Average Automobile Insurance Cost

Automobile insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the globe. The cost of insurance, however, can vary significantly based on numerous factors, making it a complex and often confusing topic. In this comprehensive guide, we delve into the world of automobile insurance, exploring the average costs, the factors influencing these expenses, and the strategies to minimize them.

Understanding the Average Automobile Insurance Cost

The average cost of automobile insurance is a crucial metric for any driver to comprehend, as it offers a benchmark for evaluating personal insurance expenses. According to industry data, the average annual premium for automobile insurance in the United States is approximately $1,674, with wide variations depending on the state and specific circumstances.

It's essential to note that this average figure is merely a starting point. The true cost of insurance can be significantly higher or lower based on an array of factors, including the driver's age, driving history, location, and the type of vehicle insured. For instance, a young driver with a clean record might pay upwards of $2,500 annually, while an experienced driver with a history of accidents could see premiums exceeding $3,000.

Breaking Down the Average Cost

To gain a deeper understanding of insurance costs, let’s examine the components that make up the average premium.

- Liability Coverage: This is the foundation of any automobile insurance policy, providing coverage for damages to other vehicles or property, as well as medical expenses for injured parties in an accident caused by the insured driver. On average, liability coverage accounts for approximately 30% of the total premium.

- Collision Coverage: This coverage pays for repairs or replacements of the insured vehicle in the event of an accident, regardless of fault. It typically constitutes 25% of the premium, making it a significant expense.

- Comprehensive Coverage: Covering non-collision incidents such as theft, vandalism, or natural disasters, comprehensive coverage is an essential addition to any policy. It typically represents 15% of the total premium, although this can vary based on the risk factors in a given area.

- Medical Payments Coverage: This coverage pays for the medical expenses of the insured driver and passengers, regardless of who is at fault in an accident. On average, it makes up 10% of the total premium.

- Uninsured/Underinsured Motorist Coverage: Protecting the insured driver against accidents caused by drivers who lack adequate insurance, this coverage is a crucial safeguard. It typically accounts for 10% of the premium, although this can vary based on state regulations.

- Additional Coverages and Deductibles: Beyond the basic coverages, there are numerous additional options, such as rental car coverage, roadside assistance, and gap insurance. The choice to include these coverages, as well as the selected deductibles, can significantly impact the overall cost of insurance.

By understanding these components, drivers can make more informed decisions about their insurance coverage and potential costs.

Factors Influencing Automobile Insurance Costs

The cost of automobile insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. Let’s explore some of the most significant factors:

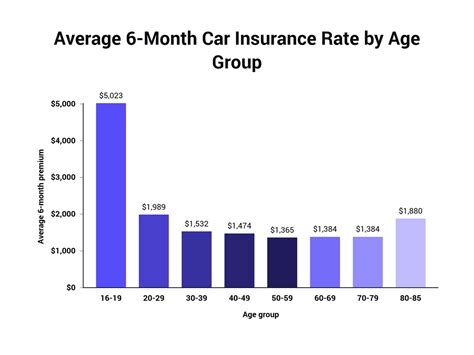

Driver’s Age and Experience

Age and driving experience are two of the most critical factors in determining insurance costs. Young drivers, particularly those under 25, are generally considered high-risk due to their limited experience and higher propensity for accidents. As a result, they often pay the highest premiums. On the other hand, mature drivers with a long history of safe driving can benefit from lower rates, as insurance companies view them as a lower risk.

| Age Group | Average Annual Premium |

|---|---|

| Under 25 | $2,800 |

| 25-34 | $2,200 |

| 35-44 | $1,800 |

| 45-54 | $1,600 |

| 55 and above | $1,400 |

As the table illustrates, the average annual premium decreases significantly with age, highlighting the importance of experience in determining insurance costs.

Driving Record

Your driving record is a critical factor in insurance costs. A clean driving record with no accidents or traffic violations can lead to significant savings on insurance premiums. Conversely, a history of accidents or moving violations can result in higher rates, as insurance companies view these drivers as a greater risk.

Location and Geographical Factors

The location where you reside and drive can have a substantial impact on your insurance costs. Factors such as traffic congestion, crime rates, and the likelihood of natural disasters can all influence insurance premiums. For instance, drivers in urban areas often pay higher premiums due to increased traffic and the higher likelihood of accidents and theft.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can also affect your insurance costs. Generally, more expensive vehicles, sports cars, and those with high-performance engines carry higher insurance premiums due to the increased risk of theft and higher repair costs. Additionally, the primary usage of the vehicle, whether for personal or business purposes, can impact the cost of insurance.

Insurance Company and Coverage Selection

The insurance company you choose and the specific coverages and deductibles you select can have a significant impact on your insurance costs. Different companies offer varying rates and coverage options, so it’s essential to shop around and compare quotes to find the best fit for your needs and budget.

Strategies to Minimize Automobile Insurance Costs

While the cost of automobile insurance is influenced by numerous factors beyond your control, there are still strategies you can employ to minimize your insurance expenses. Here are some effective tactics:

Improve Your Driving Record

Maintaining a clean driving record is one of the most effective ways to reduce your insurance costs. Avoid accidents and moving violations, and if you do have an accident, ensure you take steps to improve your driving skills and prevent future incidents.

Choose Your Vehicle Wisely

When selecting a vehicle, consider the impact on your insurance costs. Opt for a safer, more affordable model that is less likely to be targeted by thieves and has lower repair costs. This can lead to significant savings on your insurance premiums.

Utilize Discounts

Insurance companies offer a variety of discounts that can significantly reduce your premiums. These may include discounts for safe driving, multiple vehicles, bundling home and auto insurance, and even occupational or educational discounts. Be sure to inquire about all available discounts when shopping for insurance.

Increase Your Deductibles

Increasing your deductibles can lead to lower insurance premiums. However, it’s important to ensure you can afford the higher deductibles in the event of a claim. This strategy can be particularly effective if you have a clean driving record and are confident you won’t need to make frequent claims.

Shop Around and Compare

Insurance rates can vary significantly between companies, so it’s essential to shop around and compare quotes. Obtain multiple quotes from different insurers to find the best rate for your needs. Additionally, consider using an insurance broker who can provide quotes from multiple companies, making the comparison process easier.

The Future of Automobile Insurance

The automobile insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. The rise of connected cars, autonomous vehicles, and ride-sharing services is set to revolutionize the way insurance is priced and delivered. Insurance companies are increasingly leveraging data analytics and artificial intelligence to offer more personalized and dynamic insurance products.

One notable trend is the shift towards usage-based insurance (UBI), where premiums are based on actual driving behavior rather than static factors like age and location. This model, already in use by some insurers, offers the potential for significant savings for safe drivers, as their premiums reflect their actual risk profile.

Additionally, the integration of telematics devices in vehicles is allowing insurers to gather real-time data on driving habits, vehicle usage, and even environmental conditions. This data-driven approach is expected to further refine insurance pricing and coverage, offering consumers more tailored and cost-effective options.

Conclusion

Automobile insurance is a vital component of vehicle ownership, offering financial protection and peace of mind. While the average cost of insurance provides a useful benchmark, it’s important to understand the factors that influence these costs and the strategies available to minimize them. By staying informed and taking proactive steps, drivers can ensure they have adequate coverage at a reasonable cost.

As the industry continues to evolve, embracing technological advancements and adapting to changing consumer needs, the future of automobile insurance promises more personalized and dynamic coverage options. Drivers can look forward to a landscape where insurance premiums are more closely aligned with their individual risk profiles, offering greater fairness and value.

What is the difference between liability, collision, and comprehensive coverage?

+

Liability coverage is the basic requirement for automobile insurance, covering damages to other vehicles or property, as well as medical expenses for injured parties in an accident caused by the insured driver. Collision coverage pays for repairs or replacements of the insured vehicle in the event of an accident, regardless of fault. Comprehensive coverage covers non-collision incidents such as theft, vandalism, or natural disasters.

How can I reduce my automobile insurance costs?

+

There are several strategies to reduce your automobile insurance costs. These include improving your driving record, choosing your vehicle wisely, utilizing available discounts, increasing your deductibles, and shopping around for the best rates.

What is usage-based insurance (UBI)?

+

Usage-based insurance is a model where premiums are based on actual driving behavior rather than static factors like age and location. It offers the potential for significant savings for safe drivers, as their premiums reflect their actual risk profile.