Renter Insurance Policy

Renters insurance, often overlooked, is a vital component of financial protection for millions of tenants across the globe. In an era where unexpected events can cause significant financial strain, having adequate insurance coverage is more crucial than ever. This comprehensive guide delves into the world of renter insurance policies, exploring their importance, key components, and how they can provide peace of mind to individuals and families living in rented accommodations.

Understanding Renter Insurance: A Necessity for Tenants

Renter insurance, also known as tenants insurance or renter’s liability insurance, is a specialized insurance policy designed to protect individuals who rent their homes. It provides financial coverage for personal property, liability, and additional living expenses in the event of a covered loss or accident.

The primary purpose of renter insurance is to safeguard tenants against unforeseen circumstances that could lead to significant financial losses. These policies offer coverage for a wide range of incidents, including theft, fire, water damage, and even liability claims resulting from accidents that occur within the rented property.

While many renters may believe their possessions are adequately covered by their landlord’s insurance, this is a common misconception. Landlord insurance typically covers the building’s structure and the landlord’s own property, but it does not extend to the tenant’s personal belongings. Renters insurance fills this gap, providing a crucial layer of protection for individuals who invest in their personal spaces.

Key Components of Renter Insurance Policies

Renter insurance policies consist of several key components, each designed to address specific risks and provide comprehensive coverage.

- Personal Property Coverage: This is the cornerstone of renter insurance, offering financial protection for the tenant's belongings. It covers a wide range of items, including furniture, electronics, clothing, and valuable possessions. The policy typically reimburses the tenant for the actual cash value or replacement cost of the damaged or stolen items.

- Liability Coverage: Liability insurance within a renter's policy is crucial for protecting the tenant against legal claims and lawsuits. It covers bodily injury and property damage claims that arise from accidents or incidents that occur on the rented premises. This coverage provides financial support for legal defense costs and any resulting settlements or judgments.

- Additional Living Expenses: In the event that a tenant's home becomes uninhabitable due to a covered loss, additional living expenses coverage kicks in. It reimburses the tenant for temporary living expenses, such as hotel stays, meals, and other costs incurred while their primary residence is being repaired or rebuilt.

- Medical Payments Coverage: This component provides coverage for medical expenses resulting from accidents that occur on the rented property. It covers reasonable and necessary medical treatment for guests or visitors who sustain injuries, regardless of fault. Medical payments coverage offers quick and efficient reimbursement, often without the need for a liability claim to be filed.

Personalized Coverage: Tailoring Renter Insurance to Individual Needs

One of the significant advantages of renter insurance is its flexibility and adaptability to individual needs. Insurance providers offer various coverage options and limits, allowing tenants to customize their policies based on their specific circumstances and the value of their possessions.

For instance, a tenant with high-value items, such as fine art, jewelry, or electronics, may opt for a policy with higher coverage limits to ensure adequate protection. On the other hand, a student living in a shared apartment may choose a more basic policy with lower limits, focusing primarily on essential belongings.

Additionally, renters can choose between two main types of coverage for personal property: actual cash value and replacement cost. Actual cash value coverage reimburses the tenant for the item's current market value, considering depreciation. In contrast, replacement cost coverage provides reimbursement for the cost of replacing the item with a new one of similar quality.

The Process of Obtaining Renter Insurance: A Step-by-Step Guide

Acquiring renter insurance is a straightforward process that involves several key steps. Here's a step-by-step guide to help individuals navigate the process and obtain the coverage they need:

- Assess Your Needs: Begin by evaluating your personal circumstances and the value of your belongings. Consider the type of rental property you occupy, the items you own, and any specific risks associated with your location or lifestyle. This assessment will help you determine the appropriate coverage limits and additional endorsements you may require.

- Research Insurance Providers: Explore the market and compare different insurance companies that offer renter insurance policies. Look for reputable providers with a strong track record of claims handling and customer satisfaction. Consider factors such as coverage options, pricing, and any additional benefits or discounts they offer.

- Obtain Quotes: Reach out to your shortlisted insurance providers and request quotes. Provide accurate information about your rental situation, including the type of property, the value of your belongings, and any additional coverage needs. Compare the quotes based on coverage limits, deductibles, and overall cost to find the most suitable option for your budget and requirements.

- Review Policy Details: Carefully review the policy documents provided by the insurance company. Pay close attention to the coverage limits, exclusions, and any specific conditions or endorsements included in the policy. Ensure that the policy aligns with your needs and provides adequate protection for your personal property, liability risks, and additional living expenses.

- Choose Your Deductible: The deductible is the amount you agree to pay out of pocket before the insurance coverage kicks in. Select a deductible that aligns with your financial capabilities and comfort level. A higher deductible may result in lower premiums, but it means you'll bear more of the financial burden in the event of a claim.

- Purchase the Policy: Once you've found the right policy and reviewed the terms, proceed with the purchase. Provide the necessary personal and payment information to finalize the transaction. Ensure that you receive a copy of the policy documents and understand the coverage start date and any waiting periods associated with the policy.

- Maintain and Review Your Policy: Regularly review your renter insurance policy to ensure it remains up-to-date and aligns with your changing needs. As your circumstances evolve, such as acquiring new possessions or moving to a different rental property, update your policy accordingly. Stay informed about any changes in coverage limits, deductibles, or additional endorsements to maintain adequate protection.

Benefits of Renter Insurance: Beyond Financial Protection

Renter insurance offers a multitude of benefits that extend beyond the financial protection it provides. Here are some key advantages that make this type of insurance an essential consideration for tenants:

- Peace of Mind: Knowing that your personal belongings and liability risks are covered can provide immense peace of mind. Renter insurance alleviates the worry of potential financial losses and allows tenants to focus on their daily lives with confidence.

- Legal Protection: Liability coverage within renter insurance policies offers crucial protection against legal claims and lawsuits. It provides financial support for legal defense costs, ensuring that tenants can navigate complex legal situations with the necessary resources.

- Assistance in Times of Need: In the event of a covered loss, renter insurance provides essential assistance. It covers the cost of temporary accommodations, helps replace damaged or stolen items, and provides reimbursement for additional living expenses, ensuring that tenants can quickly recover and resume their normal lives.

- Cost-Effective Protection: Renter insurance policies are often surprisingly affordable, especially when compared to the potential financial losses they can prevent. By investing in this type of insurance, tenants can enjoy comprehensive protection at a reasonable cost.

- Customizable Coverage: The flexibility of renter insurance policies allows tenants to tailor their coverage to their specific needs. Whether it's adjusting coverage limits, adding endorsements for high-value items, or selecting the right deductible, renters can create a policy that suits their unique circumstances.

Frequently Asked Questions about Renter Insurance

What is the difference between renter insurance and homeowners insurance?

+Renter insurance and homeowners insurance differ in terms of coverage and purpose. Renter insurance is designed for individuals who rent their homes and provides coverage for personal property, liability, and additional living expenses. Homeowners insurance, on the other hand, is intended for homeowners and covers the structure of the home, personal belongings, liability, and additional living expenses if the home becomes uninhabitable due to a covered loss.

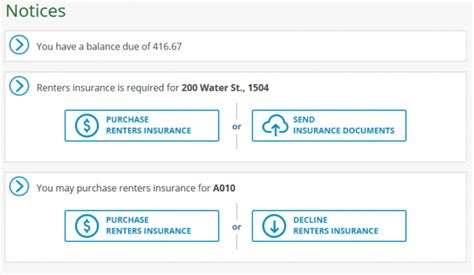

Is renter insurance mandatory?

+While renter insurance is not legally mandatory in most places, it is highly recommended. Landlords typically require tenants to have renter insurance as part of the lease agreement to protect their interests. Additionally, having renter insurance provides valuable financial protection for tenants, covering their personal belongings and liability risks.

What factors determine the cost of renter insurance?

+The cost of renter insurance can vary based on several factors. These include the coverage limits chosen, the value of personal belongings, the location of the rental property, the tenant's claims history, and any additional endorsements or riders added to the policy. Insurance providers assess these factors to determine the premium amount.

Can I customize my renter insurance policy?

+Absolutely! Renter insurance policies are highly customizable. Tenants can choose coverage limits, deductibles, and additional endorsements to tailor the policy to their specific needs and budget. This flexibility allows individuals to create a policy that provides adequate protection for their personal belongings and liability risks.

How often should I review my renter insurance policy?

+It is recommended to review your renter insurance policy annually or whenever your circumstances change significantly. Changes such as acquiring new possessions, moving to a different rental property, or experiencing a life event (e.g., marriage, birth of a child) may require adjustments to your coverage limits or additional endorsements. Regular policy reviews ensure that your coverage remains up-to-date and aligned with your needs.

Renter insurance is an indispensable tool for tenants, providing essential protection and peace of mind. By understanding the key components, benefits, and customization options of renter insurance policies, individuals can make informed decisions to safeguard their personal belongings, liability risks, and financial well-being. With the right coverage in place, renters can focus on creating their dream homes without the worry of unforeseen circumstances.