Affordable Health Insurance Missouri

Affordable Health Insurance in Missouri: Navigating Coverage Options for Cost-Effective Care

Securing affordable health insurance is a crucial aspect of financial planning and well-being, especially for residents of Missouri. With a range of options available, understanding the nuances of health insurance in the state is essential to making informed choices. This comprehensive guide aims to provide an in-depth exploration of affordable health insurance in Missouri, offering insights, tips, and real-world examples to assist individuals and families in navigating the complex landscape of healthcare coverage.

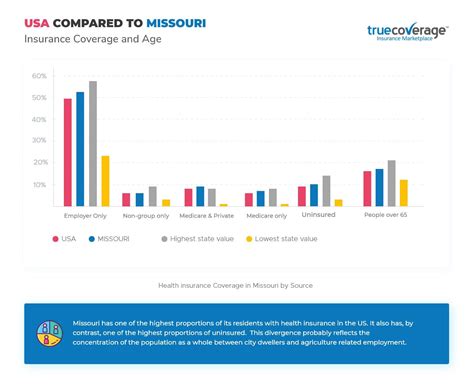

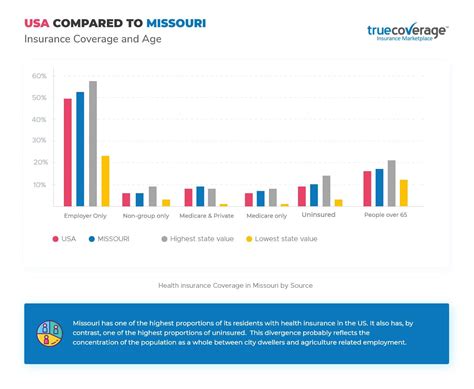

Understanding the Health Insurance Landscape in Missouri

The health insurance market in Missouri is diverse, offering various plans and coverage options to cater to the needs of its residents. From private insurers to public programs, understanding the key players and their offerings is the first step toward securing affordable and comprehensive coverage.

Private Health Insurance Providers

Missouri is served by several reputable private health insurance companies, each with its unique set of plans and policies. These providers offer a range of coverage options, including individual and family plans, as well as employer-sponsored group plans. Some of the prominent private insurers in the state include Blue Cross Blue Shield of Missouri, Anthem Blue Cross Blue Shield, and UnitedHealthcare. These companies provide a variety of plan types, such as HMO, PPO, and POS, each with its own network of healthcare providers and prescription drug coverage.

Private insurers often provide additional benefits and perks, such as wellness programs, preventive care incentives, and discounts on certain health services. They also offer a variety of deductible and copayment structures, allowing individuals to choose plans that align with their budget and healthcare needs.

Public Health Insurance Programs

In addition to private insurers, Missouri residents have access to public health insurance programs, which are government-funded initiatives designed to provide affordable coverage to eligible individuals and families. These programs include:

- Medicaid: This is a federal and state-funded program that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. In Missouri, Medicaid is known as MO HealthNet. To qualify, individuals must meet certain income and asset criteria. MO HealthNet covers a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and mental health services.

- Children's Health Insurance Program (CHIP): CHIP, also known as MO HealthNet for Kids in Missouri, provides low-cost health coverage to children in families who earn too much to qualify for Medicaid. The program covers children up to the age of 19 and offers comprehensive benefits, including regular check-ups, immunizations, dental care, and vision services.

- Affordable Care Act (ACA) Marketplace: The ACA, often referred to as Obamacare, established health insurance marketplaces where individuals and families can purchase qualified health plans. In Missouri, the HealthCare.gov marketplace is utilized. Residents can shop for plans during the annual Open Enrollment Period or qualify for a Special Enrollment Period due to certain life events. Marketplace plans offer essential health benefits and may provide cost-saving tax credits and subsidies for eligible individuals and families.

Factors Influencing Affordable Health Insurance in Missouri

When considering affordable health insurance options in Missouri, several key factors come into play. Understanding these factors is essential for making informed choices and securing the most cost-effective coverage.

Income and Eligibility

Income plays a significant role in determining eligibility for various health insurance programs in Missouri. For instance, Medicaid and CHIP have income thresholds that must be met to qualify. Individuals and families with lower incomes may find these public programs to be the most affordable option, as they often come with little to no out-of-pocket costs.

On the other hand, those with higher incomes may find private insurance plans more suitable. While these plans typically come with a higher premium, they offer more flexibility in terms of coverage options and provider networks. Additionally, some private insurers may offer discounts or incentives based on income level or other factors.

Age and Health Status

Age and health status are also crucial factors in determining health insurance affordability. Generally, younger individuals tend to have lower health insurance premiums as they are less likely to require extensive medical care. However, as individuals age, their health needs may increase, leading to higher premiums.

Pre-existing medical conditions can also impact insurance costs. Insurers may charge higher premiums or deny coverage altogether for individuals with certain health conditions. In such cases, public programs like Medicaid may be more beneficial, as they cannot deny coverage based on pre-existing conditions.

Plan Type and Coverage Options

The type of health insurance plan and the coverage options it provides can significantly impact affordability. For instance, plans with higher deductibles and out-of-pocket costs may have lower monthly premiums, making them more affordable in the short term. However, these plans may not be suitable for individuals who require frequent medical care or have chronic health conditions.

On the other hand, plans with lower deductibles and more comprehensive coverage may have higher monthly premiums but provide better financial protection in the long run. These plans are often more suitable for individuals with ongoing health needs or those who want peace of mind knowing they are covered for a wide range of medical services.

Tips for Finding Affordable Health Insurance in Missouri

Navigating the complex world of health insurance can be daunting, but with the right approach and resources, finding affordable coverage is within reach. Here are some expert tips to help Missouri residents secure the best possible health insurance deals.

Compare Plans and Prices

One of the most effective ways to find affordable health insurance is to compare plans and prices from different providers. Each insurer offers a unique set of plans with varying premiums, deductibles, and coverage options. By comparing these factors, individuals can identify the plans that best suit their budget and healthcare needs.

Missouri residents can utilize online tools and resources, such as the Missouri Health Insurance Marketplace or HealthCare.gov, to compare plans side by side. These platforms provide detailed information on each plan's coverage, costs, and network of providers, making it easier to make an informed decision.

Consider Your Healthcare Needs

Understanding your healthcare needs is crucial when selecting an affordable health insurance plan. Consider your past medical history, current health status, and any ongoing or anticipated medical treatments. If you have specific healthcare needs, such as ongoing medication or frequent doctor visits, ensure that the plan you choose covers these services adequately.

For example, if you require frequent prescription medications, look for plans with comprehensive prescription drug coverage and a wide range of preferred pharmacies. If you have a chronic condition, choose a plan that offers specialized care or disease management programs to help manage your condition effectively.

Explore Public Programs

Don’t overlook the public health insurance programs available in Missouri. These programs, such as Medicaid and CHIP, can provide comprehensive coverage at little to no cost for eligible individuals and families. Check your eligibility for these programs and apply if you meet the criteria. Even if you don’t qualify, understanding these programs can help you make more informed decisions when comparing private insurance plans.

Take Advantage of Special Enrollment Periods

In Missouri, the annual Open Enrollment Period for health insurance typically runs from November to December. However, individuals may also qualify for a Special Enrollment Period if they experience certain life events, such as losing job-based coverage, getting married, or having a baby. During a Special Enrollment Period, you can sign up for a health insurance plan outside of the regular Open Enrollment window.

Stay informed about the different life events that qualify for a Special Enrollment Period and take advantage of these opportunities to secure health insurance coverage when needed. This can be especially beneficial for individuals who experience unexpected changes in their healthcare needs or insurance coverage.

Real-Life Examples of Affordable Health Insurance in Missouri

To illustrate the variety of affordable health insurance options available in Missouri, let’s explore a few real-life scenarios and the plans that best suit each individual’s needs.

Scenario 1: Young Adult with No Major Health Concerns

Name: Emily Johnson

Age: 25

Health Status: Generally healthy, no major health concerns

Income: $35,000 annually

Emily, a young professional in Missouri, is looking for affordable health insurance that provides basic coverage without breaking the bank. She does not have any major health issues and rarely visits the doctor, so she's seeking a plan with a low monthly premium and a reasonable deductible.

After researching her options, Emily decides on a Blue Cross Blue Shield of Missouri Bronze plan. This plan has a low monthly premium of $250 and a deductible of $4,000. While the deductible is high, Emily is comfortable with this trade-off, as she anticipates minimal medical expenses. The plan includes coverage for doctor visits, hospital stays, and prescription drugs, ensuring she has the necessary coverage for unexpected health needs.

Scenario 2: Family with Young Children

Family Name: The Smith Family

Parents’ Ages: 35 and 37

Children’s Ages: 6 and 8

Health Status: Healthy, but with regular check-ups and immunizations for the children

Income: $60,000 annually

The Smith family is seeking affordable health insurance that covers their entire family, including regular check-ups and immunizations for their young children. They want a plan with a reasonable monthly premium and moderate out-of-pocket costs.

After comparing various options, they choose an Anthem Blue Cross Blue Shield Silver plan. This plan has a monthly premium of $650 for the family and a deductible of $2,500 per person. While the premium is higher than some other plans, the Smiths prioritize comprehensive coverage for their children's healthcare needs. The plan includes coverage for well-child visits, immunizations, and other essential services, providing peace of mind for the family.

Scenario 3: Senior Citizen with Chronic Health Conditions

Name: Robert Wilson

Age: 68

Health Status: Has a history of heart disease and diabetes

Income: $20,000 annually (Social Security benefits)

Robert, a senior citizen in Missouri, is looking for affordable health insurance that covers his ongoing medical needs, including regular doctor visits, prescription medications, and specialized care for his chronic conditions.

Given his health status and limited income, Robert qualifies for Medicare, the federal health insurance program for individuals aged 65 and older. He also enrolls in a Medicare Advantage plan, which is offered by private insurance companies and provides additional benefits beyond original Medicare. Robert's plan includes coverage for his prescription medications, specialist visits, and hospital stays, ensuring he receives the necessary care for his chronic conditions.

Future Implications and Industry Trends

The landscape of affordable health insurance in Missouri is continually evolving, influenced by various factors such as healthcare policy changes, economic shifts, and advancements in medical technology. Staying informed about these trends is essential for individuals and families to make proactive decisions regarding their health insurance coverage.

Impact of Policy Changes

Changes in healthcare policy at the federal and state levels can significantly impact the availability and affordability of health insurance in Missouri. For instance, the implementation of the Affordable Care Act (ACA) expanded access to health insurance for millions of Americans, including those in Missouri. The ACA’s provisions, such as the elimination of pre-existing condition exclusions and the establishment of health insurance marketplaces, have played a pivotal role in making health insurance more accessible and affordable.

However, future policy changes, such as potential modifications to the ACA or the introduction of new healthcare legislation, could bring about significant shifts in the health insurance market. Staying abreast of these policy developments is crucial for understanding how they may affect insurance options and costs.

Economic Factors and Healthcare Costs

The state of the economy and healthcare costs are closely intertwined. Economic downturns can lead to increased healthcare costs, as providers may raise prices to compensate for reduced patient volumes or other financial pressures. Conversely, a strong economy may bring about more competitive pricing and improved access to healthcare services.

In Missouri, as in many other states, the cost of healthcare continues to rise, impacting the affordability of insurance plans. As healthcare costs increase, insurers may need to adjust their premiums and deductibles, potentially affecting the affordability of coverage for individuals and families. Monitoring these economic trends is essential for anticipating changes in insurance costs and making informed decisions.

Advancements in Medical Technology

Advancements in medical technology, such as the development of innovative treatments and improved diagnostic tools, have the potential to both enhance patient care and impact insurance coverage. While these advancements can lead to better health outcomes, they may also result in increased healthcare costs.

As new treatments and technologies emerge, insurers must decide whether to cover these advancements and how to incorporate them into their plans. This can lead to changes in coverage options, premiums, and deductibles. Staying informed about these technological advancements can help individuals and families understand how they may affect their insurance coverage and make informed choices.

Conclusion: Empowering Missourians with Affordable Health Insurance

Securing affordable health insurance is a critical step toward ensuring the well-being of Missourians. By understanding the health insurance landscape, exploring various coverage options, and staying informed about industry trends, individuals and families can make empowered decisions to protect their health and financial stability.

This comprehensive guide has provided an in-depth look at affordable health insurance in Missouri, offering insights, tips, and real-world examples to assist readers in navigating the complex world of healthcare coverage. Remember, health insurance is a vital component of financial planning, and making informed choices can lead to better outcomes for both your health and your wallet.

Frequently Asked Questions

How do I know if I’m eligible for Medicaid in Missouri?

+Eligibility for Medicaid in Missouri is primarily based on income and certain other factors. Generally, individuals and families with low incomes are eligible for coverage. Income thresholds vary depending on household size and other considerations. To determine your eligibility, you can use the MO HealthNet eligibility tool on the Missouri Department of Social Services website or contact your local MO HealthNet office for assistance.

What is the difference between an HMO and a PPO plan?

+An HMO (Health Maintenance Organization) plan typically requires you to choose a primary care physician (PCP) and obtain referrals from the PCP to see specialists. HMO plans often have lower out-of-pocket costs but may limit your choice of providers to those within their network. A PPO (Preferred Provider Organization) plan, on the other hand, allows you to see any in-network provider without a referral. PPO plans often have higher out-of-pocket costs but provide more flexibility in choosing healthcare providers.

Are there any tax benefits associated with health insurance in Missouri?

+Yes, there are tax benefits associated with health insurance in Missouri. For instance, individuals and families who purchase health insurance through the Affordable Care Act (ACA) marketplace may be eligible for premium tax credits, which can lower the cost of their monthly premiums. Additionally, certain health-related expenses, such as medical bills and insurance premiums, may be tax-deductible. It’s important to consult with a tax professional to understand your specific tax benefits.

What should I do if I have a complaint about my health insurance provider in Missouri?

+If you have a complaint or concern about your health insurance provider in Missouri, you can file a formal complaint with the Missouri Department of Insurance, Financial Institutions, and Professional Registration (MDIFP). The MDIFP oversees the insurance industry in the state and can investigate and resolve consumer complaints. You can find more information and the complaint form on their website.