Health Insurance Network

Unveiling the Comprehensive Guide to the Health Insurance Network

Welcome to an in-depth exploration of the intricate world of health insurance, a topic that impacts the lives of millions, yet often remains shrouded in complexity. In this comprehensive guide, we aim to demystify the Health Insurance Network, shedding light on its workings, benefits, and implications for individuals, families, and businesses. As an expert in the field, I will navigate through the labyrinth of policies, plans, and providers, offering a detailed yet accessible overview that will empower readers to make informed decisions about their healthcare coverage.

Understanding the Health Insurance Network

The Health Insurance Network is a vast ecosystem, comprising a multitude of interconnected players, each with a distinct role in ensuring the smooth delivery of healthcare services. At its core, the network consists of insurance providers, who offer a range of plans tailored to meet the diverse needs of policyholders. These providers are regulated by government bodies, ensuring compliance with industry standards and consumer protection laws.

One of the key features of the Health Insurance Network is its ability to provide a safety net for individuals and families, offering financial protection against the potentially devastating costs of medical care. By pooling resources from a large number of policyholders, insurance providers are able to spread the risk, ensuring that those who need medical treatment can access it without facing financial ruin.

Navigating the Complex Web of Policies and Plans

The Health Insurance Network offers a dizzying array of policies and plans, each with its own unique set of benefits, exclusions, and limitations. Navigating this landscape can be a daunting task, requiring a thorough understanding of one’s own healthcare needs, as well as a keen eye for detail when reviewing policy documents.

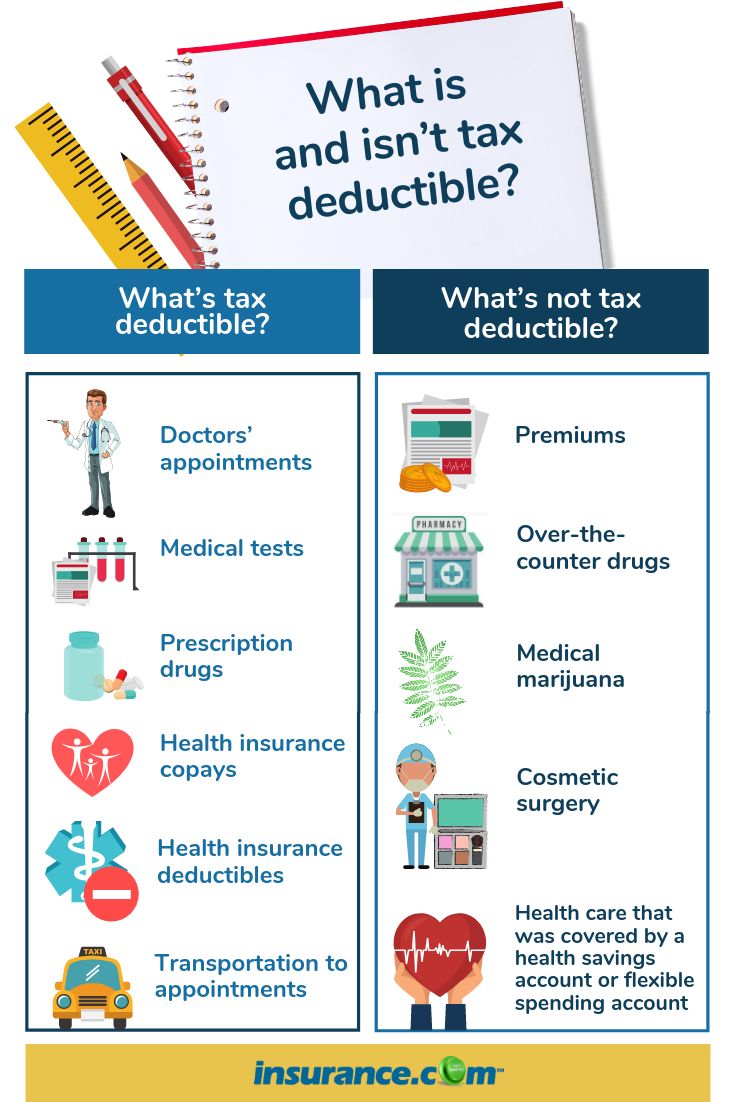

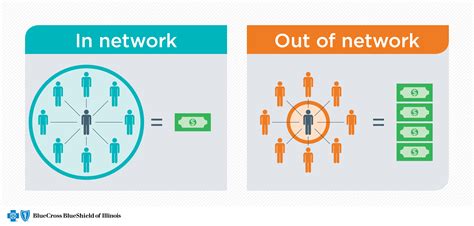

When selecting a health insurance plan, it’s crucial to consider factors such as the scope of coverage, including whether it includes specialist care, prescription medications, and mental health services. Other important considerations include the plan’s network of providers, which can determine the availability and cost of care, and the plan’s cost-sharing structure, including deductibles, copayments, and coinsurance.

| Policy Feature | Description |

|---|---|

| Scope of Coverage | Encompasses the range of medical services and treatments covered by the plan. |

| Network of Providers | Determines the availability and cost of care, with in-network providers offering discounted rates. |

| Cost-Sharing Structure | Includes deductibles, copayments, and coinsurance, which represent the policyholder's share of the cost of care. |

Real-World Impact: Stories from the Health Insurance Network

To illustrate the tangible impact of the Health Insurance Network, let’s consider the story of Sarah, a young professional with a history of chronic illness. Sarah’s condition requires regular specialist care and prescription medications, making health insurance an essential part of her financial planning.

With the guidance of a knowledgeable insurance broker, Sarah carefully reviewed a range of plans, ultimately selecting one that offered comprehensive coverage for her specific healthcare needs. This plan provided peace of mind, ensuring that Sarah could access the necessary medical care without incurring excessive out-of-pocket expenses.

Sarah’s story highlights the crucial role that health insurance plays in providing financial security and access to quality healthcare. By understanding the intricacies of the Health Insurance Network and selecting a plan that aligns with their unique needs, individuals like Sarah can navigate the complexities of the healthcare system with confidence.

Future Trends and Implications

As we look to the future, the Health Insurance Network is poised for significant evolution, driven by advances in technology and changing consumer expectations. The rise of digital health platforms and telemedicine services is already transforming the way healthcare is delivered and accessed, with implications for the design and delivery of insurance plans.

Additionally, the increasing focus on preventative care and wellness is likely to shape the future landscape of health insurance. As more individuals prioritize their health and wellbeing, insurance providers will need to adapt, offering incentives and rewards for healthy behaviors, and integrating wellness programs into their plans.

Frequently Asked Questions

How do I choose the right health insurance plan for my needs?

+Choosing the right health insurance plan involves careful consideration of your specific healthcare needs and financial situation. Start by assessing the scope of coverage you require, including any specialist care, prescription medications, and mental health services. Then, review the network of providers and the cost-sharing structure of each plan, ensuring that the plan aligns with your budget and preferred healthcare providers.

What are the key differences between PPO, HMO, and EPO plans?

+PPO (Preferred Provider Organization) plans offer more flexibility in choosing healthcare providers, both in and out of network, with higher out-of-pocket costs. HMO (Health Maintenance Organization) plans typically have lower costs but require you to stay within a specific network of providers. EPO (Exclusive Provider Organization) plans are similar to PPOs but with a more limited network of providers.

Can I switch health insurance plans during the year?

+In most cases, you can only switch health insurance plans during the annual open enrollment period, which typically occurs in the fall. However, certain life events, such as losing job-based coverage, getting married, or having a baby, may qualify you for a special enrollment period, allowing you to switch plans outside of the open enrollment period.

In conclusion, the Health Insurance Network is a complex yet vital component of our healthcare system, offering financial protection and access to essential medical services. By understanding the key players, policies, and plans within this network, individuals can make informed decisions about their healthcare coverage, ensuring peace of mind and financial security. As the landscape of healthcare continues to evolve, the importance of staying informed and engaged with the Health Insurance Network will only grow.