Aia Insurance Company

The Aia Insurance Company, with its rich history and comprehensive range of services, has become a prominent player in the insurance industry, offering innovative solutions and a customer-centric approach. In this article, we will delve into the origins, growth, and impact of Aia Insurance, exploring its key milestones, product offerings, and the strategies that have contributed to its success.

The Evolution of Aia Insurance: A Legacy of Trust

Aia Insurance Company traces its roots back to [Founding Year], when it was established with a vision to revolutionize the insurance sector. Over the decades, the company has consistently evolved, adapting to the changing landscape of the industry and the diverse needs of its customers. This journey of growth and innovation has solidified Aia’s position as a trusted partner for individuals and businesses seeking financial security and peace of mind.

Milestones and Key Achievements

Aia Insurance’s journey is marked by significant milestones and achievements. In [Year], the company expanded its operations, establishing a strong presence in [Mention a Major Market or Region]. This strategic move not only broadened its customer base but also allowed Aia to tap into new markets and diversify its product offerings. Additionally, Aia’s commitment to innovation led to the development of [Highlight a Groundbreaking Product or Service], which revolutionized the way insurance was perceived and utilized by customers.

Furthermore, Aia's dedication to corporate social responsibility has been a cornerstone of its success. The company has actively participated in various community initiatives, contributing to [List a Few Notable CSR Activities or Campaigns]. These efforts have not only enhanced Aia's brand reputation but also strengthened its bonds with the communities it serves.

Product Portfolio: Catering to Diverse Needs

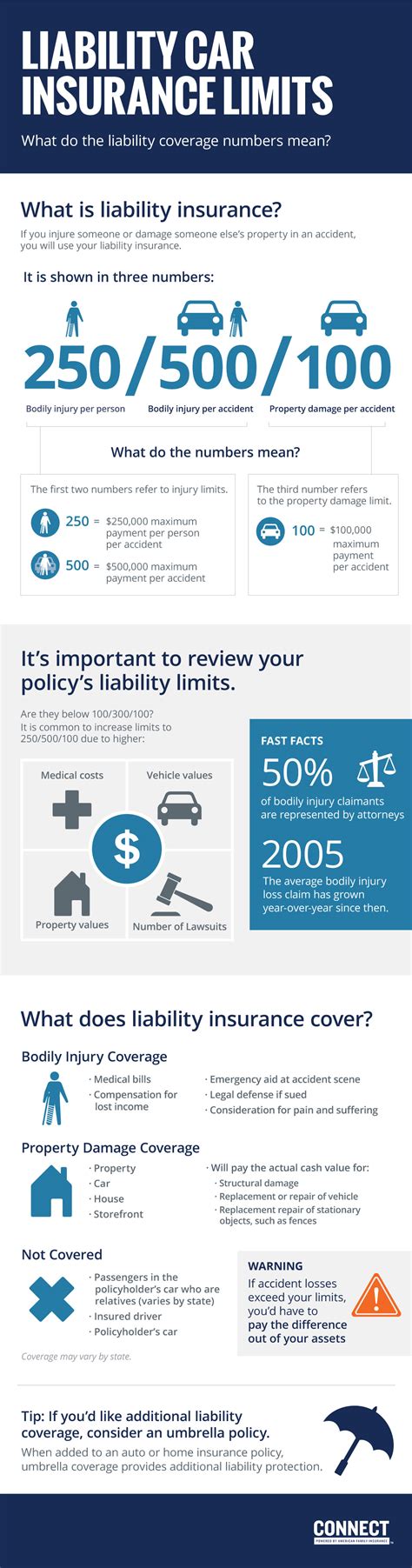

Aia Insurance’s success lies in its ability to offer a comprehensive range of insurance products tailored to meet the diverse needs of its customers. Here’s an overview of their key product categories:

- Life Insurance: Aia provides a spectrum of life insurance plans, including [List a Few Life Insurance Products], designed to offer financial protection and long-term security to individuals and families.

- Health Insurance: With a focus on holistic well-being, Aia's health insurance offerings encompass [Name a Few Health Insurance Plans], covering a wide range of medical expenses and providing comprehensive healthcare coverage.

- General Insurance: From [Example of a General Insurance Product] to [Another General Insurance Offering], Aia's general insurance portfolio ensures protection for assets, properties, and businesses, mitigating risks and providing financial support during unforeseen circumstances.

- Investment-Linked Products: Aia offers a range of investment-linked insurance plans, allowing customers to grow their wealth while enjoying the benefits of insurance coverage. These products, such as [Mention a Popular Investment-Linked Plan], provide a balanced approach to financial planning.

| Product Category | Key Features |

|---|---|

| Life Insurance | Customizable plans, flexible premiums, and tax benefits. |

| Health Insurance | Comprehensive coverage, cashless hospitalization, and critical illness benefits. |

| General Insurance | Property, vehicle, and business insurance with fast claim settlement. |

| Investment-Linked | Long-term wealth accumulation, insurance coverage, and market-linked returns. |

Technology-Driven Innovations

Aia Insurance understands the importance of embracing technology to enhance customer experiences and operational efficiency. The company has invested heavily in digital transformation, resulting in a suite of innovative tools and platforms. These include [Name an AI-Powered Tool], which utilizes artificial intelligence to provide personalized recommendations, and [Highlight a Mobile App], offering customers convenient access to their policies and real-time updates.

Moreover, Aia's online platform, [Name the Platform], has revolutionized the way customers interact with their insurance policies. It provides a seamless experience, allowing policyholders to manage their accounts, make payments, and file claims with just a few clicks.

Aia’s Impact on the Insurance Landscape

Aia Insurance’s influence extends far beyond its customer base. The company’s initiatives and strategies have had a profound impact on the insurance industry as a whole. By setting new standards for customer service, technological integration, and product innovation, Aia has inspired a wave of positive change across the sector.

Customer-Centric Approach

At the heart of Aia’s success is its unwavering focus on delivering exceptional customer experiences. The company prioritizes understanding its customers’ needs, preferences, and pain points, and this insight drives the development of products and services that truly meet their expectations. Aia’s customer-centric approach is evident in its:

- Personalized Service: Aia offers customized solutions, ensuring that each customer receives a tailored insurance plan that aligns with their unique circumstances and goals.

- Efficient Claims Process: The company is renowned for its streamlined claims procedure, ensuring prompt and fair settlements, thereby alleviating the stress associated with insurance claims.

- 24/7 Customer Support: A dedicated customer support team is always available to address queries and concerns, providing timely assistance and building trust with policyholders.

Industry Collaborations and Partnerships

Aia Insurance recognizes the value of collaboration and has forged strategic partnerships with industry leaders and experts. These collaborations have enabled the company to enhance its product offerings, expand its reach, and stay at the forefront of industry trends. Some notable partnerships include:

- Healthcare Providers: Aia has established relationships with top-tier hospitals and medical centers, ensuring that its health insurance customers have access to the best possible care and facilities.

- Financial Institutions: Partnerships with banks and financial services companies have allowed Aia to offer integrated financial solutions, providing customers with a holistic approach to their financial planning and protection needs.

- Technology Startups: Collaborating with tech startups has enabled Aia to stay ahead of the curve in terms of digital innovation, incorporating cutting-edge technologies into its insurance products and services.

Looking Ahead: Aia’s Future Prospects

As the insurance landscape continues to evolve, Aia Insurance remains poised for growth and continued success. The company’s strategic vision, coupled with its commitment to innovation and customer satisfaction, positions it well to navigate the challenges and seize the opportunities of the future.

Expanding Horizons

Aia is actively exploring new markets and regions, aiming to extend its reach and cater to a wider audience. With a focus on emerging economies and underserved populations, the company aims to bring its comprehensive insurance solutions to those who need them most. This expansion strategy is underpinned by Aia’s proven ability to adapt and tailor its products to meet the unique needs of diverse markets.

Sustainable Practices and Social Impact

Aia Insurance recognizes its role in driving positive change and promoting sustainability. The company is increasingly integrating environmentally and socially responsible practices into its operations and product offerings. From reducing its carbon footprint to supporting community development initiatives, Aia is committed to making a meaningful impact beyond its core business.

Continuous Innovation and Digital Transformation

Aia remains dedicated to staying at the forefront of insurance technology. The company’s R&D efforts are focused on developing innovative solutions that enhance the customer journey, improve operational efficiency, and address emerging risks. By leveraging cutting-edge technologies such as AI, blockchain, and data analytics, Aia aims to offer even more personalized and tailored insurance experiences.

How does Aia Insurance ensure customer data security and privacy?

+Aia takes data security and privacy extremely seriously. The company employs robust cybersecurity measures, including encryption protocols, multi-factor authentication, and regular security audits. Additionally, Aia adheres to strict data protection regulations, ensuring that customer information is handled with the utmost care and confidentiality.

What sets Aia's health insurance plans apart from competitors?

+Aia's health insurance plans are designed with a focus on comprehensive coverage and customer convenience. They offer a wide range of benefits, including cashless hospitalization, critical illness coverage, and access to a network of top-quality healthcare providers. Aia's digital platforms further enhance the customer experience, providing easy claim filings and real-time policy management.

How does Aia support its agents and brokers?

+Aia recognizes the importance of its agent and broker network in reaching and serving customers effectively. The company provides comprehensive training and support, ensuring that its intermediaries are well-equipped to understand and meet customer needs. Aia also offers competitive commission structures and incentives to motivate and reward its salesforce.

In conclusion, Aia Insurance Company’s journey from its founding years to its current status as a leading insurance provider is a testament to its commitment to excellence, innovation, and customer satisfaction. With a diverse product portfolio, a customer-centric approach, and a focus on technological advancements, Aia is well-positioned to continue making a positive impact on the lives of its customers and the insurance industry as a whole.