred healthcare professionals are included. If not, consider the out-of-network benefits and any potential additional costs.

- Claim Submission Process: Understand how to submit claims for reimbursement and the necessary documentation required. Some plans may offer electronic claim submission, while others may require paper forms.

Maximizing Your Health Insurance Coverage

Now that you have health insurance coverage, it’s essential to make the most of it. Here are some tips to help you navigate your policy and get the most value from your health insurance:

Understanding Your Benefits

Familiarize yourself with the specific benefits and services covered by your health insurance plan. Review the policy document and any accompanying materials to understand the scope of your coverage. Pay attention to any limitations, exclusions, and requirements for obtaining certain services. By understanding your benefits, you can make informed decisions about your healthcare and avoid unexpected costs.

Choosing In-Network Providers

When selecting healthcare providers, prioritize those who are in your insurance plan’s network. In-network providers have agreed to accept the plan’s negotiated rates, which can result in lower out-of-pocket costs for you. Check the plan’s website or contact the insurance company to verify the network status of your preferred providers. By choosing in-network providers, you can ensure that your visits and procedures are covered at a more affordable rate.

Understanding Cost-Sharing

Cost-sharing refers to the portion of healthcare expenses that you, as the policyholder, are responsible for paying. This typically includes deductibles, copayments, and coinsurance. Understanding your cost-sharing obligations is crucial to managing your healthcare expenses effectively. Review your policy to determine the specific amounts you’ll need to pay for different types of services. Being aware of these costs can help you budget and plan for your healthcare needs.

Utilizing Preventive Care Services

Many health insurance plans offer preventive care services at little to no cost. These services, such as annual physical exams, immunizations, and screenings, are designed to help detect and prevent health issues before they become more serious and costly to treat. Take advantage of these preventive care benefits to maintain your health and well-being. By catching potential problems early, you can avoid more extensive and expensive treatments down the line.

Managing Chronic Conditions

If you have a chronic condition, such as diabetes or asthma, it’s essential to manage your health proactively. Work closely with your healthcare providers to develop a treatment plan and regularly monitor your condition. Many health insurance plans offer specialized programs or resources for individuals with chronic conditions. Take advantage of these programs, which can provide support, education, and tools to help you manage your condition effectively and improve your overall health.

Exploring Additional Benefits

Beyond the core coverage, some health insurance plans offer additional benefits that can enhance your overall healthcare experience. These may include wellness programs, telemedicine services, or discounts on fitness memberships. Explore the extra benefits available through your plan and consider how they can align with your personal health and wellness goals. By taking advantage of these additional resources, you can further improve your health and well-being.

Staying Informed and Engaged

Staying informed about your health insurance coverage and the healthcare system in general is essential. Keep up-to-date with any changes or updates to your plan, such as network provider changes or benefit modifications. Engage with your insurance company and healthcare providers to address any questions or concerns you may have. By staying informed and actively involved in your healthcare decisions, you can make the most of your health insurance coverage and ensure you receive the care you need.

Navigating Challenges and Changes

Obtaining health insurance is just the beginning of your healthcare journey. Throughout your coverage period, you may encounter various challenges or changes that require attention. Here are some common situations and how to navigate them:

Changing Jobs or Insurance Plans

If you change jobs or decide to switch insurance plans, it’s important to understand the transition process. When changing jobs, inquire about the new employer’s health insurance benefits and coverage options. If you’re switching plans, research the new plan’s coverage, provider network, and any potential gaps in coverage. Coordinate the timing of your coverage changes to ensure seamless protection. Remember to notify your previous insurer and provide any necessary documentation to facilitate a smooth transition.

Handling Pre-Existing Conditions

Pre-existing conditions, such as chronic illnesses or ongoing medical treatments, can pose challenges when obtaining health insurance. Under the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, it’s essential to be transparent about your health status during the application process. Some plans may have waiting periods or limitations for certain pre-existing conditions, so be aware of these restrictions and plan accordingly.

Addressing Coverage Gaps

Coverage gaps can occur when your insurance coverage ends before your new plan begins. This may happen when you change jobs, lose your job, or experience other life changes. To bridge these gaps, consider short-term health insurance plans or COBRA coverage, which allows you to temporarily continue your previous employer’s health insurance. Stay vigilant and plan ahead to ensure continuous coverage and avoid potential financial burdens during transitional periods.

Filing Claims and Resolving Disputes

When you receive medical care, it’s important to understand the claim submission process. Review your insurance policy to familiarize yourself with the steps involved in filing claims for reimbursement. Keep detailed records of your medical visits, procedures, and expenses. If you encounter any issues with claim denials or delays, reach out to your insurance company’s customer service or seek assistance from a healthcare advocate. Stay persistent and proactive in resolving any disputes to ensure you receive the coverage you’re entitled to.

The Future of Health Insurance

The world of health insurance is continually evolving, with ongoing advancements and innovations shaping the industry. As we move forward, several trends and developments are expected to influence the future of health insurance:

Digital Transformation

The digital revolution is transforming the health insurance landscape. Insurance companies are embracing technology to enhance the customer experience and streamline processes. From online applications and electronic claim submission to telemedicine services and digital health platforms