Cheap Health Insurance Nyc

Securing affordable health insurance in the bustling metropolis of New York City can be a daunting task. With a diverse population and a range of healthcare needs, finding a suitable and cost-effective health insurance plan is crucial for many residents. In this comprehensive guide, we delve into the world of cheap health insurance in NYC, exploring the options, considerations, and strategies to help you navigate the complex landscape and make informed decisions.

Understanding the NYC Health Insurance Market

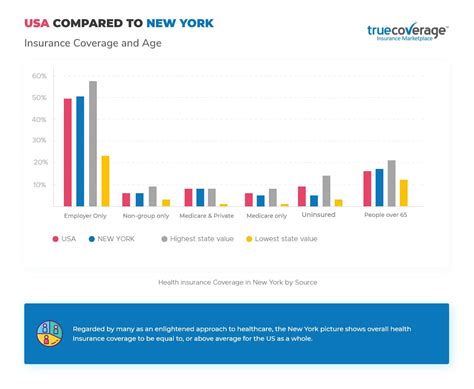

The health insurance market in New York City is highly regulated and offers a variety of plans to cater to the diverse needs of its residents. Understanding the key players and the structure of the market is essential to making the right choices. Here’s an overview:

- New York State of Health: This is the official health plan marketplace for New York, offering both individual and family plans. It provides a range of options from various insurance carriers, including Medicaid and the Essential Plan for low-income individuals.

- Private Insurance Carriers: Major insurance companies like Aetna, Cigna, UnitedHealthcare, and Oscar Health offer a variety of plans in NYC. These plans often provide more flexibility but may come with higher premiums.

- Employer-Sponsored Plans: Many employers in NYC offer health insurance benefits to their employees. These plans can vary widely in terms of coverage and cost, so it's important to carefully review the options provided by your employer.

- Government-Sponsored Programs: For those who are eligible, government-sponsored programs like Medicare (for seniors) and Medicaid (for low-income individuals) provide comprehensive coverage at little to no cost.

Key Factors to Consider for Affordable Health Insurance

When searching for cheap health insurance in NYC, there are several key factors that can significantly impact the cost and coverage of your plan. Here’s a breakdown of these considerations:

Income and Eligibility

Your income plays a crucial role in determining your eligibility for certain health insurance plans. Low-income individuals may qualify for subsidized plans through the New York State of Health marketplace or government-sponsored programs like Medicaid. Understanding your income bracket and eligibility can help you narrow down your options.

Age and Health Status

Age and health status are significant factors in health insurance costs. Younger, healthier individuals may find more affordable options, while those with pre-existing conditions or older age may face higher premiums. It’s important to assess your health needs and choose a plan that adequately covers your specific requirements.

Plan Types and Coverage

Health insurance plans in NYC come in various types, including HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), EPO (Exclusive Provider Organization), and POS (Point of Service). Each type offers different levels of coverage and provider networks. Understanding the distinctions between these plan types and choosing the right one for your needs is essential.

| Plan Type | Key Features |

|---|---|

| HMO | Generally more affordable with a limited provider network. Requires a primary care physician for referrals to specialists. |

| PPO | Offers more flexibility with a broader network and no referral requirement. Typically more expensive. |

| EPO | Similar to PPO but with a more limited network. Usually cost-effective. |

| POS | Combines features of HMO and PPO. Offers flexibility but may require referrals for out-of-network care. |

Premiums, Deductibles, and Out-of-Pocket Costs

When comparing health insurance plans, it’s crucial to look beyond just the monthly premium. Deductibles (the amount you pay before insurance coverage kicks in) and out-of-pocket costs (expenses not covered by insurance) can significantly impact your overall healthcare expenses. Plans with lower premiums often come with higher deductibles and out-of-pocket costs, so finding the right balance is key.

Strategies for Finding Affordable Health Insurance in NYC

Securing cheap health insurance in NYC requires a strategic approach. Here are some effective strategies to consider:

Research and Compare Plans

Take the time to thoroughly research and compare different health insurance plans. Utilize online resources, such as the New York State of Health marketplace, to explore various options. Compare premiums, deductibles, provider networks, and coverage to find the plan that best suits your needs and budget.

Explore Government Programs

If you are a low-income individual or a senior, don’t overlook government-sponsored programs like Medicaid or Medicare. These programs provide comprehensive coverage at little to no cost and can be a great option for those who qualify.

Consider Short-Term Plans

Short-term health insurance plans can be a temporary solution if you’re between jobs or awaiting coverage from an employer. These plans offer more flexibility and typically have lower premiums but may have limited coverage and pre-existing condition exclusions. Ensure you understand the terms and conditions before enrolling.

Review Your Coverage Needs

Assess your healthcare needs and prioritize the services you’re likely to require. If you’re generally healthy and only need basic coverage, a high-deductible plan with a health savings account (HSA) might be a cost-effective option. On the other hand, if you have specific health concerns or require regular medical care, a plan with a lower deductible and broader coverage may be more suitable.

Take Advantage of Employer Benefits

If you’re employed, carefully review the health insurance benefits offered by your employer. Many employers provide a range of plans with varying levels of coverage and cost. Consider the options available and choose the plan that aligns with your healthcare needs and budget.

Stay Informed About Changes

The health insurance landscape is subject to changes and updates. Stay informed about any modifications to plans, coverage, or eligibility requirements. This can help you make timely decisions and ensure you’re always getting the best value for your healthcare needs.

Expert Insights and Tips

Navigating the complex world of health insurance can be challenging, but with the right approach and resources, finding affordable coverage in NYC is achievable. Here are some expert tips to enhance your journey:

Conclusion

Finding cheap health insurance in NYC is a journey that requires research, comparison, and strategic planning. By understanding the market, considering your specific needs, and employing effective strategies, you can navigate the complex landscape and secure a plan that offers both affordability and adequate coverage. Remember, your health is your wealth, and investing in quality healthcare is an investment in your future.

What is the best way to compare health insurance plans in NYC?

+Utilize online resources like the New York State of Health marketplace, which provides a comprehensive platform to compare plans. You can filter options based on your specific needs and budget. Additionally, don’t hesitate to reach out to insurance brokers or agents who can offer personalized advice and guidance.

Are there any government-sponsored programs for health insurance in NYC?

+Yes, programs like Medicaid and Medicare are available for eligible individuals. Medicaid provides comprehensive coverage for low-income individuals, while Medicare is specifically designed for seniors. These programs offer affordable, sometimes no-cost, healthcare options.

Can I get health insurance if I’m self-employed in NYC?

+Absolutely! Self-employed individuals in NYC have the same options as everyone else. You can explore plans through the New York State of Health marketplace, private insurance carriers, or consider short-term plans. It’s important to carefully review your options and choose a plan that suits your needs and budget.