How Much Is Pet Insurance For Dogs

Pet insurance has become an increasingly popular topic among pet owners, especially those with beloved canine companions. With the rising costs of veterinary care and the unpredictability of pet health issues, many dog owners are seeking ways to financially protect their furry friends. This article aims to provide an in-depth analysis of the costs associated with pet insurance for dogs, offering valuable insights to help pet owners make informed decisions about their pets' healthcare.

Understanding Pet Insurance for Dogs

Pet insurance for dogs is a form of health coverage specifically designed to assist pet owners in managing the financial burden of veterinary expenses. Similar to human health insurance, pet insurance policies vary in coverage, premiums, and deductibles, allowing pet owners to choose a plan that best suits their needs and budget. By understanding the basics of pet insurance, pet owners can make informed choices to ensure their dogs receive the necessary medical care without compromising their financial stability.

Factors Influencing the Cost of Pet Insurance

The cost of pet insurance for dogs is influenced by a multitude of factors, each playing a crucial role in determining the overall premium. These factors include the breed of the dog, the pet’s age, the chosen coverage level, and the geographical location. Additionally, the insurance provider and the specific policy selected can significantly impact the cost. By examining these factors in detail, pet owners can gain a clearer understanding of how their choices contribute to the overall cost of pet insurance.

Breed and Age Considerations

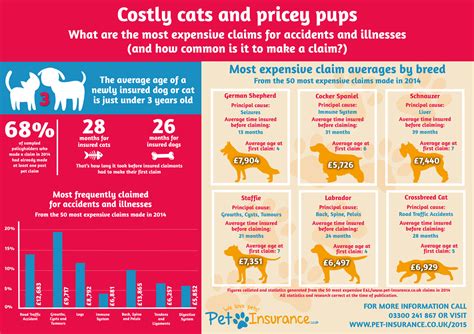

One of the primary factors influencing the cost of pet insurance is the breed and age of the dog. Certain dog breeds are predisposed to specific health conditions, which can increase the likelihood of costly veterinary treatments. For example, large breed dogs like German Shepherds and Golden Retrievers may be more susceptible to joint issues, while brachycephalic breeds such as Bulldogs and Pugs are prone to respiratory problems. Younger dogs, typically those under the age of 7, are often considered less risky by insurance providers due to their lower likelihood of developing chronic health issues. As a result, the breed and age of the dog significantly impact the cost of pet insurance, with certain breeds and older dogs often requiring higher premiums.

| Dog Breed | Average Premium (per month) |

|---|---|

| German Shepherd | $50 - $70 |

| Golden Retriever | $45 - $65 |

| Bulldog | $60 - $80 |

| Pug | $55 - $75 |

Coverage Levels and Deductibles

The level of coverage chosen by pet owners is another critical factor in determining the cost of pet insurance. Pet insurance policies typically offer a range of coverage options, including accident-only plans, basic wellness plans, and comprehensive plans covering accidents, illnesses, and routine care. The more comprehensive the coverage, the higher the premium is likely to be. Additionally, the deductible, which is the amount pet owners must pay out-of-pocket before the insurance coverage kicks in, can significantly impact the overall cost. Higher deductibles often result in lower premiums, while lower deductibles can increase the cost of insurance.

| Coverage Type | Average Premium (per month) |

|---|---|

| Accident-Only | $20 - $30 |

| Basic Wellness | $35 - $50 |

| Comprehensive | $50 - $80 |

Geographical Location and Provider Selection

The geographical location of the pet owner also plays a role in determining the cost of pet insurance. Insurance providers often consider the cost of living and veterinary fees in a particular area when setting premiums. Regions with higher veterinary costs or a higher concentration of specialty veterinary services may result in increased insurance premiums. Additionally, the choice of insurance provider can significantly impact the cost. Different providers offer varying levels of coverage, customer service, and financial stability, which can all influence the overall cost of insurance.

Analyzing Real-World Pet Insurance Costs

To provide a clearer picture of the costs associated with pet insurance for dogs, let’s examine some real-world examples. These examples will illustrate how the factors discussed above influence the premiums for different dogs and coverage levels.

Example 1: Young, Healthy Dog with Comprehensive Coverage

Let’s consider a 3-year-old Labrador Retriever named Max, living in a suburban area with an average cost of living. Max’s owner, Sarah, opts for a comprehensive pet insurance plan with a 500 deductible and 80% reimbursement rate. After researching various insurance providers, Sarah chooses a reputable company offering high-quality coverage. The monthly premium for Max's comprehensive plan is estimated at 55, providing Sarah with peace of mind and financial protection for Max’s healthcare needs.

Example 2: Senior Dog with Basic Wellness Coverage

Now, let’s look at an older dog, a 12-year-old Poodle named Charlie, residing in an urban area with higher veterinary costs. Charlie’s owner, David, chooses a basic wellness plan with a 250 deductible and 70% reimbursement rate to cover Charlie's routine care and unexpected accidents. Given the higher cost of living and veterinary fees in the urban area, David's monthly premium for Charlie's basic wellness plan is estimated at 60. While this plan may not cover all potential illnesses, it provides a cost-effective solution for Charlie’s routine healthcare needs.

Example 3: High-Risk Breed with Accident-Only Coverage

For our final example, let’s consider a 5-year-old French Bulldog named Luna, who is prone to respiratory issues due to her breed. Luna’s owner, Emily, opts for an accident-only insurance plan with a 1,000 deductible and 50% reimbursement rate. Given the higher risk associated with Luna's breed, Emily chooses a plan with a higher deductible to keep the monthly premium affordable. The estimated monthly premium for Luna's accident-only plan is 35, providing Emily with financial protection in case of accidents while managing the cost associated with Luna’s breed-specific health concerns.

The Benefits and Considerations of Pet Insurance

Pet insurance offers several benefits to pet owners, including financial protection, access to advanced veterinary care, and peace of mind. With pet insurance, pet owners can make informed decisions about their dog’s healthcare without worrying about the financial burden. Additionally, pet insurance can provide coverage for unexpected illnesses or accidents, ensuring that pets receive the necessary treatment. However, it’s important to carefully consider the cost and coverage options to find a plan that aligns with the pet’s specific needs and the owner’s financial capabilities.

Future Implications and Emerging Trends

The pet insurance industry is constantly evolving, with new trends and innovations shaping the landscape. As veterinary medicine advances and pet ownership continues to grow, pet insurance providers are adapting to meet the changing needs of pet owners. Here are some future implications and emerging trends to watch:

Increasing Popularity and Awareness

Pet insurance is becoming increasingly popular among pet owners, with a growing awareness of its benefits. As more people understand the financial risks associated with pet ownership, the demand for pet insurance is likely to rise. This increased popularity may lead to more competitive pricing and a wider range of coverage options, making pet insurance more accessible to a broader audience.

Specialty and Customized Plans

Insurance providers are recognizing the unique needs of different dog breeds and are developing specialty plans tailored to specific health concerns. For example, plans specifically designed for breeds prone to joint issues or those with a higher risk of certain illnesses may become more prevalent. Additionally, customized plans that allow pet owners to choose specific coverage levels for different aspects of their dog’s healthcare, such as accident coverage, illness coverage, and routine care, are becoming more popular.

Digital Transformation and Convenience

The digital transformation of the pet insurance industry is gaining momentum, with providers embracing technology to enhance the customer experience. Online platforms and mobile apps are being developed to streamline the insurance process, making it easier for pet owners to manage their policies, file claims, and access veterinary resources. Additionally, the integration of telemedicine and remote consultations may become more common, offering pet owners convenient access to veterinary advice and potentially reducing the need for in-person visits.

Wellness and Preventative Care Emphasis

There is a growing emphasis on wellness and preventative care in the pet insurance industry. Insurance providers are recognizing the importance of proactive healthcare for pets and are developing plans that incentivize pet owners to prioritize regular check-ups, vaccinations, and preventative treatments. These plans may offer discounts or increased coverage for preventative care, encouraging pet owners to take a more proactive approach to their dog’s health.

Data-Driven Personalization

Advancements in data analytics and machine learning are enabling insurance providers to personalize coverage based on individual pet profiles. By analyzing factors such as breed, age, medical history, and geographical location, insurance companies can offer tailored plans that meet the specific needs of each dog. This data-driven approach can lead to more accurate risk assessments and potentially lower premiums for pets with lower health risks.

Veterinary Partnerships and Networks

Insurance providers are increasingly partnering with veterinary clinics and hospitals to create networks of preferred providers. These partnerships can offer pet owners access to a network of trusted veterinary professionals, ensuring quality care for their dogs. Additionally, these partnerships may lead to negotiated rates and discounted services, providing pet owners with additional cost savings and peace of mind.

Conclusion

Pet insurance for dogs is a valuable tool for pet owners to manage the financial risks associated with veterinary care. By understanding the factors influencing the cost of pet insurance and carefully selecting a plan that aligns with their dog’s needs and budget, pet owners can ensure their furry companions receive the necessary healthcare without financial strain. As the pet insurance industry continues to evolve, pet owners can look forward to increased accessibility, customized plans, and innovative solutions that enhance the overall pet ownership experience.

What is the average cost of pet insurance for dogs?

+

The average cost of pet insurance for dogs can vary widely depending on various factors such as the breed, age, coverage level, and geographical location. On average, pet insurance premiums for dogs range from 20 to 80 per month. However, it’s important to note that these averages are just a general guideline, and the actual cost can be higher or lower based on individual circumstances.

Are there any discounts or promotions available for pet insurance?

+

Yes, many pet insurance providers offer discounts and promotions to attract new customers or reward existing policyholders. These discounts can include multi-pet discounts, automatic payment discounts, or promotional offers for signing up during certain periods. It’s worth checking with different insurance providers to see if they offer any discounts that can help reduce the cost of pet insurance.

Can I customize my pet insurance coverage to fit my budget and needs?

+

Absolutely! Most pet insurance providers offer customizable coverage options to allow pet owners to tailor their policies to their specific needs and budget. You can choose the level of coverage, select certain benefits or exclusions, and adjust the deductible and reimbursement rate to find a plan that fits your financial capabilities and provides the necessary protection for your dog.