What Type Of Life Insurance Is Best

Life insurance is an essential financial tool that provides peace of mind and ensures the financial security of your loved ones in the event of your untimely passing. With numerous types and policies available, it can be overwhelming to navigate the complex world of life insurance. In this comprehensive guide, we will delve into the different types of life insurance, exploring their unique features, benefits, and suitability for various life stages and financial goals. By the end of this article, you'll have a clearer understanding of which life insurance policy best aligns with your needs, enabling you to make an informed decision.

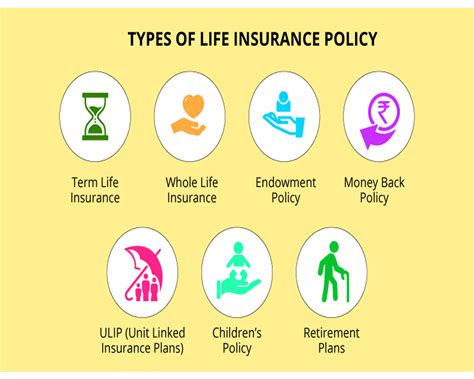

Understanding the Basics: Types of Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company. In exchange for premium payments, the insurance provider promises to pay a designated beneficiary a sum of money (known as the death benefit) upon the policyholder’s death. The primary purpose of life insurance is to provide financial support to your family or dependents, ensuring they can maintain their standard of living and meet essential expenses in your absence.

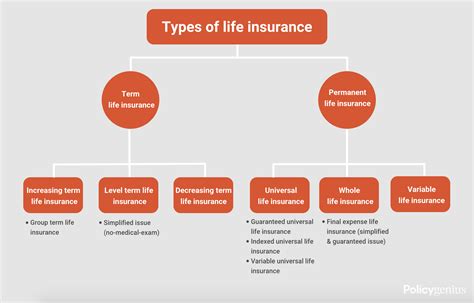

There are two main categories of life insurance: term life insurance and permanent life insurance. Each type has its own set of characteristics and serves different purposes. Let's explore these categories in detail.

Term Life Insurance

Term life insurance is a straightforward and cost-effective option that provides coverage for a specified period, typically ranging from 10 to 30 years. During the term, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive the death benefit. Term life insurance is ideal for individuals seeking temporary coverage to protect their loved ones during specific life stages, such as when they have young children or substantial financial obligations.

Key features of term life insurance include:

- Affordability: Term life insurance is generally more affordable compared to permanent life insurance policies. The premiums are fixed and remain the same throughout the term, making it an attractive option for those on a budget.

- Flexibility: Policyholders can choose the term length that aligns with their needs. For example, a 30-year-old parent might opt for a 20-year term to cover their children's education and ensure financial stability until they are independent.

- Renewability: Most term policies offer the option to renew the coverage at the end of the term, although premiums may increase with age.

- No Cash Value: Unlike permanent life insurance, term life insurance does not build cash value. The policy is solely for protection and does not offer investment opportunities.

Term life insurance is particularly beneficial for individuals with the following circumstances:

- Young families with dependent children

- Individuals with significant financial obligations, such as a mortgage or business loans

- Those seeking coverage for a specific period, like until retirement or when their children become financially independent

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage, offering protection beyond a specific term. It includes whole life insurance, universal life insurance, and variable life insurance, each with its unique features and benefits.

Key characteristics of permanent life insurance include:

- Lifetime Coverage: Permanent life insurance policies remain in force as long as the policyholder continues to pay premiums, ensuring long-term protection.

- Cash Value Accumulation: These policies build cash value over time, which can be borrowed against or used to pay premiums, providing a financial buffer.

- Investment Opportunities: Some permanent life insurance policies offer investment components, allowing policyholders to grow their cash value through stock market investments.

- Higher Premiums: Permanent life insurance policies typically have higher premiums compared to term life insurance due to the lifelong coverage and cash value accumulation.

Permanent life insurance is suitable for individuals with the following needs:

- Those seeking lifelong coverage and peace of mind

- Individuals who want to build a financial legacy for their heirs

- People who prioritize long-term financial security and asset protection

- Business owners who need insurance for key personnel or to fund buy-sell agreements

Comparing Term and Permanent Life Insurance

To help you make an informed decision, let's compare the key differences between term and permanent life insurance:

| Category | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Period | Fixed term (e.g., 10, 20, or 30 years) | Lifelong coverage |

| Premiums | Affordable, fixed rates | Higher initial premiums, but can decrease over time |

| Cash Value | None | Builds cash value over time |

| Investment Opportunities | None | Offers investment options in some policies |

| Flexibility | Renewable at the end of the term | Provides long-term protection and flexibility |

Factors to Consider When Choosing a Life Insurance Policy

When deciding between term and permanent life insurance, several factors come into play. Here are some key considerations:

- Financial Goals: Assess your short-term and long-term financial objectives. If you have immediate financial needs, such as providing for young children or paying off a mortgage, term life insurance might be more suitable. On the other hand, if you aim to leave a substantial legacy or have long-term financial goals, permanent life insurance could be a better fit.

- Budget: Evaluate your financial situation and determine how much you can afford to allocate for life insurance premiums. Term life insurance is generally more budget-friendly, while permanent life insurance may require a higher initial investment but can offer cost savings over time due to its cash value accumulation.

- Health and Lifestyle: Your health and lifestyle factors can impact the availability and cost of life insurance. If you have a clean bill of health and a low-risk lifestyle, you may qualify for better rates. However, pre-existing health conditions or high-risk activities can make permanent life insurance more expensive or even inaccessible.

- Family Needs: Consider the financial needs of your family or dependents. If you have young children or significant financial obligations, term life insurance can provide temporary coverage until those needs decrease. Conversely, if you have long-term financial responsibilities or want to leave a substantial inheritance, permanent life insurance might be the better choice.

Navigating the Life Insurance Landscape

Understanding the different types of life insurance is the first step towards making an informed decision. Here are some additional tips to guide you through the process:

- Shop Around: Compare policies from multiple insurance companies to find the best rates and coverage options. Online comparison tools can be helpful, but don’t hesitate to consult with insurance brokers or financial advisors who can provide personalized recommendations.

- Review Policy Details: Carefully read the policy documents to understand the coverage, exclusions, and fine print. Pay attention to the death benefit amount, premium payments, and any riders or additional benefits that may be available.

- Consider Your Needs: Assess your current and future financial needs. Your life insurance policy should align with your goals and provide adequate coverage for your loved ones. Regularly review and update your policy as your circumstances change.

- Seek Professional Advice: If you’re unsure about which type of life insurance is best for you, consult with a financial advisor or insurance specialist. They can assess your unique situation and provide expert guidance to ensure you make the right choice.

Conclusion

Choosing the right life insurance policy is a crucial decision that can provide financial security and peace of mind for your loved ones. By understanding the differences between term and permanent life insurance, you can make an informed choice based on your specific needs and circumstances. Remember, life insurance is a long-term commitment, so take the time to research, compare, and seek professional advice to ensure you select the best policy for your future.

What is the average cost of life insurance per month?

+

The average cost of life insurance varies depending on several factors, including your age, health, lifestyle, and the type and amount of coverage you choose. As a general guideline, term life insurance premiums can range from 20 to 300 per month, while permanent life insurance premiums can be higher, starting from $50 to several hundred dollars per month. It’s essential to obtain personalized quotes based on your specific circumstances to get an accurate estimate.

Can I change my life insurance policy later in life?

+

Yes, you can make changes to your life insurance policy as your circumstances evolve. You may have the option to increase or decrease your coverage, switch from term to permanent life insurance, or add riders to your existing policy. However, it’s important to note that making changes may impact your premiums and require a new medical examination or underwriting process.

Are there any tax benefits associated with life insurance policies?

+

Yes, life insurance policies can offer tax advantages. The death benefit received by your beneficiaries is typically tax-free, providing them with a substantial financial benefit without any tax implications. Additionally, the cash value accumulation in permanent life insurance policies may offer tax-deferred growth, although withdrawals or loans against the cash value may have tax consequences.

Can I purchase life insurance for my spouse or children?

+

Yes, you can purchase life insurance for your spouse, children, or other family members. Spouse life insurance policies are common, especially for couples with joint financial responsibilities. Children’s life insurance policies are also available, although it’s important to note that minors may have limited coverage options and may require special considerations.