Top Us Car Insurance Companies

The car insurance landscape in the United States is vast and competitive, with numerous companies vying for the attention of millions of drivers. Navigating this complex market can be challenging, but understanding the key players and their unique offerings is essential for making informed decisions about your automotive coverage. This article delves into the top US car insurance companies, analyzing their features, benefits, and reputation to provide a comprehensive guide for consumers.

Understanding the Top US Car Insurance Companies

The insurance industry in the US is highly regulated, and car insurance is mandatory in most states. This means that drivers must carry a minimum level of liability coverage to protect themselves and others on the road. However, beyond this basic requirement, the options are diverse, with companies offering a range of policies tailored to different needs and preferences.

The top car insurance companies in the US have established themselves as leaders in the market due to their financial stability, comprehensive coverage options, and innovative features. These companies have a strong presence across the country, providing services to millions of policyholders and earning recognition for their customer satisfaction and claims handling processes.

Key Factors to Consider When Choosing a Car Insurance Company

When selecting a car insurance provider, it's crucial to consider several factors to ensure you get the best value and coverage for your specific needs. Here are some key aspects to evaluate:

- Financial Strength: Look for companies with a strong financial rating, indicating their ability to pay claims promptly and honor their commitments.

- Coverage Options: Evaluate the range of coverage types offered, including liability, collision, comprehensive, personal injury protection, and additional perks like rental car coverage or roadside assistance.

- Pricing: Compare quotes from different insurers to find competitive rates that align with your budget. Remember, the cheapest option may not always provide the best value.

- Customer Service: Research the company's reputation for customer satisfaction and claims handling. Consider factors like response time, accessibility, and overall customer support.

- Discounts and Savings: Many insurers offer discounts for safe driving, multiple policies, or membership in certain organizations. Explore these options to potentially reduce your premium.

- Digital Presence and Convenience: In today's digital age, consider the insurer's online and mobile capabilities, including the ease of managing your policy, filing claims, and accessing resources.

Exploring the Top US Car Insurance Companies

Now, let's delve into the top car insurance companies in the US, examining their unique offerings and what sets them apart in the competitive market.

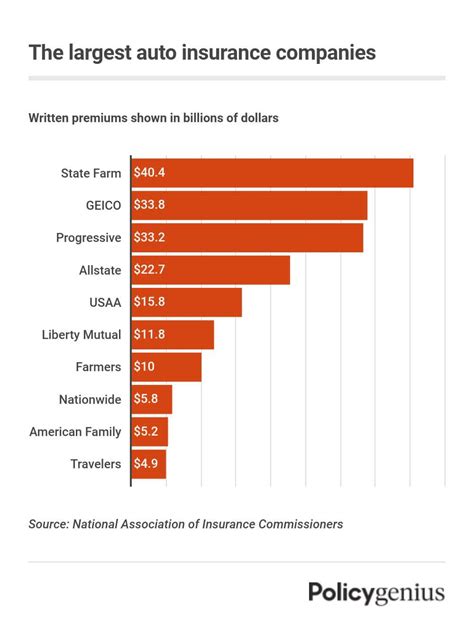

State Farm

Overview: State Farm is a prominent player in the US insurance market, known for its extensive network of local agents and comprehensive coverage options. The company has a strong reputation for customer satisfaction and has been recognized for its financial stability.

Key Features: State Farm offers a wide range of coverage types, including standard liability, collision, and comprehensive insurance. They also provide additional options like rental car reimbursement, glass coverage, and personal injury protection. State Farm's Drive Safe & Save program rewards safe driving with potential discounts.

Financial Strength: State Farm has consistently maintained a strong financial rating, indicating its ability to meet its obligations to policyholders.

Customer Service: The company's local agent network provides personalized service, and its online and mobile platforms offer convenient policy management and claims filing.

GEICO

Overview: GEICO, an acronym for Government Employees Insurance Company, has become a household name in the US insurance market. Known for its catchy advertising and competitive pricing, GEICO caters to a wide range of drivers.

Key Features: GEICO offers standard car insurance coverage, including liability, collision, and comprehensive insurance. The company is particularly renowned for its digital capabilities, allowing customers to manage their policies, file claims, and access resources with ease. GEICO also provides additional coverage options like rental car reimbursement and emergency roadside service.

Financial Strength: GEICO has a solid financial rating, reflecting its stability and ability to honor its commitments.

Customer Service: GEICO's 24/7 customer service and claims support, combined with its digital convenience, have contributed to its positive reputation among policyholders.

Progressive

Overview: Progressive is another major player in the US car insurance market, known for its innovative approach and extensive coverage options. The company has a strong focus on technology and has pioneered several unique features.

Key Features: Progressive offers a comprehensive range of coverage types, including standard liability, collision, and comprehensive insurance. The company's Snapshot program utilizes telematics to analyze driving behavior, potentially offering discounts to safe drivers. Progressive also provides additional coverage options like gap insurance and rental car reimbursement.

Financial Strength: Progressive maintains a strong financial rating, ensuring its financial stability and ability to meet its obligations.

Customer Service: Progressive's 24/7 customer service and claims support, along with its online and mobile app capabilities, have contributed to its positive customer satisfaction ratings.

Allstate

Overview: Allstate is a well-established car insurance provider in the US, known for its extensive network of agents and comprehensive coverage options. The company has a strong focus on customer education and providing tailored insurance solutions.

Key Features: Allstate offers a wide range of coverage types, including liability, collision, and comprehensive insurance. The company's unique Drivewise program utilizes telematics to reward safe driving with potential discounts. Allstate also provides additional coverage options like rental car reimbursement and roadside assistance.

Financial Strength: Allstate has a solid financial rating, indicating its stability and ability to meet its financial commitments.

Customer Service: Allstate's local agent network provides personalized service, and its online and mobile platforms offer convenient policy management and claims filing.

USAA

Overview: USAA is a unique car insurance provider, exclusively serving active military personnel, veterans, and their families. The company has earned a reputation for exceptional customer service and competitive rates.

Key Features: USAA offers standard car insurance coverage, including liability, collision, and comprehensive insurance. The company's innovative mobile app allows policyholders to manage their policies, file claims, and access resources with ease. USAA also provides additional coverage options like rental car reimbursement and roadside assistance.

Financial Strength: USAA maintains a strong financial rating, reflecting its financial stability and commitment to its members.

Customer Service: USAA's dedication to its military-affiliated members has earned it high customer satisfaction ratings, with a focus on personalized service and support.

Comparative Analysis: Top US Car Insurance Companies

Now that we've explored the key features and offerings of the top US car insurance companies, let's compare them across several critical factors to help you make an informed decision.

| Company | Financial Strength | Coverage Options | Customer Service | Discounts & Savings |

|---|---|---|---|---|

| State Farm | Strong | Comprehensive | Local Agents, Online/Mobile | Drive Safe & Save |

| GEICO | Solid | Standard, Additional Perks | 24/7 Support, Digital Convenience | Multi-Policy, Military |

| Progressive | Strong | Innovative, Comprehensive | 24/7 Support, Online/Mobile | Snapshot |

| Allstate | Solid | Comprehensive | Local Agents, Online/Mobile | Drivewise |

| USAA | Strong | Standard, Additional Perks | Personalized Service | Military Affiliation |

Considerations for Your Choice

When choosing a car insurance company, it's essential to consider your specific needs and preferences. Factors like the type of coverage you require, your budget, and your personal comfort with digital platforms or local agents can all influence your decision.

Additionally, researching the company's reputation for customer satisfaction and claims handling is crucial. Online reviews and ratings can provide valuable insights into the real-world experiences of policyholders.

The Future of Car Insurance: Industry Trends and Innovations

The car insurance industry in the US is continually evolving, driven by technological advancements and changing consumer preferences. Here are some key trends and innovations shaping the future of car insurance:

- Telematics and Usage-Based Insurance (UBI): Telematics devices and UBI programs analyze driving behavior, offering personalized insurance rates based on actual driving habits. This trend is expected to grow, providing more accurate pricing and rewarding safe drivers.

- Digital Transformation: Insurers are investing in digital platforms and mobile apps to enhance the customer experience. From policy management to claims filing, the shift towards digital convenience is likely to continue, offering greater accessibility and efficiency.

- Connected Car Technology: With the rise of connected car technology, insurers are exploring opportunities to leverage data from vehicles. This could lead to more precise risk assessment and potentially influence insurance rates.

- AI and Machine Learning: Artificial Intelligence and Machine Learning are being utilized to streamline processes, improve risk assessment, and enhance fraud detection. These technologies are expected to play a larger role in the industry, improving efficiency and accuracy.

- Sustainable and Green Initiatives: Some insurers are offering incentives for eco-friendly driving or electric vehicle ownership, reflecting a growing focus on sustainability in the industry.

As the car insurance market continues to evolve, staying informed about these trends and innovations can help you make more informed decisions about your coverage and ensure you stay up-to-date with the latest offerings.

Conclusion

Choosing the right car insurance company is a critical decision that can impact your financial security and peace of mind. By understanding the top US car insurance companies and their unique offerings, you can make an informed choice that aligns with your needs and preferences.

Remember, while financial stability and comprehensive coverage are essential, factors like customer service, digital convenience, and discounts can also play a significant role in your decision. Stay informed about industry trends and innovations to ensure you're getting the best value and coverage for your automotive insurance needs.

Frequently Asked Questions

What is the average cost of car insurance in the US?

+The average cost of car insurance in the US varies widely depending on factors like location, driving record, and the type of coverage. As of [latest data available], the national average for annual car insurance premiums was approximately $1,674. However, rates can range from a few hundred dollars to several thousand dollars per year.

How can I get cheaper car insurance rates?

+There are several ways to potentially reduce your car insurance rates. These include shopping around for quotes from different insurers, maintaining a clean driving record, increasing your deductible, taking advantage of discounts (like safe driver or multi-policy discounts), and considering usage-based insurance programs that reward safe driving.

What factors influence car insurance rates?

+Car insurance rates are influenced by various factors, including your age, gender, driving record, the type of car you drive, your location, and the level of coverage you choose. Additionally, insurers may consider credit history and other demographic factors when determining rates.

What should I do if I’m involved in a car accident?

+If you’re involved in a car accident, it’s important to stay calm and take the following steps: Ensure the safety of yourself and others, call the police to report the accident, exchange information with the other driver(s), and notify your insurance company as soon as possible. Document the scene with photos and notes, and seek medical attention if needed.

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy annually or whenever your life circumstances change (e.g., getting married, buying a new car, moving to a new location). Regular reviews can help ensure you have the appropriate level of coverage and that you’re getting the best rates.